Trump's Diplomatic Invite to Xi, US Inflation Signals Rate Cuts, and Israel's Military Escalation in Syria

Trump's unprecedented invitation to Xi for his inauguration stirs the political pot as U.S.-China tensions simmer, while inflation trends hint at a possible Fed rate cut and the ECB prepares for yet another rate reduction amid economic uncertainty.

Hello, it’s Ryosuke! Today, we’re diving into some pivotal developments that are shaping the global landscape. Here’s a quick summary of the key highlights from today’s report:

-

Diplomatic Ventures: President-elect Donald Trump extends a historic invitation to Chinese President Xi Jinping for his inauguration amid ongoing U.S.-China tensions.

-

Inflation Insights: The recent U.S. inflation data indicates stability, potentially paving the way for Federal Reserve interest rate cuts, while also revealing mixed trends in consumer goods pricing.

-

ECB's Rate Moves: The European Central Bank is poised to announce its fourth rate cut this year, reflecting growing concerns about economic sluggishness in the eurozone.

-

Currency Fluctuations: The Bank of Japan faces pressures regarding interest rate hikes, leading to a significant drop in the yen's value, raising concerns among currency strategists.

-

Market Resilience in China: Chinese stocks see a rally driven by consumer optimism and new spending initiatives, as businesses prepare for further government support measures.

Details and broader implications are covered below—let’s dive in!

Trump Invites Xi Jinping to Inauguration: A Diplomatic Gamble

Photo by History in HD / Unsplash

Historic Invitation: President-elect Donald Trump has invited Chinese President Xi Jinping to his inauguration next month, marking a bold move as no Chinese leader has attended a U.S. presidential inauguration before. This invitation could symbolize Trump's attempt to foster relations with Xi during a period of tension, particularly as he threatens new tariffs against China.

Political and Weather Concerns: Xi's potential attendance comes with considerable risks, not just politically but also practically, as January temperatures in Washington can be frigid. The discomfort of enduring a lengthy outdoor ceremony, coupled with the implications of being seen in the U.S. political arena, adds a layer of complexity to this diplomatic gesture.

Ongoing Tensions: Despite Trump's overtures, relations between the U.S. and China remain strained. Trump has campaigned on a platform of hefty tariffs against Chinese goods and is pressing Beijing to help curb the flow of fentanyl into the U.S., illustrating the continued economic and security rifts that will dominate his administration’s agenda.

Strategic Appointments: With a team of China hawks in key positions, including Representative Mike Waltz as national security adviser and Senator Marco Rubio as secretary of State, Trump is gearing up for a tough stance on China. Interestingly, he has also appointed former Senator David Perdue as ambassador to China, a move that might offer a more temperate approach amid the expected confrontational policy direction.

US Inflation Trends Point to Potential Fed Rate Cut

Stable Core Inflation: In November, the core consumer price index (CPI), which excludes food and energy, rose 0.3% for the fourth consecutive month, reflecting a year-over-year increase of 3.3%. This stability in core inflation aligns with economists' expectations and strengthens predictions for the Federal Reserve to cut rates in the upcoming December meeting.

Shelter Costs Ease: Shelter costs, which have significantly driven inflation, showed signs of relief, climbing only 0.3% in November, the smallest increase since 2021. This shift is notable as it comprised almost 40% of the overall inflation advance, indicating easing pressures in a persistently hot category.

Broader Price Trends: While essential goods excluding food and energy also rose 0.3%, which was the largest increase since May, grocery prices surged by 0.5%, the highest rise since early last year. These mixed signals from various goods and services suggest a complexity in the inflation landscape that the Fed must navigate.

Labor Market Indicators: The recent inflation data is complemented by a report on real hourly earnings, which increased by 1.3% over the past year, hinting at resilience in wage growth. However, as policymakers remain cautious about inflationary pressures, the focus will shift to how upcoming economic policies, particularly those from the incoming administration, might influence consumer prices moving forward.

ECB Poised for Fourth Rate Cut Amid Economic Concerns

Photo by Yuedongzi CHAI / Unsplash

Rate Reduction Expected: The European Central Bank (ECB) is anticipated to announce its fourth interest rate cut this year, with most analysts predicting a quarter-point decrease in the deposit rate to 3%. This move aims to alleviate pressure on the eurozone's struggling economy as inflation stabilizes around 2%.

