Security Concerns Post-New Year’s Tragedy, Wall Street's Optimism Amid Trump’s Economic Influence, and Singapore's Housing Price Surge

A tragic New Year’s attack in New Orleans raises urgent security alarms as the FBI connects it to a Tesla explosion linked to ISIS, while Wall Street predicts a mixed 2025 under Trump's influence and Singapore's housing market surges, hinting at potential intervention.

Hello, it’s Ryosuke! Today’s report covers some significant developments that highlight pressing issues and evolving economic landscapes. Here’s a snapshot of what’s in store:

- New Year’s Tragedies: A devastating attack in New Orleans during New Year’s celebrations resulted in multiple fatalities and injuries, prompting heightened security concerns as investigations unfold, including connections to ISIS.

- Wall Street’s 2025 Outlook: Analyst forecasts indicate optimism surrounding Donald Trump's policies returning to prominence, though inflationary pressures and global trade uncertainties create a cautious approach for investors.

- Singapore’s Housing Market Surge: Private home prices in Singapore have surged by 2.3% in Q4 2024, suggesting strong buyer demand and raising speculation about potential government cooling measures.

- PBOC's Strategic Moves: The People's Bank of China recently injected significant liquidity to support its banking system, delaying a reserve ratio cut to better assess incoming external economic pressures.

Details and broader implications are covered below—let’s dive in!

New Year's Tragedies Heighten Security Concerns in the U.S.

Gruesome Events Unfold: A horrific attack during New Year’s celebrations in New Orleans claimed the lives of at least 15 people and injured many others, creating chaos in the historic French Quarter. This grim incident not only prompted the postponement of major events, including a college football game, but also raised urgent security concerns just weeks before Donald Trump's inauguration.

FBI Investigation Intensifies: The FBI is investigating both the New Orleans attack and a subsequent explosion of a Tesla Cybertruck outside Trump’s Las Vegas hotel. As disturbing links between them emerge, authorities are examining the background of the suspect, 42-year-old Shamsud-Din Jabbar, an Army veteran, who reportedly drew inspiration from ISIS.

Emerging Threats: In the aftermath, law enforcement discovered an ISIS flag and improvised explosive devices in Jabbar's vehicle, suggesting a broader plot. The FBI has indicated that Jabbar may not have acted alone, as investigators expand their efforts to identify potential co-conspirators and seek public assistance in gathering information.

Responses from Leaders: Both President Biden and Trump expressed condolences to the families affected by these tragedies. Elon Musk remarked that the Cybertruck explosion, caused by explosives in the vehicle, could be tied to the New Orleans attack, spotlighting pressing issues of domestic security that the new administration will inherit.

Wall Street's 2025 Outlook: Trump, Inflation, and Asset Performance

Photo by Robert Bye / Unsplash

Dominance of Trump’s Policies: Wall Street’s forecast for 2025 is significantly shaped by Donald Trump's anticipated return to the White House, sparking optimism about pro-business policies that could energize the US economy. This optimism, however, is tempered by concerns over his unpredictable approach to global trade, which many financial experts believe may introduce volatility in international markets.

Economic Growth and Inflation Stability: The consensus among analysts suggests that US economic growth will continue, driven by Trump's policies, even as inflation remains contained yet above target levels due to potential trade barriers. Most financial institutions expect the Fed to maintain a more cautious approach to interest rate cuts, reflecting a "gradual" easing cycle which they believe will last longer than previously anticipated.

Cautious Optimism for Equity Markets: While steep gains in stock markets may not repeat, the influence of artificial intelligence is expected to broaden investment opportunities. Firms like BNY Mellon highlight that AI could surpass previous technological trends, though analysts recommend diversified portfolios that include alternatives like hedge funds and private equity to navigate a more complex economic landscape.

Global Growth Disparities: The US is predicted to outpace other major economies, including Europe and China, which face significant challenges. With Wall Street focusing on the likely impacts of Trump's renewed policies, many institutions believe that American markets will outperform, while uncertainties related to global tariffs and economic recoveries in regions like Europe and Asia contribute to a mixed outlook abroad.

Singapore's Private Home Prices Surge Amid Year-End Sales

Photo by Mike Enerio / Unsplash

Significant Price Increase: In a remarkable turnaround, private residential prices in Singapore rose by 2.3% in the fourth quarter of 2024, reversing a previous 0.7% drop. This uptick marks the largest quarterly increase in a year, indicating a strong rebound in buyer activity that is particularly linked to a surge in new project sales.

Yearly Growth Trend: Over the entirety of 2024, private home prices grew by 3.9%, maintaining a continuous rise for eight consecutive years. The rebound was fueled by an end-of-year sales rush alongside more favorable borrowing costs, contrasting a period earlier in the year when developers were more hesitant to release new projects.

