Sea of Red Plagued Markets As Big Tech Earnings Disappoints

Markets experience a slight sell off in the Asian and European session as yesterday's earnings from big tech disappoints. In the FX market, we saw a technical rebound after the GBP surged yesterday due to Reeves's tax rises.

Global Financial Markets

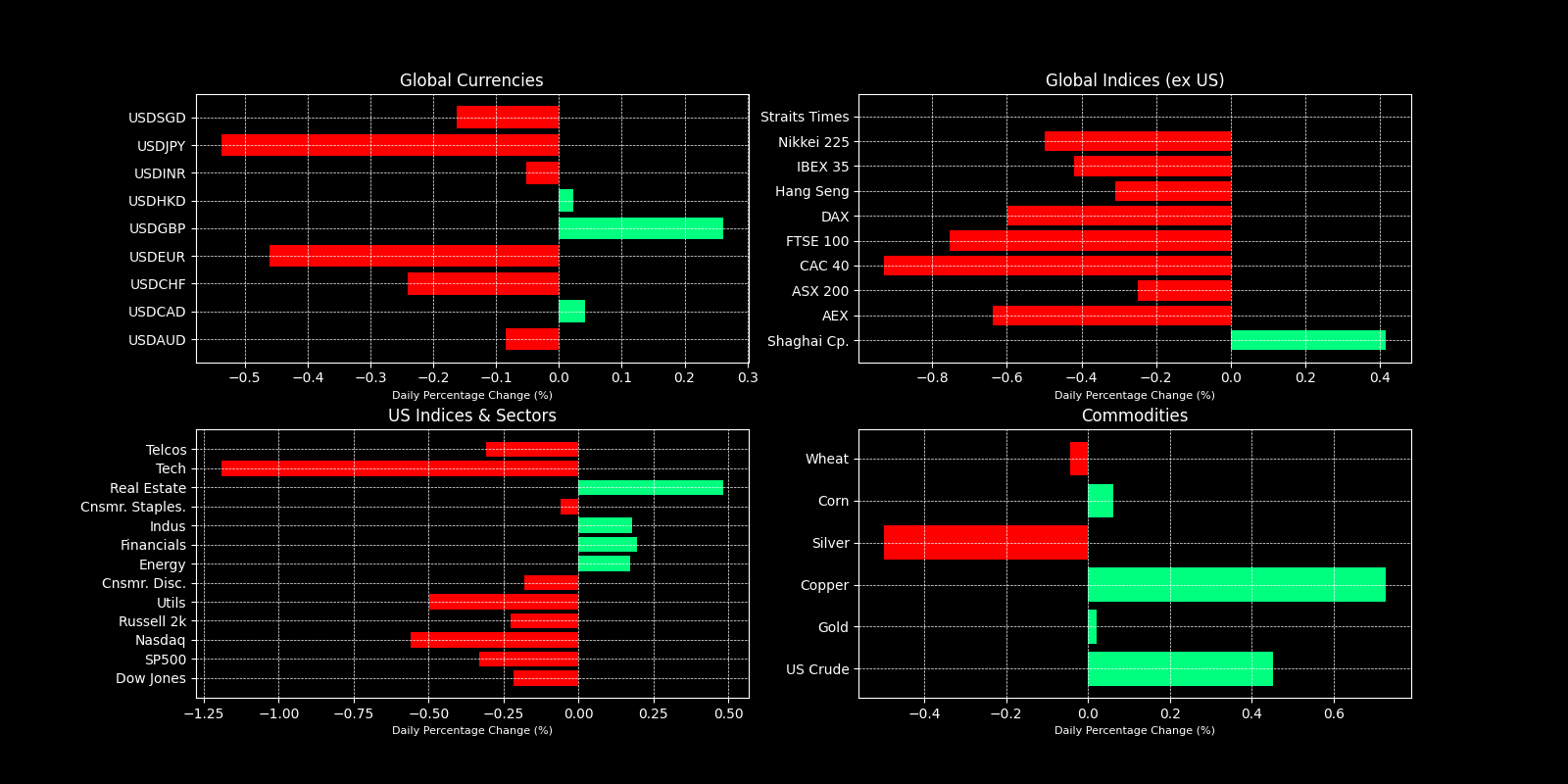

A sea of red plagued the global markets today as the Asian session digested yesterday's disappointing earnings from Big Tech companies. With the exception of Shanghai Composite, all other markets have plunged. Shanghai Composite surged by 0.40% whereas Hang Seng and Nikkei close towards the downside by 0.31% and 0.49% respectively.

