Stalling Inflation & Fed Dilemmas, China's Trade Maneuvers, and NATO's Defense Revamp

Inflation pressures rise with the CPI report hinting at a 2.7% rate, as the Fed weighs potential interest cuts, while China retaliates in the ongoing trade spat with the U.S. and NATO ramps up defense spending targets amid escalating geopolitical tensions.

Good morning, it's Ryosuke!

Here's what’s catching everyone’s attention today:

- Inflation Takes Center Stage: The November CPI report is expected to show inflation ticking up to 2.7%, with persistent pressures testing the Federal Reserve’s resolve ahead of a likely rate cut this month.

- China Strikes Back: Beijing responds to U.S. trade restrictions with strategic moves like export bans and Nvidia investigations, signaling a fresh chapter in trade tensions.

- Sanctions on Russia: The Biden administration weighs tougher sanctions on Russia’s oil exports, targeting shadow fleets and tightening global energy dynamics.

- Corporate Drama: Biden is set to block Nippon Steel’s $14.1 billion bid for U.S. Steel, citing national security concerns, sparking political and legal ripples.

Details, market reactions, and what it all means are covered below. Let’s dive in!

Inflation Progress Stalls as CPI Report Looms

Stalled Inflation Trends: The upcoming Consumer Price Index (CPI) report is set to reveal a 2.7% inflation rate for November, which represents a slight uptick from October. Core CPI, excluding food and energy costs, is forecast to remain flat at 3.3%, highlighting ongoing inflation challenges for consumers, particularly amidst rising living costs.

Federal Reserve's Interest Rate Decisions: Despite these inflation figures, there's a strong market expectation that the Federal Reserve will cut interest rates by a quarter of a percentage point at their meeting on December 18. With inflation concerns still prevalent, experts suggest the Fed may choose not to surprise the market, indicating a careful approach moving forward.

Areas Driving Price Increases: Specific sectors are contributing to the inflation rise, with car prices anticipated to increase by 2% and airfares expected to rise by 1% in November. Auto insurance also continues to strain budgets, projected to increase by 0.5% after a significant jump over the past year.

Future Outlook: While some economists predict gradual disinflation in the coming year, concerns remain over sustained inflation, particularly due to potential tariff impacts from the incoming administration. Despite expectations for interest rate cuts, persistent inflation above the Fed's 2% target complicates the economic landscape, emphasizing that a stable return to target inflation levels is still a way off.

China Prepares Strategic Moves in U.S. Trade Tensions

Photo by Anatoliy Gromov / Unsplash

New Trade Tactics: China is ramping up its response to U.S. trade restrictions by launching an investigation into Nvidia and imposing bans on the export of critical minerals. These actions come as a direct reaction to recent U.S. policies limiting China’s access to AI chip components, indicating Beijing's readiness to engage in a renewed trade war.

Calibrated Retaliation: The measures taken by China appear calculated to exert pressure on the U.S. without severely destabilizing their bilateral relationship or damaging its own economy. Experts suggest that while these retaliatory actions are significant, they are primarily symbolic, as exports to the U.S. had already decreased significantly this year.

Economic Balance: As China navigates these tensions, it remains focused on stabilizing its economy, which is currently under strain from deflation and a protracted housing downturn. The Chinese leadership is also weighing the potential depreciation of the yuan to counter the impact of tariffs, hoping to make its exports more competitive in an increasingly strained trade landscape.

Future Outlook: As the situation evolves, China continues to enhance its trade response toolbox with strategic export controls. This careful balancing act reflects a desire to stand firm against U.S. pressure while also working to shield its economic stability amidst growing global uncertainty, setting the stage for potentially tense negotiations ahead.

Biden Administration Weighs New Sanctions on Russian Oil Trade

Tightening the Squeeze: With tensions escalating as Trump returns to the political landscape, the Biden team is considering tougher sanctions aimed at Russia's oil exports, which play a crucial role in funding its military actions in Ukraine. After previously cautious approaches due to potential energy price spikes, the current drop in oil prices is prompting a reassessment of these strategies.

Targeting the Shadow Fleet: Fresh sanctions may target the shadow tanker fleet that Russia relies upon for oil transportation, alongside existing restrictions on Russian oil imports. This initiative aligns with similar measures being designed by the European Union, aiming to restrict capabilities for oil trade while boosting support for Ukraine.