Potential Government Intervention: The unexpected sales momentum has led analysts from Barclays and Citigroup to predict that the government may implement more real estate cooling measures, especially as they prepare for upcoming elections where housing affordability is a key issue. Should the government act, potential restrictions could be introduced as soon as this week.

Public Housing Insights: Interestingly, the price index for second-hand public housing flats, where most Singaporeans reside, surged by 9.6% in 2024, up from 4.9% the previous year. Despite previous government efforts to curb overheating in this sector, analysts suggest these measures have had minimal impact, leaving the market on a trajectory that may prompt further government scrutiny in 2025.

PBOC Delays Reserve Ratio Cut After Major Cash Injection

Photo by Nuno Alberto / Unsplash

Massive Cash Injection: Last month, the People's Bank of China (PBOC) injected approximately $233 billion into the banking system through substantial liquidity operations. This move was designed to ensure financial stability without immediate adjustment to the reserve requirement ratio (RRR), as officials anticipate external economic pressures.

Strategic Delay on RRR Cut: While the PBOC had hinted at a potential RRR cut by the end of 2024, this has now shifted to early 2025. Analysts suggest that the central bank is prioritizing preparedness for any economic fallout from renewed U.S. tariffs, making a delay more prudent under the circumstances.

Economic Recovery Amid Challenges: China's economy is showing signs of improvement following a broad stimulus initiative. However, uncertainties including trade tensions with the U.S. continue to pressure growth, which reinforces the need for the PBOC to maintain flexible liquidity measures, particularly as it gears up for future market demands.

Broader Monetary Policy Shift: Looking ahead, central bank officials have signaled a shift towards a “moderately loose” monetary policy in 2025, moving away from a traditionally cautious approach. This suggests that more significant policy actions may be required to effectively stimulate demand amidst ongoing economic pressures, including the potential for expanded monetary tools and measures like equity purchases.

Latest On Global Markets

US Futures: Futures are showing a positive trend, with Nasdaq 100 futures up 0.83%, Dow Jones futures rising 0.43%, and S&P 500 futures increasing 0.61%.

