Occidental Petroleum: Offsetting Near-Term Headwinds With Margin Optimization

Occidental Petroleum (OXY) shows strong long-term potential through margin improvements and a solid balance sheet. However, short-term challenges such as weak oil prices, geopolitical risks, and global demand concerns may weigh on the company.

Executive Summary

Occidental Petroleum (OXY), a global oil and gas producer with operations in the U.S., UAE, Oman, and Algeria, shows significant long-term growth potential driven by margin enhancements and a strengthened balance sheet. While near-term pressures from low oil prices, geopolitical risks, and macroeconomic challenges weigh on the company, OXY’s initiatives in cost reduction and margin improvements position it for substantial long-term value. We rate OXY as BUY, with a potential upside of 13%, driven by ongoing margin expansion.

We base this rating on the following factors:

-

Macroeconomic and Industry Headwinds: OXY faces near-term challenges from geopolitical tensions, weak demand from China, and OPEC+ decisions. While oil prices remain under pressure, particularly if OPEC+ unwinds cuts too quickly, these are temporary factors that OXY can navigate in the long run.

-

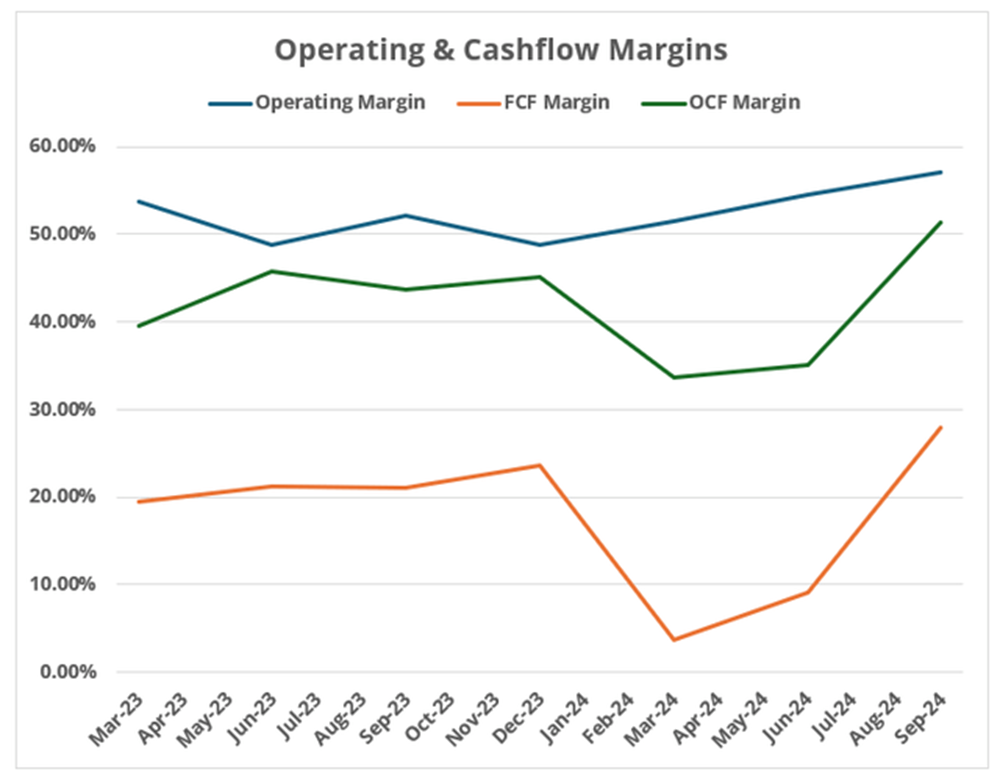

Margin Enhancements: OXY has improved its operating margin by 328 bps since Q1 2023. Its focus on cost reduction, particularly in drilling and well operations, should continue to boost margins and offset short-term revenue challenges.

