Starlink Controversy, Macron's New PM Promise, and China's Export Controls

SpaceX is in hot water as the FCC faces calls to delay its Starlink expansion, France’s Macron scrambles for a new PM after a historic political shake-up, and China escalates trade tensions with fresh export controls.

Morning, everyone! It’s Ryosuke here with today’s top stories: SpaceX is in hot water as the FCC faces calls to delay its Starlink expansion, France’s Macron scrambles for a new PM after a historic political shake-up, and China escalates trade tensions with fresh export controls. Plus, India’s central bank takes action to defend the rupee, and Xi’s military purges raise eyebrows in Beijing. Stick around—there’s plenty to unpack.

SpaceX Faces FCC Challenge Over Starlink Expansion

Ukrainian-American Group Pushback: The Ukrainian Congress Committee of America (UCCA) filed a petition urging the FCC to delay SpaceX's plan to launch over 22,000 satellites. Concerns include Elon Musk’s alleged ties to Russia, claims that Starlink was used in Russian military activities, and potential environmental impacts from SpaceX’s Texas launch site.

Conflict of Interest Allegations: The UCCA highlighted Musk’s dual roles as SpaceX CEO and incoming advisor to Trump’s Department of Government Efficiency (DOGE), suggesting financial conflicts and regulatory influence risks. Musk’s position could impact FCC oversight of SpaceX and other ventures.

Environmental and National Security Concerns: The group criticized SpaceX for harming protected habitats and linked its satellites to alleged Russian military use. Previous reports also tied Starlink to drones used in Ukraine, sparking broader calls for investigation into Musk’s actions.

Potential FCC Delays: If successful, the petition could lead to environmental reviews and regulatory scrutiny of SpaceX. The case raises questions about balancing technological advances with ethical and environmental accountability.

Macron Pledges Quick Appointment of New Prime Minister

Photo by Pourya Gohari / Unsplash

Barnier Resigns After Historic No-Confidence Vote: French President Emmanuel Macron has vowed to appoint a new prime minister "in the coming days" following Michel Barnier's resignation. Barnier was ousted after a no-confidence vote, the first such removal of a French government in over 60 years.

Political Deadlock Looms: Macron faces a divided National Assembly, split into left, center, and far-right blocs. His next prime minister will need to navigate this fractured parliament, with Socialist leader Olivier Faure hinting at potential collaboration under a "fixed-term contract."

Macron Defends His Leadership: Acknowledging criticism for calling snap elections that led to parliamentary gridlock, Macron accused his opponents of prioritizing political chaos over voters' interests. He reaffirmed his commitment to completing his mandate through 2027.

Immediate Challenges Ahead: Macron's next prime minister must swiftly address the 2025 budget amid speculation about potential candidates, including Defence Minister Sébastien Lecornu and centrist François Bayrou. The announcement is expected before Saturday’s global event, the reopening of Notre-Dame Cathedral.

China Expands Export Controls, Targeting US Supply Chains

Photo by Emmanuel Appiah / Unsplash

New Extraterritorial Rules: Beijing has imposed export controls on dual-use goods and critical materials, such as gallium and germanium, extending its rules to companies and individuals outside China. The move seeks to mirror the extraterritorial reach of US and EU sanctions.

Escalating Trade Tensions: These controls, effective this week, block the sale of materials to the US military and tighten re-export restrictions. Analysts warn businesses to find alternative suppliers, as China’s dominance in critical minerals could exacerbate supply chain disruptions.

Broader Implications: While Beijing frames the rules as a defense against US "economic coercion," critics see it as a precedent-setting escalation ahead of President-elect Trump’s term. The controls close loopholes for rerouting exports but raise concerns about Beijing's willingness to enforce them internationally.

Strategic Pushback: China’s latest move follows years of legal preparation, including the “Unreliable Entity List” and export laws. However, enforcement capabilities may lag behind US measures, leaving global firms to navigate growing trade uncertainties.

Trump’s China Ambassador Pick Offers Hope for Cooperation

Photo by Joseph Chan / Unsplash

David Perdue Named Ambassador: President-elect Donald Trump has chosen ex-Senator David Perdue as the next US ambassador to China. Perdue, a former businessman with experience in Asia, is expected to balance Trump’s hawkish policies with a pro-business approach, signaling a potential olive branch to Beijing during heightened tensions.

Balancing Hardliners: While Trump’s administration includes China hawks like Marco Rubio as Secretary of State, Perdue’s nomination introduces a more conciliatory tone. Known for his emphasis on cooperation during the first trade war, Perdue could act as a bridge to improve ties between the world’s two largest economies.

