Slowing Services in China, Mitsubishi Fraud, and Intel’s CEO Hunt Drive Market Sentiment

Today’s key updates: South Korea lifts martial law, U.S. job openings rise, and the Fed signals rate cuts. Macron faces political unrest, OPEC+ delays output hikes, and Intel searches for a new CEO. Let's dive in.

Hello, it's Ryosuke. Today’s key updates: South Korea lifts martial law after 45 years, the U.S. sees rising job openings, and the Fed signals ongoing policy adjustments. Meanwhile, Macron faces political challenges in France, and OPEC+ seeks to delay production hikes. In the corporate world, Intel searches for a new CEO, while Seven & i plans a major buyout. Let's dive into the details.

Mitsubishi Corp Faces $90 Million Loss Amid Copper Fraud Scandal

Photo by Jezael Melgoza / Unsplash

Copper Fraud Discovery: Mitsubishi Corp. has reported a loss exceeding $90 million due to suspected fraudulent activities by a Shanghai-based copper trader, Gong Huayong. The trader, who worked at Mitsubishi’s China unit, was dismissed after making unauthorized transactions with local companies, some of which were allegedly linked to him personally.

Impact on Mitsubishi’s Share Price: The news sent Mitsubishi’s shares down by over 2% initially, though the stock later recovered slightly, trading down 0.7% by afternoon. The company confirmed the loss in its quarterly report, attributing it to Gong's actions.

Previous Commodity Trading Scandals: Mitsubishi’s loss follows a similar case involving Trafigura Group, which reported a $1.1 billion loss due to employee misconduct in Mongolia. While Mitsubishi’s financial hit is smaller, the incident underscores the risks posed by individual traders handling large sums of commodities.

Broader Implications for Mitsubishi: This scandal is not the first for Mitsubishi, which has faced trading-related losses before, including a 2019 incident involving a rogue trader at its oil unit. The company’s cautious approach may now intensify, especially among its Chinese employees, as it faces both reputational damage and potential legal action.

Intel Searches for New CEO Amid Leadership Shake-Up

Photo by Slejven Djurakovic / Unsplash

Leadership Void: Following the sudden ouster of CEO Pat Gelsinger, Intel Corp. is on the hunt for a new leader, focusing on external candidates like Marvell Technology’s Matt Murphy and former Cadence Design Systems CEO Lip-Bu Tan. The company has enlisted Spencer Stuart to assist in the search, marking a departure from Intel’s tradition of promoting from within.

Challenges in Finding a Replacement: Intel’s search for a new CEO comes at a time of internal instability, with many senior executives having left over recent years. The company’s dwindling bench strength and deteriorating market position complicate the process. Analysts caution that finding a suitable candidate with the right experience to navigate Intel’s challenges is no easy feat.

Potential Candidates and Market Response: Marvell’s Murphy and Tan, who recently served on Intel’s board, are under consideration, though Murphy has stated he is fully committed to Marvell. Shares of Marvell and Intel fell following the news, signaling investor uncertainty. Intel’s focus on outsiders underscores the company’s need for fresh leadership to revive its fortunes.

Broader Industry Implications: Intel remains a dominant player in the chip industry, but its recent struggles highlight the growing competition from firms like AMD and TSMC. Analysts suggest that Intel’s next CEO will need to not only steer the company through innovation but also address significant market share losses to rivals. Given the complexity of Intel’s operations, a successful turnaround will require a leader with deep technical expertise and strategic acumen.

Macron Urges Lawmakers to Reject No-Confidence Motion Amid Political Crisis

Photo by Pourya Gohari / Unsplash

Political Tensions Escalate: President Emmanuel Macron has called on French lawmakers to reject the upcoming no-confidence motion that could topple Prime Minister Michel Barnier's government. The motion, backed by the far-right National Rally and a left-wing coalition, threatens to plunge the country into further political chaos. Macron urged politicians to prioritize the national interest over personal ambitions.

Le Pen’s Power Play: Marine Le Pen’s National Rally party, now the largest in the lower house of parliament, has vowed to support the motion. This marks another escalation in Le Pen’s growing influence, which was solidified after Macron's snap elections in June. Despite Macron's calls for unity, Le Pen and her party remain steadfast in their position.

Implications for Government Stability: If the no-confidence motion succeeds, it would result in the shortest tenure for a French premier since the Fifth Republic's founding in 1958. The political turmoil has already caused investors to push up borrowing costs for France, raising concerns over the stability of the nation’s finances.

Potential Outcomes: Should the government collapse, Barnier would tender his resignation, with the cabinet remaining in place under caretaker powers. Macron, however, would hold sole responsibility for appointing a new prime minister, a process that could take months, given the fragmented parliament. In the interim, emergency legislation may be enacted to manage taxes and essential spending, but the economic and financial fallout remains uncertain.

