US Hacked by Chinese Cyber Threats, China's Economic Resilience, and South Korea's Political Crisis

A serious cybersecurity breach hits the US Treasury, China boasts a stable economic forecast despite global tensions, South Korea faces unprecedented political turmoil with an arrest warrant for its president, and cocoa prices surge amid West African supply fears.

Hello, it’s Ryosuke! Today has been packed with significant developments that reflect the evolving landscape of global politics, economics, and market dynamics. Here’s a quick snapshot of the key topics covered in today’s report:

-

US Treasury Cybersecurity Breach: Chinese state-sponsored hackers accessed US Treasury employee systems, raising serious security concerns and prompting a major investigation.

-

China’s Economic Outlook: President Xi Jinping forecasts a 5% GDP growth for 2024, supported by increased public sector salaries aimed at bolstering consumer confidence.

-

Political Turmoil in South Korea: An arrest warrant has been issued for President Yoon Suk Yeol over alleged insurrection, creating unprecedented political instability amid a national mourning period.

-

Cocoa Prices Surge: Concerns over cocoa crop health in West Africa have led to a significant price jump, while broader agricultural markets also show signs of volatility.

Details and broader implications are covered below—let’s dive in!

US Treasury Hacked by Chinese State-Sponsored Actors in Serious Breach

Photo by Mohammad Rahmani / Unsplash

Major Cybersecurity Incident: The US Treasury Department reported a significant breach by Chinese hackers earlier this month, accessing employee workstations and some unclassified documents. This prompted the agency to classify the incident as "major" and notify lawmakers, emphasizing the seriousness of the threat to national security.

Method of Breach: The hackers exploited a third-party service provider, BeyondTrust, which offers remote technical support. After detecting the suspicious activity, BeyondTrust took the service offline, and investigations revealed that the hackers may have had access to systems for a couple of days before detection, altering passwords and possibly creating new accounts.

Nature of the Attack: While no sensitive financial data was reportedly targeted, the hackers appeared to be conducting espionage, likely seeking valuable information. Officials from the Treasury noted that they are collaborating with the FBI and other cybersecurity entities to assess the full impact of the intrusion.

China’s Denial and Fallout: In response to the allegations, China vehemently denied involvement, labeling the accusations "baseless." Tensions between the US and China over cyber threats continue to rise, as this incident follows other high-profile breaches attributed to Chinese hackers, raising concerns about national and cybersecurity policy going forward.

China's Economic Outlook for 2024: Stability and Growth Goals

Positive GDP Predictions: According to President Xi Jinping, China is set to achieve a GDP growth of around 5% in 2024, showcasing the country’s economic resilience despite a challenging recent history marked by uncertainties. This forecast aligns with improved optimism bolstered by proactive stimulus measures initiated by policymakers since September.

Focus on Stability: Xi emphasized that the economy remains "overall stable," with key areas such as employment and prices under control, which lays the groundwork for a solid foundation moving into 2025. With this stability, the government plans to maintain support through more aggressive macroeconomic policies, signaling ongoing efforts to mitigate growth challenges.

Public Sector Salary Increases: In an effort to boost spending and morale, China has introduced a significant pay rise for government workers, increasing salaries by at least 500 yuan ($68.51) monthly. This move aims to enhance consumer spending ahead of the new year, further supporting Xi's priority of revitalizing domestic consumption amidst economic pressures.

Wider Implications for Consumer Confidence: While the salary boosts primarily target civil servants, their impact could ripple into the broader economy by encouraging private sector confidence. However, the disparity in wage growth between the public and private sectors could provoke unrest if more extensive support for lower-income groups isn't introduced, underscoring the delicate balance needed to sustain social stability as the economic landscape evolves.

South Korea's Political Turmoil: Arrest Warrant Issued for President Yoon

Photo by Hill Country Camera / Unsplash

Historic Law Challenges: South Korea's Seoul Western District Court has approved an arrest warrant for President Yoon Suk Yeol amid allegations of insurrection linked to his controversial martial law declaration. This unprecedented move could lead to Yoon becoming the first sitting president in the country to be arrested, highlighting the severity of the constitutional crisis unfolding in the nation.

Escalating Political Crisis: The warrant follows Yoon's repeated refusals to cooperate with investigators, further complicating the already tumultuous political landscape marked by his impeachment on December 14. With Prime Minister Han Duck-soo also suspended, the government is experiencing heightened instability as calls for cooperation between parties grow louder, reflecting deepening divisions.

Defense Against Arrest: Yoon’s team has responded by claiming the arrest warrant is “illegal and invalid," planning to seek an injunction from the Constitutional Court. His administration argues that the joint investigation team lacks the proper authority to pursue insurrection charges against him, a claim complicating the path forward for both legal proceedings and political governance.

