Tanker Rate Collapse, Canal+ Stock Dive, and China's Retail Woes Signal Economic Shifts

Tanker rates plummet amid China's shifting demand for crude, Canal+ sees a rocky London debut, while Singapore's housing market thrives despite speculation of stricter regulations; meanwhile, Volkswagen grapples with labor tensions threatening its financial future.

Hello, it’s Ryosuke! In today’s report, we’ll explore some significant developments shaping the global market landscape. Here’s a quick summary of what we’ll cover:

- Tanker Rate Challenges: The sharp drop in spot rates for VLCCs due to declining crude demand from China, alongside heightened competition and operational hurdles for tanker operators.

- Canal+ Stock Debut: A rocky start for Canal+ in the London Stock Exchange, raising questions about the future of UK listings amid a broader market struggle.

- China’s Economic Struggles: Disappointing retail sales growth and a deepening real estate crisis signal continued consumer hesitance in the Chinese market.

- Singapore’s Housing Surge: Remarkable new home sales indicate a resurgence in the property market, prompting speculation about potential regulatory changes ahead of upcoming elections.

- Volkswagen's Labor Negotiations: Ongoing labor disputes threaten Volkswagen's turnaround plans, raising concerns about its financial stability going into 2025.

Details and broader implications are covered below—let’s dive in!

Decline in Tanker Rates Amid China's Slower Crude Demand

Photo by Enguerrand Blanchy / Unsplash

Tanker Rate Plummet: Spot rates for Very Large Crude Carriers (VLCCs) transporting oil from the Middle East to China have seen a staggering 33% drop this year, largely resulting from reduced demand in China. This surprising downturn is unusual as rates typically rise in the final quarter due to seasonal demands.

Economic Factors at Play: China's crude imports are lagging almost 2% behind last year's pace due to a combination of economic slowdown and a notable shift toward electric and LNG-powered vehicles. This shift not only impacts raw-material demand but also signals a broader transformation in energy consumption that may influence future oil market dynamics.

OPEC+ Actions: The OPEC+ alliance has postponed the restart of idle crude capacity, reflecting the subdued demand outlook and rising competition from other suppliers. This cautious approach has contributed to a tighter supply landscape, exacerbating the challenges for VLCC operators facing tough market conditions.

Market Competition and Operational Challenges: With increased competition from Iranian "shadow tonnage" and Russian crude flows, tanker operators are finding the going tough. Additionally, recent disruptions in shipping routes, attributed to attacks by Iran-backed militias, further complicate an already challenging environment for these operators, leading to a significant drop in supertankers heading to China.

Canal+ Shares Plummet After London Stock Debut

Dramatic Drop: Shares of Canal+, the French broadcaster, fell nearly 16% during their first day on the London Stock Exchange, trading at approximately 243 British pence ($3.07). This decline came after the company's separation from parent company Vivendi, which was intended to unlock greater value in its assets.

Company Transformation: CEO Maxime Saada highlighted that Canal+ has transformed from a French-centric service with about 9 million subscribers to a global entity, with two-thirds of its audience now outside France. This international growth is a significant part of the company's strategy post-spinoff, aiming to increase its global footprint.

Implications for London Markets: The listing was intended as a boost for the UK's capital markets, which have faced a challenging year with numerous companies delisting. Chancellor Rachel Reeves called Canal+'s move a "vote of confidence" in London, reinforcing that successful listings could encourage other companies to consider the UK for their foreign exchanges.

Future Listings in the Balance: As attention shifts to other potential UK listings like fast-fashion giant Shein, stakeholders are eager to see if Canal+'s performance will create a ripple effect and attract more major companies to launch in London. The outcome could be pivotal for rejuvenating the market after a challenging period marked by significant departures.

China's Retail Sales Disappoint Amid Deepening Real Estate Slump

Photo by Nate Landy / Unsplash

Slow Retail Growth: In November, China's retail sales grew by only 3%, falling short of the expected 4.6% and representing the slowest increase in three months. This underwhelming performance highlights ongoing consumer hesitancy, exacerbated by a sluggish economy fueled by declining real estate sentiment.