A Diplomatic Challenge: Perdue’s experience in outsourcing and Asian markets positions him uniquely for the role, though his past business ties with China have drawn scrutiny. His warnings about the risks of deteriorating US-China relations highlight the stakes as Trump pushes for tougher trade and military policies.

Implications for Beijing: Analysts see Perdue’s appointment as offering "upside" for China, given his business acumen and diplomatic potential. However, his support for Taiwan and military preparedness may continue to irk Beijing, suggesting a nuanced approach in his upcoming tenure.

India Raises Non-Resident Deposit Rates to Support Rupee

Photo by Ayaneshu Bhardwaj / Unsplash

Attracting Forex Inflows: The Reserve Bank of India (RBI) raised rate ceilings on non-resident deposits to counter the rupee's recent record lows. Banks can now offer rates of up to the Overnight Alternative Reference Rate (ARR) plus 400-500 basis points, depending on deposit maturity.

Rupee Under Pressure: The rupee has struggled against global headwinds, hitting a record low of 84.7625 on Dec. 3. The central bank has spent heavily from its reserves, which have dropped from $705 billion in September to $657 billion, to curb volatility.

Policy Objectives: RBI Governor Shaktikanta Das emphasized the need for competitive forex reserves to act as economic shock absorbers while limiting intervention in currency markets. Non-resident deposits saw a net inflow of $10.2 billion from April to September, nearly doubling year-on-year.

Market Reaction: Following the announcement, the rupee strengthened by 0.3% to 84.52 per dollar, showcasing early signs of market confidence in the RBI’s measures.

Xi’s Military Purge Signals Widening Mistrust

Photo by Hennie Stander / Unsplash

Loyalists Under Fire: President Xi Jinping has launched a new wave of military purges, targeting even his own appointees. The investigation of Miao Hua, a top-ranked Central Military Commission (CMC) member, marks a significant escalation, following the earlier downfall of Defense Minister Li Shangfu. The CMC now faces unprecedented vacancies, reflecting deep cracks in Xi's military leadership.

Corruption or Control? Xi’s purges echo his earlier campaigns targeting rivals like Bo Xilai, but this time, his focus is internal. Analysts suggest graft accusations may serve as a tool to consolidate power, with some claiming widespread corruption has compromised the capabilities of China’s armed forces, including its missile programs.

PLA Loyalty Under Scrutiny: Xi's intensified efforts to instill political loyalty in the People’s Liberation Army highlight ongoing challenges. Despite his dominance, the top leader appears increasingly distrustful of his military bureaucracy, resorting to reshuffles and purges to maintain control as he ramps up drills near Taiwan.

Broader Implications: The sweeping crackdown raises questions about China’s military stability and Xi’s grip on power. Critics argue these measures, seen by some as signs of weakness rather than strength, underscore the difficulties of governing an entrenched and sprawling military institution.

Latest On Global Markets

US Futures: Futures are pointing towards the upside, with Dow Jones futures rising 0.05% and S&P 500 futures increasing 0.04%.

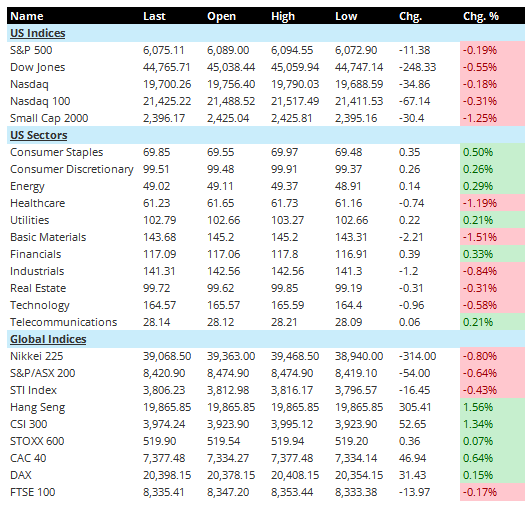

US Indices (Previous Session):

The S&P 500 dropped 0.19% to 6,075.11, while the Dow Jones declined 0.55% to 44,765.71. The Nasdaq slipped 0.18%, ending at 19,700.26, and the Nasdaq 100 fell 0.31%. The Small Cap 2000 posted the steepest loss, down 1.25%.

US Sectors (Previous Session):

Consumer Staples led the gains, rising 0.50%, followed by Financials, up 0.33%, and Energy, which increased 0.29%. On the downside, Basic Materials dropped 1.51%, Healthcare declined 1.19%, and Industrials fell 0.84%.

Global Indices:

The Hang Seng surged 1.56%, while the CSI 300 climbed 1.34%. In Europe, the CAC 40 rose 0.64%, and the DAX gained 0.15%. Conversely, the Nikkei 225 dropped 0.80%, the S&P/ASX 200 declined 0.64%, and the FTSE 100 edged down 0.17%.

