Treasury Yields Soar, Brazil's Equity Exodus, and Tencent's Bold Buybacks Amid Geopolitical Strain

In a turbulent week for markets, the U.S. Treasury bond yields surge past 5% amidst inflation fears, Brazilian stocks see historic outflows as the economy falters, and Tencent launches a major buyback amidst U.S. blacklisting, highlighting global investor anxieties.

Hello, it’s Ryosuke! Today, we’re diving into some compelling developments across global markets that are sure to pique your interest. Here’s a quick summary of the key topics covered in this report:

-

Rising Treasury Yields: The 20-year Treasury bond yield has surpassed 5%, signaling a potential shift in investor sentiment amid inflationary fears and changes in fiscal policies.

-

Foreign Investment Retreat in Brazil: A significant outflow of foreign capital from Brazilian stocks highlights growing concerns over the nation’s economic performance and increasing budget deficits.

-

Tencent’s Strategic Share Buybacks: In response to being blacklisted by the US, Tencent undertook its largest share repurchase since 2006, aiming to reassure investors amidst geopolitical tensions.

-

Market Volatility Anticipation: As economic data releases loom, investors are positioning themselves for potential volatility, with the Federal Reserve’s interest rate decisions playing a crucial role.

Details and broader implications are covered below—let’s dive in!

Rising Yields Signal New Era for Treasury Bonds

Photo by rc.xyz NFT gallery / Unsplash

Historic Threshold Breached: The 20-year Treasury bond yield has crossed the 5% mark for the first time since 2023, highlighting growing concerns over inflation and fiscal policies under President-elect Donald Trump. This shift indicates broader implications for the $28 trillion Treasury market and investor sentiment toward long-term debt.

Market Reaction: Following the Federal Reserve's aggressive interest rate cuts, yields across various U.S. bonds have surged, with the 10-year yield approaching 4.73% and the 30-year yield nearing 4.96%. As global markets respond to similar inflationary fears, these trends suggest that bond investors should prepare for sustained high yields.

New Norm for Investors: Leading financial institutions are beginning to accept that the era of low yields might be over, as strategies shift towards potential 5% yields. The upcoming issuance of $119 billion in government debt adds urgency to this matter, especially with anticipated auctions drawing the highest yields seen in years.

Future Projections: With economic data releases on labor and inflation looming, traders are increasingly positioning themselves for volatility in the bond market. As the Fed contemplates further interest rate cuts amid rising yields, investors are left balancing the need for safety against the risk of inflation creeping upward, setting the stage for significant market shifts ahead.

Foreign Investors Withdraw from Brazilian Stocks Amid Economic Concerns

Photo by D A V I D S O N L U N A / Unsplash

Steady Outflows: Foreign investors are pulling significant money from Brazilian equities, with recent data showing about 3 billion reais (approximately $495 million) exiting in just the first three sessions of the year. This comes on the heels of a staggering $5.3 billion pulled out throughout 2024, marking the largest annual dip since 2020.

Market Struggles: The Brazilian stock market has faced dire performance, lagging behind its peers as the national currency, the real, weakened by 21% against the dollar, and the benchmark Ibovespa index dropped over 10%. This downturn resulted in a dramatic loss of more than $290 billion in market value, a clear sign of shrinking investor confidence.

Fiscal Challenges: Heightened concerns about Brazil's swelling budget deficit have led to rising inflation expectations, forcing the central bank to increase interest rates. As analysts predict borrowing costs could rise to 15% by year-end, the appeal of investing in local equities diminishes further, even as valuations approach a 20-year low compared to other emerging markets.

Dim Global Outlook: The economic strain on Brazil occurs alongside broader uncertainties in emerging markets, exacerbated by speculation around the Federal Reserve's rate cuts and global economic health, particularly China's. Major financial players like Morgan Stanley, JPMorgan, and HSBC have downgraded their outlook on Brazilian stocks, suggesting that investors may continue to face challenges in this “toxic” economic environment.

Tencent Makes Major Share Buybacks Amid US Blacklist Turmoil

Significant Buyback Action: Tencent has initiated its largest share buyback since 2006, acquiring 3.93 million shares on Tuesday, followed swiftly by another 4.05 million. This aggressive move comes in response to a roughly 10% drop in stock value after the company was blacklisted by the US for purported ties to the Chinese military.

Clarification Efforts: In the wake of the blacklist, Tencent is actively engaging with the Department of Defense, aiming to resolve any misunderstandings surrounding the allegations. This proactive communication hints at the company’s desire to restore investor confidence and mitigate market panic caused by the news.