Real Estate Woes Continue: The downturn in real estate investment deepened, with a 10.4% year-on-year decline observed from January to November. This deterioration, following a 10.3% drop from January to October, underscores a broader economic struggle where construction and property markets confront significant challenges.

Mixed Signals from Industrial Production: Despite the retail slump, industrial output saw a 5.4% rise, slightly above analyst expectations of 5.3%. However, the disparity between a robust manufacturing sector and lackluster consumer spending raises concerns about the sustainability of this growth, suggesting a larger imbalance in the economy.

Call for Stimulus Measures: Economists have highlighted the urgent need for more effective policies to stimulate consumer spending, particularly as deflationary pressures mount. Though recent policy shifts signal a commitment to supporting domestic demand, clarity on the scale of these initiatives is still needed, as officials aim to navigate the intricacies of boosting economic confidence.

Singapore Home Sales Hit Decade High Amidst Curb Speculations

Photo by Mike Enerio / Unsplash

Remarkable Resurgence: November's new private home sales soared to 2,557 units, marking the highest monthly figure since March 2013. This surge reflects a strong recovery in the property market, driven largely by a series of attractive mass-market launches that appealed to buyers eager to take advantage of lower borrowing costs.

Strong Buyer Demand: The overwhelming interest in these new residential projects, particularly in suburban areas, has set the stage for heightened market activity, as evidenced by one project that achieved a remarkable 99% sales rate for its 846 units. This growing demand raises pressing questions about potential implications for property prices in the coming months.

Policy Implications: With the market heating up, speculations are mounting that the Singaporean government may implement stricter housing regulations to address concerns over affordability, especially ahead of the upcoming elections. Analysts suggest that if the buying frenzy persists, we might see “aggressive” measures introduced rather than the modest adjustments previously made.

Future Market Prospects: To ease housing pressure, the government plans to release land for approximately 8,505 private homes in the first half of 2025, marking an increase from prior offerings. This proactive approach indicates an effort to balance the soaring demand while keeping affordability issues in check, a crucial focus as Singapore navigates its evolving housing landscape.

Volkswagen’s Labor Standoff Threatens 2025 Turnaround

Photo by sgcdesignco / Unsplash

Labor Tensions Continue: Volkswagen AG is facing an ongoing stalemate with the IG Metall union as they head into their fifth round of negotiations, indicating a resolution will likely extend into 2025. Both sides are struggling to find common ground on critical issues like cost-cutting and potential layoffs that could significantly impact the automaker's operations.

Financial Impact Looms: The turmoil has already complicated Volkswagen's financial situation, with CEO Oliver Blume warning of a possible non-cash impairment of up to €20 billion. Recently, the company's shares have taken a hit, dropping over 20% this year, which further highlights the uncertainties surrounding Volkswagen's future.

Negotiation Pressures Mount: While both parties aimed for a deal by Christmas, talks have stalled, prompting the union to prepare for possible strikes in January if progress isn’t made. This tension escalated earlier this month when tens of thousands of workers participated in temporary walkouts after management rejected union proposals regarding profit-sharing.

Unfinished Business with Stakeholders: As negotiations drag on, Volkswagen has informed Porsche SE that it won't finalize its corporate planning by the end of December. This delay forces Porsche, which has a significant stake in Volkswagen, to rely on analyst estimates that could anticipate a substantial impairment on their investment, further complicating the already precarious financial landscape.

