Taiwan's Cable Crisis, Boeing's Rebuilding Journey, Trudeau's Leadership Shift, and India's Currency Strategies

Taiwan accuses a Chinese ship of undersea cable sabotage amid rising geopolitical tensions, Boeing's CEO pivots the company towards safety after a year of scrutiny, and Trudeau's looming resignation could shake up Canada's political landscape as markets react.

Hello, it's Ryosuke! Today, we dive into some significant global developments that reflect shifts in political landscapes, corporate challenges, and humanitarian efforts. Here’s a quick overview of what you can expect in this report:

- Taiwan's Communication Vulnerability: Taiwan accuses a Chinese ship of damaging undersea cables, prompting enhanced security measures.

- Boeing's Recovery Journey: Following a serious safety incident, Boeing focuses on restoring confidence and addressing quality control challenges under new leadership.

- Trudeau's Political Future: Speculation grows around Prime Minister Trudeau's likely resignation amid increasing pressure, which could usher in a competitive Liberal leadership race.

- RBI Policy Recommendations: Former RBI Deputy Governor advises embracing rupee volatility for economic stability, highlighting challenges for the new RBI Governor.

- Afghan Resettlement in the Philippines: Nearly 300 Afghan nationals arrive for visa processing, marking a key U.S.-Philippines cooperation effort amid public security concerns.

Details and broader implications are covered below—let’s dive in!

Taiwan Alleges Sabotage as Chinese Ship Damages Undersea Cable

Photo by Bing Zhang / Unsplash

Incident Overview: Taiwan has accused a Chinese-owned cargo ship of damaging an undersea cable off its northeastern coast, raising alarms about the nation's communications vulnerability. This act of alleged sabotage has been highlighted by officials, who point to the growing threats to Taiwan's offshore infrastructure from foreign vessels.

Context of the Attack: The cargo ship involved is linked to a Hong Kong-based company with ties to a mainland Chinese director. This incident follows prior concerns, including allegations of a different Chinese vessel damaging data cables in the Baltic Sea, illustrating an emerging pattern of disruptive activity in crucial maritime zones.

Immediate Impact and Response: Fortunately, Chunghwa Telecom reported that the damage did not disrupt services, as data was swiftly rerouted to other cables. In response to the incident, Taiwan’s authorities are enhancing their surveillance and resilience in communication networks, which have been targeted before, including disruptions in 2023 caused by Chinese fishing boats in the Matsu Islands.

Future Measures: Taiwan is actively seeking assistance from South Korea; the suspect vessel is expected to dock in Busan soon. Additionally, to bolster its resilient communication framework, Taiwan plans to launch its first domestically produced low-Earth orbit communication satellite by next year, underscoring the nation's commitment to safeguarding its telecommunications against future threats.

Boeing’s Long Road to Recovery: A Year After the Door Plug Incident

Photo by Sven Piper / Unsplash

Year of Reckoning: A year ago, Boeing faced serious safety scrutiny when a door plug blew out of an Alaska Airlines Boeing 737 Max 9 during flight. Although there were no serious injuries, the incident highlighted manufacturing flaws, reigniting concerns about the aircraft maker's quality controls and leading to a significant drop in stock price.

Leadership Changes: Under new CEO Kelly Ortberg, who took the reins last August, Boeing is working to restore confidence and stability. Ortberg has emphasized a cultural shift to prioritize safety over profits, following a period of significant executive turnover and employee feedback sessions aimed at addressing quality issues.

Increased Oversight and Challenges: The Federal Aviation Administration has ramped up scrutiny of Boeing, still limiting production of the 737 Max despite the company's efforts to tighten quality controls. This intensified oversight underscores Boeing's struggle to achieve consistent delivery timelines, as the company copes with the aftermath of mounting losses and strikes that have disrupted operations.

Moving Forward Amidst Setbacks: With plans to reduce its workforce by 10%, Boeing aims to streamline operations while tackling ongoing challenges, including delivery delays and safety concerns. Industry insiders like Southwest Airlines' CEO Bob Jordan believe Ortberg is committed to a comprehensive overhaul, suggesting that while recovery is in its early stages, there is cautious optimism for a turnaround.

