Our Approach Towards Investing

Markets are often driven by fear and greed, leading to mispricing. We capitalize on these emotional swings by identifying opportunities where market participants overreact, allowing us to seize undervalued assets and deliver strong returns.

Investment Philosophy

At Seven Insights, we believe that financial markets are often inefficient. These inefficiencies create opportunities—moments where a security's market price deviates significantly from its intrinsic value due to misconceptions, misinterpretations, or emotional extremes like over-optimism or excessive pessimism.

Our approach centers on critically analyzing how the market perceives and values the specific company of our interest. By scrutinizing these perceptions, we assess whether they are rooted in reality or distorted by irrationality. When we identify opportunities where a company’s fundamentals deviates from its price, we act decisively—but only when there is a clear margin of safety to protect against downside risk and ensure potential upside rewards.

At the core, we are value investors, committed to uncovering hidden opportunities, emphasizing a disciplined approach, and leveraging asymmetric risk-reward advantages for our clients.

Investment Process

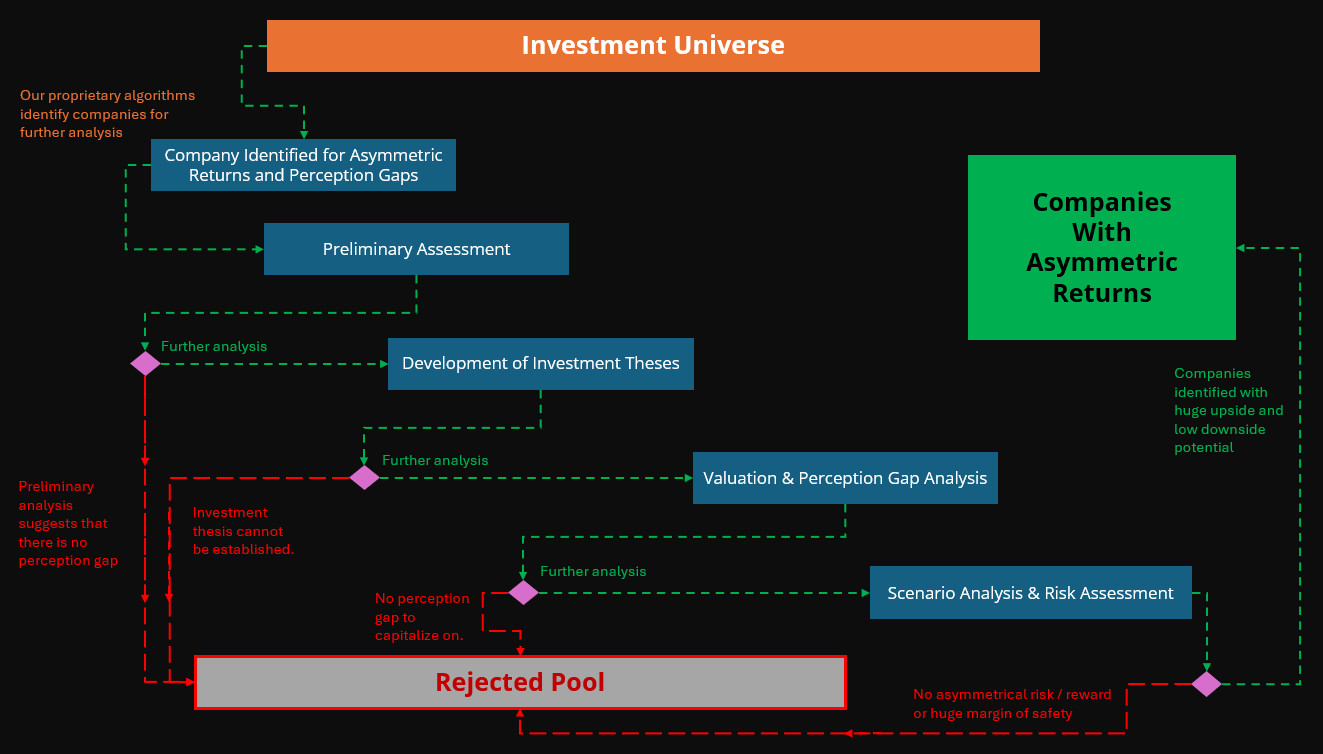

Our investment research identifies perception gaps with asymmetrical risk/reward potential through a five-step process: (1) Idea Generation , (2) Preliminary Assessment, (3) Development of Investment Theses, (4) Valuation & Perception Gap Analysis, (5) Scenario & Risk Assessment, and (6) Ongoing Monitoring.

1. Investment Idea Generation

Over time, we’ve crafted proprietary algorithms to pinpoint companies where fundamentals and market prices are completely out of sync. We don’t limit ourselves to any specific sector or geography—our approach is agnostic. For ease of trading and accessibility, we focus solely on securities available in developed markets. For example, we may consider MercadoLibre, a Brazilian company listed in the United States.

2. Preliminary Assessment

Once our proprietary algorithm identifies a company, we conduct an in-depth analysis, reviewing financial statements, growth potential, and industry positioning. We focus on key documents like 10-Qs, 10-Ks, earnings presentations, and earnings call transcripts. If required, we will also conduct interviews with company's management team. The core objective is to identify any deviations between the company's fundamentals and the company’s stock price (i.e., potential perception gaps).

3. Development of Investment Theses

After conducting a thorough preliminary assessment, we begin developing a detailed investment thesis by synthesizing the data gathered during the initial analysis. This process involves identifying key factors that could influence the company's future performance, focusing on elements such as its competitive position, management team, strategic initiatives, and potential catalysts like market trends, regulatory changes, or product innovations.

