UK GDP Slump, China-U.S. Trade Talks, and Soaring Coffee Prices

The UK grapples with a surprising GDP contraction and a falling pound, the U.S. and China engage in cautious trade talks ahead of Trump’s inauguration, and soaring coffee prices signal potential long-term supply issues due to extreme weather.

Hello, it’s Ryosuke! Today, we’ve got a packed report covering some major developments affecting global markets and economies. Here are the key topics we'll explore:

- UK Economic Slowdown: The UK faces a surprising downturn as GDP contracts for the second consecutive month, prompting concerns over currency stability and fiscal policies.

- US-China Trade Relations: In light of incoming administration changes, both nations are attempting to mend trade ties amid worries about tariff impacts and economic strategies.

- Record Coffee Prices: A significant surge in coffee prices signals potential long-term changes in the market, driven by climate issues and growing global demand.

- Escalating Conflict in Ukraine: Renewed Russian missile strikes on western Ukraine raise regional tensions and pose challenges to energy stability in Europe.

- ECB's Interest Rate Dilemma: The European Central Bank is facing scrutiny over its high interest rates in light of sluggish economic growth, with policymakers considering potential rate cuts.

Details and broader implications are covered below—let’s dive in!

UK Economy Faces Downturn as GDP Contracts for a Second Month

Photo by Maxim Hopman / Unsplash

Unexpected Decline: The latest data from the Office for National Statistics revealed that the UK economy shrank by 0.1% in October, following a similar downturn in September. Economists had anticipated a stable month, expecting a rise in GDP, underscoring the unexpected nature of the current economic climate.

Impact on Currency: In reaction to this disappointing GDP report, the British pound fell 0.3% against the U.S. dollar, trading at $1.2627. This currency dip reflects broader concerns about the sustainability of the UK’s economic growth, which may affect investor confidence moving forward.

Government Response: UK Finance Minister Rachel Reeves acknowledged the concerning figures but defended the government’s economic strategies, citing efforts aimed at long-term growth. Specific policies include a corporation tax cap and the introduction of a comprehensive 10-year infrastructure strategy aimed at revitalizing the economy.

Criticism of Fiscal Policies: The government’s recent budget proposals have faced backlash, particularly the planned tax hikes totaling £40 billion. Critics argue that increases in National Insurance and capital gains taxes could hinder job creations, as reported by recruitment agencies, signaling ongoing tension between fiscal strategy and economic health in the UK.

China and the U.S. Initiate Efforts to Repair Trade Relations Ahead of Trump’s Inauguration

Photo by Pau Casals / Unsplash

Xi's Overtures for Dialogue: President Xi Jinping recently emphasized the importance of dialogue with U.S. President-elect Donald Trump, urging both nations to prioritize cooperation over confrontation. His remarks suggest an anxiety within Beijing about potential trade conflicts, as he highlighted open communication and the benefits of mutual negotiation.

Concerns Over Trump's Policies: Trump's "America First" strategy poses significant challenges for Chinese leaders amid their efforts to revitalize a slowing economy. With plans for increased tariffs on Chinese imports already on the table, China is preparing for uncertain economic relations, while also stressing that it will not yield to pressure without a fight.

Trade Tensions Escalate: As tensions mount, both sides are likely to engage in negotiations to navigate the potential introduction of tariffs. Experts believe that while some tariffs may be implemented, they are expected to be closely coordinated and gradual rather than abrupt, mitigating the impacts on both economies.

A Diplomatic Balancing Act: While promoting an openness to dialogue, China is cautious not to appear overly submissive to U.S. demands, indicating a readiness to engage but not to concede significant control. This delicate balance will be crucial as the two nations head toward more direct interactions and potential compromises in the near future.

Record Coffee Prices Signal Long-Term Changes Ahead

Photo by Demi DeHerrera / Unsplash

Unprecedented Climbs: Coffee prices have skyrocketed to near 50-year highs, with arabica futures hitting 348.35 cents per pound—the highest since 1977. This remarkable surge reflects a 70% increase year-to-date, raising critical concerns about the supply chain for this beloved beverage.

