Trump Announces the DOGE, Market Showing Signs of Post Election Exhaustion

Morning Briefs

Trump Announces the DOGE, Market Showing Signs of Post Election Exhaustion

7-Eleven contemplates going private. Markets display post-election fatigue. Trump unveils DOGE. Japanese yen drops to 155 once more. US CPI releases tonight.

On this page

Your Favourite Convenience Store, 7-Eleven, Considers Going Private In Japan's Biggest Buyout

Photo by Kenny Eliason / Unsplash

- Seven & i Holdings will be contemplating going private in a management buyout.

- The management buyout will be funded from banks, Itochu Corp and the Ito family. Currently, the potential deal is estimated to be $58 billion and would be the largest ever in Japan.

- By the end of Japan's trading session, Seven & i holdings surged by more than 12%.

- Previously, Canadian retailer Couche-Tard had offered to acquire Seven & i at a potential valuation of $38.5 billion; however, the deal was rejected. Eventually Couche-Tard proposed a higher price of $47.2 billion.

- If the management buyout succeeds, it would highlight the unified efforts within corporate Japan to resist foreign influence over one of its most iconic companies. Itochu, the owner of FamilyMart, stands as a major competitor to 7-Eleven.

Australia Plans to Ban Social Media For Those Under 16

Photo by Solen Feyissa / Unsplash

- In Australia, the government has proposed banning social media for individuals under 16.

- The legislation will be introduced in parliament this year and is expected to take effect within 12 months.

- In an opinion piece, the Prime Minister emphasized the importance of protecting children from online harm.

- He stated, "social media isn't social at all. Instead, it's used as a weapon for bullies, a platform for peer pressure, a driver of anxiety, a vehicle for scammers, and, worst of all, a tool for online predators."

Dogecoin Surges After President-elect Announces The Department Of Government Efficiency ("DOGE")

Photo by Kanchanara / Unsplash

- President-elect Donald Trump announced that Elon Musk and Vivek Ramaswarmy will lead the Department of Government Efficiency.

- Trump's recently wrote that the DOGE will help to "dismantle Government Bureaucracy, slash excess regulations, cut wasteful expenditures, and restructure Federal Agencies".

- For now, it is important to note that the DOGE, has neither been officially formed by the Congress nor funded yet.

- Cryptotraders will know that dogecoin used to be a meme; used purely for fun and speculation. However, in the past five days, the Dogecoin surged more than 90%!

The Japanese Yen Plunged To 155 Again; Today's CPI Will Dictate The Fate Of USD/JPY

- No wonder there is a huge spike in Japan's tourism.

- Due to fears of inflation, market participants and traders are loading up the dollar against the yen again.

- This is the first time that USD/JPY pushed to 155 since July 2024.

- Today, the US will release date relating to CPI at 8:30 AM Eastern Time. If US CPI surprises towards the downside, it is likely that we will see some sort of short-term reversal. However, if CPI exceeds expectations, expect the greenback to continue its trek upwards.

- That being said, the Japanese authorities have often intervened to safeguard its currency. Throughout the past two years, authorities have spent trillions to protect the plunge of the yen. If the JPY continues its plunge, expect the authorities to come in again to defend the safe-haven currency.

| Date Range | Dollar-Yen Exchange Rate | Intervention Amount (¥ Trillion) |

|---|---|---|

| 2022 | 151.95 to 146.23 | ¥5.62 trillion |

| 2022 | 149.71 to 145.56 | ¥0.73 trillion |

| 2022 | 145.90 to 140.36 | ¥2.84 trillion |

| 2023 | 160.17 to 154.54 | ¥5.92 trillion |

| 2024 | 161.76 to 157.44 | ¥3.17 trillion |

| 2024 | 157.99 to 153.04 | ¥3.87 trillion |

| 2024 | 159.45 to 157.38 | ¥2.37 trillion |

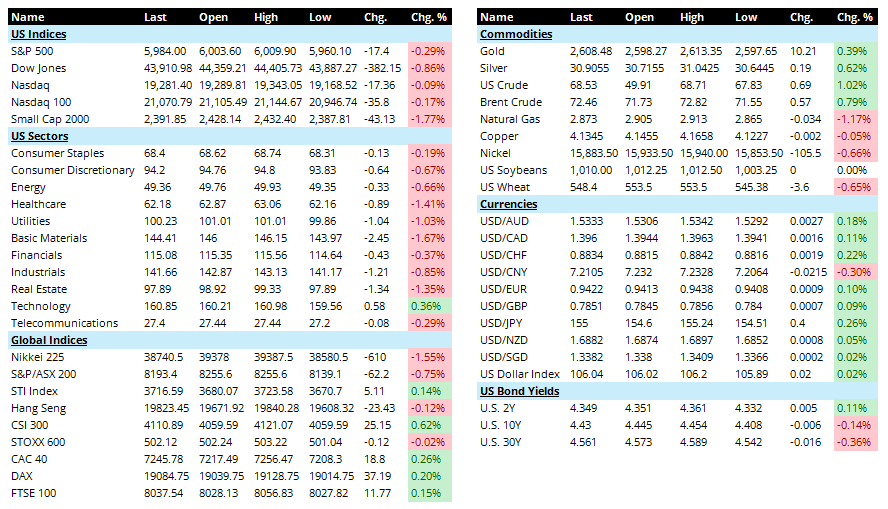

Global Markets Today

- We are seeing a little bit of post-election exhaustion. Afterall, markets can't go up forever right? Currently, futures point towards the downside with the Dow and S&P 500 decreasing by 0.20% and 0.18%. The USD dollar continues its trek upwards, posting strong gains against all major currencies. However, against the CNY, the dollar fell by 0.30%; investors are currently awaiting CPI numbers at 8:30AM Eastern Time. In terms of rates, 2Y is near 4.35% while the 10 year is at 4.43%.

- In the previous US session, we saw a sea of RED. Small Caps were the biggest underperformer, plunging by 1.77%. Dow Jones and S&P fell by 0.86% and 0.29% respectively. In terms of sectors, with the exception of technology, everything else closed lower; healthcare was the biggest underperformer, falling by 1.41%.

- Earlier in today's Asian session, Nikkei fell by 1.55% while Australia's ASX 200 fell by 0.75%. CSI 300 and STI outperformed, posting 0.62% and 0.14% gains.

- In the European markets, the broader Stoxx 600 remained flat. However, major indices such as the CAC 40, DAX, and FTSE continues trading towards the upside; CAC 40 outperformed, posting 0.26% in gains.

- Finally, in the commodities market; Gold and Silver rebounded. However, the US crude outperformed all other commodities, posting a 1.02% gain. Natural gas fell by 1.17%.

Other Notable News

- Tencent reports a 47% increase in profits, exceeding projections.

- Japan intensifies initiatives to rejuvenate its semiconductor industry.

- SoftBank's Swiggy shares rose 15% upon debut in the Indian market.

- Apple’s upcoming device is rumored to be an AI-powered wall-mounted tablet.

- SoftBank announces plans to develop a supercomputer in collaboration with Nvidia.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.