The investment thesis is not limited to "buy" opportunities; it also considers scenarios where an exit or reduction in position may be warranted. By evaluating both positive growth drivers and potential risks, we create a flexible framework that can guide decisions to either invest, hold, or divest based on ongoing analysis and market dynamics.

4. Valuation & Perception Gap Analysis

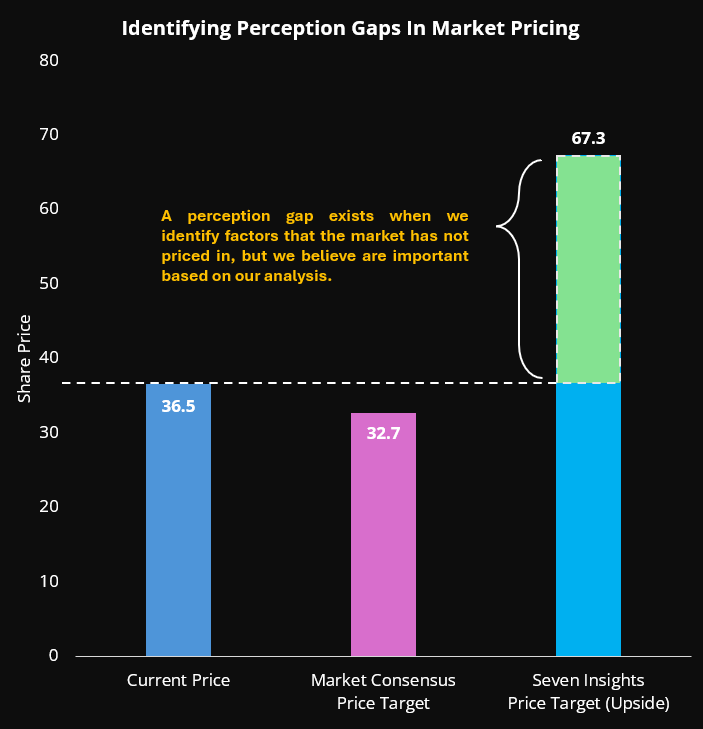

In this phase, we validate our investment theses using valuation models based on the key factors identified earlier, such as growth potential, market conditions, and company-specific dynamics.

If our valuation differs significantly from the current market price or consensus forecasts, it highlights a perception gap—indicating that the market may be mispricing the company. Depending on the situation, we also conduct reverse valuation analysis to understand what assumptions the market is pricing in and whether they align with our expectations.

5. Scenario Analysis & Investment Risk Analysis

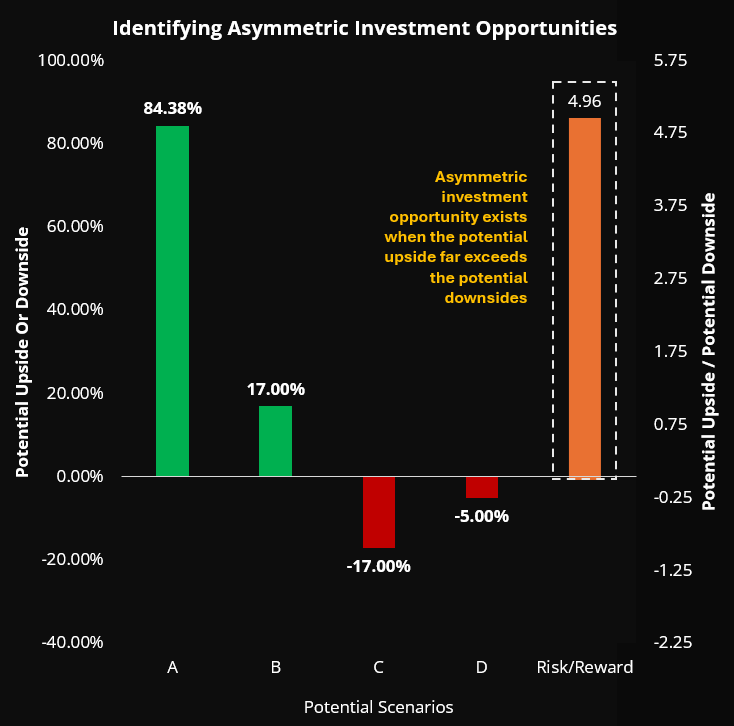

We evaluate the potential outcomes of our investment thesis under various scenarios, considering both best-case and worst-case situations. This helps us understand the range of possible risks and rewards, ensuring we are well-prepared for different market conditions and company-specific developments.

We incorporate factors such as changes in market trends, regulatory shifts, and company performance to assess their potential impact on the investment. This analysis allows us to identify critical risks, quantify their effects, and determine whether the expected returns justify those risks.

Our focus is on achieving asymmetrical returns—high upside with limited downside exposure. By mapping out these scenarios and analyzing the associated risks, we gain a clearer picture of the investment’s potential, which ultimately guides our ratings: whether to buy (outperform), hold, or sell (underperform) based on the expected performance and risk-reward profile.

6. Dynamic Monitoring & Assessment

At this stage, we continuously track the performance of our investments and reassess our initial thesis in light of new data, market developments, and company-specific changes. This involves reviewing financial reports, market trends, and relevant news to ensure that the assumptions driving our investment thesis remain valid.

If new information indicates that the company’s fundamentals or market conditions have shifted significantly, we adjust our thesis accordingly. This ongoing validation process allows us to stay aligned with evolving market realities and ensures that our investment decisions are always based on the most accurate and up-to-date information available.

By actively monitoring and refining our thesis, we can make informed decisions on whether to maintain, adjust, or exit a position based on changing circumstances, maximizing the potential for success.