President To Have Influence in Monetary Policy?

Morning Briefs

President To Have Influence in Monetary Policy?

Futures point towards the upside. Elon Musk’s call for presidential influence on the Fed raises concerns over political interference. TSMC stops AI chip shipments to China under U.S. orders. Bitcoin hits $81K amid Trump’s pro-crypto stance, while China’s economic growth disappoints.

On this page

Elon Musk Endorses President To Have Influence In Monetary Policy

Photo by History in HD / Unsplash

- Elon Musk had recently endorsed the idea of allowing presidents to intervene on the Federal Reserve policy. What a bad idea.

- Musk's endorsement came after the US Fed reduced interest rates by 25 bps and Fed Chairman Powell's statement emphasizing on the independence of the Federal Reserve.

- The US Fed was designed to be non-political, allowing the bank to independently control inflation and promote financial stability. A politically affiliate Fed will result in a more volatile environment as policy makers focuses on short-term political agenda such as unnecessary fiscal policies that may cause inflation.

- Although in the early stages, investors should closely monitor this development. Any inclination that the Fed loses its independent is likely to cause a huge panic in the financial markets.

TSMC To Stop Shipments to China For Chips Used in AI Applications

- It's all about the Semiconductor war again. US has recently implemented further trade restrictions in the semiconductor sector, instructing TSMC to halt shipments of advanced AI-capable chips to China.

- This order follows a recent disclosure by TSMC to the Commerce Department, reporting the presence of one of its chips in a Huawei AI processor.

- As per a Department of Commerce directive, TSMC will be required to stop exporting advanced chips to China (i.e., those under its 7nm process).

- Expect further policy tightening in exports as the United States attempt to maintain its technological lead in Artificial Intelligence. Fortunately, TSMC is Taiwanese based and is likely to continue supporting US's agenda despite these policies can affect its overall sales.

Bitcoin Is Back In Trend

- Price of the cryptocurrency surged to an all-time high of $81k. Prices of futures also soared, suggesting that market participants are betting that the rally will sustain.

- The recent momentum in Bitcoin can be attributable to Donald Trump's reelection as POTUS. During his campaign, Donald Trump had pledged to launch a national crypto reserve and reduce interest rates. In addition, the POTUS had previously pledged to fire SEC Chief Gary Gensler, easing regulations in the crypto industry.

- For now, as markets await the next big move from Trump, we should expect to see 'hodlers' trending again.

China Underwhelms Again

Photo by Igor Sporynin / Unsplash

- Market participants seem to have a love-hate relationship with China. A few weeks ago we saw a huge rally; now, investors are disappointed and underwhelmed again by China's latest stimulus and economic data.

- Last week, China announced a $1.4 trillion package to help resolve its local government debt problem.

- In addition, deflation persists in China, further weighing on investor's sentiment. Latest CPI data indicated that the economy surged only by 0.3% year-on-year, disappointing estimates of 0.42%.

- In addition, producer price index fell by 2.9% in October, disappointing estimates of 2.5% decline; this is the 25th consecutive time that PPI has fell.

Other Notable News

- Singapore Airlines shares dropped by 6% following a nearly 50% decline in profits amid stronger competition. Source.

- India is promoting transactions in its local currency due to a fivefold increase in trade with Russia.

- FTX filed a lawsuit against Binance, aiming to recover $1.8 billion.

- U.S. Federal Reserve's Neel Kashkari warned that Trump-era tariffs could spur inflation if trade retaliation continues.

- Germany’s Continental saw shares rise by over 7% after exceeding profit expectations in Q3, contrasting with profit challenges faced by Japanese automakers like Nissan and Toyota.