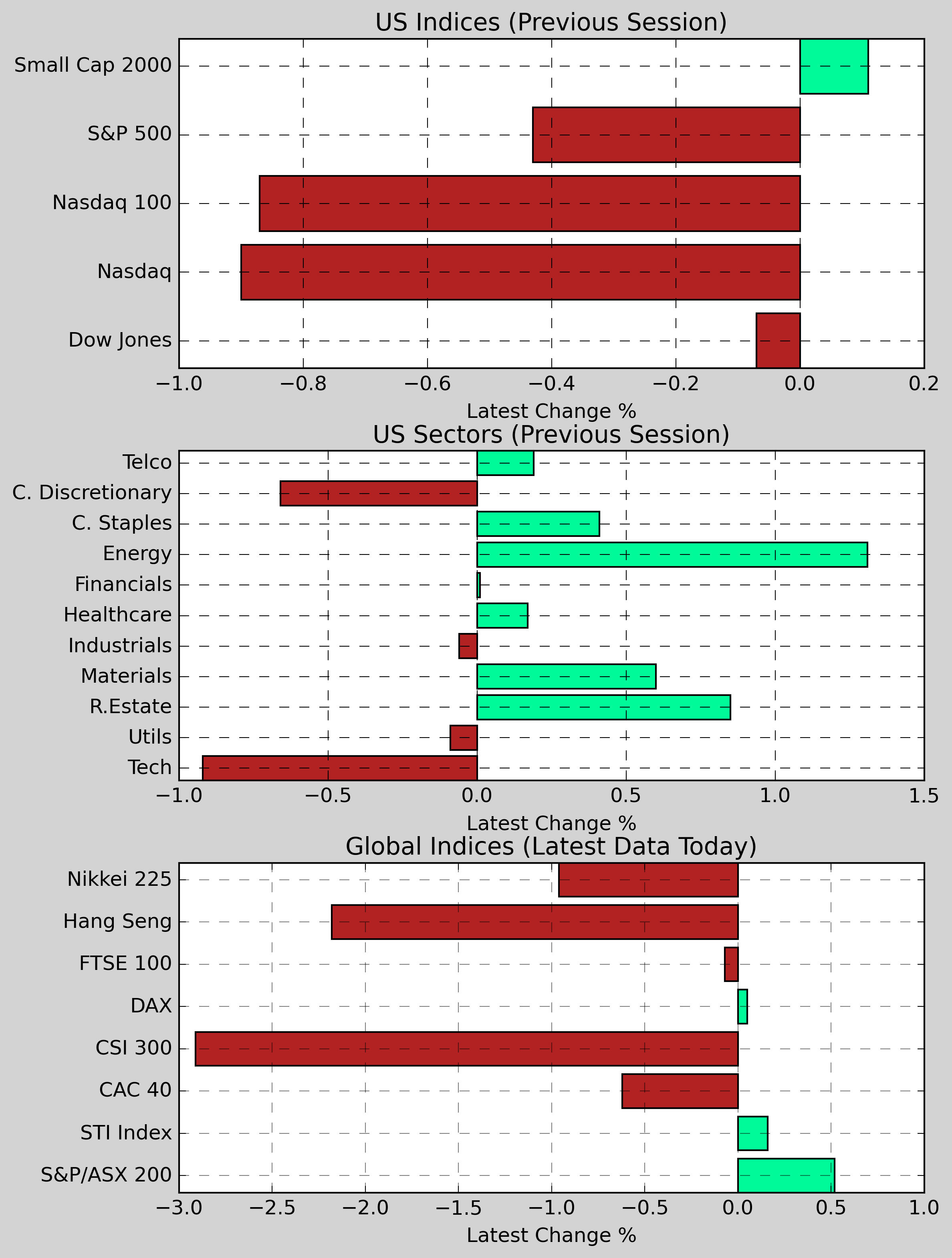

US Indices (Previous Session): The S&P 500 decreased 0.43% to 5,881.60, while the Dow Jones fell 0.07% to 42,544.22. The Nasdaq declined 0.90%, closing at 19,310.79, and the Nasdaq 100 decreased 0.87%. The Small Cap 2000 managed to achieve a slight gain, up 0.11%.

US Sectors (Previous Session): Energy showed resilience, with gains of 1.31%, and Utilities rose 0.09%. However, Consumer Services struggled, dropping 0.66%, and Technology fell 0.92%.

Global Indices: The S&P/ASX 200 advanced 0.52%, while the DAX edged up 0.05%. In contrast, the CAC 40 fell 0.62%, the CSI 300 declined 2.91%, and the Hang Seng experienced a significant drop of 2.18%.

