Tech Wars, Tariffs, and Tangled Tales

Hello there, it’s Ryosuke. Today’s highlights are packed with tech battles, political drama, and market moves. From Huawei’s chip struggles to Trump’s self-driving car push and Google’s antitrust showdown, it’s all happening. Let’s dive in!

Chip Wars: Huawei’s Uphill Battle

-

Huawei’s ambitions to dominate AI and smartphone chips are stuck in a 7nm bottleneck, thanks to US sanctions blocking access to cutting-edge EUV machines. While the rest of the world moves toward 2nm chips by 2025, Huawei is forced to rely on aging technology until at least 2026.

-

To compensate, Huawei and SMIC are using multi-patterning techniques on older machines, but the process is riddled with inefficiencies—higher costs, lower yields, and frequent errors. Even creative solutions can’t replace the precision of advanced EUV tools.

-

Huawei’s main chipmaking partner, SMIC, is struggling with low yields and production issues, casting doubt on whether Huawei can secure enough processors for its AI and smartphone ambitions. This puts Huawei in a precarious position as it faces surging demand.

-

Despite heavy R&D investment and Beijing’s backing, Huawei’s struggles highlight how US sanctions have frozen China’s semiconductor progress, leaving the nation’s tech dreams increasingly out of reach while rivals race ahead.

Trump's Drive for Self-Driving Cars

Photo by Moritz Kindler / Unsplash

-

Trump’s transition team is eyeing a federal framework for self-driving cars, a move that could revolutionize autonomous tech. This would be a win for Elon Musk, Tesla CEO and Trump ally, who’s pushing for regulatory clarity to deploy steering wheel- and pedal-free vehicles.

-

Current rules cap self-driving deployments at 2,500 vehicles per year, limiting growth. Musk’s vision? A world of Tesla robotaxis, potentially starting production by 2026. However, achieving mass adoption will require bipartisan Congressional action, a notoriously steep hill to climb.

-

Tesla faces stiff competition from Alphabet’s Waymo and GM’s Cruise, which have made strides but still operate under constraints tied to safety standards written long before autonomous vehicles. High-profile incidents and federal investigations into safety issues have slowed adoption industry-wide.

-

The stakes are high: A federal framework could unleash the “autonomy economy,” but challenges include outdated safety laws, industry resistance, and public trust in the tech. For now, the road ahead for self-driving cars remains bumpy.

Google Faces Historic Antitrust Crackdown

Photo by Pawel Czerwinski / Unsplash

-

The Justice Department is pushing for Google to sell off its Chrome browser, which holds a 61% market share. Chrome plays a pivotal role in Google’s search and advertising dominance, making it a key target in efforts to curb the company’s monopoly.

-

Antitrust officials are proposing measures to address Google’s influence in AI and Android, including separating Android from search and the Play Store and requiring Google to license search results and data. These steps aim to foster competition in search, ads, and AI.

-

Google’s AI features, like "AI Overviews," have raised concerns over their impact on website traffic and ad revenues. Enforcers want more accountability and fair data-sharing practices to allow rivals to improve their search and AI capabilities.

-

A two-week hearing in April will decide on the proposed remedies, with a final ruling expected by August 2025. If approved, this could become one of the most significant antitrust actions against a tech giant in decades.

Nvidia Teams Up with Google for Quantum Leap

Photo by BoliviaInteligente / Unsplash

-

Nvidia is collaborating with Google’s Quantum AI division to accelerate the design of quantum computing processors. Using Nvidia’s Eos supercomputer, the project aims to simulate the complex physics needed to develop scalable quantum systems while managing interference, or "noise."

-

Quantum computing, which leverages quantum mechanics for vastly superior computational power, remains an ambitious long-term goal. While breakthroughs have been reported, large-scale commercial quantum systems are likely decades away.

-

Nvidia’s cutting-edge AI accelerator chips will power simulations, slashing computation times from weeks to minutes. This efficiency enables Google to explore designs for quantum chips that must operate at extremely low temperatures to remain functional.

-

The partnership underscores Nvidia’s expansion into emerging technologies like quantum computing, as the company unveils additional innovations at SC24, the International Conference for High Performance Computing in Atlanta.

Longest National Security Law Sentence in Hong Kong

Photo by Tanner Marquis / Unsplash

-

Benny Tai, a former democracy advocate, has been sentenced to 10 years in prison, the longest punishment under Hong Kong’s China-imposed national security law. Joshua Wong, a prominent youth activist, received four years and eight months. The sentences are part of a crackdown that has effectively silenced political opposition since 2021.

-

The charges stem from organizing unofficial primary polls in 2020, which authorities allege were an attempt to "paralyze" the government and incite a "color revolution." Critics, including the US and Australia, condemned the sentences, citing concerns over judicial independence and human rights.