Implications for Global Markets: Implementing these sanctions could lead to a tightening in global oil supply, potentially driving prices up and straining economies worldwide. The Biden administration is aware of these risks but believes that applying pressure on Russia now will maximize leverage for Ukraine in any future negotiations, especially as Trump emphasizes the need for a resolution to the conflict.

Evolving Strategies: The Biden administration's shift towards more aggressive policies marks a significant change in approach. With previous efforts yielding mixed outcomes, officials are determined to strengthen Ukraine’s position by diminishing Kremlin revenues, while remaining vigilant to how these actions could impact international partnerships and energy markets.

Biden Poised to Block Major Steel Acquisition

Photo by Brandon Day / Unsplash

Decision on the Horizon: President Biden is set to block the $14.1 billion sale of United States Steel Corp. to Nippon Steel, citing national security concerns. The Committee on Foreign Investment in the U.S. (CFIUS) is expected to finalize its review and refer the decision to Biden by December 22 or 23, indicating potential risks associated with the deal.

Litigation Threats: Both US Steel and Nippon Steel are considering legal action if the merger faces a formal roadblock. This potential conflict underlines the stakes involved, with US Steel warning that failure of the deal could lead to significant operational cutbacks and relocation from its Pennsylvania headquarters.

Political Context and Implications: The proposed acquisition has ignited political debates, given Biden’s origin in Pennsylvania and his administration's focus on domestic ownership of critical industries. With the powerful United Steelworkers union also opposing the deal, it adds another layer of complexity to the already tense negotiations.

Nippon Steel's Approach: IN a bid to sway public opinion, Nippon Steel has announced plans to provide a $5,000 bonus to US Steel workers if the acquisition proceeds. However, the Japanese company has expressed concerns that political interests may overshadow legitimate national security discussions, hinting at a strong commitment to pursuing their interests if the merger is blocked.

BOJ Set to Weigh Interest Rate Hike Amid Stable Inflation Signals

Photo by Cullen Cedric / Unsplash

Current Assessment: The Bank of Japan (BOJ), under Governor Kazuo Ueda, is slated to discuss a potential hike in the benchmark interest rate, currently at 0.25%. Officials seem relaxed about waiting a bit longer, feeling that inflation pressures are manageable and risks of overshooting are minimal.

Data-Driven Decision: A final determination on whether to raise rates will hinge on a careful evaluation of incoming data, including upcoming U.S. CPI figures and domestic business sentiment reports. This careful scrutiny indicates that the BOJ is keen on ensuring any decision aligns closely with the economic realities.

Impact of Currency Strength: Unlike the previous summer, when the yen's weakness posed inflation risks, the current outlook shows a more stable currency positioning. This shift reduces immediate concerns over inflation driven by currency fluctuations, giving the BOJ more breathing room in its decision-making.

Looking Ahead: The BOJ is keeping an eye on multiple data sources leading up to its policy announcement on December 19. Whether they choose to raise rates or hold off, the central bank is signaling that any adjustments will be strategically timed based on rigorous analysis of the economic landscape.

NATO Sets New Targets for Defense Spending and Capabilities

Photo by Bryan Ramos / Unsplash

Strengthening Defense Capabilities: NATO is stepping up its defense strategy by planning to set specific targets for member nations regarding the production of weapons systems, including tanks and planes. This initiative is driven by increasing threats to Europe, particularly from Russia, and is likely to raise the alliance's defense spending goal from 2% to potentially 3% of GDP.

Focus on Key Areas: The proposed targets emphasize enhancing air defenses, nuclear deterrents, and offensive weapon systems. These priority areas reflect NATO's commitment to strengthen its military readiness in light of ongoing geopolitical tensions, with discussions expected to gain traction during defense ministers' meetings early next year.

Political Pressures and Funding Gaps: The push for higher defense spending is partly influenced by U.S. demands for greater financial contributions from NATO allies, especially under incoming leadership. This situation has highlighted existing capability gaps that need to be addressed to ensure Europe can defend itself without relying solely on U.S. support.

Response to Financial Disparities: The EU is exploring new financing mechanisms, including a proposed joint borrowing strategy for military expenses. With significant variations in what NATO members spend—Poland investing a remarkable 4.7% of its GDP on defense compared to Germany's 2.1%—there's an urgent need for consistent investment to bolster collective security efforts across the alliance.

Latest On Global Markets

US Futures: Futures are mixed at the moment, with Nasdaq 100 futures rising 0.19% and S&P 500 futures increasing 0.09%. However, Dow Jones futures are down 0.10%.