Latest On Global Markets

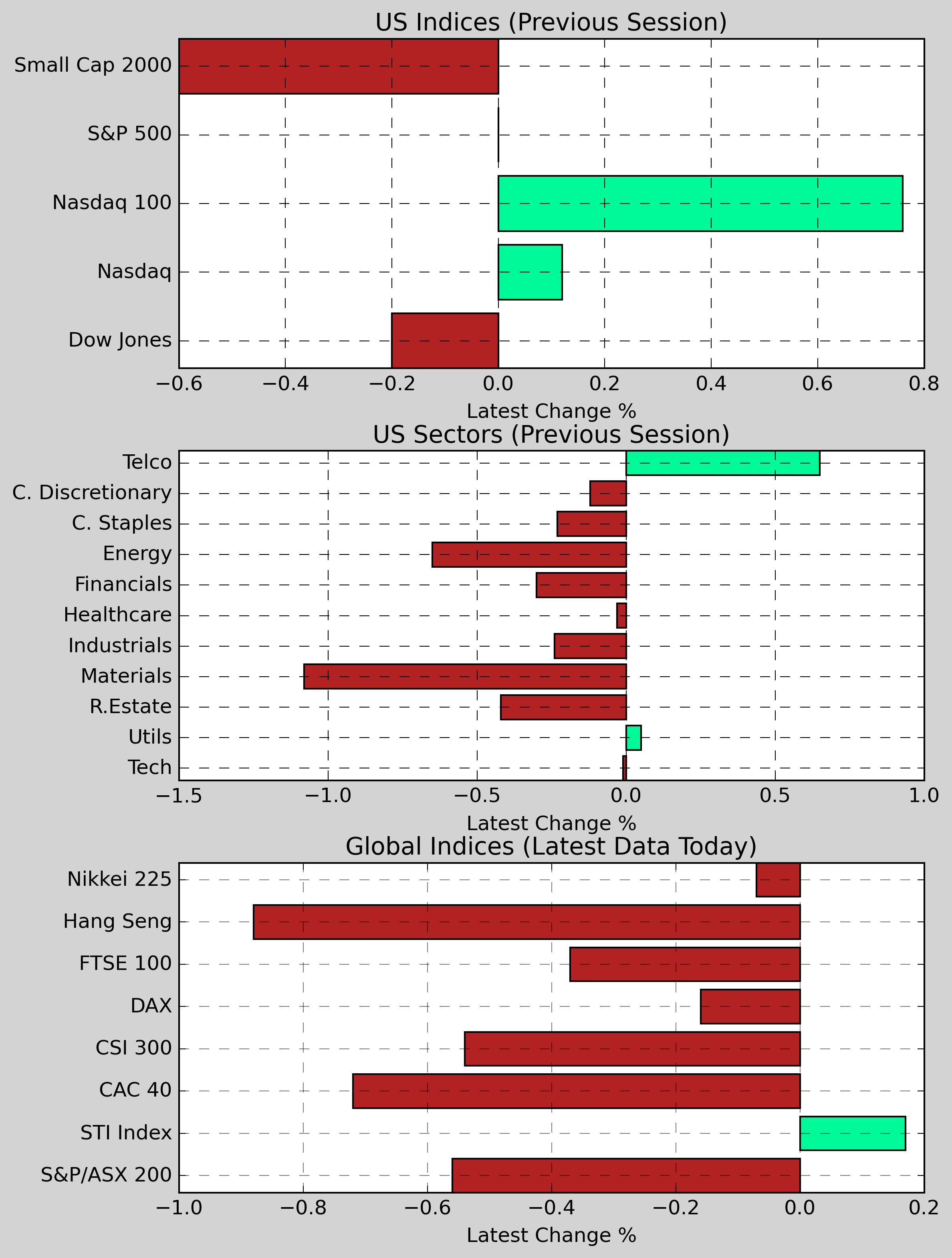

US Futures: Futures are indicating a positive start, with Nasdaq 100 futures up 0.35%, Dow Jones futures rising 0.13%, and S&P 500 futures increasing 0.23%.

US Indices (Previous Session): The S&P 500 closed down 0.00% at 6,051.09, while the Dow Jones declined 0.20% to 43,828.06. The Nasdaq posted a slight gain of 0.12%, finishing at 19,926.72, and the Nasdaq 100 also rose 0.76%. The Small Cap 2000 fell 0.60%.

US Sectors (Previous Session): The Consumer Services sector was the standout, gaining 0.53%, followed by Consumer Staples, which increased 0.50%. However, Basic Materials saw the largest drop, declining 1.08%. Healthcare and Industrials also fell, decreasing 0.03% and 0.24%, respectively.

