Yoon's Standoff and Economic Pressures, Yuan's Decline, Boeing's Quality Reforms, and ISIS Resurgence in New Orleans

South Korea faces a political maelstrom as investigators clash with President Yoon Suk Yeol over a high-stakes arrest, while the yuan slips past 7.3 per dollar amid economic anxiety, and Boeing works to rebuild trust after quality concerns post-crisis.

Hello, it’s Ryosuke! Today, we have some significant developments shaping both political landscapes and economic forecasts across the globe. Here’s a quick look at what we’ll be diving into:

-

South Korea's Political Turmoil: Major tensions have arisen as investigators attempted to arrest President Yoon Suk Yeol amid a controversy over his martial law declaration, leading to a standoff with protesters and a brewing impeachment trial.

-

Yuan Faces Decline: The Chinese yuan has slipped past the critical threshold of 7.3 per dollar, prompting concerns about China's economic health and its competitiveness on the global market as analysts predict further depreciation.

-

Boeing’s Quality Assurance Journey: A year after a serious manufacturing incident, Boeing is under scrutiny to enhance its operational safety and quality standards, with significant leadership changes and regulatory oversight being emphasized.

-

ISIS Resurgence in U.S.: A tragic New Year’s attack in New Orleans highlights the ongoing influence of ISIS, as concerns grow over the group’s ability to inspire violence despite a perceived decline in its organizational strength.

Details and broader implications are covered below—let’s dive in!

Tensions Rise as Investigators Attempt to Arrest South Korean President Yoon Suk Yeol

Standoff at the Presidential Residence: Investigators from South Korea's Corruption Investigation Office engaged in a nearly six-hour standoff at President Yoon Suk Yeol's residence, seeking to execute an arrest warrant for insurrection linked to his controversial martial law declaration last month. Positioned outside were about 1,200 protesters advocating for Yoon, which ultimately led the investigators to abandon their efforts due to safety concerns.

Legal Backlash and Claims of Illegitimacy: Yoon's legal representatives termed the arrest attempt illegal and have threatened legal action against the investigators. Despite the court-issued warrant, Yoon’s team argues that the Corruption Investigation Office lacks the authority to investigate insurrection, a claim the investigators contest by citing their mandate to look into related abuses of power.

Political Fallout and Economic Impacts: Since declaring martial law on December 3—a decision quickly reversed by the National Assembly—South Korea has plunged into political crisis, affecting its economy and prompting revisions in growth forecasts. Despite looming political uncertainty, financial markets reacted positively on Friday, with the benchmark Kospi index rising by 1.8%, suggesting that investors may be absorbing the prevailing tensions.

Impeachment Process Continues: The situation remains fluid as Yoon’s impeachment trial is set to officially begin on January 14, with substantial political implications for the nation’s future. Lawmakers and political commentators emphasize the urgency of resolving the impeachment swiftly to stabilize the country's governance amidst ongoing unrest.

Yuan Slumps Past 7.3 Per Dollar: Economic Pressures Mount

Photo by Timon Studler / Unsplash

Yuan Breaks Key Level: The onshore yuan has fallen below 7.3 per dollar for the first time since late 2023, even with the central bank, the People’s Bank of China (PBOC), maintaining its daily reference rate support. This decline signals potential easing as China grapples with a sluggish economy and competitive pressures from the U.S. dollar's strength.

Impact of Economic Conditions: Analysts attribute the yuan's drop to challenging economic fundamentals in China, including poor risk sentiment and low government bond yields. The currency’s weakening is further complicating the landscape for exporters, as a stronger dollar makes Chinese goods less competitive internationally.

Market Reactions and Predictions: Traders reported that state banks momentarily halted dollar sales around the 7.3 mark, contributing to the yuan's decline. As concerns persist, forecasting organizations are predicting further drops — with estimates ranging from 7.45 to 7.6 against the dollar by mid-2025, reflecting continued pessimism about China’s economic trajectory.

Future Interventions Expected: While the PBOC may allow some depreciation of the yuan, financial stability is a priority, and rapid declines are less likely. Experts suggest that a careful approach will be adopted, using various tools to maintain order in the currency markets while managing expectations around yuan depreciation to stabilize regional investor sentiment.

Boeing’s Quality Journey: A Year After Crisis

Photo by Justin Lim / Unsplash

Regulatory Vigilance: A year after a significant fuselage accident, FAA Administrator Mike Whitaker emphasized that Boeing's improvements in manufacturing quality are still a work in progress. He highlighted the necessity for a cultural realignment at Boeing, prioritizing safety over short-term profits, signaling that rigorous oversight from the FAA will remain a constant.