Trudeau's Anticipated Resignation May Spark Liberal Leadership Contest

Photo by Hermes Rivera / Unsplash

Resignation Rumblings: Prime Minister Justin Trudeau is reportedly expected to announce his resignation as leader of the Liberal Party within the week. This decision comes amid increasing pressure from party members, particularly after the departure of Finance Minister Chrystia Freeland, who cited policy disagreements with Trudeau.

Political Fallout: The call for Trudeau's resignation has intensified, with over 20 Liberal MPs publicly supporting his exit, signaling a significant shift in party dynamics. Concerns about economic stability, especially with potential US tariffs looming, add urgency to the situation, forcing Liberal lawmakers to reconsider their leadership.

Market Reactions: Following the Globe report, the Canadian dollar gained strength, reflecting traders' optimism that the political turmoil might be nearing resolution. The currency has struggled recently but showed signs of recovery, hinting at a potential turning point for investor confidence in the nation's governance.

Leadership Uncertainty Ahead: If Trudeau steps down, the Liberal Party would need to navigate a leadership race quickly, potentially leading to an interim leader being chosen from within current MPs. Key figures like Freeland and former Bank of Canada governor Mark Carney are expected to emerge as candidates, intensifying the stakes as the party faces upcoming threats from the Conservatives in election season.

RBI Urged to Embrace Rupee Volatility for Economic Stability

Photo by Martin Jernberg / Unsplash

A Call for Flexibility: Former RBI Deputy Governor Viral Acharya believes the Reserve Bank of India should adopt a more flexible approach towards rupee volatility. He argues that allowing some fluctuations can help maintain private hedging, something essential since the central bank cannot absorb all risks alone, especially in times of economic uncertainty.

Transition in Leadership: Acharya's recommendations come as financial markets are keenly observing whether new RBI Governor Sanjay Malhotra will continue the conservative policies of his predecessor. The rupee has recently been the most stable currency in emerging Asia, yet it faced increased volatility, trading near the 86-mark amidst a stronger dollar and a broader trade deficit.

Historical Context: During Acharya's tenure from January 2017 to July 2019, he gained insights from significant global economic shifts, including US interest rate rises and trade tensions. His experience led to a strategy prioritizing gradual depreciation of the rupee as a means of absorbing macroeconomic shocks, rather than unwavering defense against currency fluctuations.

Risks and Signals: While the RBI's foreign-exchange reserves were as high as $705 billion, they have recently dropped to a low of $640.3 billion. Acharya warns that rapid depletion of reserves can send negative signals to the market, emphasizing the importance of balancing reserve management with an adaptable currency strategy that reflects current economic realities.

Afghan Nationals Arrive in the Philippines for Visa Processing

Photo by charlesdeluvio / Unsplash

New Arrivals: Nearly 300 Afghan nationals, including women and children, have landed in Manila to begin the process of resettling in the U.S. This movement comes as a result of a recent agreement between the Philippines and the United States, highlighting cooperation amid ongoing humanitarian efforts.

Agreed Terms: In August, the U.S. and Philippines reached a deal allowing Afghans to transit through the Philippines for special immigrant visa processing. This arrangement aims to facilitate smoother transitions for those who worked alongside American forces during the Afghan conflict, emphasizing the importance of these pathways for vulnerable populations.

Public Concerns: Senator Imee Marcos has raised questions regarding the security implications of the agreement, expressing concerns for national safety. However, President Ferdinand Marcos Jr. has advocated for a welcoming Filipino spirit, stressing the importance of hospitality during these critical times.

Safety Assurance: The Philippine government has confirmed that all visa applicants underwent comprehensive security screenings by national authorities, aiming to alleviate public concerns. This thorough vetting process underscores the commitment to ensuring both safety and support for Afghan nationals in their pursuit of a new life.

