US Fed Chair Implies Rates Will Be Higher For A Little Longer

Global markets see mixed trends: Powell hints at steady US rates, boosting the dollar; Japan’s GDP rebounds, eyeing BOJ hikes; China’s retail growth beats forecasts despite industrial lag; India battles food inflation and weak demand, curbing rate cut options.

Powell's Higher For A Little Longer

Photo by Frederick Warren / Unsplash

- Yesterday, US's Fed Chairman, Jerome Powell said that the US economy remains strong. Perhaps the most important statement is that the US economy "is not sending any signals that we need to be in a hurry to lower rates"

- Specifically, he has suggested that the labor market continues to hold up well. Although the unemployment rate has been rising, it has flattened out recently and remains historically low.

- On Inflation, Powell stated that inflation is on the right track, moving close to Fed's 2% goal but "it is not there yet".

- Powell's slightly cautious statements had sent the dollar rallying and bond yields surging; see the global markets section below on actual movements.

- For now, it will seem that the Fed will deaccelerate the pace of rate cuts.

- Perhaps, president-elect Trump may step in and put some pressure soon.

Japan's GDP Finally Turns Around

- In the land of the rising sun, 3Q24 GDP expanded by 0.3% year-on-year.

- Latest GDP reading marked a reversal from the previously 1.1% decline.

- Holders of yen should rejoice as the Bank of Japan had previously stated that they will continue to increase interest rates if economic activity continues to develop.

- If the economy continues to move towards BOJ's target, the central bank said that it might raise rates to 1% by 2H25.

- Unfortunately, for now, the JPY continues its descend against the dollar.

China's Retail Sales Came In Higher Than Expected

Photo by Christian Chen / Unsplash

- According to the National Bureau of Statistics, retail sales surged by 4.8% against market estimates of 3.8%. Meanwhile, industrial production disappoints, surging only by 5.3% as compared to market estimates of 5.4%.

- Fixed asset investment surged by 3.4% while urban jobless rate fell to 5% from 5.1%.

- Boosting consumption and unlocking household savings will continue to be China's priority given that president-elect Trump is likely to put a 60% tariff on Chinese impots. China must diversify its economy away from exports.

- The strength in recent data suggests that China's policies are working. However, it is likely that more policy support will be needed to continue the current momentum.

Seems Like India has a Tomato Problem

- Due to heavy rainfall, India is facing a food inflation crisis. Tomato prices have surged 161% year-on-year. Overall, the cost of a home cooked meal has reached its highest level in 14 months.

- Unfortunately, it is likely that inflation will persist; moreover, trump's tariffs may be potentially inflationary. This will mean that India's central bank cannot reduce rates to help the economy.

- Currently, weak consumer demand, deteriorating income growth, and capital outflows is affecting India's economy. India must resolves its domestic issues before it starts to consider how to protect its economy against trump's tariffs.

Latest Market Developments

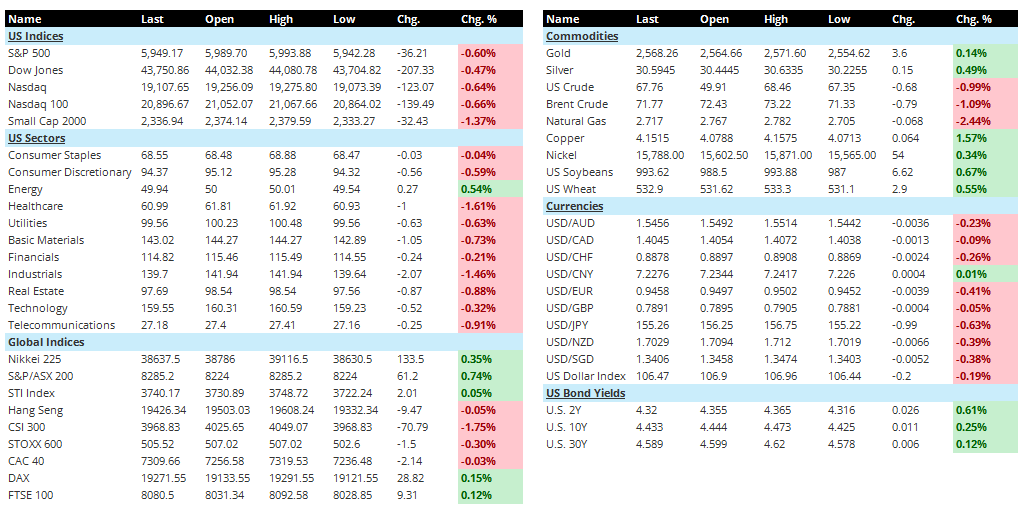

- We are seeing a sea of red again. Currently, US futures point towards the downside. The S&P 500 and Dow is declining by 0.38% and 0.51%. US dollar weakened against most major currencies but remains increasingly volatile. At one point, the dollar surged to 156.75 against the yen. Rates continue its trek upwards with the 2Y and 10Y standing at 4.32% and 4.43%.

- Previously in the US session, all major indices fell with the Small Caps underperforming. by the end of the day, S&P 500 fell by 0.60% whle Small Caps fell by 1.37%. All sectors ended in the negative territory except for Energy, surging by 0.54%.

- In Asia, the Hang Seng and CSI underperformed, falling by 0.05% and 1.75%. Japan's Nikkei, Australia's ASX and Singapore's STI outperformed.

- In the European session, we are seeing mixed performance. DAX together with the FTSE surged by 0.15% and 0.12% respectively. However, the CAC and broader EU stoxx 600 fell.

- Later tonight, US will release a slew of data. Expect to see retal sales, industrial production and manufacturing production data releasing between 8:30AM 9:15AM eastern time

Other Notable News

- Israel continue to push further into Lebanon, widening the geopolitical situation in Middle-East.

- UK economy surged by a mere 0.1% growth, falling short of estimates.

- Bill Ackman increases his stake and reiterates his conviction in Nike

- China home prices continue to fall but at a slower pace after China's stimulus

- Hong Kong expect growth to slow due to deteriorating demand

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.