Financial and Management Turbulence: Following the January 2024 incident, Boeing endured turmoil, resulting in leadership changes and a significant cash infusion to counteract massive financial losses. New CEO Kelly Ortberg has taken the reins during this challenging time, emphasizing the need for a more effective operational strategy as the company grapples with the fallout from a devastating strike and reduced production capabilities.

Process Improvements and Audits: Boeing has shared its commitment to rectify quality issues, noting significant reductions in fuselage defects. Enhanced collaboration and rigorous training are underway, alongside increased inspections and audits, reflecting proactive steps to address safety concerns that have plagued the manufacturer since before the accident.

Future Oversight and Accountability: As Boeing strives for recovery, key legislative figures, including Senator Ted Cruz, indicated ongoing scrutiny will persist into 2025. With orders anticipated to ramp up significantly, the spotlight remains firmly on Boeing to restore trust and align production with safety, ensuring its place in the competitive aerospace market amidst these challenges.

New Orleans Attack Highlights Resurgence of ISIS Influence

Deadly Attack Details: The recent New Year’s attack in New Orleans, perpetrated by Shamsud-Din Jabbar, showcased a tragic instance of violence inspired by the Islamic State. Jabbar drove a truck into a crowded celebration, resulting in 15 fatalities, while reportedly pledging allegiance to the group online and displaying an Islamic State flag in his vehicle.

Broader Concern Over ISIS: While officials assert that the Islamic State did not direct Jabbar’s assault, the event underscores growing fears regarding the group's enduring influence. Experts note that since its peak around 2014 and 2015, the Islamic State has adapted, inspiring numerous attacks globally—from Afghanistan to Africa—despite claims of being defeated.

Increased Activity and Foiled Plots: The rising trend of attacks inspired by the Islamic State is alarming, with a notable increase in foiled plots in 2024 compared to previous years. Such incidents speak to the effectiveness of the group’s propaganda, which has evolved post-social media crackdowns, allowing for a broader reach and increased recruitment potential.

US Military Presence and Ongoing Challenges: The US maintains approximately 2,000 troops in northeastern Syria to prevent the Islamic State's resurgence amid the turmoil following the Assad regime's destabilization. As authorities continue to grapple with the threat of "lone wolf" attacks—often harder to predict due to their spontaneous nature—officials stress that celebrations, often featuring large gatherings, remain prime targets for such opportunistic terrorism.