-

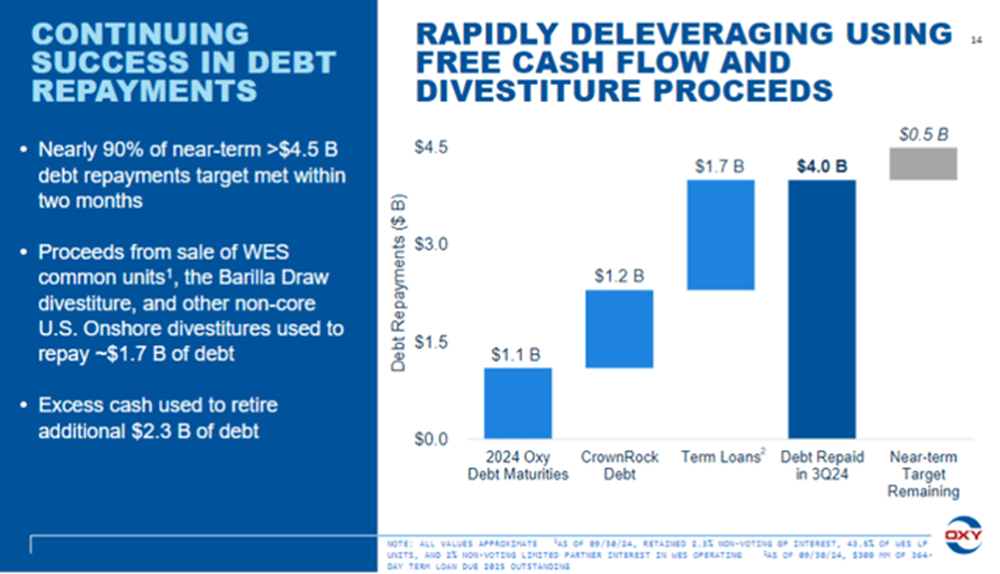

Balance Sheet Strength: OXY has reduced its debt by over $4.5 billion, improving its financial flexibility. This de-leveraging positions the company for potential acquisitions and strengthens its long-term growth outlook.

-

Valuation and Upside Potential: OXY trades at a 12.95% discount to its estimated fair value of $53, indicating solid upside potential if margin improvements continue.

-

Risks from Oil Price Volatility: While OXY is highly correlated with crude oil prices, the company’s margin enhancement strategy and financial strength position it well to weather volatility and capitalize on future recovery in oil prices.

Introduction

Based on our analysis, we believe in the long-term potential for Occidental Petroleum (OXY). Despite near-term headwinds, OXY's initiatives in margin enhancement can provide significant value to shareholders. Moreover, as the company continues to strengthen its balance sheet, there is a possibility that the company increases its dividends or share repurchases. Our valuation model suggests that if OXY continues improving its margins, there is a potential upside of 13%. In this report, we will demonstrate why shareholders should consider OXY in their portfolios.

Company Overview

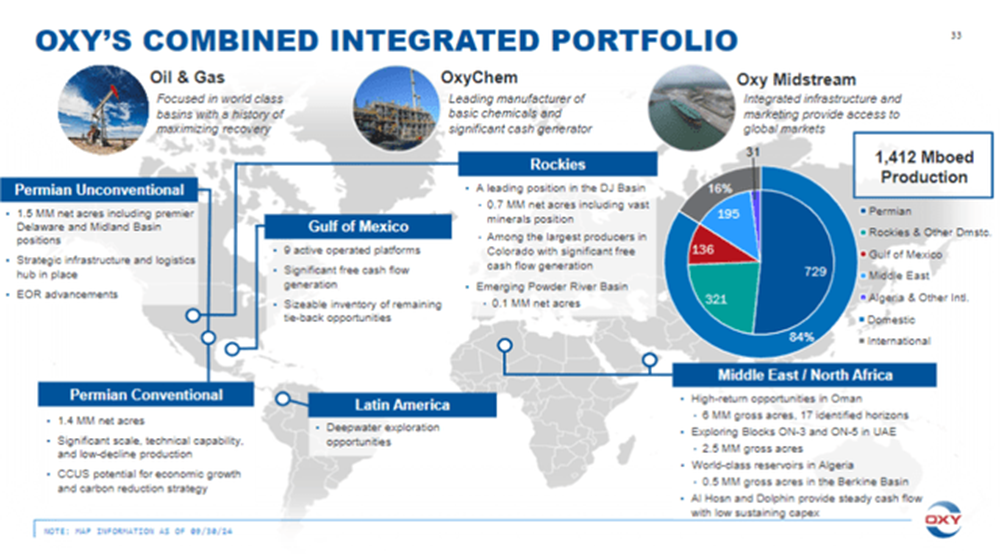

OXY is an oil and gas producer that has operations in the United States, United Arab Emirates, Oman, and Algeria. As of FY2023, the company has approximately 12.57 thousand full-time employees of which 8.8 thousand are in North America.