Strong Investor Interest: Amid the selloff, mainland Chinese investors purchased HK$14 billion (about $1.8 billion) worth of Tencent shares, solidifying Tencent's status as a sought-after investment despite recent challenges. This support highlights a broader belief in the company’s long-term potential even as geopolitical tensions rise.

Broader Implications: While Tencent’s actions reflect a commitment to shareholder value, the ongoing geopolitical risks could still deter some investors from fully engaging with the stock. As the US-China dynamics evolve, Tencent's strategy and market response will be closely watched for signals on its resilience in a turbulent landscape.

Latest On Global Markets

US Futures: Futures are showing a mixed pattern, with Dow Jones futures slightly down 0.02% and S&P 500 futures decreasing 0.08%, while Nasdaq 100 futures are down 0.06%.

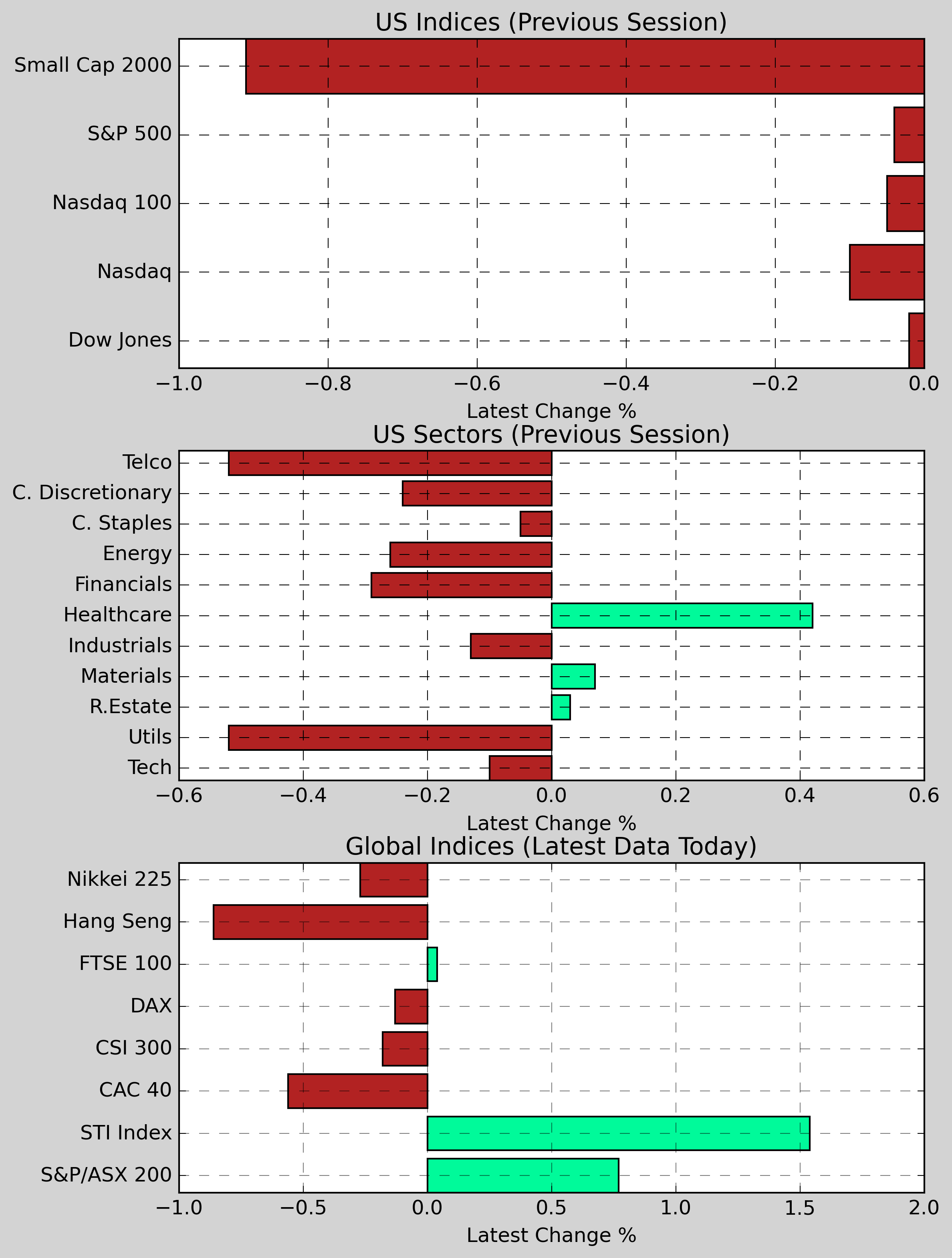

US Indices (Previous Session): The S&P 500 fell 0.04% to 5,906.90, while the Dow Jones edged down 0.02% to 42,518.14. The Nasdaq declined 0.10% to 19,469.81, and the Small Cap 2000 decreased 0.91%.