Economic Worries Highlighted: Policymakers are increasingly concerned about sluggish growth potentially dragging inflation below target levels. Compounding these challenges are recent government instability in major economies like Germany and France, as well as potential economic implications from international developments, particularly concerning the U.S.

Future Projections Under Review: The ECB's upcoming quarterly forecasts are expected to reflect weaker economic growth, suggesting that adjustments to previous optimism may be necessary. Analysts foresee a gradual decline to a deposit rate around 2%, though some officials advocate for rates to potentially drop below the expected neutral level to facilitate recovery, aiming to keep options open without disrupting market stability.

Political Turmoil and Market Response: Challenges in France, including a stalled budget agreement, have injected volatility into debt markets, echoing past financial crises. While some speculate on the ECB possibly resorting to emergency bond-buying measures, officials like Bundesbank President Joachim Nagel caution against using such tools for political events, underscoring the complexity of navigating economic recovery in a turbulent political landscape.

Emerging Risks for the Yen as BOJ Considers Rate Plans

Photo by Jezael Melgoza / Unsplash

Diminishing Hike Expectations: Recent speculations suggest the Bank of Japan (BOJ) may hold off on interest rate hikes until March or later, which worries currency strategists in Tokyo. This sentiment contributed to the yen dropping to its lowest level in over two weeks, specifically hitting 152.82 against the dollar, reflecting traders' anxieties about delayed monetary policy adjustments.

Market Reactions: Following a Bloomberg report indicating internal hesitations among BOJ officials, the currency continued its descent. Notably, the probability of a rate hike this December has plummeted to just 15%, while economists expect a more significant 76% likelihood of action by January and 94% by March, highlighting shifting market confidence.

Cautious Outlook on Weakness: Analysts express that waiting longer on rate increases could revitalize yen carry trades, potentially pushing the currency down to levels as low as 155 or even below 157. This concern is underscored by commentary from Shusuke Yamada of Bank of America, who indicated that the dynamics of the yen would significantly shift if a delay occurs.

Inflation Influences and Future Actions: While some experts believe rate hikes may still be on the horizon, the potential for further yen depreciation could compel the BOJ to act quicker than anticipated. If the Federal Reserve signals hawkish policies due to rising US inflation, it may further weaken the yen, potentially speeding up BOJ decisions on interest rates in the coming months.

Chinese Stocks Rally on Consumer Optimism and New Vouchers

Photo by Steve Long / Unsplash

Strong Market Response: Chinese consumption stocks saw significant gains on Thursday, with major players like Trip.com and Haidilao each rising over 5%. This surge occurred after the announcement of policies aimed at boosting domestic demand ahead of the highly anticipated Central Economic Work Conference.

Policy Expectations Drive Hopes: Analysts, including Shen Meng from Chanson & Co., highlighted optimism for more targeted measures to enhance consumption, which are expected to be discussed during the conference. The combination of these new policies with previous stimulus efforts is fostering a positive sentiment in the market.

Local Initiatives Boost consumer spending: Anticipation is also building around new voucher programs set to launch in major cities like Shanghai and Beijing, aimed at energizing local spending just in time for the holiday season. These initiatives are seen as crucial to counteracting the slowdown in consumer activity.

Investor Sentiment in Flux: While recent gains suggest traders are regaining confidence, there remains caution due to past policy disappointments. Investors are keenly watching for concrete plans emerging from the conference to determine if the current rally can sustain itself, especially after previous peaks were not maintained.

Israel's Strategic Military Operations Amid Syrian Turmoil

Photo by Taylor Brandon / Unsplash

Massive Air Strikes: In a significant military campaign, Israel has launched over 350 air strikes targeting Syrian military assets since Saturday. This operation reportedly dismantles 70-80% of Syria's strategic military capabilities, marking it as the largest Israeli military action in recent history.

Ground Control Seized: Israeli Defense Forces (IDF) have taken control of crucial positions in southern Syria, including the summit of Mt. Hermon, which offers a strategic vantage point over the capital, Damascus. This move is framed as a necessary action to eliminate perceived threats from militant groups and secure Israel's borders.

Rationale and Reactions: Israeli officials assert that their actions stem from a need to prevent weapons from falling into the hands of extremist factions or Hezbollah. While some regional neighbors view these moves as a breach of Syria's sovereignty, Israeli public opinion largely supports the military's proactive stance in light of Hamas attacks earlier this October.