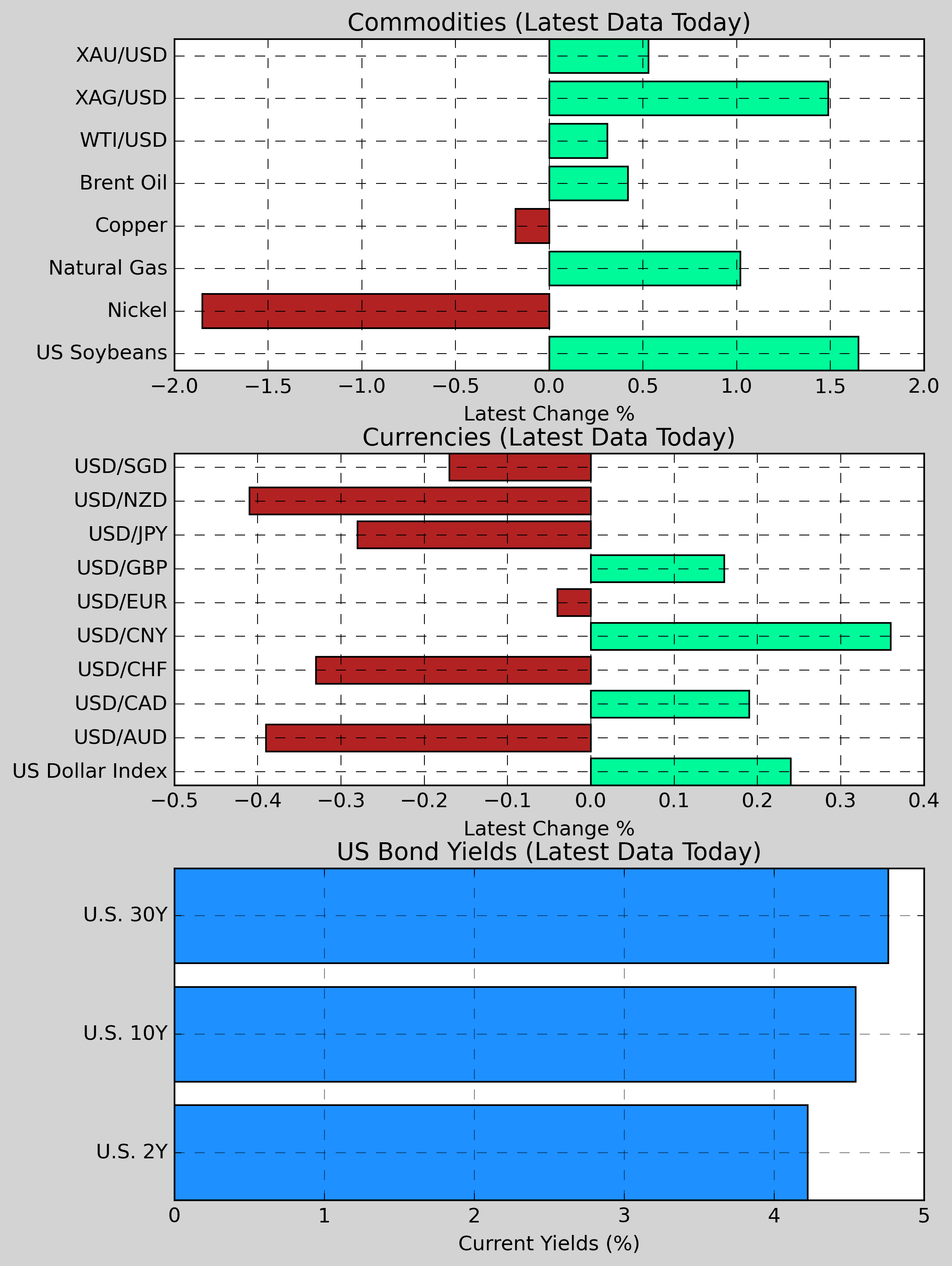

Commodities: Gold increased 0.53% to $2,638.44, while Copper decreased 0.18% to $4.0192. Nickel fell 1.85% to $15,876.00. US Wheat gained 0.36% to $551.00, and Natural Gas edged up 1.02% to $3.670. On the other hand, US Soybeans advanced 1.65% to $998.25. Brent Crude gained 0.42%, now priced at $74.95.

Currencies: The US Dollar showed mixed results against other currencies. USD/CAD rose 0.19% to 1.4413, while USD/CNY gained 0.36% to 7.3261. Conversely, USD/AUD slipped 0.39% to 1.6088, and USD/NZD fell 0.41% to 1.7790. The US Dollar Index improved slightly by 0.24% to 108.39.

US Bond Yields: The U.S. 2-Year Treasury yield rose slightly, up 2.70bps to 4.225%, while the U.S. 10-Year Treasury yield dropped 0.34bps to 4.543%. The U.S. 30-Year Treasury yield declined 2.10bps to 4.762%.

Economic Data & Central Bank Developments (Eastern Time)

- 08:30 AM ET: Number of first-time unemployment claims in the United States last week (estimated at 221,000, previous value at 219,000)

- 09:30 AM ET: Canada's December manufacturing PMI (previous value: 52)

- 09:45 AM ET: Final value of US manufacturing PMI in December (estimated to be 48.3, initial value to be 48.3)

- 10:00 AM ET: U.S. construction spending in November seasonally adjusted month-on-month annualized rate (estimated to be 0.3%, previous value is 0.4%)

Other Notable News

-

New Orleans Terror Attack on New Year’s Eve: A devastating incident unfolded in New Orleans during the New Year’s celebrations, where a pickup truck crashed into the French Quarter, claiming the lives of at least 10 individuals and injuring over 30 others. Authorities discovered an improvised explosive device and an ISIS flag in the vehicle belonging to the suspect.

-

ECB Sets Inflation Target: Christine Lagarde, the President of the European Central Bank, expressed her ambitions to reach a 2% inflation rate by the year 2025, signaling the central bank's ongoing commitment to navigating economic challenges.

-

Explosion Outside Trump Hotel: A Tesla Cybertruck caught fire outside the Trump Hotel in Las Vegas on Wednesday, leading to the driver’s death. Law enforcement is considering the incident as a potential terrorist act, although Elon Musk has stated that the explosion was not linked to the vehicle's integrity.

-

Ukraine Gas Supply Cut Off: Russia has ceased supplying natural gas to Europe through Ukraine following the latter's decision not to extend the transit agreement. This development compels Central European nations to purchase gas at higher prices from alternative sources.

-

Impeachment Warrant for South Korean President: In a surprising turn of events, a South Korean court issued an arrest warrant for President Yoon Seok-yeol due to controversies surrounding martial law. Yoon's representative denounced the warrant as "illegal and invalid" and plans to seek an injunction from the Constitutional Court.

-

Nippon Steel’s Acquisition Bid: Nippon Steel is making a final push to obtain U.S. approval for its acquisition of U.S. Steel. The company insists that if the deal is sanctioned, the U.S. government will have the authority to block any plans involving cuts to domestic steel production.

-

Home Prices in the U.S. Stabilizing: In October, the growth of home prices across the United States slowed in comparison to September, giving buyers more leverage in negotiations within the housing market.

-

Israeli Defense Minister Issues Warning to Hamas: Israel’s Defense Minister has declared that Hamas will face severe repercussions if hostages are not released in the near future.

-

Singapore’s Economic Performance Exceeds Expectations: Singapore’s GDP expanded by 4% last year, surpassing preliminary forecasts. The Prime Minister noted that this robust economic performance will facilitate growth in real incomes, allowing them to keep pace with inflation.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.