Merger Talks Among Auto Giants, Hong Kong's IPO Scrutiny, Semiconductor Trade Investigations, ECB's Flexible Rate Strategy, and Boeing's Production Resurgence

Nissan and Honda eye a merger to tackle financial woes and strengthen their market stance, while Hong Kong probes potential market misconduct amidst Nasdaq concerns, and the U.S. gears up for a trade investigation against Chinese semiconductors.

Hello, it’s Ryosuke! Today, we’re diving into a series of major developments shaping the global landscape across various sectors. Here’s a snapshot of what’s on the agenda:

-

Honda and Nissan Merger Talks: The automotive giants are discussing a potential merger that could create the world’s third-largest car manufacturer, spurred by Nissan’s financial struggles and a rising interest from Foxconn in the EV market.

-

Hong Kong Listings Investigation: The city’s securities watchdog is probing finance firms over possible malpractices on the Nasdaq, aiming to restore trust in the market amidst concerns of "pump-and-dump" schemes affecting IPO stability.

-

Biden's Semiconductor Investigation: President Biden is set to launch a trade investigation into Chinese semiconductors, signaling a push to bolster U.S. technological independence amid ongoing competition with China.

-

ECB's Flexible Monetary Policy: The European Central Bank is adopting a data-driven approach to interest rates, indicating potential cuts to bolster the euro-area economy amid ongoing uncertainty.

-

Boeing Resumes Production: After a significant worker strike, Boeing has restarted production, addressing backlog issues and focusing on stabilizing its operations amidst various supply chain challenges.

Details and broader implications are covered below—let’s dive in!

Major Talks Brewing: Honda and Nissan Consider Merger Amid Challenges

Photo by Erik Mclean / Unsplash

Merger Talks Initiated: Nissan Motor Co. and Honda Motor Co. are engaged in discussions about a potential merger, which could bolster Nissan's position in the automotive market and create the world’s third-largest automaker. This strategic move comes as Nissan faces significant financial challenges and declining sales, prompting the need for a stronger alliance.

Foxconn's Involvement: The Taiwanese tech giant Foxconn has shown interest in acquiring a stake in Nissan, indicating its ambition to enter the electric vehicle (EV) market more decisively. This interest may have accelerated Honda and Nissan's merger talks, as both companies look to safeguard against potential foreign takeovers and enhance their competitive edge.

Financial Landscape Shift: Nissan has recently struggled, slashing profit forecasts and announcing substantial job cuts. Meanwhile, Honda has maintained a relatively stable market presence. A merger could create a unified front to fend off competition, particularly from leading automakers like Toyota, and improve the overall strength of Japanese car brands in a rapidly evolving global market.

Potential Outcomes on the Horizon: An announcement regarding the merger could happen soon, possibly as early as December 23. With Renault also possessing a significant stake in Nissan, it is likely to play a crucial role in these discussions, further complicating the landscape but also presenting opportunities for new synergies among these automotive giants.

Hong Kong Watchdog Probes Finance Firms Amid Nasdaq Concerns

Photo by Andrew Jephson / Unsplash

Follow-Up on Listings Scrutiny: In December 2024, Hong Kong's securities watchdog launched an investigation into several finance firms, targeting possible misconduct related to listings on the Nasdaq exchange. This inquiry involves both local brokers and overseas underwriters, focusing on potential "pump-and-dump" schemes which could severely impact investor trust and market stability.

Nasdaq's Growing Concerns: The investigation follows Nasdaq's inquiries regarding the investor identities and share allocations of Hong Kong-based firms. These firms have increasingly turned to Nasdaq for listings, as their local market has struggled to attract companies due to regulatory hurdles, leading to just three initial public offerings in 2024.

Mixed Results for IPOs: Despite 55 firms from China and Hong Kong raising a total of $1.3 billion on Nasdaq this year, the IPO outcomes have been unstable. Some companies saw their stock prices soar only to later plummet, highlighting the potential risks involved for investors and prompting the need for regulatory oversight.

Commitment to Market Integrity: The Securities and Futures Commission (SFC) is intensifying its enforcement actions to restore Hong Kong's reputation as a global financial hub. Their proactive approach aims to combat fraud while enhancing investor confidence, reinforcing that they will utilize all available legal tools to maintain market integrity amid rising scrutiny from international counterparts.