China’s Services Growth Slows Despite Stimulus Efforts

Photo by Shoaib Asif / Unsplash

Slower Expansion in Services: China’s services sector showed signs of cooling in November, with the Caixin services PMI falling to 51.5 from 52.0 in October, missing economists’ expectations. While any reading above 50 signals expansion, the decline highlights ongoing sluggish consumer demand despite recent stimulus measures.

Impact of Policy Support: Despite the slowdown, some service providers remain optimistic about future market improvements, citing continued policy support. However, concerns over the future trade environment, particularly amidst global tensions, are causing some uncertainty.

Market Reaction: China’s CSI 300 Index dropped 0.4%, breaking a three-day winning streak. Meanwhile, the yuan showed slight gains, trading at 7.2789 against the US dollar, after a dip to its lowest level in a year.

Government Stimulus and Economic Outlook: Since late September, the Chinese government has rolled out several stimulus measures, including rate cuts and a $1.4 trillion support program for local governments. With expectations high for the upcoming Central Economic Work Conference, there are signs that policymakers will aim to meet the 2025 growth target while preparing for potential economic challenges, including trade tensions and a projected increase in borrowing.

Seven & i Plans $60 Billion Management Buyout with U.S. IPO

Photo by Md Samir Sayek / Unsplash

Buyout Proposal Details: Seven & i Holdings is preparing a ¥9 trillion ($60 billion) management buyout, which will include an IPO of its North American convenience stores and gasoline stations to alleviate financing concerns. The Ito family is racing to finalize their offer, which counters a rival bid by Alimentation Couche-Tard, a Canadian company.

IPO to Raise Funds: The proposed IPO would raise more than ¥1 trillion, helping to pay down part of the ¥6 trillion in loans from Japan’s top banks, including Sumitomo Mitsui and Mizuho Financial Group. This move is expected to provide reassurance to lenders involved in the buyout.

Split into Three Entities: As part of the buyout, Seven & i will be effectively split into three entities: one for its domestic supermarkets and retail business, another for Japan’s 7-Eleven stores, and a third for the North American 7-Eleven operations, including Speedway and Sunoco gasoline stations.

Strategic Goals and Future Plans: The Ito family, with support from Itochu Corp., aims to retain a stake in the North American business after its listing. The company is also considering bringing in strategic partners and potentially listing the domestic retail business. Despite a higher offer from Couche-Tard, Seven & i remains committed to exploring its own path to maximize value for its shareholders.

BOK’s Rhee Dismisses Rate Cut Amid Political Uncertainty

Photo by Sava Bobov / Unsplash

Rate Cut Unlikely: Bank of Korea Governor Rhee Chang-yong downplayed the possibility of further interest rate cuts, emphasizing that the recent political turmoil sparked by President Yoon Suk Yeol's brief martial law decree will not alter the central bank's economic outlook. Rhee stressed that the economy's underlying strengths and weaknesses, not political events, should guide policy decisions.

Political Chaos Contained: The brief martial law declaration, which was swiftly overturned by parliament, led to a drop in the South Korean won against the dollar. However, Rhee assured that the political crisis would not fundamentally disrupt the economy, citing the country’s strong market fundamentals and robust governance.

Geopolitical and Economic Risks: Rhee acknowledged the broader risks facing South Korea, including geopolitical tensions and global trade uncertainties, especially with the looming return of Donald Trump to the White House and potential tariffs. While the political turmoil adds to the challenges, he emphasized that the authorities are well-equipped to manage the situation.

Currency and Liquidity Management: In response to market volatility, Rhee reaffirmed that the Bank of Korea is not targeting a specific exchange rate for the won but will provide unlimited liquidity if needed. Despite the brief turbulence, the won has only weakened slightly, and the central bank has managed the situation effectively so far.

Latest On Global Markets

US Futures: Futures are both up, with Dow Jones futures rising 0.42% and S&P 500 futures increasing 0.21%.

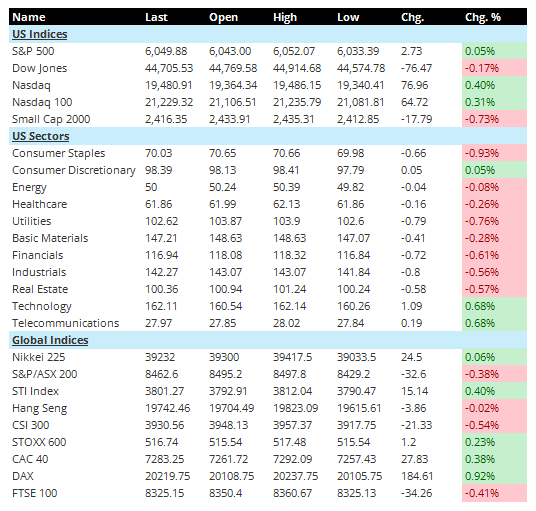

US Indices (Previous): The Nasdaq gained 0.40%, followed by the Nasdaq 100 with a 0.31% increase. The S&P 500 rose 0.05%, while the Dow Jones slipped 0.17%. The Small Cap 2000 posted the steepest loss, down 0.73%.

