Rocket Man Strikes Again While Markets Await Non Farm Payrolls

Markets are awaiting for the release of key employment data today. US futures point to a slight rebound after a huge sell off yesterday. US dollar strengthen as traders position themselves for a potential strong economic data. North Korea strikes again with an Intercontinental Ballistic Missile.

Global Markets

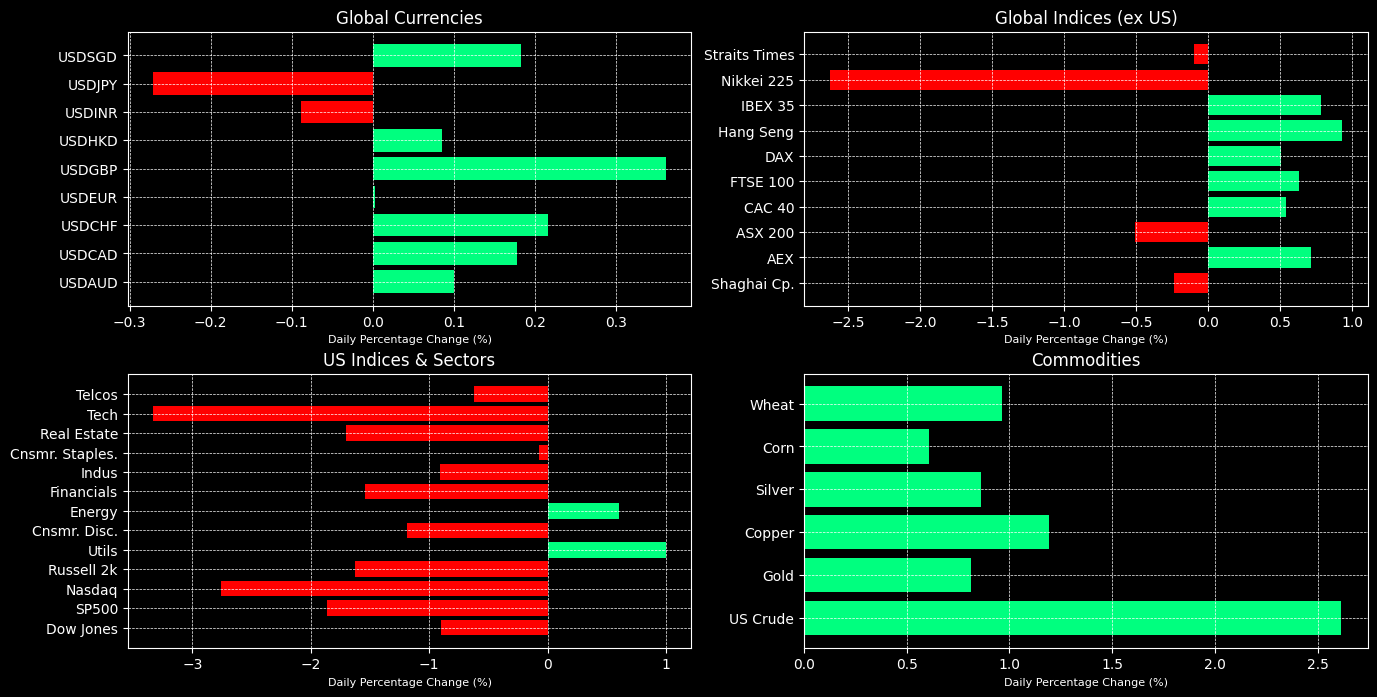

- Yesterday, we saw the major US indices plunged as earnings continue to disappoint. With the exception of energy and utilities, all US sectors have posted negative gains yesterday. US tech underperformed, plunging by more than 3% as earnings disappoint severely.

- In the Asian market, the Hang Seng surged by 0.5%, outperforming Japan's Nikkei. Nikkei plunged more than 2.5% as losses in Pharmaceutical and Rubber industry led shares lower. Falling stocks outnumbered advancing stocks.

- Currently, the US futures point to slight rebound in sentiment. Futures of S&P 500 climbed by 0.39% whereas Nasdaq 100 rebounded by 0.51%. The Dow Jones has surged by 0.36%. Investors are urged to remain wary as key employment data from the United States such as nonfarm payrolls and unemployment rate are scheduled to release today.