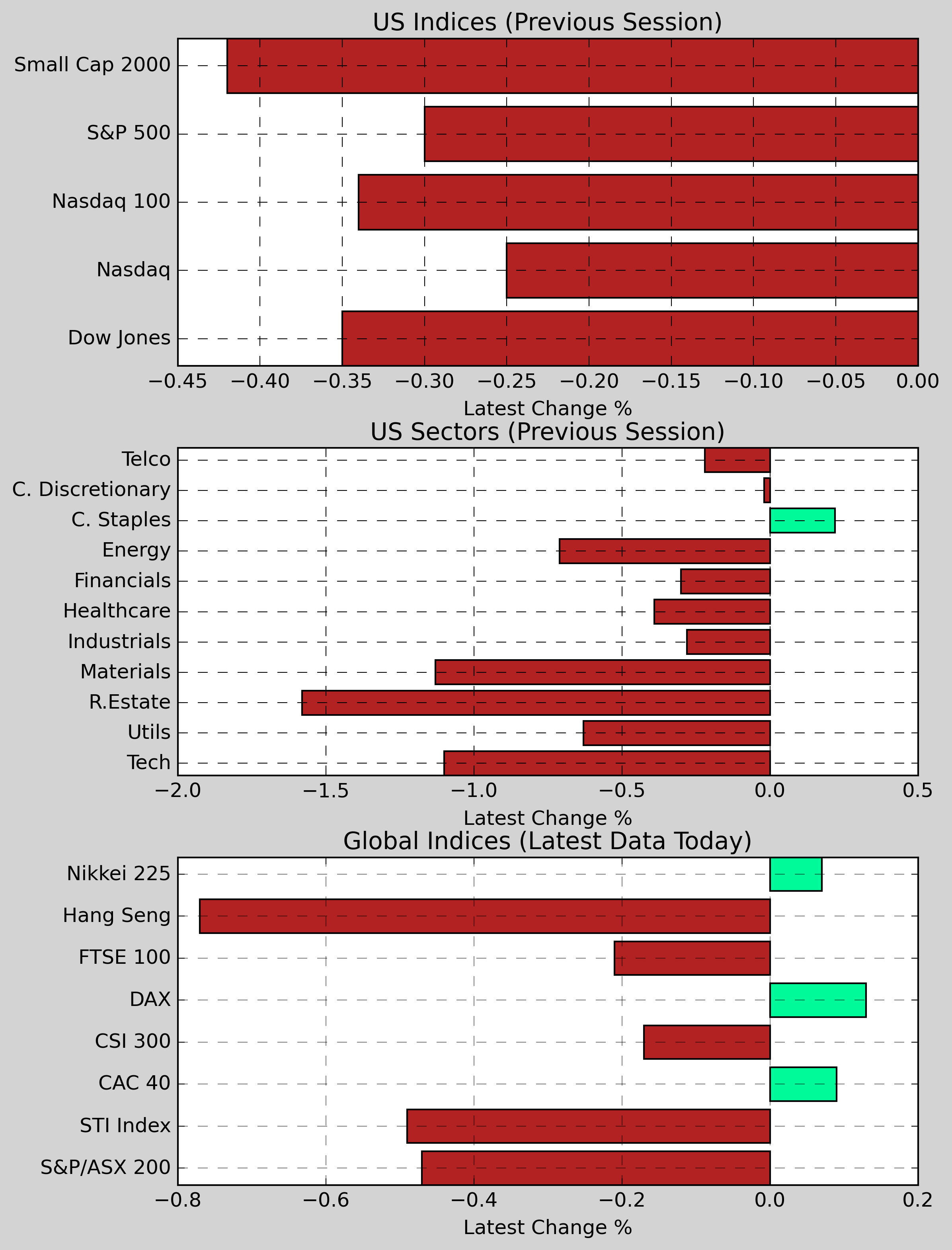

US Indices (Previous Session): The S&P 500 fell 0.30% to 6,034.91, the Dow Jones decreased 0.35% to 44,247.83, while the Nasdaq dropped 0.25% to 19,687.24. The Small Cap 2000 also declined 0.42%.

US Sectors (Previous Session): On the sector front, consumer goods led with a slight gain of 0.22%. Utilities and real estate both experienced declines, dropping 0.63% and 1.58%, respectively. Basic materials and healthcare also fell by 1.13% and 0.39%.