Global Indices: The Hang Seng index fell 0.88%, while the CSI 300 lost 0.54%. In Europe, the CAC 40 dropped 0.72%, while the DAX declined 0.16%. The Nikkei 225 dipped 0.07%, but the S&P/ASX 200 ended down 0.56% while the FTSE 100 lost 0.37%.

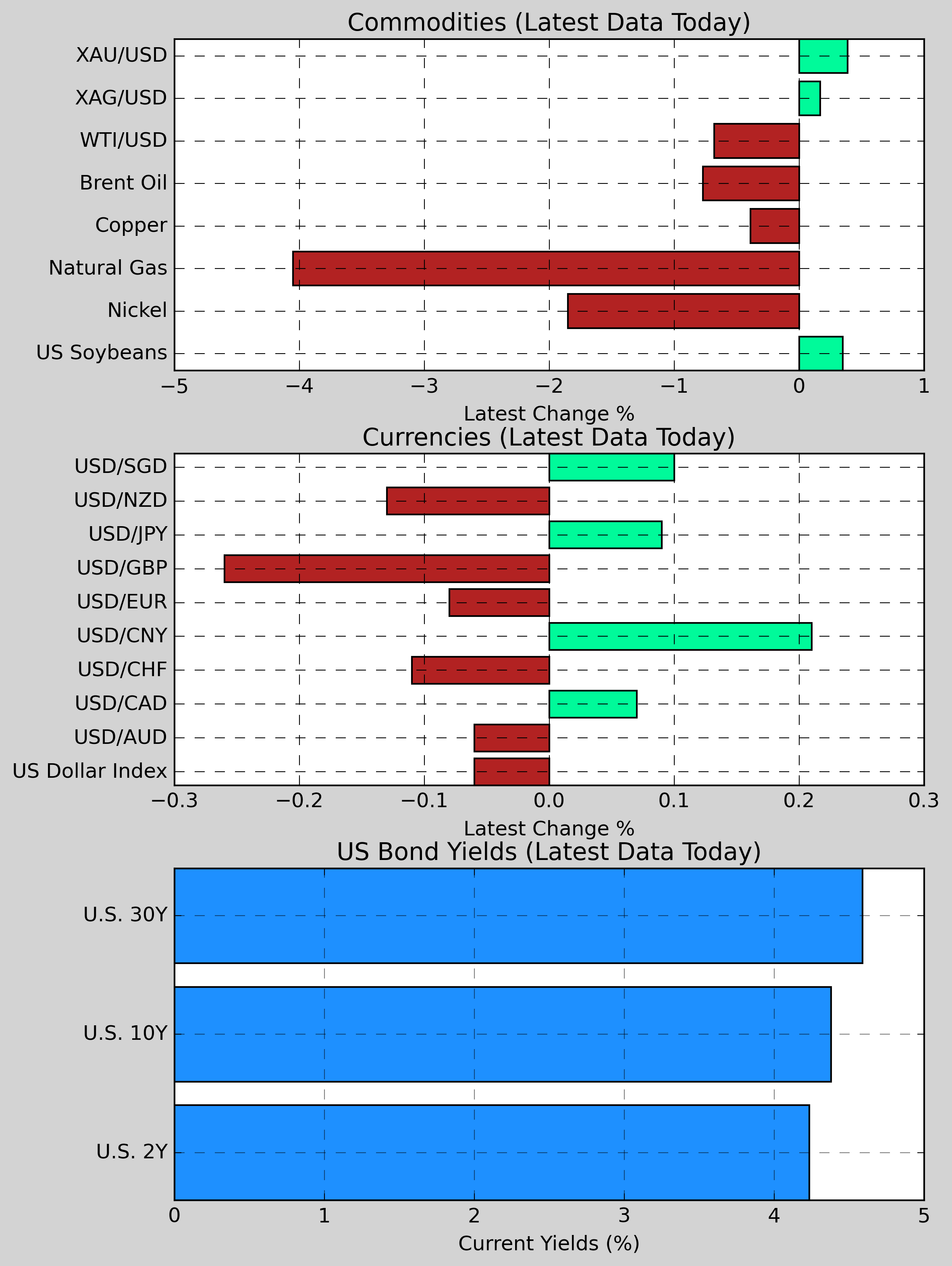

Commodities: Gold increased 0.39% to $2,658.78, while US Soybeans gained 0.35% to $991.50. US Wheat rose 0.62% to $555.40. Conversely, Nickel fell 1.85% to $15,876.00, and Natural Gas decreased 4.05% to $3.1470. Copper declined 0.39% to $4.1807. Brent Oil slipped 0.77% to $73.92.

Currencies: The US Dollar exhibited a mixed performance against other currencies, with USD/CNY up 0.21% and USD/CAD rising 0.07%. However, USD/GBP fell 0.26%, and the US Dollar Index dipped slightly, down 0.06% to 106.94. USD/JPY rose 0.09% to 153.79.

US Bond Yields: The U.S. 2-Year Treasury yield decreased 0.17bps to 4.234%, while the U.S. 10-Year Treasury yield fell 0.41bps to 4.381%. The U.S. 30-Year Treasury yield also dropped 0.54bps to 4.589%.

Economic Data & Central Bank Developments (Eastern Time)

- 08:30 AM ET: US New York State Manufacturing Index for December (estimated at 10, previous value at 31.2)

- 09:45 AM ET: U.S. December manufacturing PMI preliminary value (previous value is 49.7)

- 09:45 AM ET: U.S. December service industry PMI preliminary value (previous value is 56.1)

- 3:20 PM ET: Macklem, Governor of the Bank of Canada, speaks

Other Notable News

-

Impeachment Motion in South Korea: South Korea's parliament has initiated proceedings to impeach President Yoon Seok-yeol, pending approval from the Constitutional Court. The suspended president remains defiant, while Prime Minister Han Deok-soo is set to assume control. In light of these developments, the Bank of Korea has pledged to prioritize the stability of the financial markets.

-

Macron's Search for a New Government: French President Emmanuel Macron has named Francois Bayrou as his new prime minister. In an effort to secure parliamentary support for the budget, Bayrou is scheduled to meet with far-right leader Marine Le Pen on Monday to facilitate the formation of a new government in the context of a fragmented parliament.