- In the FX market, we saw the dollar strengthening against all major currencies excpet for the Japanese yen. Traders are likely positioning for a potential strong employment data that may pose as an obstacle towards Fed's plan to reduce interest rates. Given that EU inflation data had surprised towards the upside, there is a likelihood that US employment rate will come in stronger than expected as well.

- All major commodities posted strong gains with crude oil outperforming. US Crude surged more than 2.5% as market participants brace for a potential attack from Iran.

Prepare for US Nonfarm Payrolls & Unemployment Rate

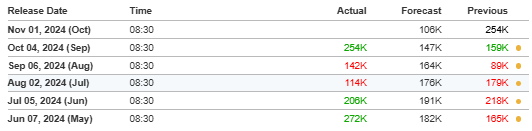

Today, key employmeny data from the United States is set to release at 8.30AM New York time. Recently we have seen multiple labor actions and weather events that may potentially affect these economic data towards the downside. However, it is important to note that previously nonfarm payrolls have exceeded estimates significantly.

For the month of September, market expected only 147k new jobs; however, data came in at 254k, exceeding by more than 70%. For the month of October, markets are expecting an addition of 106k jobs to be added to nonfarm payrolls. Unemployment rate also came in at 4.1% as compared to 4.2% previously. Given that the US economy has shown resilience, investors are urged to be cautious and prepare for any surprises towards the upside (especially if they are using instruments to bet on a reduction in interest rates such as shorting the dollar).

Rocket Man Strikes Again

North Korea launched an intercontinental ballistic missile (ICBM) eastward, marking its longest flight duration of 86 minutes before landing in waters off its coast. This launch followed accusations from South Korea and the United States that North Korea has deployed troops to support Russia in Ukraine, with the Pentagon estimating around 10,000 North Korean soldiers stationed in eastern Russia.

North Korean leader Kim Jong Un stated the launch demonstrates the country's resolve to confront its adversaries, calling it a justified military action. Meanwhile, the U.S. condemned the missile launch as a blatant violation of U.N. security resolutions, prompting South Korea to announce forthcoming sanctions against North Korea.

The country continues to advance its missile technology, aiming to develop missiles capable of reaching the U.S., even when equipped with larger, heavier warheads.

Interesting Developments in Nomura

Nomura Holdings, Japan's leading brokerage and investment bank, is currently navigating a series of challenges. Chief Executive Officer Kentaro Okuda and other top executives have voluntarily accepted a 20% pay reduction for two months following the firm's admission that an employee manipulated the bond market, resulting in a profit of approximately ¥1.48 million ($10,259). Shortly thereafter, reports emerged of a former Nomura employee's arrest on charges of robbery and attempted murder involving elderly clients.

Despite these setbacks, Nomura reported robust financial performance, with net profit more than doubling from the previous year to ¥98.4 billion ($645 million) in the July-September quarter. This growth was driven by strong results across its wealth management, trading, and investment banking divisions. However, the company's stock experienced a decline of up to 2.7% following these announcements.

In response to the bond market manipulation incident, at least ten institutional investors have suspended business activities with Nomura, and several clients have removed the firm from underwriting debt deals. Additionally, Japan's Ministry of Finance has temporarily suspended Nomura's primary dealer status for government bonds for a month, effective October 15, 2024.

Other Notable News

- Conflict in the Middle East escalates as rocket attacks from Lebanon lead to casualties in Israel.

- Mass shootings continue to impact public areas across the United States, with multiple casualties reported at locations like Vancouver Mall and downtown Orlando.

- Donald Trump and Kamala Harris exchanged heated remarks over gender-related issues in recent debates.

- Exxon exceeded earnings expectations and increased its fourth-quarter dividend, while Chevron plans to return over $7 billion to its shareholders.

- Boeing has presented an improved contract proposal in efforts to conclude an ongoing strike.

- Amazon's stock surged by 6% in pre-market trading following a strong earnings report, highlighting 19% growth in its cloud sector.

- Apple reported a 6% rise in sales, though weakening demand from China led to a 1.51% drop in its pre-market shares.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.