Supply Struggles: The primary culprits driving these price hikes are severe droughts and extreme temperatures impacting major coffee-producing regions, especially Brazil, which is responsible for over half of the world’s coffee supply. This climate instability has left analysts predicting that it could take years to restore stock levels, as consistently poor harvests compound the problem.

Global Demand vs. Production: The growing global appetite for coffee, particularly in China, keeps the pressure on an already strained supply. As coffee is mainly cultivated in a limited tropical zone, adverse weather conditions pose significant risks, amplifying the potential for future price surges.

Impact on Consumers: With these rising costs, coffee companies like Nestlé are likely to pass on prices to consumers, leading to higher retail costs. As manufacturers try to absorb increased expenses, customers can expect smaller packaging and rising prices for their favorite brews moving forward, indicating that these changes in the coffee market may be here to stay.

Renewed Russian Missile Strikes Hit Western Ukraine

Surprising Attack: After weeks of relative quiet, Russia launched intense missile strikes targeting western Ukraine on Friday. The assault involved hypersonic Kinzhal missiles directed at key regions, signaling a stark escalation in hostilities as air defenses struggled to cope.

Regional Reaction: In an immediate response, Poland scrambled its fighter jets amidst growing tensions. This move highlights the increasing regional concern over Russian aggression and suggests that neighboring countries are preparing for potential spillover effects from the ongoing conflict.

Political Tensions: The strikes followed controversial remarks by US President-elect Donald Trump, expressing opposition to Ukraine's use of long-range Western weapons against Russian targets. This backdrop of political rhetoric complicates the dynamics of military engagement, as both nations recalibrate their strategies in response to external pressures.

Continued Conflict Impact: Russia's persistent strikes are largely aimed at crippling Ukraine's energy and gas transport infrastructure, keeping the country under threat as it prepares for a strategic transition in its gas contracts with the EU by early 2025. As the conflict rages on, the implications for energy stability in Europe and the ongoing integration of military support for Ukraine will remain crucial points of discussion.

ECB's Interest Rates Under Scrutiny Amid Economic Weakness

Photo by micheile henderson / Unsplash

High Rates Causing Concern: European Central Bank (ECB) Governing Council member Madis Muller expressed that current borrowing costs may be too high, given the sluggish economic growth across Europe. He noted that the rates are restrictive, potentially hampering economic activity as the ECB had just implemented its fourth rate cut of the year.

Anticipated Rate Cuts Ahead: Policymakers are looking at further cuts, with predictions of a quarter-point decrease in January and possibly in March, as inflation stabilizes around the 2% target. There’s even talk of a half-point cut if economic conditions deteriorate significantly, although care must be taken to avoid creating a sense of urgency.

Cautious Optimism on Recovery: While Muller sees potential for gradual economic improvement, he cautions against expectations for a strong rebound. He recognizes that while markets are predicting an overall reduction of rates by another 100 basis points, reality suggests that robust growth is not imminent.

Flexibility in Decision-Making: Supporting this cautious strategy, fellow ECB council member Martins Kazaks highlighted that future interest rate decisions will remain data-driven and adaptable to evolving economic conditions. He believes significant reductions are still required, suggesting the neutral rate lies closer to 2%, while also acknowledging potential inflationary pressures from geopolitical factors.

Latest On Global Markets

US Futures: Futures are showing mixed signals, with Dow Jones futures increasing 0.12%, S&P 500 futures up 0.22%, while Nasdaq 100 futures are rising 0.47%.