Global Indices: In global markets, the Hang Seng slid 0.77%, while the CSI 300 dropped 0.17%. In Europe, the CAC 40 gained 0.09%, and the DAX rose 0.13%. The Nikkei 225 showed a slight increase of 0.07%, whereas the FTSE 100 edged down 0.21%.

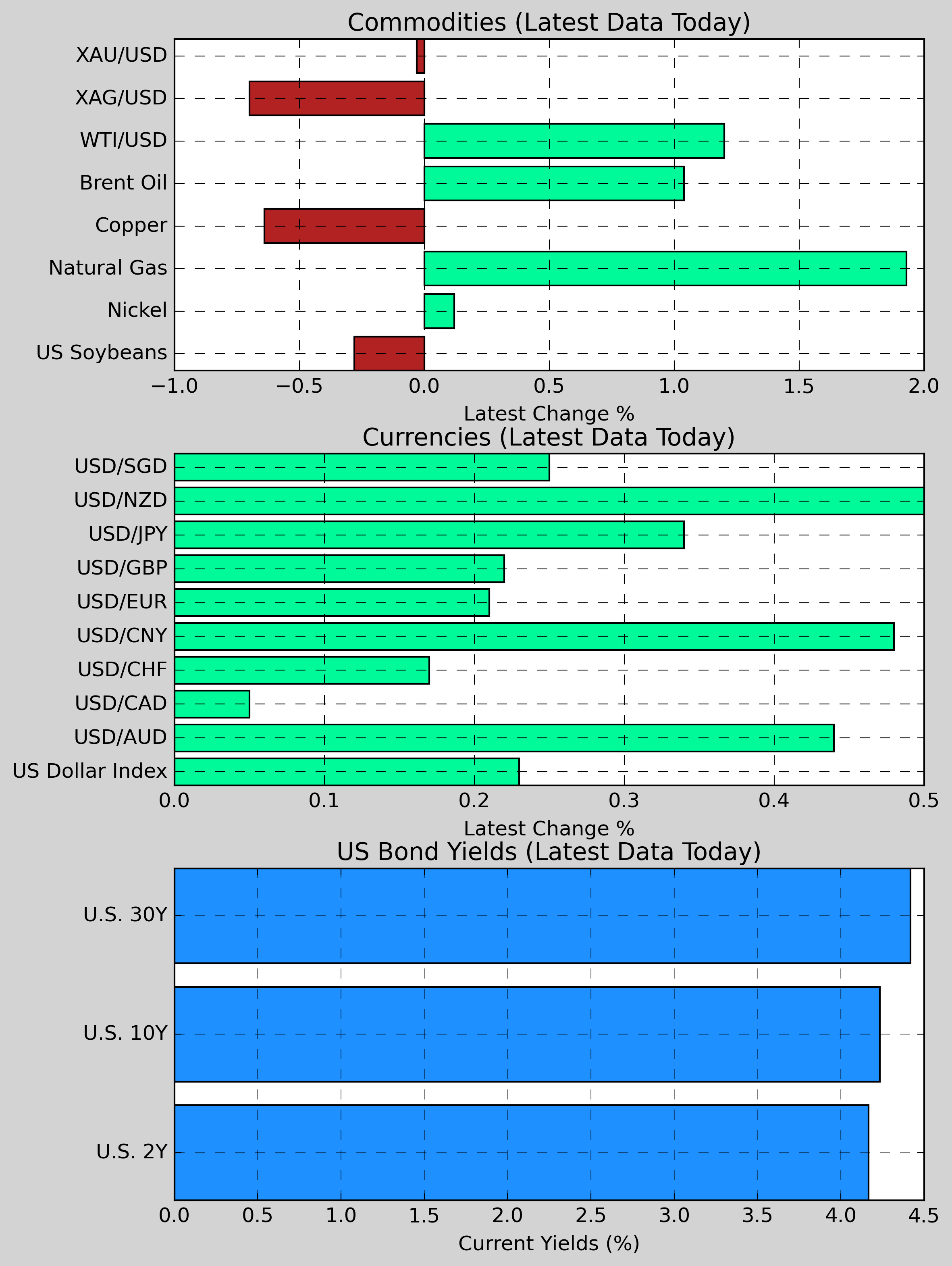

Commodities: Gold decreased 0.03% to $2,693.19, while Copper fell 0.64% to $4.2447. Nickel advanced 0.12% to $15,812.50. US Wheat saw a rise of 0.33% to $563.88, whereas Natural Gas increased 1.93% to $3.2240. US Soybeans slipped 0.28% to $992.25. Brent Crude oil rose 1.04% to $72.94.