International Concerns: Despite Israel's justification of self-defense, international criticism has risen from entities like the UN, France, and Germany, urging a return to diplomatic norms and cautioning against further escalation in the area. As tensions simmer, the complex web of regional politics remains divisive, signaling a tense future for Israeli-Syrian relations.

Latest On Global Markets

US Futures: Futures are indicating a mixed outlook, with Dow Jones futures declining 0.25% and S&P 500 futures falling 0.14%. Meanwhile, Nasdaq 100 futures saw a slight dip, decreasing 0.17%.

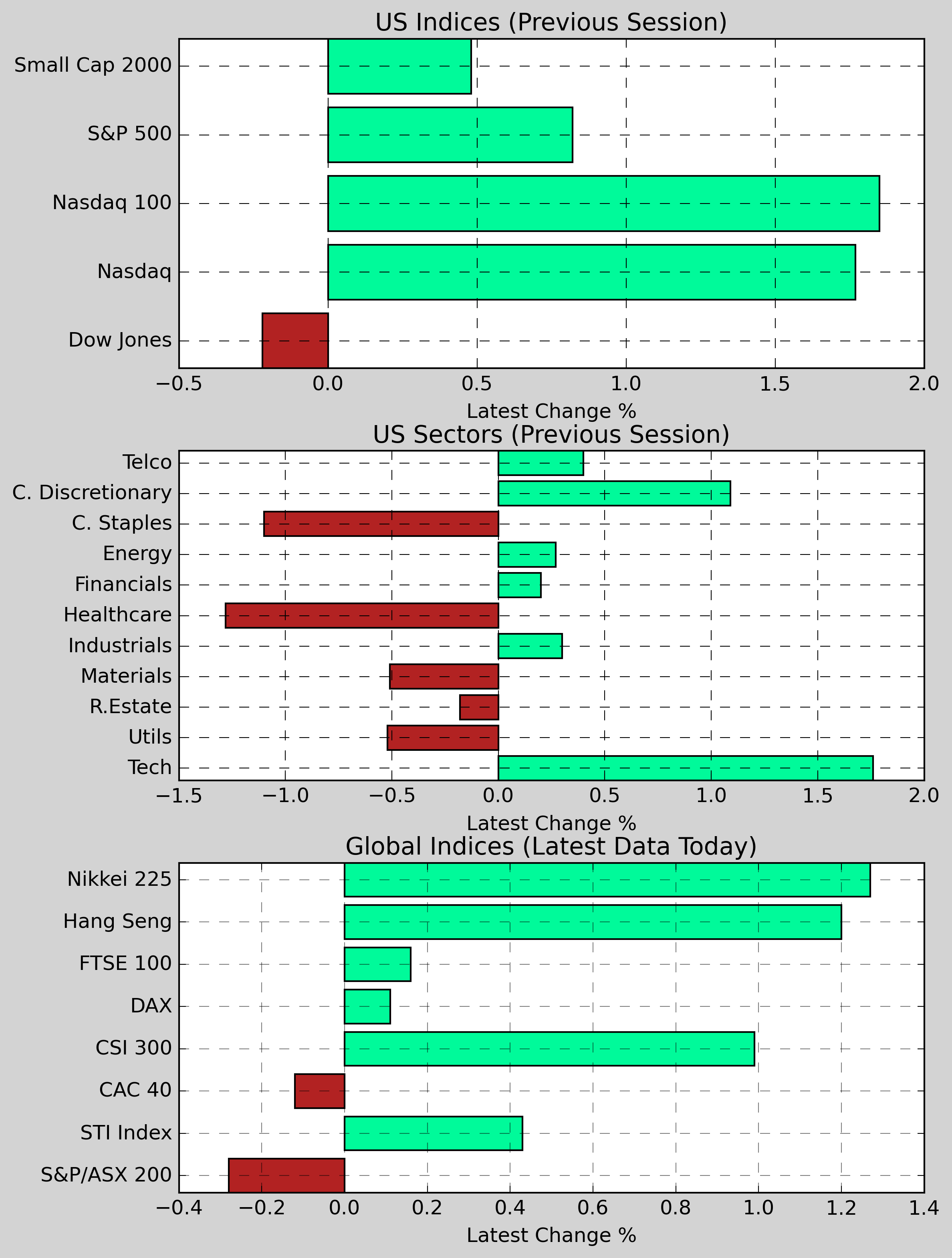

US Indices (Previous Session): The S&P 500 rose 0.82% to 6,084.19, while the Dow Jones fell 0.22% to 44,148.56. The Nasdaq increased 1.77%, ending at 20,034.89, and the Nasdaq 100 surged 1.85%. The Small Cap 2000 also showed a positive gain of 0.48%.