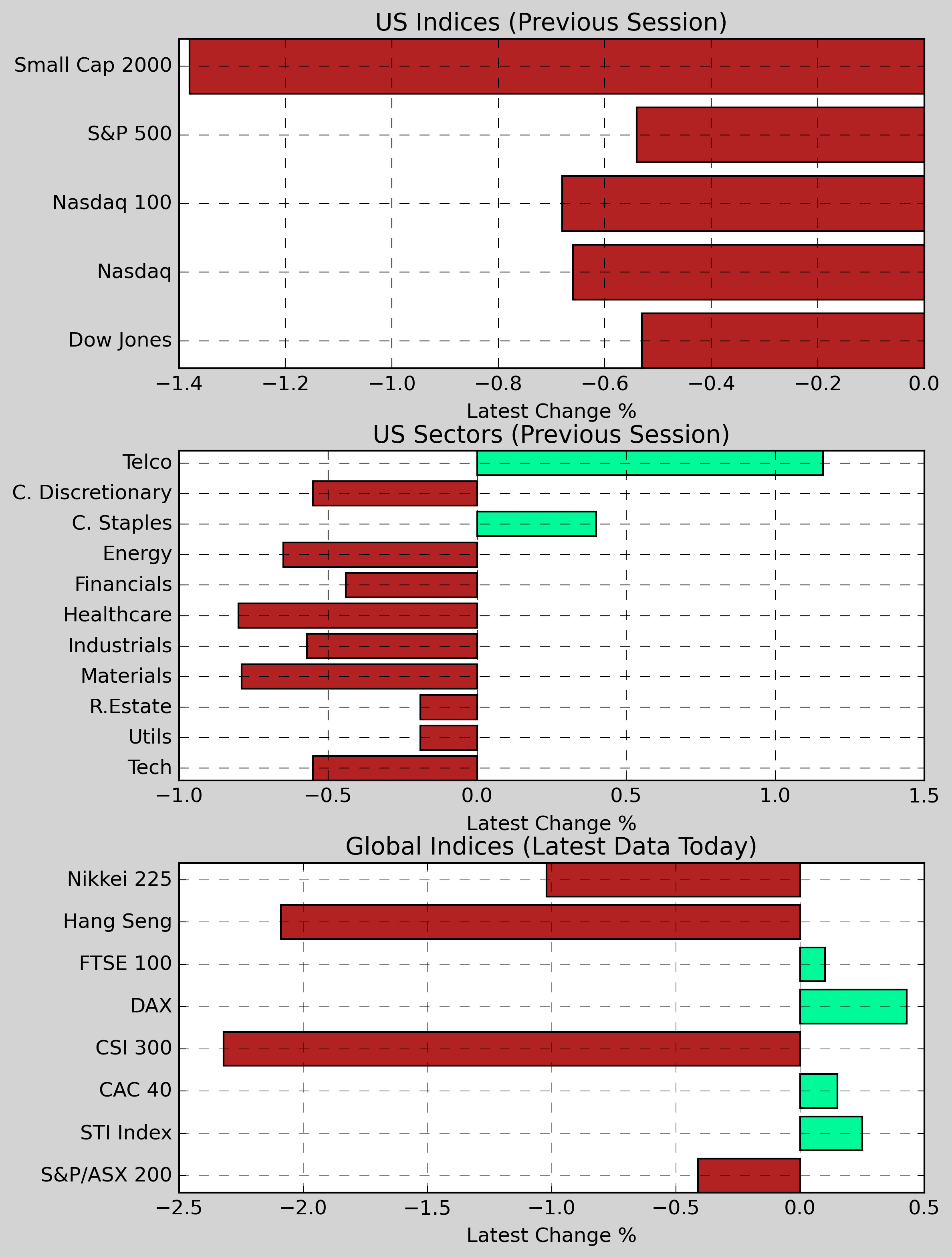

US Indices (Previous Session): The S&P 500 fell 0.54% to 6,051.25, while the Dow Jones declined 0.53% to 43,914.12. The Nasdaq slipped 0.66%, closing at 19,902.84, and the Nasdaq 100 dropped 0.68%. The Small Cap 2000 experienced the largest decline, down 1.38%.

US Sectors (Previous Session): The Consumer Goods sector made gains, rising 0.40%, while Consumer Services fell 0.55%. Utilities decreased 1.90%, and Basic Materials dropped 0.79%. Financials also showed weakness, declining 0.44%, along with Energy falling 0.65%.

Global Indices: The CAC 40 registered a modest gain of 0.15%, while the DAX increased 0.43%. In contrast, the Nikkei 225 lost 1.02%, and the S&P/ASX 200 fell 0.41%. The Hang Seng slipped 2.09%, as the CSI 300 declined 2.32%.