Currencies: The US Dollar showed strength against various currencies, with USD/AUD increasing 0.44%, and USD/NZD rising 0.50%. USD/CNY also gained 0.48%. USD/CAD saw a minor ascent of 0.05%. Conversely, USD/GBP edged up 0.22%, while the US Dollar Index climbed 0.23% to 106.64.

US Bond Yields: The U.S. 2-Year Treasury yield increased 0.45% to 4.168%, and the U.S. 10-Year Treasury yield rose 0.28% to 4.235%. The U.S. 30-Year Treasury yield saw a slight uptick, climbing 0.30% to 4.420%.

Economic Data & Central Bank Developments (Eastern Time)

- 08:30 AM ET: U.S. Consumer Price Index for November (estimated to be 0.3%, previous value 0.2%)

- 08:30 AM ET: U.S. core consumer price index month-on-month in November (estimated to be 0.3%, previous value is 0.3%)

- 08:30 AM ET: U.S. Consumer Price Index Year-on-Year in November (estimated to be 2.7%, previous value was 2.6%)

- 08:30 AM ET: U.S. core consumer price index year-on-year in November (estimated to be 3.3%, previous value was 3.3%)

- 09:45 AM ET: Bank of Canada interest rate decision (estimated at 3.25%, current value at 3.75%)

- 02:00 PM ET (Dec 12): U.S. November budget report

- 06:30 AM ET (Dec 12): Brazilian Central Bank interest rate decision

Other Notable News

-

Surge in Small Business Optimism in the U.S.: The small business optimism index experienced a significant rise, reaching a three-year high in November, buoyed by expectations of favorable economic policies following the election of President Trump.

-

Bank of International Settlements Warning: A report from the Bank for International Settlements has highlighted the excessive government debt as a major risk to global stability, emphasizing concerns in the market about the growing bond supply.

-

Political Shifts in South Korea: The Democratic Party of South Korea successfully pushed a budget bill through parliament, reinforcing their control amidst ongoing political tensions in the country.

-

Response to Israeli-Syrian Relations: Israeli Prime Minister Netanyahu declared that Israel would take vigorous action if the new Syrian regime permits Iran to regain its influence in the region.

-

Boeing Resumes Production: After the conclusion of a strike, Boeing has restarted its 737 production line, although the November delivery figures have plummeted to a four-year low.

-

French Political Landscape Under Scrutiny: French President Emmanuel Macron aims to prevent another parliamentary election before 2027, amidst concerns regarding his government's stability.

-

Former Defense Officials Arrested in South Korea: Several high-ranking officials, including former South Korean Defense Minister Kim Yong-hyun and top police leaders, have been taken into custody, as reported by Yonhap News Agency.

-

Emergency Response in Malibu: A rapidly spreading wildfire in Malibu, California, has forced tens of thousands of residents to evacuate as its size doubled within a short time.

-

Brazilian President's Health Update: Brazilian President Lula has successfully undergone brain surgery and will remain in intensive care for 48 hours, according to medical professionals.

-

Apple’s Ambitious Smartwatch Feature: Apple is reportedly planning to enhance its smartwatch with satellite communication capabilities, targeting outdoor enthusiasts.

-

Federal Labor Cost Adjustments: The U.S. Bureau of Labor Statistics revised down the increase in labor costs for the third quarter, reinforcing the notion that the job market is no longer driving inflationary pressures.

-

Cautious Economic Forecasts from JPMorgan and Citigroup: JPMorgan Chase has raised its forecast for net interest income for next year, while Citigroup's CFO remains optimistic about the company's revenue performance for the current year.

-

Distant Prospects for Russia-Ukraine Peace Talks: Polish Prime Minister Tusk indicated that discussions regarding peace between Russia and Ukraine could potentially commence this winter.

-

Mixed Reactions to Trump’s Tariff Strategy: Prominent fund managers, including those from Guggenheim, have suggested that Trump's tariff strategy might serve more as a negotiation tactic than a substantial economic measure.

-

U.S. Fast-Track Investment Offer: President-elect Trump announced that any individual or corporation that invests $1 billion or more into the U.S. would benefit from a fast-tracking process to facilitate the investment.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.