Latest On Global Markets

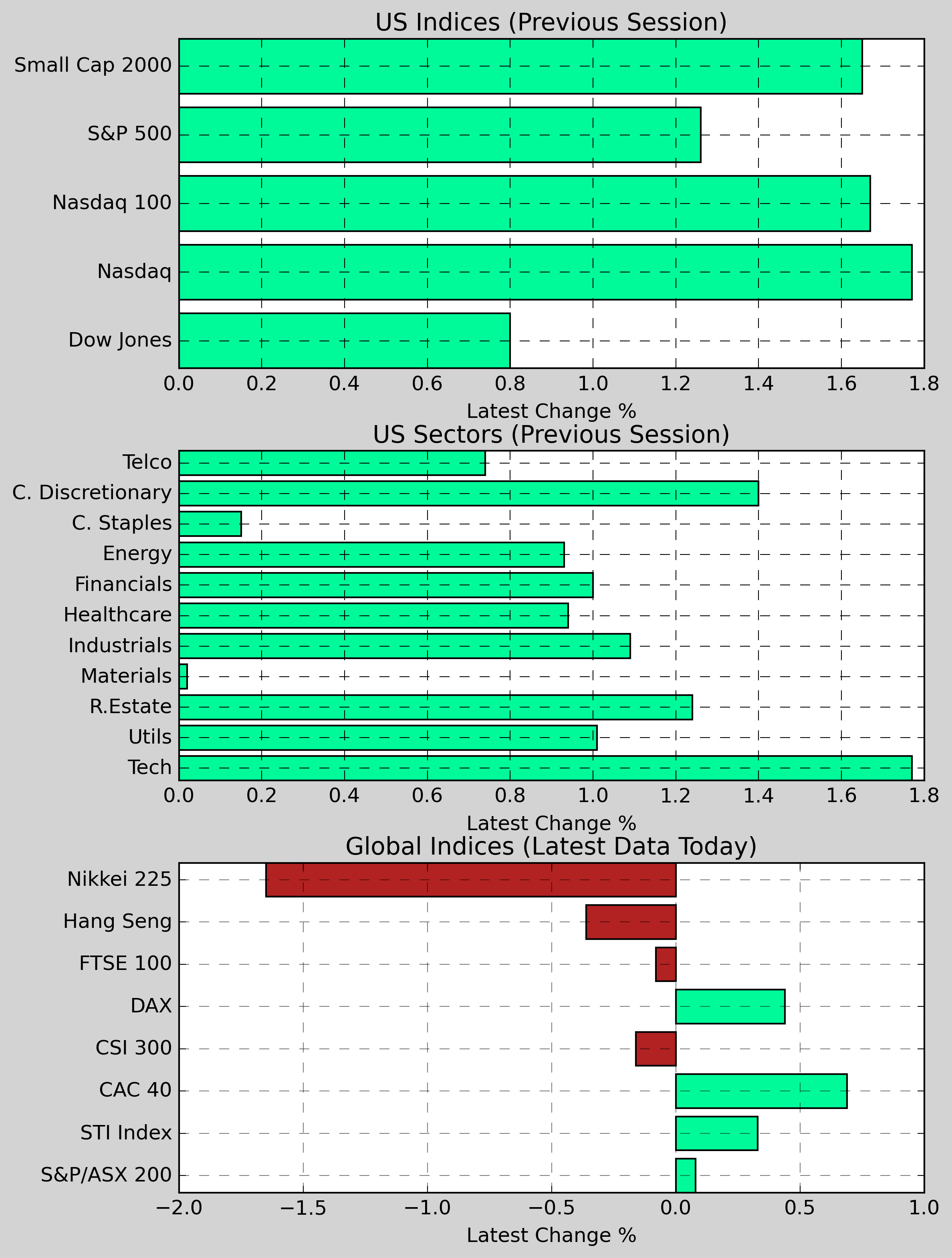

US Futures: Futures are showing positive momentum, with Dow Jones futures rising 0.09%, S&P 500 futures increasing 0.29%, and Nasdaq 100 futures up 0.47%.