Broader Implications and Mourning Period: As this political drama unfolds, South Korea also grapples with the aftermath of a tragic plane crash in Jeju, which claimed nearly all lives on board. In this context, Acting President Choi Sang-mok has declared a national mourning period while overseeing a delicate balance of leadership—facing both the question of Yoon's potential arrest and the need for national unity during a week of remembrance.

Cocoa Prices Surge Amid Supply Concerns in West Africa

Photo by Monique Carrati / Unsplash

Significant Price Increase: Cocoa futures in New York experienced a notable jump of up to 14%, marking the largest intraday rise since May. This rally comes after a week of profit-taking, revealing the market's response to ongoing supply fears linked to crop health in West Africa.

Impacts of Climate: In the Ivory Coast, cocoa farmers are increasingly worried as dry conditions, fueled by the Harmattan winds, adversely affect the health of cocoa trees. Symptoms such as yellowing leaves and withering young pods highlight the vulnerabilities in the cocoa supply chain, setting the stage for potential market fluctuations.

Global Commodity Trends: This cocoa spike resonates within a broader agricultural context, where the soybean market also experienced volatility. Although soybeans climbed briefly, concerns over dry weather in South America persist, yet current soil conditions remain favorable for crops.

Support from Export Data: Encouraging export figures from the US Department of Agriculture have boosted commodity prices, particularly for soybean oil. With rising sales to India marking a 14-year high, US bean oil is positioned as the most competitively priced vegetable oil globally, reinforcing the interconnected nature of agricultural markets.

Latest On Global Markets

US Futures: Futures are pointing towards a mixed session, with Dow Jones futures declining 0.04%, while S&P 500 futures are down 0.11%. Nasdaq 100 futures have also dropped 0.17%.

