Trump, Tariffs, and Global Tensions Take Center Stage

Global markets are buzzing as China's red lines clash with Trump’s tariff threats, adding tension to trade dynamics. Xi Jinping emphasizes peace but warns against meddling in Taiwan and U.S. tech policies. Meanwhile, a Peruvian port becomes a geopolitical hotspot, and oil tycoons face steep falls.

China's Peace Offerings And Red Lines for Trump

Photo by 五玄土 ORIENTO / Unsplash

- Xi Jinping’s farewell chat with Joe Biden came with a not-so-subtle heads-up for Donald Trump: “We’re cool with playing nice, but don’t poke the dragon.”

- Xi laid out China’s “four red lines” like a diplomatic mic drop: no messing with the Communist Party, no nudging towards democracy, no stalling China’s economic rise, and definitely no stirring the pot in Taiwan.

- While calling for peace and avoiding a “new Cold War,” Xi made it clear that crossing these lines isn’t an option. Chinese state media called it the blueprint for how things will roll with Trump.

- Trump, meanwhile, is bringing tariffs and hardliners to the table, promising a rocky ride ahead. Xi’s message? China’s ready to tango but won’t back down from a fight.

- On top of it all, Xi called out U.S. tech restrictions, Taiwan flirtations, and meddling in the South China Sea. Translation: “Stay in your lane, and we’ll talk business.”

- With Trump’s unpredictable playbook, China’s hedging its bets—extending a handshake while gripping its sword in the other.

Trump's Administration Focuses On China's Peruvian Port

Photo by Scott Umstattd / Unsplash

- Staying on the topic of Trump and Xi, a Trump insider has floated a bold idea: slap that hefty 60% tariff not just on Chinese goods, but also on anything passing through China’s shiny new port in Chancay, Peru.

- Mauricio Claver-Carone, a key Trump adviser, says it’s all about stopping “transshipment”—the sneaky rerouting of Chinese goods through third countries to dodge tariffs.

- But there’s a twist: this isn’t just about trade. It’s a not-so-subtle warning shot to countries thinking of cozying up to Beijing’s port-building spree. The message? Partner with China, and you might pay the price.

- Meanwhile, Xi Jinping is hyping the new port as a trade game-changer, promising faster shipping and lower costs with a direct route to Shanghai. But could it also become a backdoor to the U.S. market?

- The real question: is this a tariff strategy or a geopolitical flex? Either way, it’s clear Trump’s trade team is ready to "Make America Great Again".

- Separately, in Peru's APEC CEO summit, Xi Is stepping up as a defender of free trade.

Singapore Oil Tycoon Goes To Jail

Photo by Timothy Newman / Unsplash

- Once the kingpin of oil trading, O.K. Lim, founder of Hin Leong Trading Pte, is now trading business suits for prison stripes, sentenced to 17.5 years for outsmarting HSBC—and not in a good way.

- Hin Leong wasn’t just a business; it was a global fuel-shipping juggernaut with over 100 vessels making waves around the world. But the tide has turned.

- By September 2024, Lim and his kids, Evan and Huey Ching, made a US$3.5 billion promise to Hin Leong’s liquidators and HSBC. The kicker? They flat-out admitted they were broke and headed straight for the bankruptcy queue.

- The downfall story? Classic 2020 drama. COVID-19 sent oil prices plummeting, exposing a cool $800 million in hidden losses. Turns out, Hin Leong had a trick up its sleeve—using the same cargoes to bag multiple loans. Despite years of boasting big profits, the truth was darker: they’d been hemorrhaging cash for ages. With $3.5 billion owed to 23 banks, the once-mighty empire capsized into liquidation.

- If O.K. Lim's appeal fail, the once revered kingpin is likely to spend his remaining days in Singapore's Changi Prison.

Europe Is Already Coming Up With "European First" To Counter Trump's Looming Tariffs

Photo by Luca Bravo / Unsplash

- The trade wars are heating up, and Europe’s tech leaders are sounding the alarm! At the Web Summit, CEOs urged a bold “Europe-first” approach to reclaim the continent’s tech dominance.

- Proton’s CEO Andy Yen called for EU protectionist policies to rival the U.S., advocating aggressive moves in AI, cloud computing, and web technologies.

- Vinted’s CEO warned Europe must make “the right choices” to stay competitive, especially in education, energy, and innovation, or risk falling behind.

- AI sovereignty was a hot topic, with calls to localize AI infrastructure to reflect European values and reduce reliance on U.S. giants like Microsoft.

- Frustration with U.S. Big Tech’s “unfair play” is mounting, with leaders urging Europe to abandon its globalist mindset and fight back.

- Trump’s return to power raises fears of U.S. retaliation, but leaders insist the EU should double down on tough Big Tech regulations and leverage the AI Act to set global standards.

- The message is clear: Europe must stop playing nice and start playing smart to secure its tech future.

