US Economic Strength, OPEC+ Delays, FTC Probes, and Trump-Zuckerberg Meeting Stir Headlines

Today's highlights include the US economy showcasing resilience in Q3, OPEC+ postponing key decisions amid market uncertainties, the FTC intensifying scrutiny on giants like Microsoft and Uber, and a surprising Trump-Zuckerberg dinner sparking widespread speculation.

Good morning! It’s Ryosuke. Today’s updates focus on the resilience of the US economy in Q3, OPEC+’s delayed decisions amid market uncertainties, the FTC’s scrutiny of major players like Microsoft and Uber, and a surprising dinner between Trump and Zuckerberg that has stirred speculation. Let’s jump in!

US Economy Powers Through Q3 with Strong Growth

Photo by Paul Weaver / Unsplash

GDP Growth Resilient: The US economy expanded at an annualized 2.8% in Q3, driven by a 3.5% rise in consumer spending, its strongest showing this year. While household spending saw slight downward revisions, business investment in R&D was revised higher, signaling economic durability.

Inflation and the Fed: Core PCE inflation held steady at 2.1%, reflecting progress on taming price pressures. However, the Federal Reserve remains cautious, signaling no immediate rate cuts as economic momentum and a resilient labor market continue to reduce recession fears.

Trump’s Economic Impact: President-elect Donald Trump’s return has bolstered stock market optimism, with traders betting on corporate tax cuts and tariff plans. Yet, economists warn his fiscal policies could drive inflation higher, complicating the Fed’s policy outlook.

Business Investment Shifts: Nonresidential investment rose 3.8%, supported by a 10.6% surge in equipment spending, the strongest in over a year. Notable gains included a 39% spike in computer-related outlays, though structural investment remained a drag.

Trade and Employment Trends: Net exports shaved 0.57 points off GDP, while the October merchandise trade deficit narrowed to $99.1 billion. Meanwhile, jobless claims remained stable, though rising continuing claims hint at challenges for the unemployed in finding new opportunities.

Chipmakers Surge as US Softens Stance on China

Photo by Nicolas Arnold / Unsplash

Semiconductor Stocks Rally: Shares of key chip equipment firms like ASML (+4.3%) and Tokyo Electron (+6%) jumped following reports that US sanctions on China's chip sector may be less severe than earlier proposals.

Policy Shift on Huawei: The US is reportedly reconsidering its Entity List additions, sparing some firms like ChangXin Memory Technologies, a potential rival to Samsung and SK Hynix. This marks a departure from previous hardline measures targeting Chinese tech.

Analyst Insights: Jefferies noted that ASML previously projected a 30% revenue drop from China in 2025, but softer restrictions could ease this decline, offering a more optimistic outlook for next year’s sales.

Broader Implications: The potential shift reflects a balancing act by Washington, aiming to curb China's tech advances without overly disrupting global semiconductor supply chains.

FTC Opens Broad Antitrust Probe Into Microsoft

Sweeping Investigation: The US FTC has launched an extensive antitrust investigation into Microsoft, focusing on its cloud computing, software bundling, cybersecurity practices, and AI offerings. The inquiry follows over a year of informal interviews and includes a detailed demand for information, approved by outgoing FTC Chair Lina Khan.

Bundling and Market Dominance: A central concern is Microsoft’s bundling of productivity tools like Teams with Office software, which competitors like Slack and Zoom argue stifles competition. Licensing practices and its dominance as a government contractor are also under scrutiny.

Cybersecurity Failures Spotlighted: Recent security incidents, including the CrowdStrike crash impacting millions of Windows devices, have underscored Microsoft’s outsized influence on critical infrastructure and the economy. The FTC cites risks posed by concentrated power in the cloud market.

Future Regulatory Landscape: Khan’s departure leaves the case’s fate to a Trump-appointed FTC chair, raising questions about whether the aggressive regulatory stance will continue or soften under the new administration.

Uber Under FTC Scrutiny Over Subscription Practices

Photo by Priscilla Du Preez 🇨🇦 / Unsplash

Consumer Protection Probe: The FTC is investigating Uber’s Uber One subscription service, focusing on its enrollment and cancellation policies. Uber, which claims most cancellations take under 20 seconds, says it is cooperating with the inquiry.