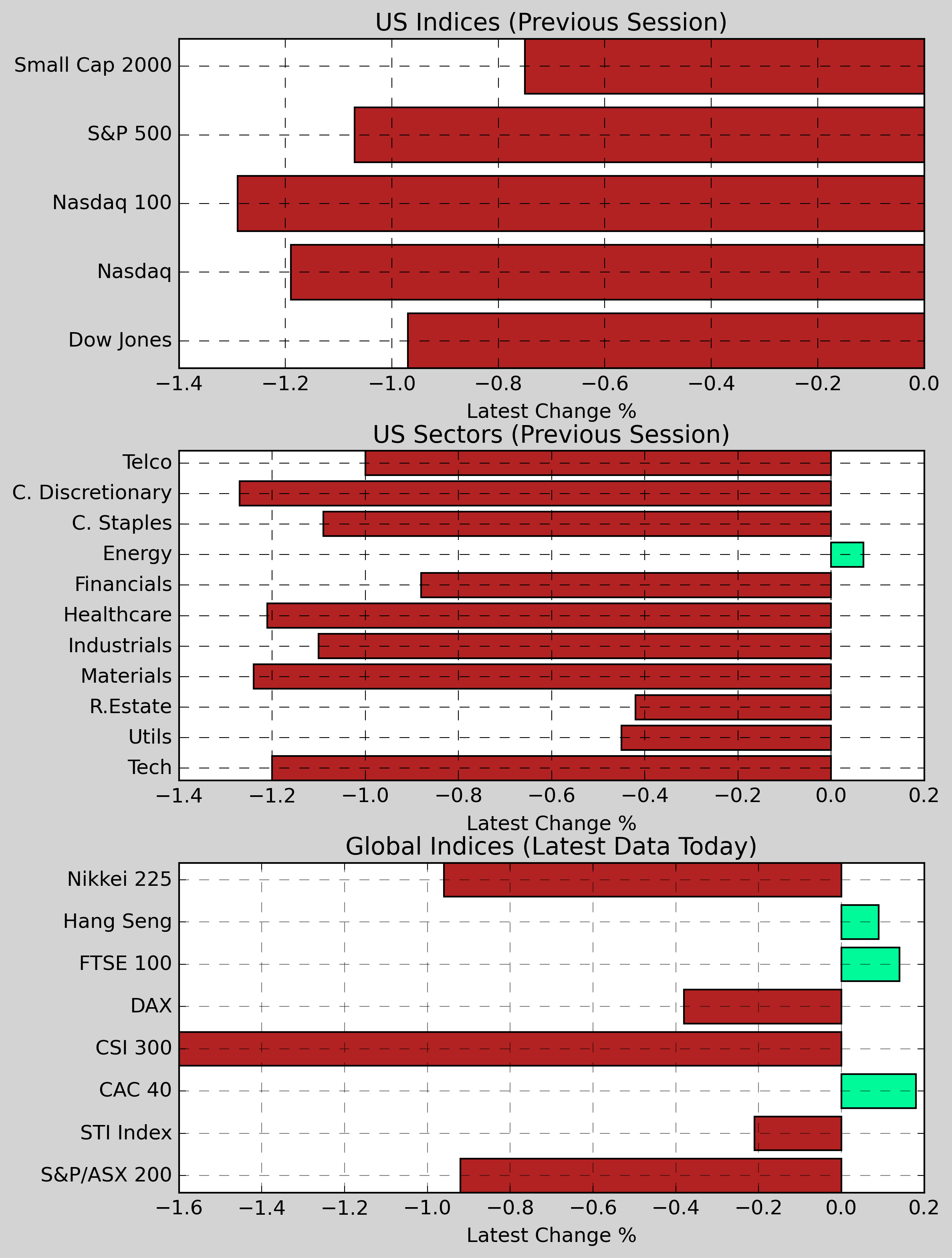

US Indices (Previous Session): The S&P 500 closed lower by 0.10% at 5,906.94, and the Dow Jones decreased 0.97% to 42,573.73. The Nasdaq slipped 1.19% to 19,486.79, while the Nasdaq 100 fell 1.29%. The Small Cap 2000 also declined, down 0.75%.

US Sectors (Previous Session): Energy was the sole sector to gain, rising 0.07%. Consumer Staples dropped 0.11%, while Financials fell 0.88%. Basic Materials saw a decline of 1.24%, with Industrials and Healthcare falling by 1.10% and 1.21%, respectively.

Global Indices: The Hang Seng increased by 0.09%, while the CAC 40 rose 0.18%. However, the CSI 300 dropped 1.60%, the DAX decreased 0.38%, and the S&P/ASX 200 declined 0.92%. The FTSE 100 edged up with a modest gain of 0.14%.