Latest On Global Markets

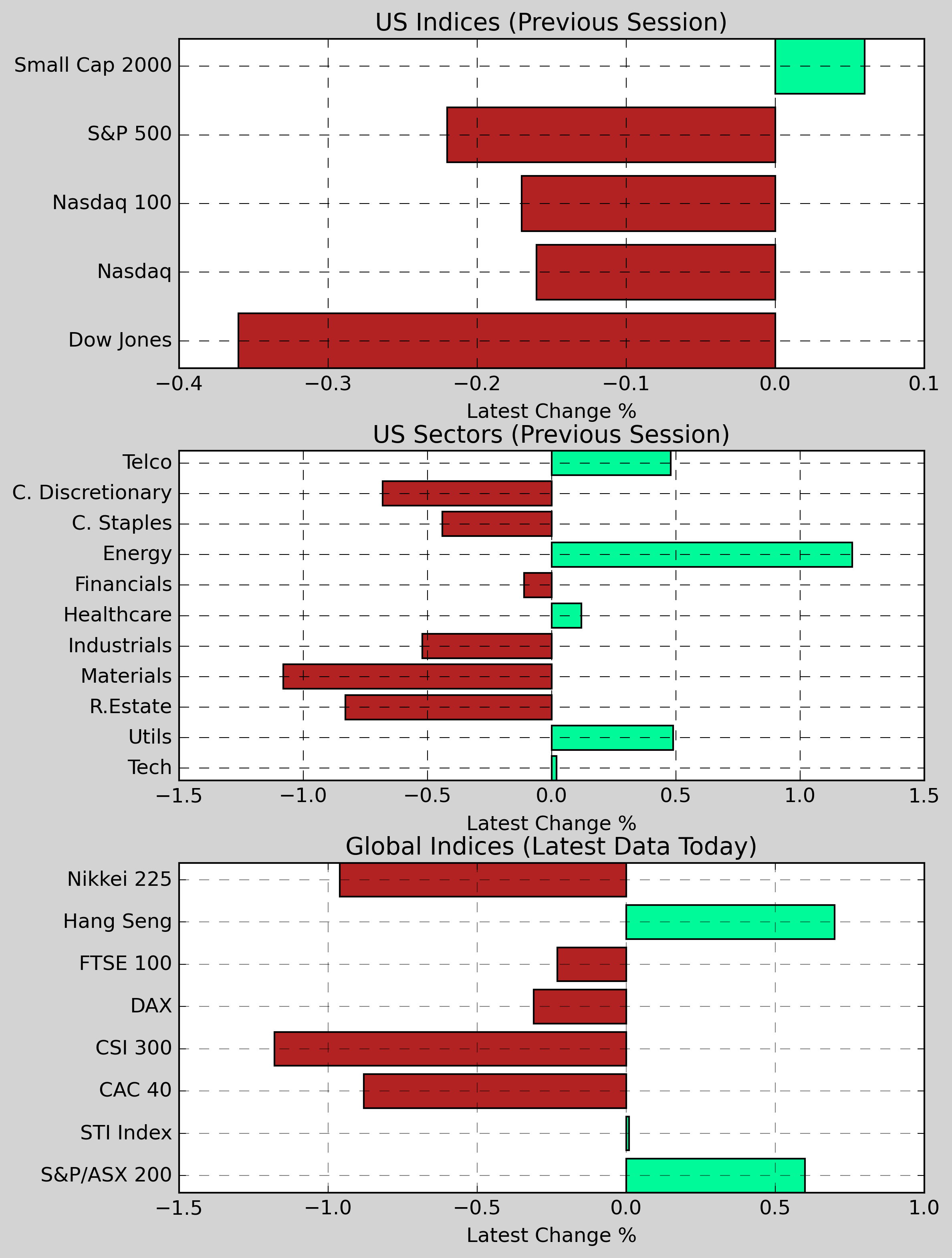

US Futures: Futures are showing a slight upward trend, with Dow Jones futures climbing 0.12%, S&P 500 futures inching up 0.16%, and Nasdaq 100 futures gaining 0.28%.

US Indices (Previous Session): The S&P 500 fell 0.22% to 5,868.60, while the Dow Jones dropped 0.36% to 42,392.27. The Nasdaq declined 0.16% to 19,280.79, and the Nasdaq 100 was down 0.17%. The Small Cap 2000 rose slightly, gaining 0.06%.

US Sectors (Previous Session): Utilities led the way with a strong increase of 0.49%, followed closely by Energy, which saw an uptick of 1.21%. On the other hand, Basic Materials fell 1.08%, Industrials decreased 0.52%, and Real Estate dropped 0.83%.

Global Indices: The Hang Seng experienced a notable rise of 0.70%, while the S&P/ASX 200 increased 0.60%. In contrast, the DAX declined 0.31%, and the CAC 40 dropped 0.88%. Meanwhile, the Nikkei 225 decreased 0.96%, and the FTSE 100 slipped 0.23%.