Latest On Global Markets

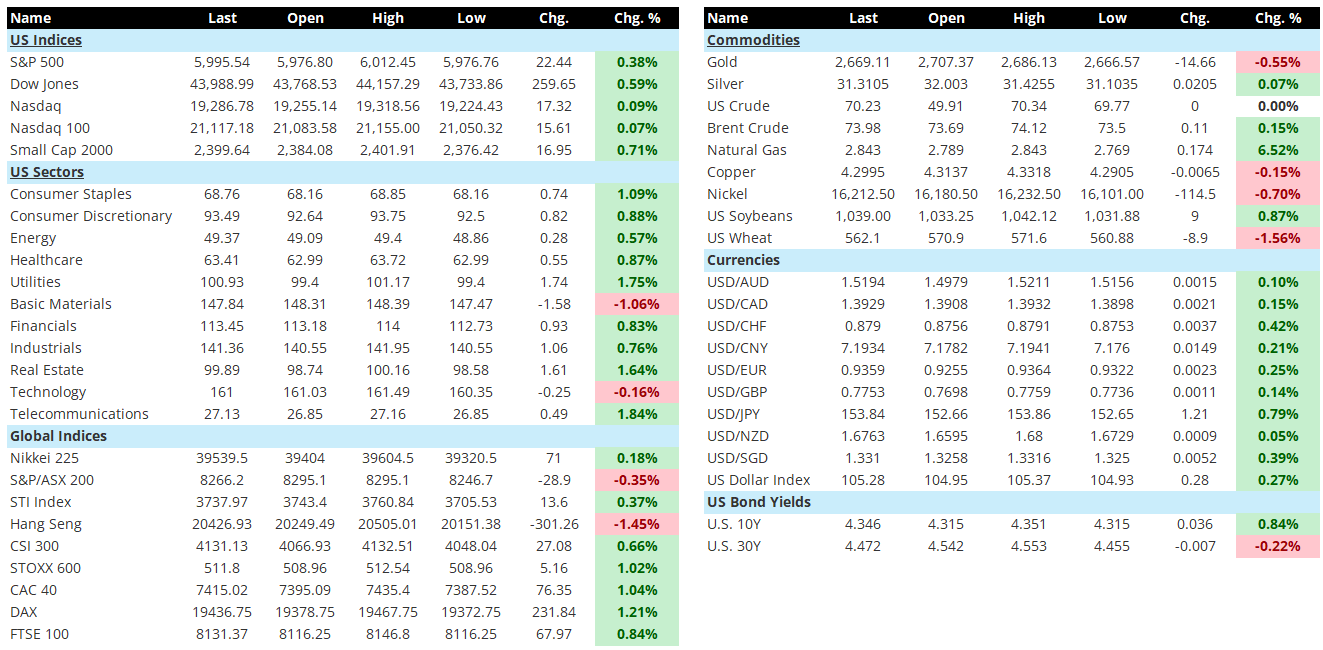

- Overall, we are seeing strength in the global markets with the exception of the Hong Kong and Australia's market. US futures point towards the upside. Currently, the Dow increased by 0.30% while the US 500 rallied by 0.33%.

- In the previous US session, we saw all major indices finished strong in the positive territory. Dow Jones and Russell 2000 outperform all other indices, closing higher by 0.59% and 0.71% respectively. In terms of sectors, we are seeing market participants favoring the defensives. Utilities and Consumer Staples outperformed, surging by 1.75% and 1.09% respectively. Materials plunged the most by -1.06%.

- Earlier today, in the Asian Market, Japan's Nikkei 225 and Singapore's Straits Times Index outperformed the Chinese markets, closing the day higher by 0.18% and 0.37%. Hang Seng and fell by 1.45% while Australia's ASX 200 deteriorated by 0.35%; Australia's economy is highly dependent on China due to exports.

- In Europe, greens across all major indices. EU's Stoxx 600 rally by 1.02% while the French CAC and German Dax increased by 1.04% and 1.21%. FTSE 100 underperformed, but remain well in the positive territory.

- In the currency markets, the dollar strengthened against all major currencies. Dollar index surged by 0.27%. 10Y yields trekked towards 4.346%.

- Finally, we are seeing mixed signals in the commodities market. Gold fell by 0.55% while Silver remained flat. Natural gas outperformed, surging by 6.52% while Copper and Nickel fell by 0.15% and 0.70% respectively.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.