US Sectors (Previous Session): Consumer Services saw a decrease of 0.24%, followed by Financials down 0.29%, and Industrials which fell 0.13%. In contrast, Healthcare gained 0.42%, while Basic Materials increased slightly by 0.07%.

Global Indices: In Asia, the Nikkei 225 dropped 0.27%, while the Hang Seng fell 0.86%. Conversely, the S&P/ASX 200 gained 0.77%. In Europe, the CAC 40 dipped 0.56%, while the DAX also showed a minor decline of 0.13%.

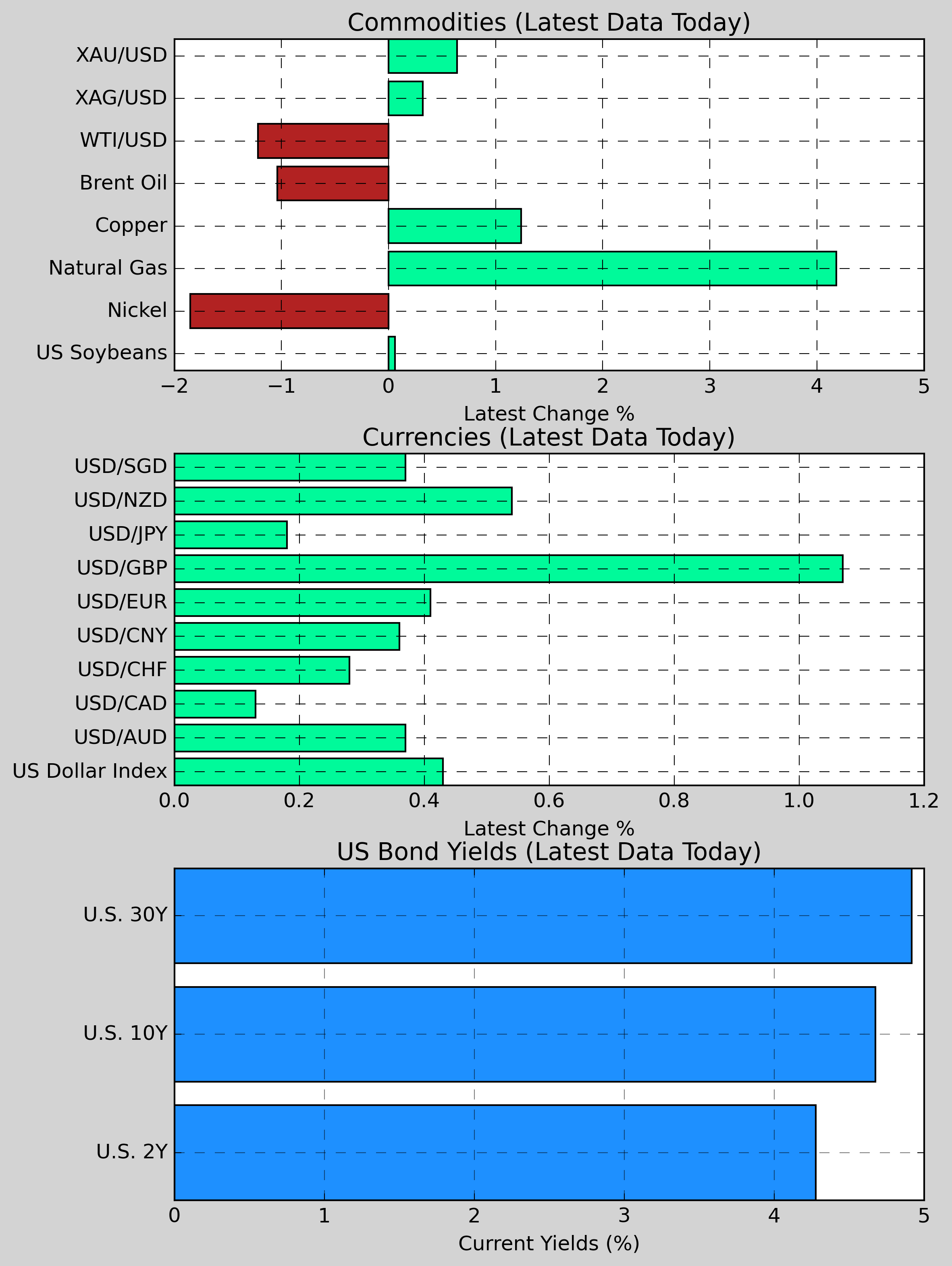

Commodities: Gold rose 0.64% to $2,665.73, while Copper increased 1.24% to $4.2477. Nickel experienced a decline of -1.85% to $15,876. On the grain front, US Wheat fell 0.90% to $537.10, whereas US Soybeans edged up 0.06% to $997.62. Natural Gas gained 4.18% to $3.593, while Brent Crude saw a decrease of 1.04% to $76.25.

Currencies: The US Dollar showed strength against several currencies with USD/AUD up 0.37%, showing a rise to 1.6108. USD/NZD gained 0.54%, reaching 1.7843, and USD/CNY increased 0.36% to 7.3525. USD/CAD saw a minor rise of 0.13% to 1.4388, while USD/GBP appreciated by 1.07% to 0.8100. The US Dollar Index was up 0.43% to 109.17.

US Bond Yields: The U.S. 2-Year Treasury yield dipped slightly, down 0.37bps to 4.279%, while the U.S. 10-Year Treasury yield fell 0.17bps to 4.677%. The U.S. 30-Year Treasury yield saw a minimal increase of 0.10bps, raising it to 4.917%.

Economic Data & Central Bank Developments (Eastern Time)

- 08:15 PM ET (Dec 8): Change in ADP employment in the United States in December (estimated to increase by 140,000, the previous value was an increase of 146,000)

- 08:30 PM ET (Dec 8): Number of first-time unemployment claims in the United States last week (estimated at 215,000, previous value at 211,000)

- 01:15 AM ET (Dec 9): Speech by Villeroy, Governor of the Bank of France and member of the European Central Bank Governing Council

- 03:00 AM ET (Dec 9): Minutes of the Federal Reserve’s December monetary policy meeting

Other Notable News

-

U.S. Job Openings Surge: In November, American job openings reached a six-month peak, showcasing a notable boost in the services sector and suggesting that the labor market is stabilizing.

-