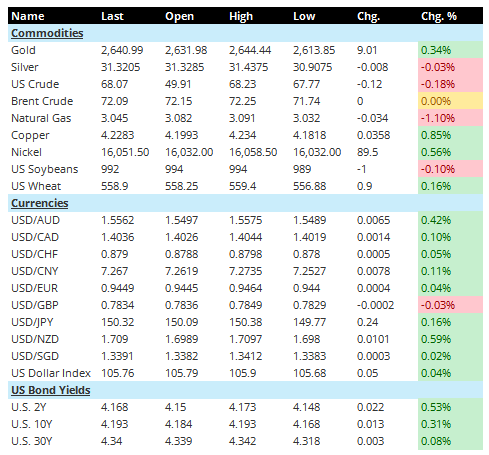

Commodities: Gold gained 0.34% to $2,640.99, while Copper rose 0.85% to $4.2283. Nickel advanced 0.56% to $16,051.50. US Wheat edged up 0.16% to $558.9. On the other hand, Natural Gas fell 1.10% to $3.045, and US Crude dipped 0.18% to $68.07. Silver was nearly flat, slipping 0.03%, while US Soybeans declined 0.10%. Brent Crude remained unchanged at $72.09.

Currencies: The US Dollar strengthened against most currencies, with USD/AUD up 0.42% and USD/NZD rising 0.59%. USD/CNY increased 0.11%, and USD/CAD gained 0.10%. USD/GBP edged down 0.03%, and the US Dollar Index was up slightly, rising 0.04% to 105.76.

US Bond Yields: The U.S. 2-Year Treasury yield climbed 0.53% to 4.168%, while the U.S. 10-Year Treasury yield rose 0.31% to 4.193%. The U.S. 30-Year Treasury yield increased slightly, up 0.08% to 4.34%.

Economic Data Calendar and Central Bank Developments (ET)

Economic Events:

- 05:00: Final quarterly seasonally adjusted GDP growth rate of the Eurozone in the third quarter (estimated at 0.4%, initial value at 0.4%).

- 08:30: Canada's unemployment rate in November (estimated at 6.6%, previous value was 6.5%).

- 08:30: Change in U.S. non-farm payrolls in November (estimated to be an increase of 220,000, previous value was an increase of 12,000).

- 08:30: U.S. unemployment rate in November (estimated to be 4.1%, previous value was 4.1%).

- 10:00: Preliminary value of the University of Michigan Consumer Confidence Index in December (estimated to be 73.3, previous value was 71.8).

- 15:00: U.S. consumer credit in October (estimated at $10 billion, previous value of $6.002 billion).

Speeches:

- 09:15: Speech by Fed Governor Bowman.

- 10:30: Chicago Fed President Goolsbee speaks.

- 20:00: Hammack, President of the Federal Reserve Bank of Cleveland, will speak.

- 21:00: Daly, President of the Federal Reserve Bank of San Francisco, speaks.

Other Notable News

-

Chip Sanctions Debate: The chairman of the U.S. House of Representatives' special committee on China criticized President Biden for leaving loopholes in the latest chip restrictions on Beijing, potentially allowing companies like Huawei to access U.S. technology. Speculation is rising that Trump could impose stricter semiconductor measures if he takes office again.

-

Economic Signals: U.S. unemployment claims rose to a one-month high during Thanksgiving week, exceeding economists' forecasts. Additionally, layoffs in November increased 26.8% year-on-year, according to the Challenger report.

-

Trade Deficit Shrinks: The U.S. trade deficit narrowed in October from its two-year high, as imports dropped to a four-month low.

-

South Korea's Stance: South Korea's finance minister dismissed concerns that martial law would lead to economic recession, emphasizing that markets and the economy remain stable.

-

OPEC+ Update: OPEC+ announced a three-month delay in resuming oil production increases, pushing the timeline to April 2024. The pace of production growth will also be slower than previously planned.

-

Ukraine's Stand: Ukraine's foreign minister reiterated the country’s firm position against any compromise on territorial integrity, sovereignty, or security.

-

Germany's Industrial Outlook: October factory orders in Germany fell less than expected, with signs pointing to a possible rebound as the manufacturing sector seeks to recover.

-

Nvidia in Vietnam: Nvidia will establish an artificial intelligence center in Vietnam, signaling its push to expand into the Southeast Asian market.

-

Earthquake Alert: A magnitude 7.0 earthquake struck off Northern California’s coast on Thursday, briefly triggering tsunami warnings in San Francisco and surrounding areas.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.