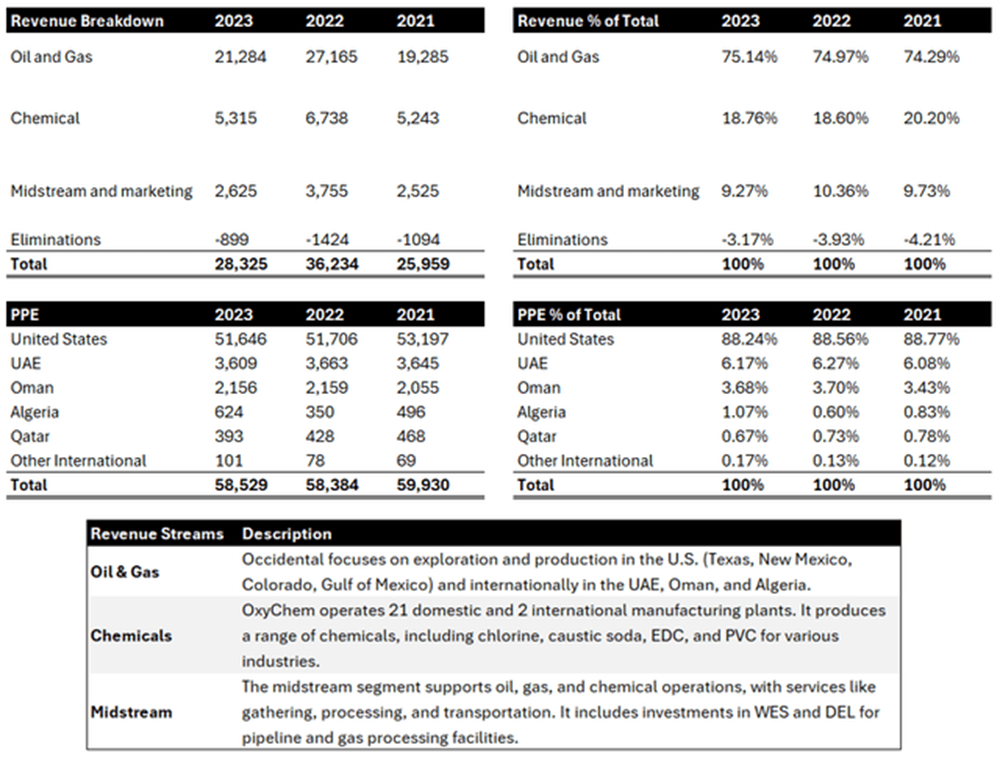

The company has three operating segments: (1) Oil and Gas, (2) Chemical, and (3) Midstream and Marketing. Majority of the company's revenues are derived from upstream oil and gas activities, accounting for close to 75% of the company's total revenue. Naturally, approximately 88.24% of the company's assets is in the United States. The remaining 11.74% is split between countries in the MENA region.

Latest Developments

In 3Q24, OXY generated $7.17 billion, representing a revenue growth of 0.21% y/y and 5.22% q/q. Operating margin and cashflow margins improved due to improvements in drilling efficiency and strong operating performance in OXY's midstream segment. During this period, OXY company generated OCF and FCF of $3.68 billion and $2 billion, reflecting a growth of 17.67% and 32.38% respectively. That being said due to higher other expenses and financial expenses, OXY's net margin deteriorated to 15.80% from 18.21% in the same period last year. Net income fell -17.60% y/y and -2.50 q/q.

