Northvolt’s Bankruptcy, Germany’s Budget Battles, and Japan’s Rate Hike Hints

Northvolt’s bankruptcy shakes Europe’s EV sector, Germany’s debt brake stirs political turmoil, Japan eyes rate hikes as inflation persists, and Apple reveals ambitious Siri plans.

Good morning! It’s Ryosuke. Today’s edition dives into Northvolt’s bankruptcy shaking Europe’s EV ambitions, Germany’s budget disputes over the debt brake, Japan’s inflation and rate hike prospects, and Apple’s ambitious Siri overhaul. We’ll also look at Singapore’s booming housing market and key global market updates. Let’s get started!

Northvolt's Chapter 11: A Setback for Europe's EV Ambitions

-

Bankruptcy Blow: Swedish battery maker Northvolt has filed for Chapter 11 bankruptcy in the U.S., dealing a significant blow to Europe’s drive for electrification. The move aims to restructure its debt and stabilize operations by the first quarter of next year.

-

Survival Strategy: Northvolt plans to secure $245 million in new financing, including $145 million in cash and $100 million in debtor-in-possession loans. Operations at its flagship Northvolt Ett gigafactory in Sweden will continue as the company pushes forward with its mission to bolster Europe’s battery production capacity.

-

Market Challenges: Once Europe’s premier EV battery hopeful, Northvolt has faced mounting competition from China and financial pressures, prompting a major cost-cutting drive. In September, the firm announced plans to slash its global workforce by 20%.

-

Future Outlook: Despite financial woes, interim chairman Tom Johnstone emphasized Northvolt’s long-term vision to build a Western industrial base for battery production. However, whether it can capture the growing EV demand amidst these challenges remains to be seen.

Germany’s Debt Brake: Collapse, Controversy, and the Road Ahead

Photo by Stephan Widua / Unsplash

- Government Collapse: Germany's ruling coalition fell apart over budget and economic policy disputes, with the contentious Schuldenbremse (debt brake) at the center. Chancellor Olaf Scholz's call to suspend the rule for budget flexibility clashed with ex-Finance Minister Christian Lindner's strict adherence to it.

- Debt Brake Debate: The 2009 debt brake, limiting structural deficits to 0.35% of GDP, aimed to curb excessive borrowing but faces criticism for stifling investment in infrastructure and education. While exceptions like the pandemic allowed suspension, newer crises, like climate change, remain excluded.

- Political Tensions: The breakup exposed deeper rifts, with critics noting Lindner’s rigid stance might have been politically motivated. Observers also cite personal tensions and broader disagreements beyond fiscal policy.

- Future Uncertain: With elections looming, reform prospects are mixed. Likely outcomes range from modest adjustments—e.g., boosting military spending and investment—to symbolic tweaks reflecting Germany’s debt-averse culture. Without major changes, fiscal workarounds or limited stimulus may fill the investment gap.

Japan Inflation and the BOJ's Rate Hike Prospects

Photo by gibblesmash asdf / Unsplash

-

October Inflation Eases: Japan's headline inflation rate fell to 2.3% in October, its lowest since January and down from 2.5% in September. Core inflation, excluding fresh food, also dipped slightly to 2.3% but remained above expectations of 2.2%.

-

Core-Core Inflation Rises: The "core-core" inflation rate, excluding fresh food and energy, edged up to 2.3% from 2.1% in September, signaling persistent underlying price pressures closely monitored by the Bank of Japan (BOJ).

-

Rate Hike Still Likely: Despite cooling headline inflation, 55% of economists polled by Reuters expect the BOJ to raise rates by 25 basis points in December, potentially pushing the policy rate to 0.5%. The BOJ forecasts rates could reach 1% by late 2025, supported by Governor Kazuo Ueda’s focus on wage-driven inflation.

-

Currency Impact: The yen, after hitting a four-month low of 156.74 against the dollar in mid-November, has rebounded slightly to 154.28, with monetary policy adjustments seen as crucial for stabilizing the currency.