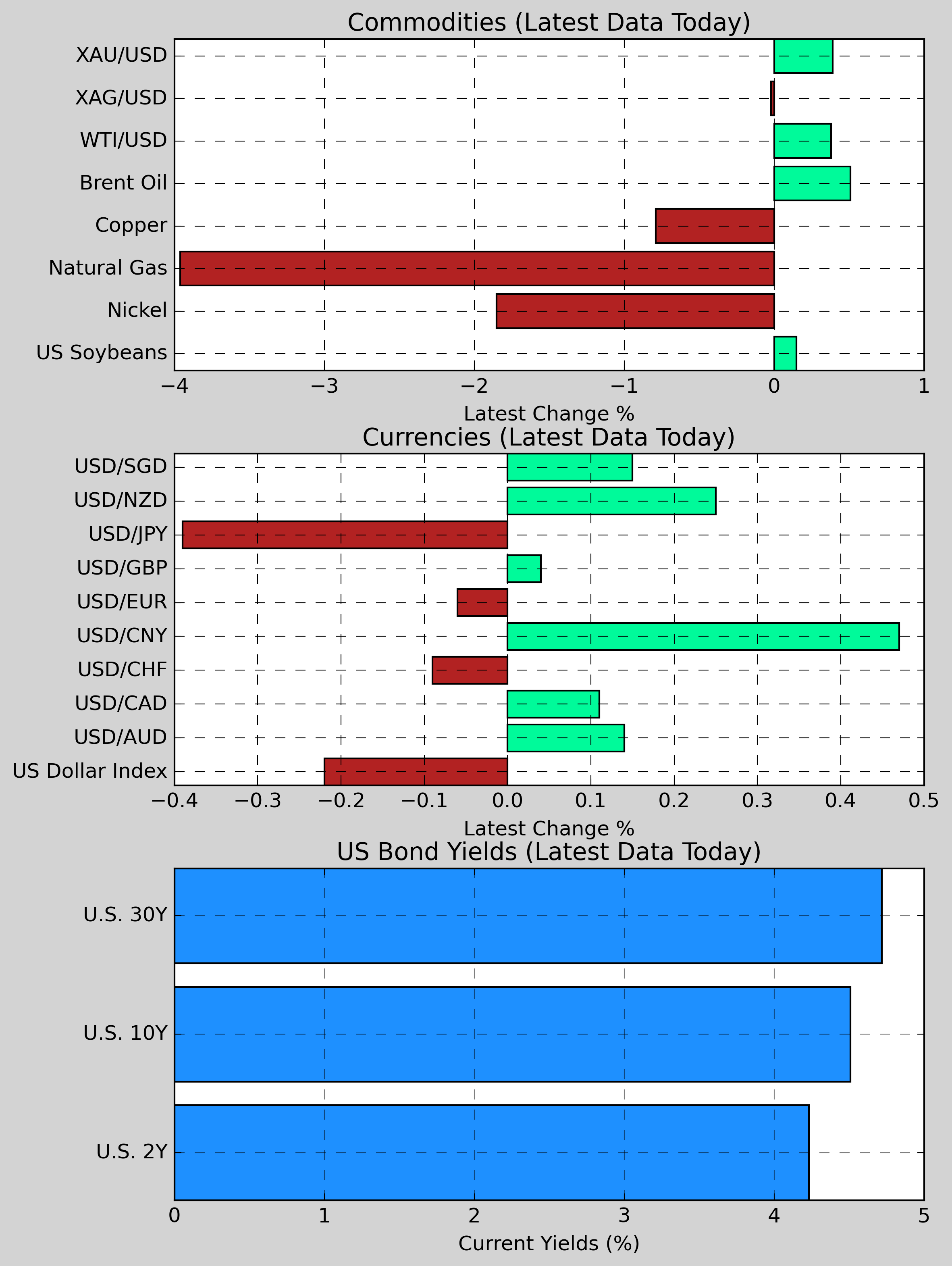

Commodities: Gold rose 0.39% to $2,616.10, while Copper declined 0.79% to $4.0605. Nickel saw a significant drop, falling 1.86% to $15,876.00. US Wheat decreased 0.20% to $547.88, while Natural Gas fell 3.96% to $3.780. US Soybeans increased slightly, climbing 0.15% to $983.50. Brent Crude rose 0.51% to $74.37.

Currencies: The US Dollar experienced slight fluctuations, with USD/AUD up 0.14% and USD/CAD gaining 0.11%. USD/CNY rose 0.47%, and USD/GBP edged up 0.04%. In contrast, USD/JPY dipped 0.39%, and the US Dollar Index fell 0.22% to 107.89.

US Bond Yields: The U.S. 2-Year Treasury yield decreased 4.9bps to 4.233%, while the U.S. 10-Year Treasury yield fell 7.9bps to 4.509%. The U.S. 30-Year Treasury yield also decreased, dropping 9.4bps to 4.719%.

Economic Data & Central Bank Developments (Eastern Time)

- 9:00 AM ET: U.S. FHFA house price index month-on-month in October (estimated to be 0.4%, previous value is 0.7%)

- 9:00 AM ET: U.S. S&P CoreLogic Case-Shiller 20-city house prices in October year-on-year (estimated to be 4.1%, previous value was 4.57%)

Other Notable News

-

U.S. House Speaker's Future in Question: With a crucial election for U.S. House Speaker approaching, current Speaker Johnson has received full backing from Trump, who believes Johnson will swiftly enact his policies.

-

Market Pause in Mourning: The U.S. stock market will observe a closure on January 9, while the bond market will conclude early at 2 p.m. New York time, as a tribute to the late former President Carter.

-

Brazil's Forex Intervention: The central bank of Brazil made another move on Monday by selling approximately $1.8 billion in the foreign exchange market to support the value of the real.

-

Record Highs for Home Contracts: In November, existing home contracts in the U.S. reached their highest levels since early 2023, as buyers now anticipate no imminent interest rate reductions.

-

Preliminary Investigation into Plane Crash: Authorities are focusing their investigation into the recent Jeju Air incident on potential bird strikes and landing gear anomalies. A special inspection will commence on all 101 active Boeing 737-800 aircraft, though analysts do not expect a substantial impact on Boeing's stock prices.

-

Tragic Aviation Statistics for 2024: Data reveals that the number of fatalities due to passenger plane accidents in 2024 has risen to the highest level observed since 2018.

-

Spanish Inflation Reacts to ECB Stance: Inflation in Spain saw an uptick in December, reinforcing the European Central Bank’s gradual approach to interest rate cuts.

-

Trade War Implications: ECB board member Knot warned that the ongoing U.S.-China trade tensions could result in China exporting deflationary pressures to Europe.

-

Diplomatic Shift with Syria: Ukraine's foreign minister announced that Kyiv is prepared to re-establish diplomatic relations with Syria following the fall of the pro-Russian Assad regime.

-

TikTok Faces Penalties in Venezuela: Venezuela's Supreme Court has imposed a hefty fine of $10 million on TikTok in connection with a viral challenge that resulted in the tragic deaths of three children.

-

Japan's Diplomatic Engagement with the U.S.: Reports indicate that Japanese Prime Minister Shigeru Ishiba is gearing up for a visit to Washington, with a meeting with Trump anticipated as early as February next year.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.