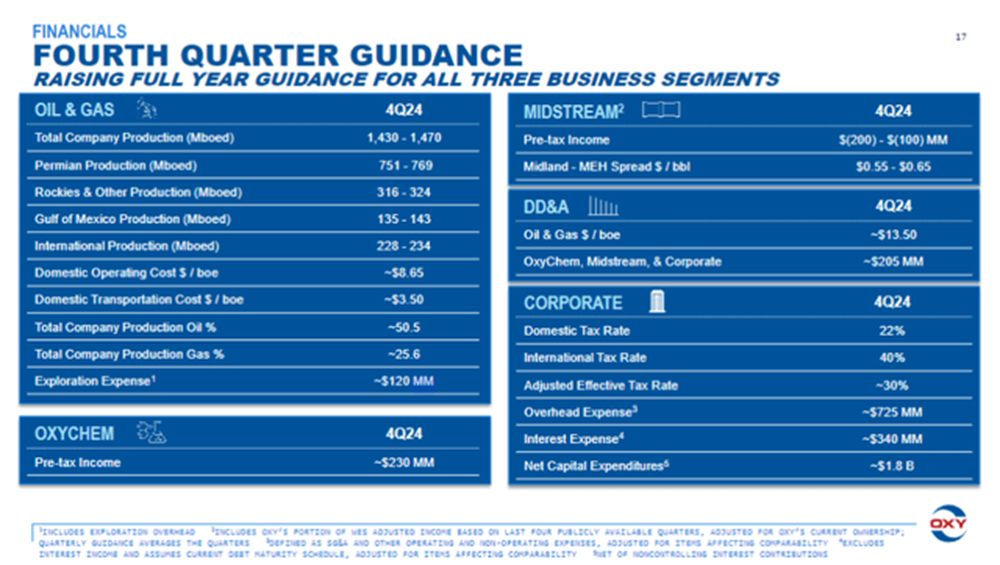

Looking forward, due to better than expected 3Q24 performance, OXY raised its guidance for 4Q24. Total production for oil and gas is expected to range between 1,450 Mboed. For OXY's chemical and and midstream segment, the company expect to post a pre-tax income of $230 million and -$150 million respectively. Effective tax rate is estimated to be 30%. Finally, OXY expects to spend $340 million and $1.8 billion in interest expenses and capital expenditures.

OXY's Prospects Will Be Pressured By Macroeconomic Headwinds

Currently we are seeing multiple macro and industry level indicators suggesting that the outlook for OXY will be bleak in the near future. Despite tensions not abating in the Middle East and OPEC+ extension of voluntary cuts, crude oil prices remain depressed.

China's economy, which accounts for approximately 41% of global oil consumption, continues to struggle despite numerous fiscal stimulus and monetary easing. China's new home prices fell 0.2% m/m, falling for the eighteen consecutive time while year-to-date oil demand fell by 3.26% y/y to 14 million barrels per day. Moreover, with further acceleration in EV and LNG-fueled trucks, demand for oil will continue deteriorating. According to China National Petroleum Corporation, China will reach peak oil demand by 2025.

In the United States, Trump's "drill, baby, drill" policy may further pressure oil prices. Moreover, due to concerns about a potential lack of demand and higher input prices due to potential tariffs, United States Manufacturing PMI fell for the sixth consecutive time, contracting to 48.3 from 49.7.

Currently, OPEC+ had extended cuts till April 2025 and will gradually unwind the cuts till September 2026. Based on OPIS's estimation, there is a likelihood that crude prices could plunge to about $30 to $40 per barrel if the unwinding becomes too aggressive. Even if there is no unwinding, Citi expects that oil prices to by another $10 from current levels due to higher surplus levels.