Trump Picks Pam Bondi for Attorney General: A Loyal Ally Steps In

-

Bondi Steps Up: President-elect Trump has nominated Pam Bondi, former Florida Attorney General and staunch supporter, to lead the Department of Justice. Bondi replaces Matt Gaetz, who withdrew amid scrutiny over past allegations and investigations.

-

Track Record: Bondi defended Trump during his first impeachment and has been a vocal advocate of his policies. As Florida AG, she spearheaded efforts against the Affordable Care Act and worked on opioid abuse during Trump’s first term.

-

DOJ Overhaul: Trump lauds Bondi as a tough "America First" advocate. Her appointment signals potential sweeping changes, including a hardline stance on investigations Trump has criticized, such as those led by Special Counsel Jack Smith.

-

Controversy Ahead?: Bondi’s past includes scrutiny over a $25,000 Trump Foundation donation linked to a decision not to pursue a case against Trump University. While cleared of wrongdoing, her history may draw renewed attention during the confirmation process.

Apple’s Next Move: A More Conversational Siri

Photo by appshunter.io / Unsplash

-

Catching Up in AI: Apple is developing “LLM Siri,” a revamped digital assistant powered by advanced large language models, aiming to match competitors like ChatGPT and Google Gemini. The upgrade promises human-like conversations and faster handling of complex tasks.

-

Release Timeline: The upgraded Siri is slated for announcement in 2025 alongside iOS 19 and macOS 16, with a public rollout planned for spring 2026. It will integrate with Apple Intelligence and offer features like summarizing text and enhanced app control.

-

Bridging the Gap: While the full overhaul is years away, Apple is introducing interim improvements in iOS 18, such as smarter context use and routing requests to a second-generation LLM. ChatGPT and other AI tools will also be integrated into Apple Intelligence next month.

-

Privacy Focus: Apple’s vision is to bring advanced AI capabilities in-house while emphasizing user privacy. Job postings reveal efforts to build groundbreaking conversational assistant technologies to redefine how Siri interacts with users.

Singapore's Housing Frenzy Challenges Government's Cooling Measures

Photo by Aliff Haikal / Unsplash

-

Record Sales Defy Curbs: November is set to break a decade-long record with over 1,900 private units sold, showcasing a resilient market despite cooling measures like higher stamp duties. Builders released more units this month than in the first three quarters combined.

-

Election Pressure: Surging home prices are a key voter concern ahead of elections. Government efforts to curb affordability issues face pushback, with young buyers leveraging parental savings and foreigners using trusts to bypass tax hikes.

-

Suburban Boom, Urban Slump: Suburban projects like Katong see near-total sellouts, driven by locals and long-term residents. In contrast, downtown luxury homes struggle under high stamp duties, illustrating the uneven impact of government interventions.

-

Market Outlook: Analysts predict mixed trends—Bloomberg Intelligence expects a 3% price rise in 2025, while Morgan Stanley foresees a 5% decline next year, citing potential oversupply and policy risks. The government faces tough choices as buyers remain undeterred.