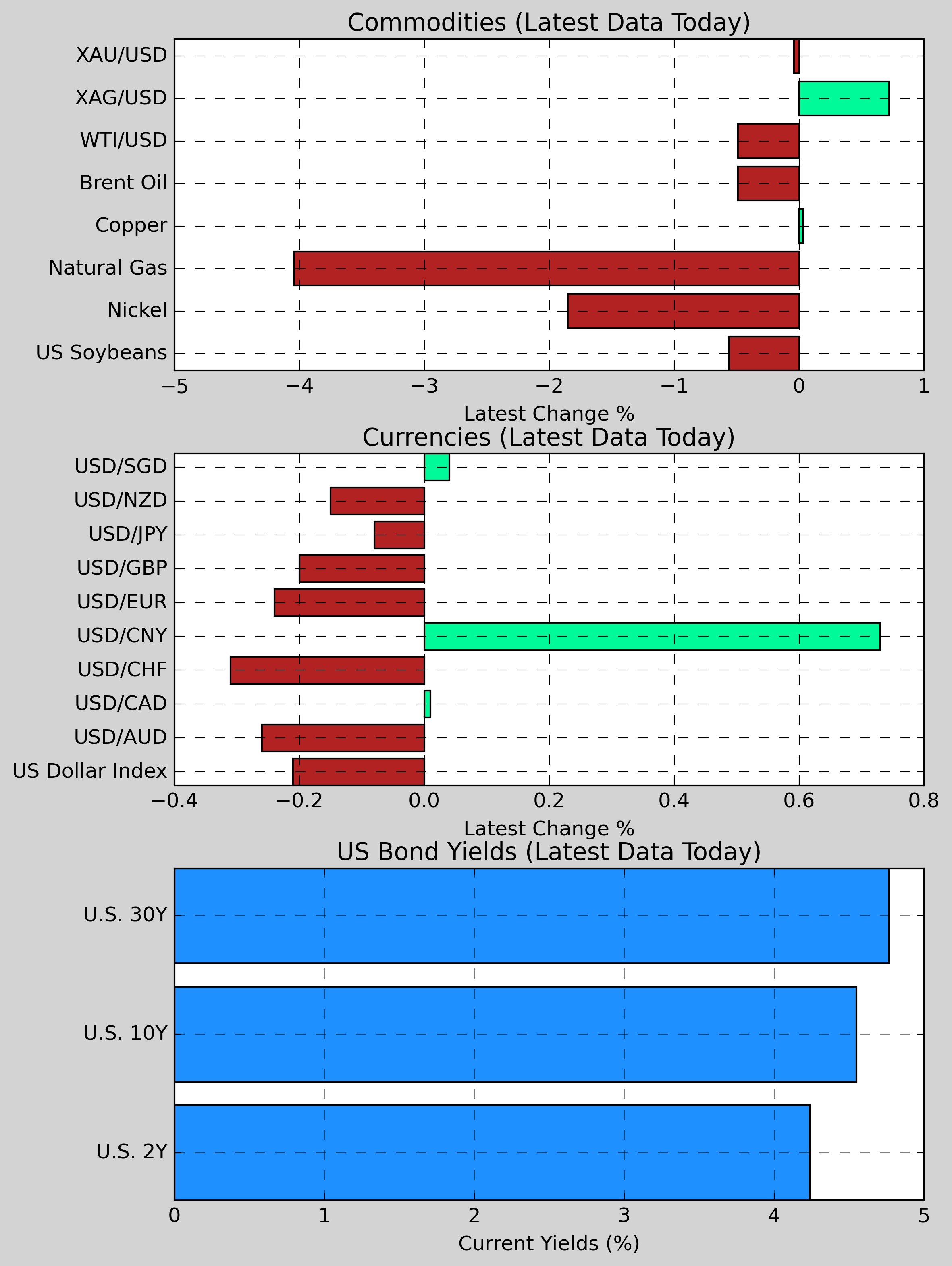

Commodities: Gold decreased 0.04% to $2,657.34, while Copper saw a slight increase of 0.03% to $4.0273. Nickel fell 1.85% to $15,876.00. US Wheat dropped 0.16% to $544.12, and Natural Gas declined 4.04% to $3.5120. On the other hand, US Soybeans decreased 0.56% to $993.38. Brent Crude slipped 0.49% to $75.56.

Currencies: The US Dollar showed mixed results against major currencies. The USD/CNY rose 0.73%, while USD/CAD edged up 0.01%. Conversely, USD/AUD dipped 0.26%, and USD/GBP was down 0.20%. The US Dollar Index fell 0.21% to 109.02.

US Bond Yields: The U.S. 2-Year Treasury yield remained stable at 4.239%, while the U.S. 10-Year Treasury yield dipped slightly 0.55bps to 4.550%. The U.S. 30-Year Treasury yield also fell 0.71bps to 4.764%.

Economic Data & Central Bank Developments (Eastern Time)

- 10:00 AM ET (December 3): US December ISM manufacturing index (estimated to be 48.2, previous value is 48.4)

- 11:00 AM ET (December 3): Speech by Barkin, President of the US Richmond Federal Reserve

- 11:00 AM ET (December 3): ECB Chief Economist Lane speaks

Other Notable News

-

Surprising Drop in Unemployment Claims: Recent data reveals a significant decline in American unemployment benefit applications, hitting an eight-month low and indicating a sturdy labor market amid lower than expected layoffs.

-

Political Uncertainty in Canada: Canadian Prime Minister Trudeau has been notably absent in public for over two weeks, leading to increasing pressure from his party to resign as his approval ratings continue to slide.

-

European Gas Prices Spike: On the first trading day of 2025, European gas prices surged to their highest level in over a year, attributed to disruptions in Russian gas supplies through Ukraine and halted Norwegian shipments.

-

ECB Rate Expectations: Stournaras, a member of the European Central Bank, anticipates that interest rates will climb to around 2% by the autumn season.

-

Tragic Events in the U.S.: The U.S. Army confirmed that an active-duty special forces soldier was identified as the suspect in the Las Vegas bombing, while the FBI maintains that this incident is not connected to the recent attack in New Orleans.

-

Impeached President’s Legal Troubles in South Korea: South Korea's anti-corruption agency has reportedly executed an arrest warrant for the impeached President Yoon Seok-yeol, as reported by Yonhap News Agency.

-

U.S. House Speaker's Confidence: House Speaker Johnson expressed optimism about securing re-election in a single vote.

-

Musk Calls for UK Elections: Elon Musk has advocated for a general election in the UK; his remarks, given his role as a Trump adviser, could potentially strain the relationship between the U.S. and the UK.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.