US Sectors (Previous Session): The Consumer Services sector led the gains, increasing 1.09%, followed by Financials, which rose 0.20%, and Energy, which climbed 0.27%. On the downside, Healthcare dropped 1.28%, Basic Materials fell 0.51%, and Utilities declined 0.52%.

Global Indices: The Hang Seng climbed 1.20%, while the CSI 300 rose 0.99%. In Europe, the DAX gained 0.11%, while the CAC 40 slipped 0.12%. On the downside, the Nikkei 225 dropped 0.27%, and the FTSE 100 edged up 0.16%.

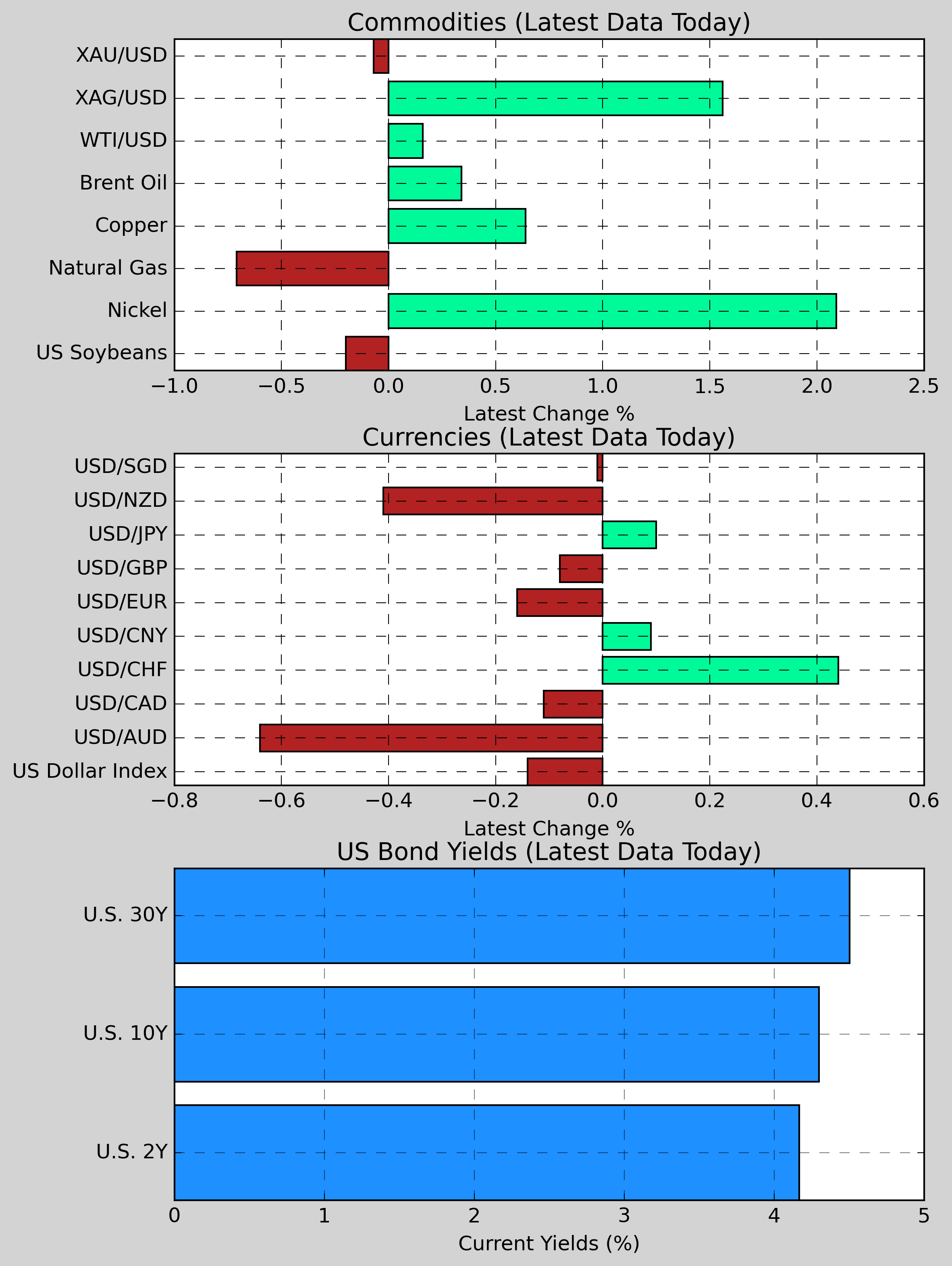

Commodities: Gold slightly declined 0.07% to $2,716.14. Copper increased 0.64% to $4.2908, while Nickel advanced 2.09% to $16,163. Natural Gas fell 0.71% to $3.354, and US Wheat dropped 0.25% to $561.60. US Soybeans also decreased 0.20%. Brent Crude saw a slight gain, up 0.34% to $73.77.

Currencies: The US Dollar exhibited mixed performance; USD/AUD fell 0.64%, while USD/CNY increased 0.09%. USD/CAD and USD/CHF saw small declines of 0.11% and 0.44% respectively. The US Dollar Index dipped 0.14% to 106.56.

US Bond Yields: The U.S. 2-Year Treasury yield saw a marginal increase of 2bps to 4.168%, while the U.S. 10-Year Treasury yield rose 6bps to 4.300%. The U.S. 30-Year Treasury yield increased slightly as well, adding 2bps to 4.505%.

Economic Data & Central Bank Developments (Eastern Time)

- 08:15 AM ET: ECB deposit rate (estimated at 3%, current value at 3.25%)

- 08:15 AM ET: ECB main refinancing rate (estimated at 3.15%, current value at 3.4%)

- 08:15 AM ET: ECB marginal lending rate (estimated at 3.4%, current value 3.65%)

- 08:30 AM ET: U.S. Producer Price Index month-on-month in November (estimated to be 0.2%, previous value was 0.2%)

- 08:30 AM ET: U.S. Producer Price Index year-on-year in November (estimated to be 2.6%, previous value was 2.4%)

- 08:30 AM ET: Number of first-time unemployment claims in the United States last week (estimated at 220,000, previous value at 224,000)

- 08:45 AM ET: Press conference by ECB President Lagarde

Other Notable News

-