-

The landmark case highlights broader concerns about Hong Kong’s rule of law, as Western governments warn of eroding confidence in the city’s judicial system. A record number of foreign judges have exited Hong Kong’s top court since the national security law was enacted.

-

The crackdown signals Beijing’s tightening grip on Hong Kong, raising geopolitical tensions while overshadowing the city’s efforts to maintain its status as a global financial hub.

Other Related News

- Trump’s Treasury Toss-Up: Kevin Warsh, former Fed Governor, might snag the Treasury Secretary spot, while hedge fund wizard Scott Bessent is tipped to steer the White House economic ship. Get ready for a Wall Street-friendly lineup.

- G-20 Gossip: Leaders in Rio skipped the group photo op drama—Biden, Trudeau, and Meloni were no-shows. Meanwhile, UK’s Starmer ruffled feathers talking human rights with Xi, and China promptly showed British reporters the door.

- Market Moves and Rate Rumors: Homebuilder confidence just hit a seven-month high—someone’s got big renovation vibes. Over in Europe, the ECB is flirting with a December rate cut of 25 basis points, while Goldman Sachs bets on a long-lasting strong dollar, powered by Trump’s tariff tantrums.

- Missiles and Middle East Moves: The US might loosen its leash on Ukraine’s missile use, but Germany’s sticking to its guns—or rather, keeping them. Meanwhile, Lebanon and Hezbollah just gave a cautious thumbs-up to a US ceasefire plan.

Latest Market Developments

-

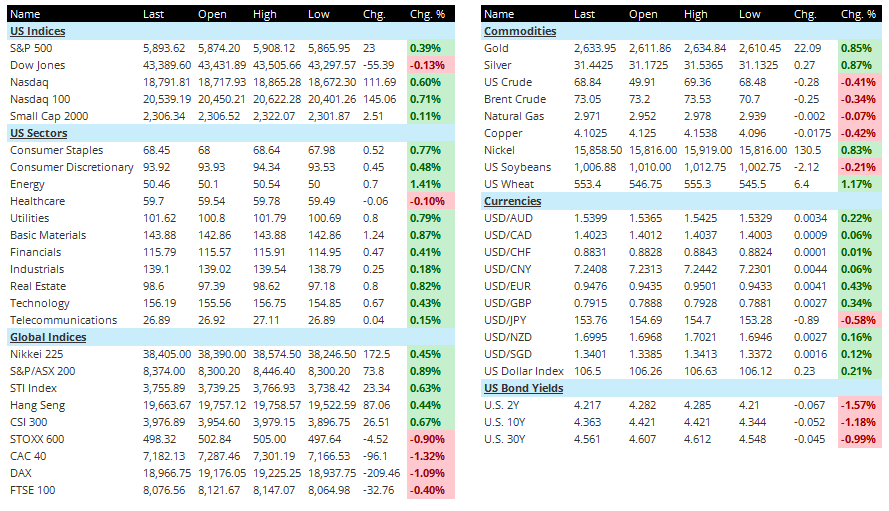

US Futures: Mixed movements in the futures market. S&P 500 futures are up by 0.39%, while Dow futures are slightly down by 0.13%. Nasdaq futures lead with a strong gain of 0.71%.

-

US Indices: The previous session saw mostly positive results. The S&P 500 gained 0.39%, and the Nasdaq climbed by 0.60%. However, the Dow Jones slipped by 0.13%. Small Caps followed with a modest rise of 0.11%.

-

US Sectors: Sector performance was mostly positive. Energy led with a rise of 1.41%, followed by Basic Materials at 0.87%. Healthcare lagged slightly, dipping by 0.10%.

-

Asia: Asian markets delivered mixed results. The Nikkei 225 added 0.45%, while the Hang Seng rose by 0.44%. Meanwhile, the CSI 300 gained 0.67%, and the STI Index climbed by 0.63%.

-

Europe: European indices fell across the board. The STOXX 600 dropped by 0.90%, while the DAX and CAC 40 declined by 1.09% and 1.32%, respectively. The FTSE 100 saw a smaller loss of 0.40%.

-

Commodities: Precious metals showed strength, with Gold up by 0.85% and Silver rising by 0.87%. However, US Crude and Brent Crude dipped slightly, losing 0.41% and 0.34%, respectively.

-

Currencies: The US Dollar Index strengthened by 0.21%. The dollar gained 0.43% against the euro and 0.34% against the pound, but fell by 0.58% against the yen.

-

US Bond Yields: Treasury yields trended lower. The 2-year yield dropped by 1.57% to 4.217%, while the 10-year yield fell by 1.18% to 4.363%.

-

Upcoming Economic Indicators: At 5:00 AM ET, the final Eurozone CPI for October is expected to show a year-on-year increase of 2% and a month-on-month rise of 0.3%. At 8:30 AM ET, the US October housing starts and building permits data will be released, alongside Canada’s October CPI, forecasted at 1.9% year-on-year.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.