Latest Market Developments

-

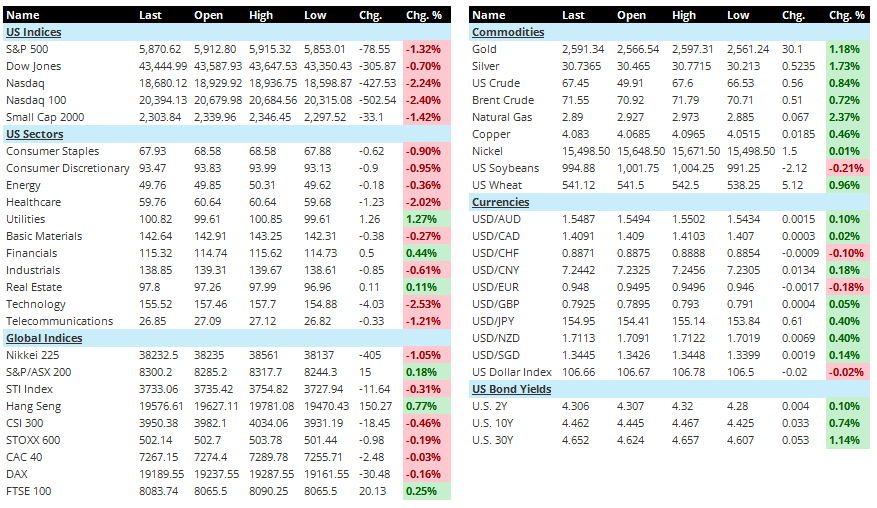

US Futures: We are seeing mixed movements in the futures market. S&P 500 futures are up by 0.07%, indicating slight optimism, while Dow futures are down by 0.25%.

-

US Indices: The cash market saw a sea of red during the last session. The S&P 500 dropped by 1.32%, while the Dow Jones fell by 0.70%. The Nasdaq and Nasdaq 100 underperformed significantly, declining by 2.24% and 2.40%, respectively. Small Caps also followed the downward trend, losing 1.42%.

-

US Sectors: Most sectors ended in negative territory. Technology and Healthcare were the biggest laggards, falling by 2.53% and 2.02%, respectively. On the upside, Utilities rose by 1.27%, and Financials gained 0.44%.

-

Asia: Asian markets delivered a mixed performance. The Nikkei 225 fell by 1.05%, and the STI Index dropped 0.31%. However, Hang Seng gained 0.77%, and S&P/ASX 200 inched up by 0.18%.

-

Europe: The European session also showed varied outcomes. The FTSE 100 rose by 0.25%, while the DAX and CAC 40 registered slight declines of 0.16% and 0.03%, respectively. The STOXX 600 edged lower by 0.19%.

-

Commodities: The commodities market is displaying strength. Gold surged by 1.18% to $2,591.34, while Silver gained 1.73%. US Crude and Brent Crude were both up, rising by 0.84% and 0.72%, respectively. Natural Gas experienced the largest move, climbing 2.37%.

-

Currencies: The US Dollar Index remained largely unchanged, edging down by 0.02%. The dollar strengthened against the yen, up 0.40% to 154.95, but weakened against the euro and Swiss franc, down 0.18% and 0.10%, respectively.

-

US Bond Yields: Treasury yields are trending higher. The 10-year yield climbed to 4.462%, and the 2-year yield rose to 4.306%.

-

Upcoming Economic Indicators: Later today, watch for the NAHB Housing Market Index release at 10:00 AM Eastern Time. ECB President Lagarde is scheduled to speak at 1:30 PM, followed by Fed's Goolsbee at 10:00 AM.

Other Related News

-

Samsung Strikes Back: Samsung shares popped over 7% after the company announced a sizzling $7 billion buyback plan. Guess they’re saying, “If you want something done right, buy it yourself!”

-

Thailand Says “I Do” to Equality: Thailand is about to make history as the first Southeast Asian nation to legalize same-sex marriage. Love wins, and so does Thailand's coolness factor.

-

Self-Driving Dreams: Team Trump is putting the pedal to the metal on self-driving car rules. Looks like the Transportation Department might be getting a software update!

-

Musk Under the Microscope: Senate Democrats want to know if Elon’s SpaceX is too cozy with Uncle Sam. Oh, and whispers of a $255 billion valuation might be launching soon.

-

Putin and Scholz Reconnect: In a rare moment of dialogue, Putin and Scholz discussed Ukraine peace plans over the phone. Meanwhile, Zelensky is out here manifesting peace by 2025.

-

Kim Jong Troops? Rumor has it North Korea could send up to 100,000 soldiers to help Russia in Ukraine. When bromances go ballistic, literally.

-

Nvidia’s Hot Chips: Nvidia’s servers are too hot to handle—literally. They’re now scrambling to cool things down, which might mean delays for their next-gen chips. Yikes!

-

GM Tightens the Belt: General Motors is cutting 1,000 salaried jobs to save some cash. Looks like they’re trading horsepower for manpower.

-

Stockpile Season: The New York Fed’s manufacturing index is on fire, with companies apparently hoarding goods in case Trump decides to slap on more tariffs. Better safe than sorry, right?

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.