Subscription Transparency at Stake: The FTC has sued companies like Amazon and Adobe for making cancellations difficult. This case aligns with the agency’s broader push for easier subscription terminations, despite challenges to its recently finalized rule on the matter.

Settlement Disputes: Uber criticized the FTC for seeking a quick settlement with “enormous” penalties just months into the investigation. The probe comes as the agency rushes to finalize cases before Donald Trump’s administration begins.

Leadership Transition Looms: Republican Commissioner Melissa Holyoak, a potential FTC chair under Trump, flagged concerns over the probe's haste. The case’s resolution may hinge on the agency’s new leadership and their regulatory stance.

OPEC+ Postpones Oil Supply Meeting Amid Market Uncertainty

Photo by Delfino Barboza / Unsplash

Meeting Delayed: OPEC+ has rescheduled its planned online meeting from December 1 to December 5 due to key ministers attending the Gulf Cooperation Council summit. Such delays often signal behind-the-scenes negotiations to reach consensus.

Production Hike in Question: The group is debating whether to postpone a 180,000 barrel-per-day output increase set for January, with leaders Saudi Arabia and Russia holding talks this week with Iraq and Kazakhstan to align strategies.

Market Challenges: OPEC+ faces a dilemma: extending production cuts into 2025 to prevent a price slump or risking a supply glut, as forecasted by the IEA. Brent crude remains subdued at just under $73 a barrel, down 17% since July, reflecting weak Chinese demand and abundant supply from the Americas.

Compliance Improves: Iraq, Russia, and Kazakhstan, previously lagging in production cut compliance, have improved performance, but sustaining these efforts remains critical to stabilizing global markets.

Trump and Zuckerberg Hold Mar-a-Lago Dinner Amid Tech Tensions

Photo by Glen Carrie / Unsplash

Unexpected Reunion: President-elect Donald Trump hosted Meta CEO Mark Zuckerberg at Mar-a-Lago on Wednesday. While details of the discussion remain unclear, Meta described the meeting as happening at a "crucial time for US innovation."

History of Conflict: The relationship between Trump and Zuckerberg has been contentious, particularly after Facebook banned Trump following the Capitol attack in January 2021. Despite this, Meta reinstated Trump's accounts in early 2023, signaling a thaw in relations.

Political Implications: Zuckerberg’s presence could mark an effort to navigate Republican criticism of tech platforms for alleged censorship of conservative voices. His post-election congratulations to Trump hints at a strategic shift to maintain Meta's influence under the new administration.

No Thanksgiving Stay: While Zuckerberg attended the meeting, he reportedly did not remain at Mar-a-Lago for Thanksgiving celebrations, emphasizing the professional nature of the encounter.

Latest On Global Markets

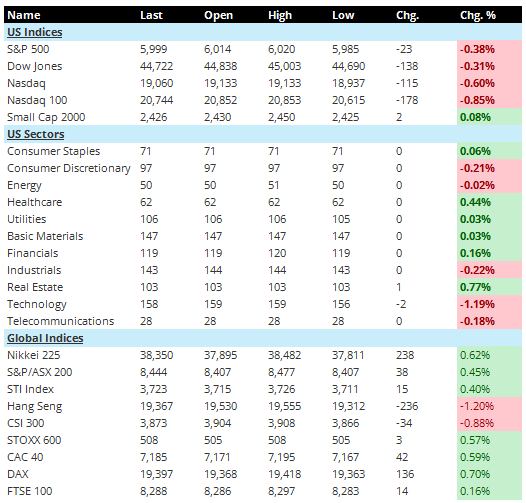

US Futures: Futures are pointing upward, with Dow Jones futures up 0.11% and S&P 500 futures rising 0.12%. This suggests optimism heading into the session, despite mixed performance in prior trading.

US Indices (Previous Session): The major US indices closed lower, reflecting broad market caution. The S&P 500 dropped 0.38%, and the Dow Jones declined 0.31%. Tech-heavy indices saw sharper losses, with the Nasdaq down 0.60% and the Nasdaq 100 falling 0.85%. Small caps bucked the trend slightly, with the Small Cap 2000 eking out a 0.08% gain, showing resilience among smaller companies.

US Sectors: Sector performance was mixed as investors weighed sector-specific developments. Healthcare led the gains with a rise of 0.44%, supported by positive sentiment in biotech and pharmaceuticals. Real Estate also performed well, climbing 0.77%, likely buoyed by easing bond yields. Conversely, Technology took a hit, dropping 1.19%, as concerns over growth and valuation weighed on sentiment. Energy remained flat, edging lower by 0.02%, amid fluctuating oil prices.