Trump Contemplates Forceful Actions: Former President Trump indicated he hasn't dismissed the option of utilizing force to take control of Greenland or the Panama Canal. He also discussed potential economic strategies for merging with Canada and urged NATO allies to allocate 5% of their GDP toward defense.

-

CFTC Chair Announces Resignation: Behnam, the Chairman of the Commodity Futures Trading Commission, has disclosed his intent to step down on January 20.

-

Signs of U.S. Economic Growth: The ISM services index in the U.S. experienced a rise exceeding expectations in December, with costs for raw materials and services hitting their highest point since early 2023.

-

South Korea Faces Political Unrest: Reports suggest that South Korean authorities may pursue the arrest of President Yoon Seok-yeol as early as Wednesday morning, indicating a potential political crisis.

-

Trade Deficit Expands in U.S.: In November, the United States saw its trade deficit widen due to a significant increase in imports, marking the largest rise since March 2022.

-

Economic Predictions from the Atlanta Fed: The President of the Atlanta Federal Reserve warned of the need for caution regarding interest rate cuts, suggesting it might be more prudent to maintain higher rates to achieve stable inflation. Traders anticipate the Fed will likely hold off on rate cuts until mid-year.

-

Online Shopping Spending Hits Record: Adobe reported a significant rise in U.S. online shopping during the holiday season, totaling a staggering $241 billion last year.

-

Euro Area Inflation Pressured by Energy: Energy costs are pushing inflation higher in the euro zone for December, although this development is not expected to disrupt the European Central Bank's plans for rate cuts.

-

Market Dynamics Shift: According to Bank of America strategists, the trend in U.S. bonds signals that the stock market may be overvalued, as they expect to see a transition to a "good news is bad news" scenario.

-

Billionaire Hedge Fund Performance Varied: Reports have emerged that billionaire Platt's BlueCrest achieved a remarkable 38% return in the previous year, whereas Said Haidar's hedge fund experienced a decline of 33%, witnessing a $4 billion drop in assets.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.