Latest On Global Markets

-

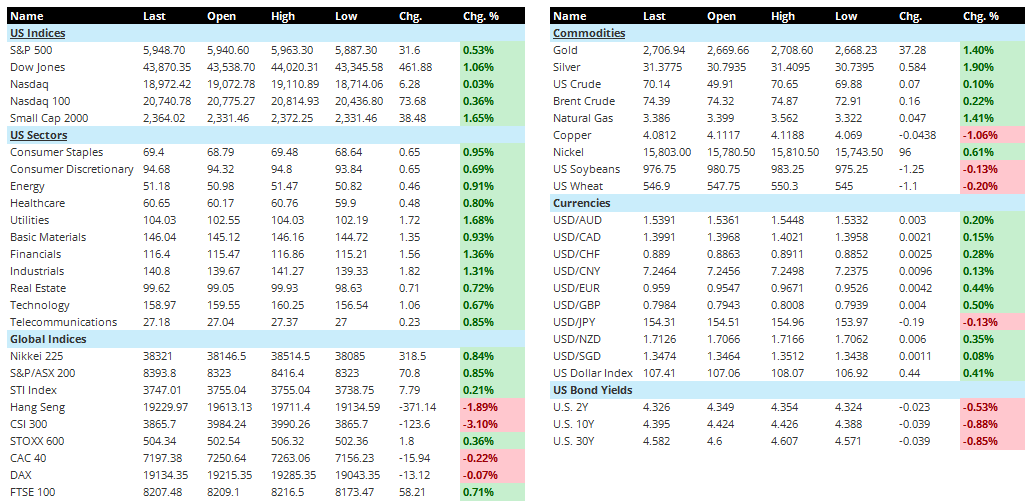

US Futures: Futures are leaning negative this morning, reflecting cautious sentiment. Dow futures are down by 0.16%, and S&P 500 futures have slipped 0.28%.

-

US Indices: Gains dominated the previous session. The Dow Jones climbed 1.06%, while the S&P 500 rose 0.53%. Small Caps stood out, surging 1.65%, while the Nasdaq edged up a modest 0.03%.

-

US Sectors: Broad-based sector gains led by Utilities (1.68%) and Financials (1.36%). Energy and Industrials also performed well, up 0.91% and 1.31%, respectively. Technology posted a more tempered gain of 0.67%.

-

Asia: Mixed performance in Asia. The Nikkei 225 gained 0.84%, and the S&P/ASX 200 added 0.85%. However, the Hang Seng dropped 1.89%, and the CSI 300 fell sharply by 3.10%.

-

Europe: A mostly positive session in Europe. The FTSE 100 climbed 0.71%, and the STOXX 600 rose 0.36%. In contrast, the DAX and CAC 40 slipped 0.07% and 0.22%, respectively.

-

Commodities: Gains dominated the commodities space. Gold rose by 1.40%, and Silver gained 1.90%. Natural Gas advanced 1.41%, while US Crude and Brent Crude recorded smaller gains of 0.10% and 0.22%, respectively.

-

Currencies: The US Dollar Index gained 0.41%. The dollar strengthened 0.44% against the euro and 0.50% against the pound, while holding steady against the yen.

-

US Bond Yields: Yields fell across the curve. The 2-year yield declined by 2.3 basis points to 4.326%, the 10-year yield dropped 3.9 basis points to 4.395%, and the 30-year yield fell 3.9 basis points to 4.582%.

Other Notable News

-

Ukraine Conflict: Ukraine accused Russia of firing a "new" ballistic missile at Dnipro. While Kyiv claimed it was an intercontinental missile, the Pentagon and Moscow refuted this, citing it as medium-range.

-

US-Russia Sanctions: The Biden administration sanctioned Gazprombank and other Russian financial institutions, escalating economic pressure. This move may provoke Russian retaliation, potentially cutting gas supplies to Europe.

-

Labor Market: Jobless claims fell unexpectedly to their lowest since April, signaling a resilient labor market.

-

Interest Rates: Chicago Fed's Goolsbee forecasts rate cuts in 2024, citing progress in curbing inflation. In Japan, BoJ Governor Ueda hinted at potential rate hikes in December, while PM Ishiba is set to unveil a $140B stimulus package.

-

ECB Policy: ECB board member Holzmann stressed the need for restrictive policies to address inflation risks.

-

SEC Leadership: SEC Chair Gary Gensler plans to resign on Trump’s inauguration, potentially signaling regulatory shifts for crypto.

-

Geopolitical Tensions: The ICC issued an arrest warrant for Israeli PM Netanyahu over alleged war crimes.

Economic Data & Central Bank Speeches Today

- 8:00 AM: Speech by the President of the German Central Bank and the Governor of the Bank of France.

- 10:45 AM: Canada's September retail sales month-on-month (forecast: 0.4%, previous: 0.4%).

- 9:45 AM: U.S. November Manufacturing PMI preliminary value (forecast: 48.9, previous: 48.5).

- 9:45 AM: U.S. November Services PMI preliminary value (forecast: 55.0, previous: 55.0).

- 10:00 AM: Final value of the University of Michigan Consumer Confidence Index for November (forecast: 73.9, initial: 73.0).

- 10:45 AM: ECB Executive Board member Schnabel speaks.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.