Biden Launches Investigation into Chinese Semiconductors to Safeguard U.S. Industry

Photo by Vishnu Mohanan / Unsplash

Trade Investigation Incoming: President Biden is set to announce a trade investigation into Chinese semiconductors aimed at reducing reliance on technologies viewed as security threats. This could lead to tariffs on older-model semiconductors, impacting various sectors such as medical devices and smartphones, as the U.S. navigates its competitive landscape against China.

Political Timing: The investigation, conducted under Section 301, is expected to continue for months. Interestingly, the findings and potential responses will fall into the hands of President-elect Donald Trump’s administration, leaving the future of U.S.-China semiconductor relations uncertain during a politically transitional period.

Domestic Production Focus: Protecting the U.S. chip industry is a top priority for Biden, who has already initiated substantial incentives for domestic semiconductor manufacturing. This move seeks to lessen dependence on cheaper Chinese chips, signaling a strategic shift towards fortifying U.S. technological sovereignty.

Context of Global Competition: While the Biden administration has imposed existing tariffs and restrictions, the U.S. faces challenges from China's competitive pricing of legacy semiconductors. As the White House prepares for this investigation, the focus remains on preventing market disruption and fostering a robust domestic semiconductor industry, essential for both economic health and national security.

ECB Emphasizes Flexibility Amid Economic Uncertainty

Photo by micheile henderson / Unsplash

Open-Minded Approach: Philip Lane, the Chief Economist of the European Central Bank (ECB), stresses the importance of remaining adaptable in their interest-rate strategies. With uncertainty in the global economy, factors like wage growth and geopolitical tensions could unsettle inflation, prompting the ECB to stay responsive rather than lock into a specific rate path.

Rate Cuts on the Horizon: Following a recent quarter-point reduction, ECB officials are leaning towards further cuts as they try to find a neutral borrowing cost. However, there’s debate within the bank regarding the exact point of neutrality, with some members feeling closer to that than others, creating a complex environment for decision-making.

Diverse Policy Views: Opinions differ among ECB policymakers about whether interest rates should dip below the neutral level to revitalize a lagging euro-area economy. Investors are betting on multiple additional cuts in 2025, highlighting the market's expectations amidst varying outlooks among ECB officials.

Looking Ahead with Caution: Lane maintains optimism about domestic inflation easing as service costs stabilize and labor pressures reduce. The ECB remains committed to achieving a sustainable 2% inflation target while ensuring that their monetary policy adapts to ongoing economic developments, emphasizing a data-driven and flexible approach moving forward.

Boeing Restarts Full Aircraft Production Following Strike

Photo by Sven Piper / Unsplash

Production Resumption: After weeks of halted operations due to a lengthy worker strike, Boeing has resumed production of its aircraft in the Pacific Northwest, including the much-anticipated 737, 767, and 777 models. This return to full output is a significant step for the company, addressing production gaps and responding to market demands.

Training and Inventory Optimization: Boeing's commercial jet division head, Stephanie Pope, emphasized the company's commitment to ensuring all manufacturing staff are up-to-date with training and certifications. Additionally, careful positioning of inventory is prioritizing a smooth ramp-up in production, laying the groundwork for efficiency going forward.

Financial Stability in Focus: This production comeback is critical for Boeing as it aims to recover from financial strain caused by the over 50-day strike. With November deliveries hitting a four-year low, the company recognizes the urgent need to stabilize output and meet delivery timelines to regain customer trust.

787 Impact Assessment: While the 787 Dreamliner wasn't directly affected by the strike, its production is still challenged by shortages of cabin equipment and components. This dual challenge illustrates the broader complexities Boeing faces in revitalizing its entire production spectrum while managing separate supply chain issues.

Latest On Global Markets

US Futures: Futures are indicating a positive start, with Dow Jones futures up 0.15%, S&P 500 futures rising 0.18%, and Nasdaq 100 futures increasing 0.13%.