-

Fed's Interest Rate Outlook: Economists surveyed by Bloomberg anticipate that the Federal Reserve will announce a third interest rate cut this week. However, they project that only three rate reductions will occur over the next year as progress in combating inflation appears to be stalling.

-

Bank of Japan's Stance: Reports suggest that the Bank of Japan may opt against raising interest rates during its upcoming policy meeting, aiming to monitor wage negotiation trends in early 2025 and the implications of Trump’s policies.

-

U.S. Shows Support for Syrian Opposition: U.S. Secretary of State Antony Blinken announced in Jordan that the Biden administration is engaging with the ruling opposition group in Syria. The U.S. is prepared to acknowledge the legitimacy of Hayat Tahrir al-Sham if it adheres to principles that would lead to a political transition and the creation of an inclusive government.

-

Economic Insights from ECB Officials: Some officials from the European Central Bank have indicated that more rate cuts could be expected next year. The French central bank governor noted that investor expectations of cumulative rate cuts exceeding 100 basis points in the coming year seem justified.

-

Apple's Production Shift: In a move to diversify its manufacturing, Apple plans to commence the production of AirPods wireless earphones in India early next year, seeking to reduce its dependence on Chinese manufacturing.

-

Transition Team's Banking Regulatory Review: The Wall Street Journal has reported that former President Trump's transition team is exploring avenues to significantly cut back, consolidate, or even abolish the position of the top banking regulator that oversees financial institutions.

-

Moody's Downgrades France’s Credit Rating: Moody's has lowered France’s credit rating from Aa2 to Aa3, projecting a significant deterioration in public finances over the next several years.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.