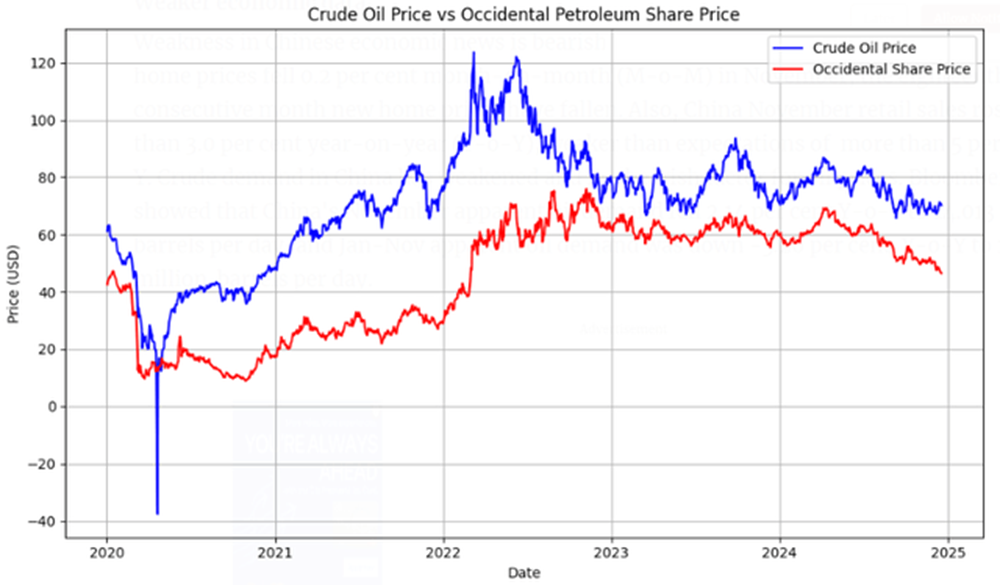

Overall, macro and industry level indicators suggest that crude oil will face multiple headwinds, translating to a poorer outlook for OXY. Moreover, it is important to note that OXY is highly correlated with crude oil prices. Based on data between 2020 and 2024, the correlation between OXY and WTI is about 0.80. In fact, OXY's management have also acknowledged that there will be a downside risk to crude oil prices in 2025.

Margin Enhancements To Offset Potential Revenue Deterioration

On the company's end, OXY has multiples initiatives to further improve and enhance its overall margins, potentially offsetting any revenue decay. In fact, since 1Q23, OXY has managed to improve its operating margin from 53.72% to 57.01%, expanding by close to 328 bps.

A huge contributing factor to OXY's recent margin improvements can be attributable to the company's reduction in drilling and well costs. Permian drilling operations saw an improvement of 10% while the DJ basin experienced a 20% reduction in overall costs. Moreover, OXY has successfully reduce lease related operating expenses across most off its assets.

Looking forward into 4Q24, we should see further margin enhancement as OXY expects increased uptime, improved CO2 utilization rates and synergy effects from its CrownRock acquisition. Additionally, due to the acquisition, OXY will focus on further optimizing its supply chain to reduce the cost of operations (i.e. inputs and construction) and accelerate its time to market.

Separately, OXY has successfully de-levered its balance sheet. The company has met its debt repayment target and paid down more than $4.5 billion, effectively reducing future interest payments that may pressurize the company and improving overall net margins. For FY2024, the company has no upcoming maturities and its current cash level is sufficient to pay off its FY2025 maturities. More importantly, this suggests that the company now has extra capacity to leverage up for another acquisition if the opportunity arise in FY2025.

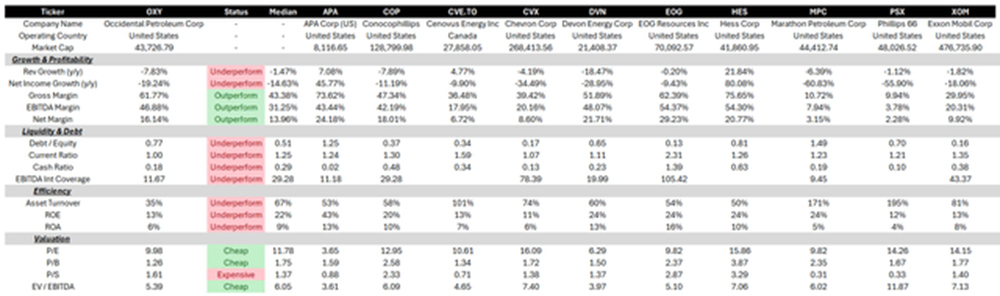

Upside Potential Exists Despite Relative Underperformance Against Peers

Our comparable company analysis suggests that it is reasonable for OXY to trade at a discount as compared to its peers. With the exception of non-margin related metrics, OXY has underperformed its peers. Based on TTM data, the industry only saw a revenue and net income decline of -1.47% and -14.63%, significantly outperforming OXY's revenue and net income decline of -7.83% and -19.24%. OXY's liquidity, debt, and efficiency metrics have also underperformed its peers.