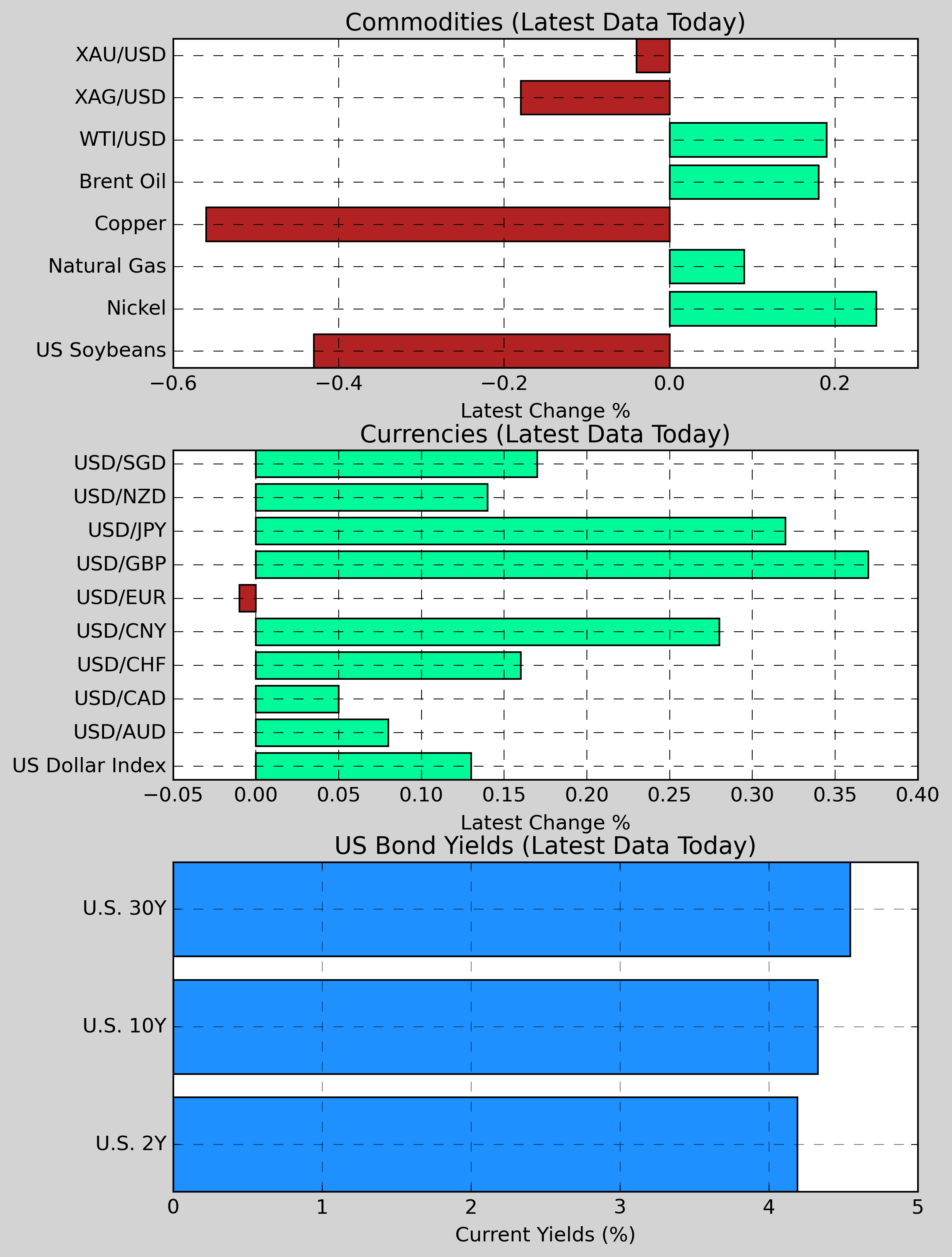

Commodities: Gold decreased 0.04% to $2,679.87, while Copper fell 0.56% to $4.2207. Nickel rose 0.25% to $16,216.50. US Wheat dipped 0.20% to $556.88. Natural Gas gained slightly, rising 0.09% to $3.458. Brent Crude edged up 0.18% to $73.54. On the other hand, US Soybeans declined 0.43%.