US Indices (Previous Session): The S&P 500 closed down 0.12% at 5,942.50, while the Dow Jones fell 0.08% to 42,732.13. The Nasdaq saw a decrease of 0.17%, finishing at 19,621.68, and the Nasdaq 100 dropped 0.17%. The Small Cap 2000 ended the session down 0.16%.

US Sectors (Previous Session): Consumer Services saw the largest gains, up 1.40%, followed closely by Technology, which rose 1.77%. On the contrary, Basic Materials experienced a slight decrease of 0.02%, while Healthcare declined 0.17%, and Industrials fell 0.09%.

Global Indices: The CAC 40 advanced 0.69%, and the DAX gained 0.44%. In contrast, the Nikkei 225 fell 1.65%, as did the S&P/ASX 200 which decreased 0.08%, and the FTSE 100 edged down 0.08%. The Hang Seng also saw a slight decline of 0.36% while the CSI 300 dropped 0.16%.

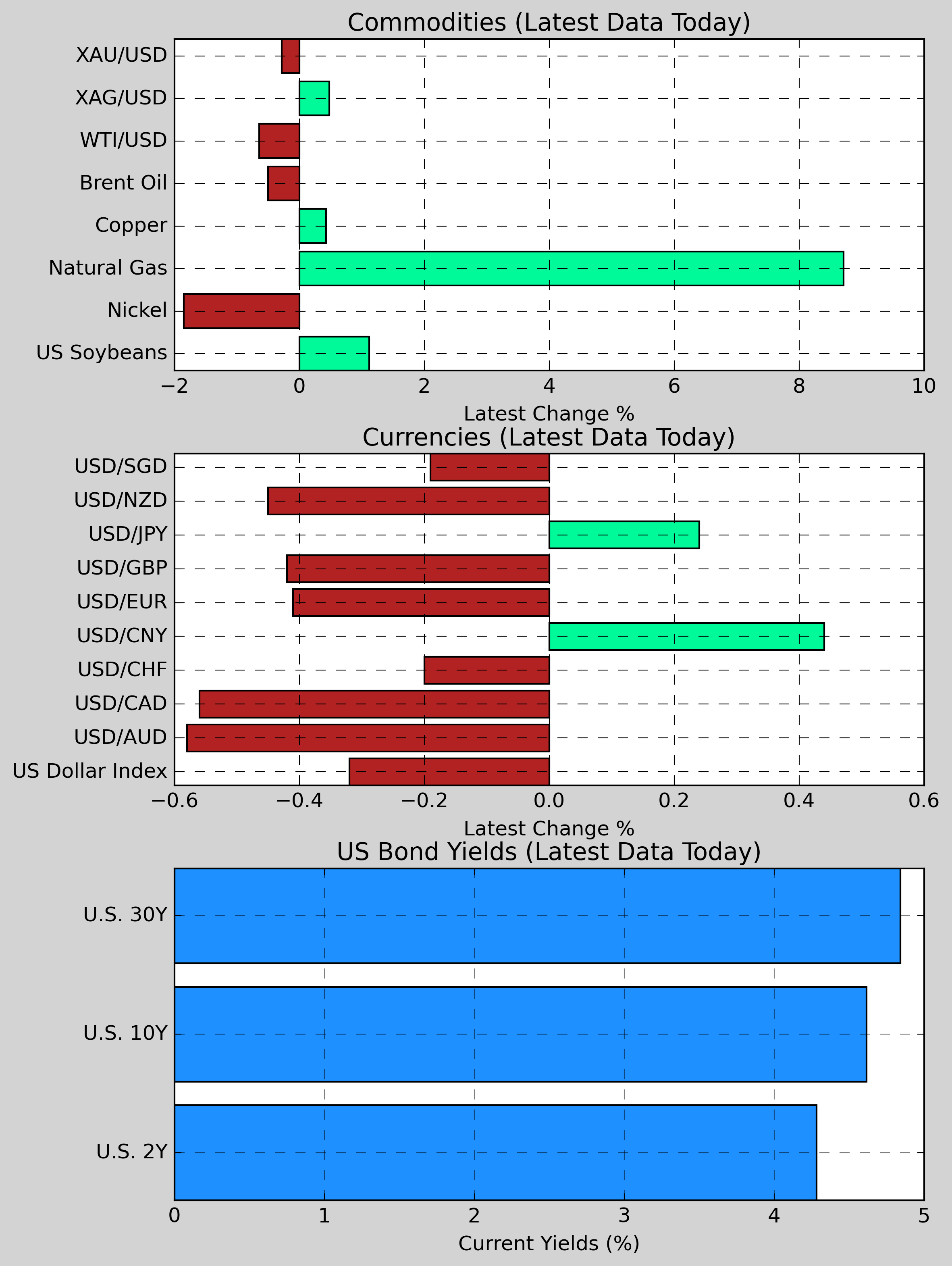

Commodities: Gold fell 0.28% to $2,631.60, while Copper rose 0.43% to $4.0910. Nickel declined 1.85% to $15,876.00. US Wheat increased 0.49% to $532.60, and Natural Gas gained 8.71% to $3.646. On the other hand, US Soybeans rose 1.12% to $1,003.12, while Brent Crude decreased 0.50% to $76.13.

Currencies: The US Dollar experienced mixed movements, with USD/AUD down 0.58%, and USD/CAD falling 0.56%. However, USD/CNY increased 0.44%, and USD/JPY rose 0.24%. The US Dollar Index dipped 0.32% to 108.60.

US Bond Yields: The U.S. 2-Year Treasury yield decreased slightly 0.40bps to 4.283%, while the U.S. 10-Year Treasury yield rose marginally by 2.10bps to 4.616%. The U.S. 30-Year Treasury yield also increased slightly 2.70bps to 4.842%.

Other Notable News

-

Sales of Advanced Missiles to Japan Approved: The U.S. government has sanctioned the sale of sophisticated air-to-air missiles to Japan, with an estimated worth reaching $3.64 billion.

-

Rise in ISM Manufacturing Index: In December, the Institute for Supply Management reported that the manufacturing index increased nearly one point to 49.3, the best figure since March, surprising most economists and suggesting that the challenges faced by the manufacturing sector may be starting to lift.

-