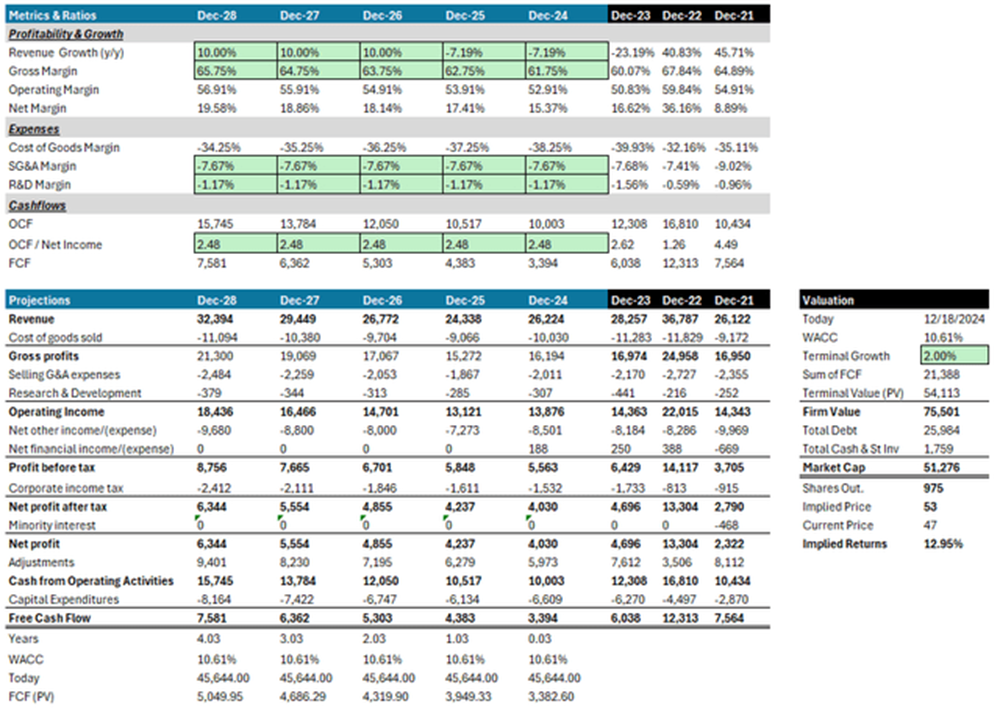

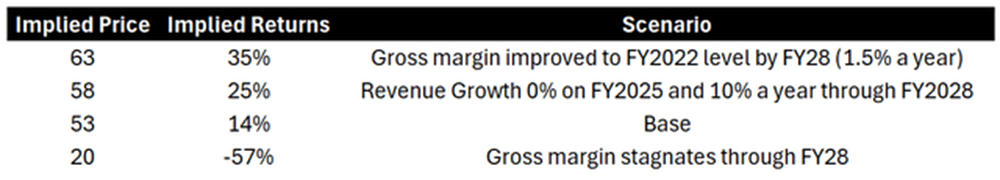

To further ascertain the share price of OXY, we have conducted a DCF analysis based on the following assumptions:

- OXY's revenue will decline by 7.19% for FY2024 and FY2025 due to a poor oil and gas outlook. Revenues growth will rebound to 10% a year from FY26 to FY28.

- OXY's operating margin to expand cumulatively by 600 bps through FY2028 due to potential margin expansion.

- Terminal Growth of 2% and WACC of 10.61%

Based on the above assumptions, our model suggests that the implied price of OXY should be $53. Currently, OXY trades at $47, suggesting a potential upside of 12.95%. That being said, it is important to note that OXY's upside potential will primarily come up margin expansion. If OXY starts showing evidence that it cannot further improve its margins, it may be wise to start avoiding this company; at least until its share price provides a huge margin of safety.

Closing Remarks

Overall, we believe in the long-term prospects of OXY and rate the company as a buy. Despite near-term headwinds (at least well into FY2025), OXY's initiatives to expand its margins can bring substantial value to its shareholders. Moreover, as the company continues to strengthen its balance sheet, there is a possibility that the company increases its dividends or share repurchases.

That being said, in the short-run, there are full of potential negative catalysts that may further pressure the company's share price. If OPEC+ unwinds earlier or more aggressive than expected, we will likely see crude oil prices capitulate, affecting the overall profitability of OXY. Additionally, if China's economy continues to stagnate, crude oil prices will further deteriorate. Finally, investors should monitor OXY's margin enhancement progress closely; any signs of operating or cash flow margin deterioration will render our thesis invalid.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.