US Equities: The Nasdaq 100 Futures surged 0.47% to 21,754.00, while Dow Jones Futures increased 0.12% to 44,029.00. S&P 500 Futures moved up 0.22% to 6,074.00. Conversely, the small cap index fell, with Small Cap 2000 down 1.38% to 2,361.08.

Currencies: The US Dollar index rose 0.13% to 107.10. The Dollar strengthened against various currencies, with USD/CNY up 0.28% and USD/GBP rising 0.37%. However, USD/EUR slipped 0.01% to 0.9553, and USD/AUD recorded a slight gain of 0.08% to 1.5715.

US Bond Yields: The U.S. 2-Year Treasury yield dipped 0.15bps to 4.192%, while the U.S. 10-Year Treasury yield declined 0.05bps to 4.328%. The U.S. 30-Year Treasury yield remained unchanged at 4.546%.

Economic Data & Central Bank Developments (Eastern Time)

- 08:30 AM ET: U.S. import prices in November (estimated to be -0.2%, previous value is 0.3%)

- 13 to 15 December China's November money supply M2 year-on-year (estimated to be 7.5%, previous value is 7.5%)

- 13 to 15 December China's new RMB loans from January to November (estimated at 17.515 trillion yuan, previous value is 16.52 trillion yuan)

- 13 to 15 December China's social financing scale increase from January to November (estimated to be 29.791 trillion yuan, the previous value was 27.06 trillion yuan)

Other Notable News

-

Economic Adjustments in the Eurozone: The European Central Bank has implemented its third consecutive interest rate reduction and omitted previous statements regarding the necessity of maintaining a restrictive monetary policy. There are indications that further cuts of 25 basis points are anticipated in January and March of the coming year. Moreover, President Lagarde has lowered expectations for economic growth and inflation, highlighting a loss of momentum in the eurozone economy.

-

U.S. Inflation Insights: The Producer Price Index (PPI) in the U.S. saw an unexpected rise in November, primarily driven by increasing food costs. However, various sub-indicators suggest that the Personal Consumption Expenditures (PCE) inflation rate, which is of particular concern to the Federal Reserve, may remain more subdued.

-

South Korea’s Political Instability: President Yoon Seok-yeol of South Korea faces mounting pressure as the opposition party moves forward with a second impeachment motion, gaining traction as more members from the ruling party signal support for the initiative.

-

SNB's Unexpected Rate Cut: The Swiss National Bank made a surprising decision to reduce interest rates by 50 basis points, signifying a potential return to negative interest rates if necessary to mitigate speculation surrounding the Swiss franc.

-

Wealth Trends in the U.S.: U.S. household wealth has surged to an all-time high during the third quarter, largely driven by gains witnessed in the stock market.

-

Broadcom’s Forecast Success: Following market close, Broadcom's stocks soared as the company projected a remarkable 65% increase in sales of artificial intelligence products for the first fiscal quarter, outpacing average growth rates across the semiconductor industry.

-

Macron's Government Reshuffle: French President Emmanuel Macron's office announced that a new prime minister will be revealed on Friday morning, indicating potential shifts in the government structure.

-

Energy Market Outlook: The International Energy Agency has warned of an anticipated oversupply in the global oil market next year, even in cases where OPEC+ decides to delay production increases.

-

U.S.-Russia Negotiation Leverage: Former President Trump stated his intent to utilize U.S. aid to Ukraine as a bargaining chip to urge Russia toward negotiations.

-

Canada's Consideration of Export Taxes: Reports suggest that Canada is weighing the implementation of export taxes on uranium and oil as a defensive strategy against tariff threats from Trump.

-

Russia-Syria Military Base Agreement: Reports indicate that Russia is nearing an agreement with Syria’s newly appointed leader to maintain its military presence in the country, aiming to secure strategic military assets.

-

Apple’s In-House Chip Development: Apple is reportedly set to begin in-house production of a significant wireless chip next year, aimed at replacing components currently supplied by Broadcom.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.