South Korean Political Turmoil: Anti-corruption officials in South Korea encountered resistance when they attempted to detain impeached President Yoon Seok-yeol last Friday. Reports reveal that his security personnel hindered efforts, leading to a court's rejection of Yoon's appeal against the arrest warrant.

-

BlackRock Bitcoin ETF Sees Significant Outflow: The iShares Bitcoin Trust ETF managed by BlackRock experienced its largest outflow to date, totaling $333 million on Thursday, indicating a potential reduction in investor confidence.

-

Microsoft's Major Investment in AI: The tech giant Microsoft has announced plans to allocate $80 billion for the construction of data centers in the upcoming fiscal year, underscoring the escalating demand for infrastructure aimed at supporting artificial intelligence initiatives.

-

Republican Leadership Battle: In a tightly contested struggle, Republican Kevin Johnson successfully secured his position as Speaker of the U.S. House of Representatives, overcoming opposition from key conservative figures with the support of President-elect Trump after prolonged negotiations.

-

JPMorgan Advises on Yen Investment: In a strategic move, JPMorgan is recommending investors increase their exposure to the yen to hedge against an unanticipated slowdown in the U.S. economy.

-

Inflation Developments in the Eurozone: Anticipated inflation figures for the Eurozone due this week are expected to indicate that there remains significant distance to cover in reaching inflation targets, with economists forecasting a year-on-year increase of 2.4% for December, slightly above the prior month.

-

Fed Perspectives on Inflation: Federal Reserve officials, including Governor Kugler and San Francisco's President Daly, reiterated that the fight to manage inflation is ongoing, while Richmond Fed President Barkin expressed a belief that inflation would decrease by 2025.

-

U.S. Steel Sale Blocked by Biden: Shares of U.S. Steel saw a sharp decline after President Biden exercised his veto against a $14.1 billion sale of the company to Nippon Steel. Both firms plan to contest this decision, with labor representatives endorsing Biden's stance against the takeover.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.