Bank of Canada Adjusts Monetary Policy: In a consecutive move, the Bank of Canada reduced interest rates by 50 basis points, but indicated a potential slowdown in its pace of monetary easing for the upcoming year.

-

OPEC Revises Oil Demand Forecasts: For the fifth month in a row, OPEC downgraded its projections for global oil demand growth for this year and the next, with the most significant reduction being made for 2024.

-

Political Tensions in South Korea: Amidst escalating political unrest, South Korea's central bank announced aggressive cash infusions into the financial markets, promising 'unlimited liquidity' to stabilize the situation. Additionally, it has been reported that the head of the ruling party may back an impeachment motion against President Yoon Seok-yeol as early as Thursday.

-

Germany's Confidence Vote Call: Chancellor Scholz of Germany has officially requested a confidence vote set for next Monday, a move that could pave the way for an early election by late February.

-

Rising Tensions and Military Developments: U.S. officials disclosed that Russia is anticipated to test a new medium-range ballistic missile named "Oreshnik" targeting Ukraine within days, while the Russian Ministry of Defense has promised a response to recent attacks on its bases.

-

Apple's AI Chip Development: Reports suggest that Apple is collaborating with Broadcom to produce artificial intelligence chips, which are anticipated to enter mass production by 2026.

-

Hershey Rejects Takeover Offer: The leading stakeholder in U.S. chocolate manufacturer Hershey has reportedly spurned an initial takeover proposal from Mondelez, claiming it was undervalued.

-

Vanguard's Strategic Shift: In an unconventional move, Vanguard is advocating for a strategy of "60% debt, 40% equity" to navigate the policy risks expected in 2025.

-

FBI Director's Early Departure: Christopher Wray, the FBI Director, is set to resign ahead of Trump’s inauguration, marking an early end to his term.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.