Asia: Asian markets presented a mixed picture. The Nikkei 225 gained 0.62%, bolstered by strength in automotive and export sectors, while the S&P/ASX 200 rose 0.45%. The STI Index also advanced, up 0.40%, reflecting steady performance in Singaporean blue-chip stocks. On the downside, the Hang Seng dropped 1.20%, weighed down by concerns over Chinese economic recovery, and the CSI 300 fell 0.88%.

Europe: European markets showed strength, with most indices in positive territory. The STOXX 600 rose 0.57%, driven by gains in financials and industrials. France’s CAC 40 added 0.59%, while Germany’s DAX climbed 0.70%, supported by upbeat corporate earnings. The FTSE 100 inched up 0.16%, reflecting cautious optimism amid steady performance in UK-focused stocks.

The mix of sector and regional movements reflects ongoing uncertainty, with markets closely monitoring economic data and central bank signals for clearer direction.

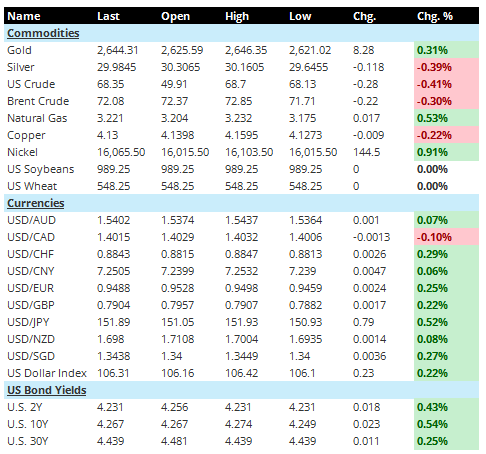

Commodities: Precious metals had a mixed day, with Gold rising 0.31% to $2,644.31, while Silver fell 0.39% to $29.98. Energy markets showed weakness as US Crude declined 0.41% to $68.35, and Brent Crude slipped 0.30% to $72.08. Natural Gas posted gains, climbing 0.53% to $3.22, while Nickel outperformed, rising 0.91% to $16,065.50. Agricultural commodities remained flat, with US Soybeans and US Wheat unchanged.

Currencies: The US Dollar Index advanced 0.22% to 106.31, reflecting broad strength. Against major currencies, the USD gained 0.52% versus the JPY, reaching 151.89, and rose 0.29% against the CHF to 0.8843. The greenback also gained 0.25% against the EUR, trading at 0.9488, and climbed 0.22% against the GBP to 0.7904. Losses were modest, with USD weakening 0.10% against the CAD.

US Bond Yields: Yields rose across the curve. The 2-year yield increased by 4.3 basis points to 4.231 (0.43%), while the 10-year yield climbed 5.4 basis points to 4.267 (0.54%). The 30-year yield also edged higher, gaining 2.5 basis points to 4.439 (0.25%).

Economic Data Today

5:00 AM ET: Final value of the Eurozone Consumer Confidence Index for November is expected (initial value was -13.7).

8:00 AM ET: Preliminary German Consumer Price Index (CPI) for November (year-on-year) is estimated at 2.3%, compared to the previous value of 2.0%.

8:30 AM ET: Speech by François Villeroy de Galhau, Governor of the Bank of France and ECB Governing Council member.

27th (Evening): Bank of Korea interest rate decision (expected to remain at 3.25%, current value 3.25%).

12:00 AM ET (28th): Speech by ECB Chief Economist Philip Lane.

Other Notable News

Housing Market: Existing home sales hit a seven-month high in October, spurred by a temporary dip in mortgage rates, signaling unexpected resilience in the sector.

Elon Musk, tapped for government efficiency, calls for abolishing the Consumer Financial Protection Bureau.

ECB official Isabel Schnabel warns against excessive rate cuts, cautioning they could harm economic stability.

The Philippine peso may hit a record low, but central bank authorities pledge to maintain market order.

New US sanctions have severely impacted the ruble, with Russia's foreign exchange channels nearing exhaustion.

Texas-led lawsuits target BlackRock, Vanguard, and State Street for alleged antitrust violations.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.