In Europe, the CAC 40 underperformed all other indices declining by close to 1%. The FTSE and DAX fell by 0.74% and 0.60% respectively. Separately, we saw UK's GBP plunged although the USD weakened across all currencies. The GBP plunge can be attributable to a technical rebound as the GBP strengthened tremendously yesterday due to UK's Chancellor Reeves unveiling of the GBP 40 billion worth of tax rises and ramped up borrowing to "rebuild" UK.

In the FX market, the USD deteriorated against all other currencies as traders await PCE and job related data. On a separate note, Canada is scheduled to release its GDP data today as well. Finally, in the commodities market, there were no significant catalysts that moved the markets. Copper and crude outperformed, climbing by 0.75% and 0.45% respectively. However, prices of silver and wheat plunged.

Eurozone Inflation Surged Higher Than Expected

The likelihood of a significant rate cut in the EU appears to have diminished. Inflation in the Eurozone rose from 1.7% to 2.0%, exceeding market expectations of 1.9%. The primary contributors to this inflation increase were food, alcohol, and tobacco, with prices climbing by 2.9%. So far this year, the European Central Bank (ECB) has cut rates three times, bringing them down from 4% to 3.25%. Markets are now anticipating an additional 25 basis point reduction by the ECB in December.

China's Economy Pull Ahead on Stimulus Support

China's economy is showing signs of stabilization following efforts to bolster growth through various stimulus measures. The Purchasing Managers' Index (PMI) increased to 50.1, surpassing the market's expectation of 49.9. Additionally, the CSI 300 index rose by 0.90%, and the Shanghai Composite increased by 0.40%. According to a recent Bloomberg survey, economists now expect China to meet its official growth target of 5% this year.

China Pressures Pulau to Ditch Taiwan

The leader of Pulau expressed that his country is facing pressure from China to withdraw its support for Taipei. At present, Pulau is among the few nations still allied with Taiwan, being one of only 12 countries worldwide that maintain diplomatic relations with it.

Analysts are paying close attention to developments in island nations like Pulau, as these countries are strategically positioned between the United States and the Philippines. Should these nations align with China and distance themselves from the United States, it could create a significant "blockage" between the U.S. and the Asia Pacific region.

Microsoft Unveils Soft Guidance, Meta Disappoints, and Samsung Electronics Misses Estimates

Major tech companies focused on artificial intelligence disappointed investors yesterday. Microsoft reported revenues and net income that surpassed expectations; however, the CFO indicated that Azure's growth is expected to slow. The company will also continue to increase capital expenditures to enhance its AI capabilities.

Meta Platforms also mentioned rising capital expenditures. Mark Zuckerberg highlighted a significant boost in investments due to the funding needed for the company’s AI infrastructure. So far, Meta has not outlined any strategies for monetizing its AI initiatives.

Samsung Electronics, a leading chipmaker, experienced a 40% drop in revenues for its semiconductor division, significantly missing estimates. Nonetheless, Samsung's share price ended the day in positive territory.

Other Notable News

- The Bank of Japan maintained its interest rate at 0.25%.

- Shell reported a slight decline in third-quarter profits, totaling $6 billion.

- BYD’s quarterly sales in China surpassed those of Tesla for the first time.

- In response to a worsening demographic crisis, China is converting kindergartens into senior care facilities.

- Uber provided cautious projections for the fourth quarter of 2024, even after achieving record profits.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.