US Sectors (Previous): Technology led the gains, up 0.68%, followed by Telecommunications with a 0.68% increase. Consumer Discretionary edged up 0.05%. Utilities posted the steepest loss, down 0.76%, with Consumer Staples and Financials declining 0.93% and 0.61%, respectively.

Global Indices: The DAX gained 0.92%, and the CAC 40 rose 0.38%. The STOXX 600 increased 0.23%, while the Nikkei 225 climbed 0.06%. The FTSE 100 dropped 0.41%, and the S&P/ASX 200 declined 0.38%. The Hang Seng and CSI 300 slipped by 0.02% and 0.54%, respectively.

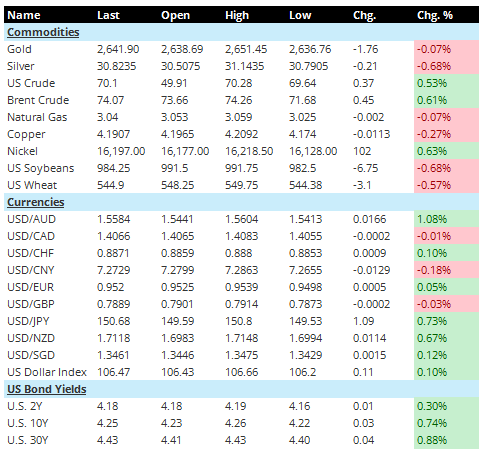

Commodities: Gold edged down 0.07%, while Silver declined 0.68%. US Crude rose 0.53%, and Brent Crude climbed 0.61%. Copper saw a slight decrease of 0.27%, and Nickel advanced 0.63%. Natural Gas declined 0.07%.

Currencies: The USD strengthened 1.08% against the AUD and 0.10% against the CHF. However, it weakened 0.18% against the CNY, 0.03% against the GBP, and 0.01% against the CAD. The USD/JPY rose 0.73%, while the US Dollar Index increased 0.10%.

US Bond Yields: The 2-year yield rose 0.30 basis points to 4.18%. The 10-year yield increased 0.74 basis points to 4.25%, and the 30-year yield climbed 0.88 basis points to 4.43%.

Economic Data Calendar and Central Bank Developments (ET)

- 04:00 AM: Eurozone November Services PMI (final) (est.: 49.2, initial: 49.2)

- 04:00 AM: ECB Executive Board Member Cipollone speaks

- 04:00 AM: Bank of England Governor Bailey speaks

- 04:30 AM: UK November Services PMI (final) (est.: 50, initial: 50)

- 08:15 AM: U.S. ADP Employment Change for November (est.: +150K, previous: +233K)

- 03:30 PM: ECB President Lagarde speaks

- 03:45 PM: St. Louis Fed President Bullard speaks

- 04:00 PM: Richmond Fed President Barkin speaks

- 05:45 PM: U.S. Services PMI (final) for November (est.: 57, initial: 57)

- 06:00 PM: U.S. ISM Non-Manufacturing Index for November (est.: 55.7, previous: 56)

- 06:00 PM: U.S. Factory Orders for October (est.: 0.2%, previous: -0.5%)

- 06:00 PM: U.S. Durable Goods Orders (final) for October (est.: 0.2%, initial: 0.2%)

- 07:10 PM: ECB Governing Council Member and German Central Bank President Nagel speaks

- 08:40 PM: Fed Chair Powell speaks

- 09:00 PM: Federal Reserve releases the Beige Book report

Other Notable News

-

In the U.S., job openings surged to over 7.7 million in October, signaling a stabilization of labor demand after a sharp decline in previous months.

-

The President of the San Francisco Federal Reserve expressed that interest rates should be lowered to maintain economic stability, regardless of any rate cuts in December.

-

Fed Governor Kugler remains confident that inflation is on a sustainable path toward the 2% target.

-

In the wake of Trump’s victory, Federal Reserve Bank surveys indicate that business confidence soared to a multi-year high, fueled by expectations of more pro-business policies and reduced regulatory burdens.

-

In the U.S., while Thanksgiving weekend shopper turnout decreased year-on-year, Adobe data revealed a 7.3% increase in online spending on Cyber Monday.

-

In France, lawmakers are preparing for a no-confidence vote on Wednesday, with far-right leader Marine Le Pen aligning with the left-wing coalition to challenge the government. President Emmanuel Macron, however, remains optimistic about the government's survival.

-

OPEC+ is working to finalize an agreement to delay an increase in oil production for an additional three months.

-

European Central Bank board member Holzmann remarked that any potential rate cut next week would be "mild."

-

Intel is reportedly considering external candidates for the CEO role, with Marvell Technology's Matt Murphy among those under consideration.

-

Indonesia has announced that Apple is raising its investment pledge to $1 billion in an effort to lift the iPhone ban.

-

Tesla’s major individual shareholder, Leo KoGuan, disclosed that he is reducing his holdings and redirecting some of the proceeds into three-month U.S. Treasury bills, citing concerns over a potential future sell-off.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.