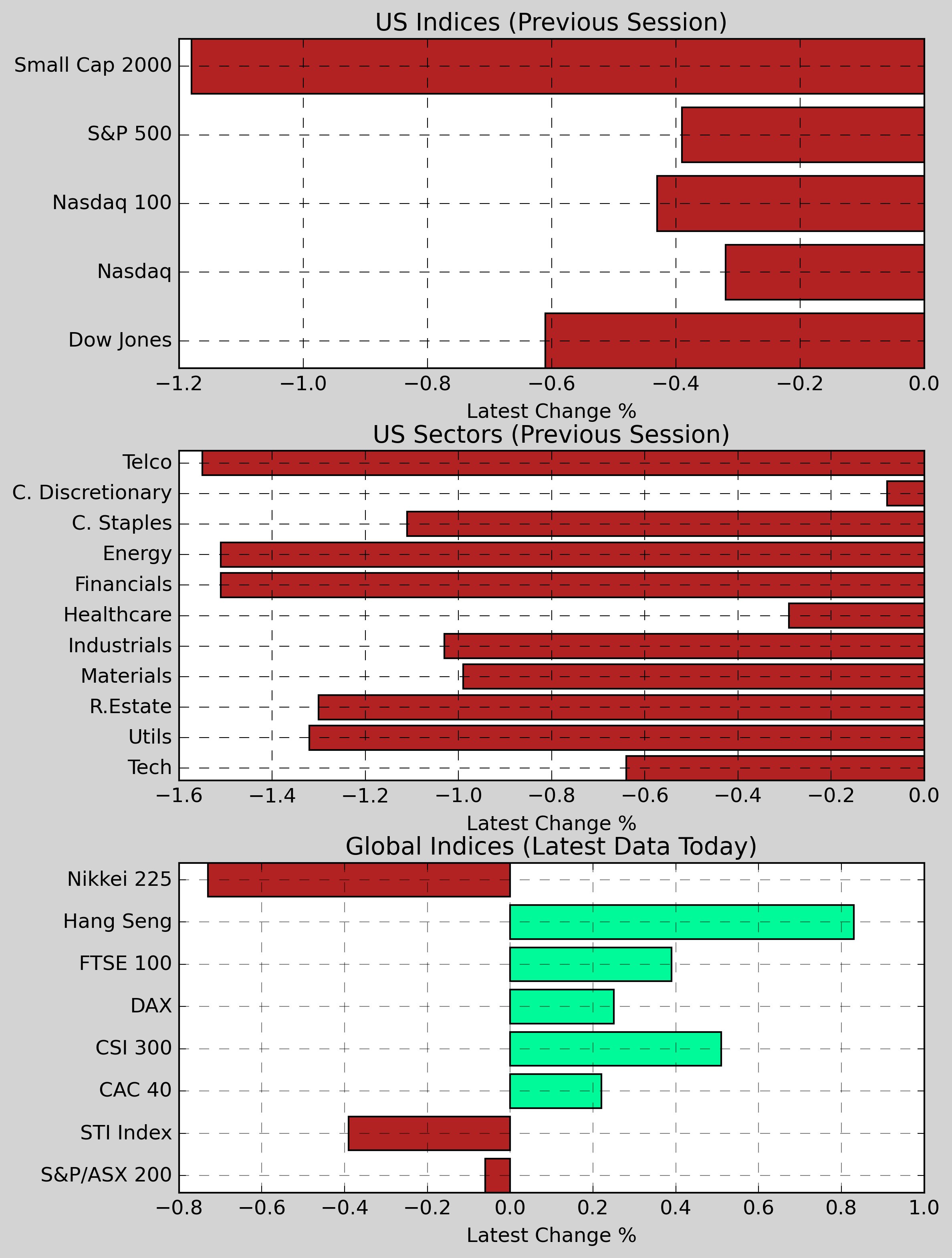

US Indices (Previous Session): The S&P 500 edged down 0.39% to 6,050.61. The Dow Jones dropped 0.61% to 43,449.90, and the Nasdaq fell 0.32%, closing at 20,109.06. The Small Cap 2000 also saw a decline, down 1.18%.

US Sectors (Previous Session): In sector performance, there were no significant gainers as all sectors closed in the red. The most notable declines were seen in Financials, which fell 1.51%, followed closely by Utilities which decreased 1.32%, and Real Estate, down 1.30%.

Global Indices: The Hang Seng Index performed well, rising 0.83%, while the CAC 40 and DAX both posted modest gains of 0.22% and 0.25%, respectively. In contrast, the Nikkei 225 fell by 0.73%, and the FTSE 100 showed a small decrease of 0.39%.

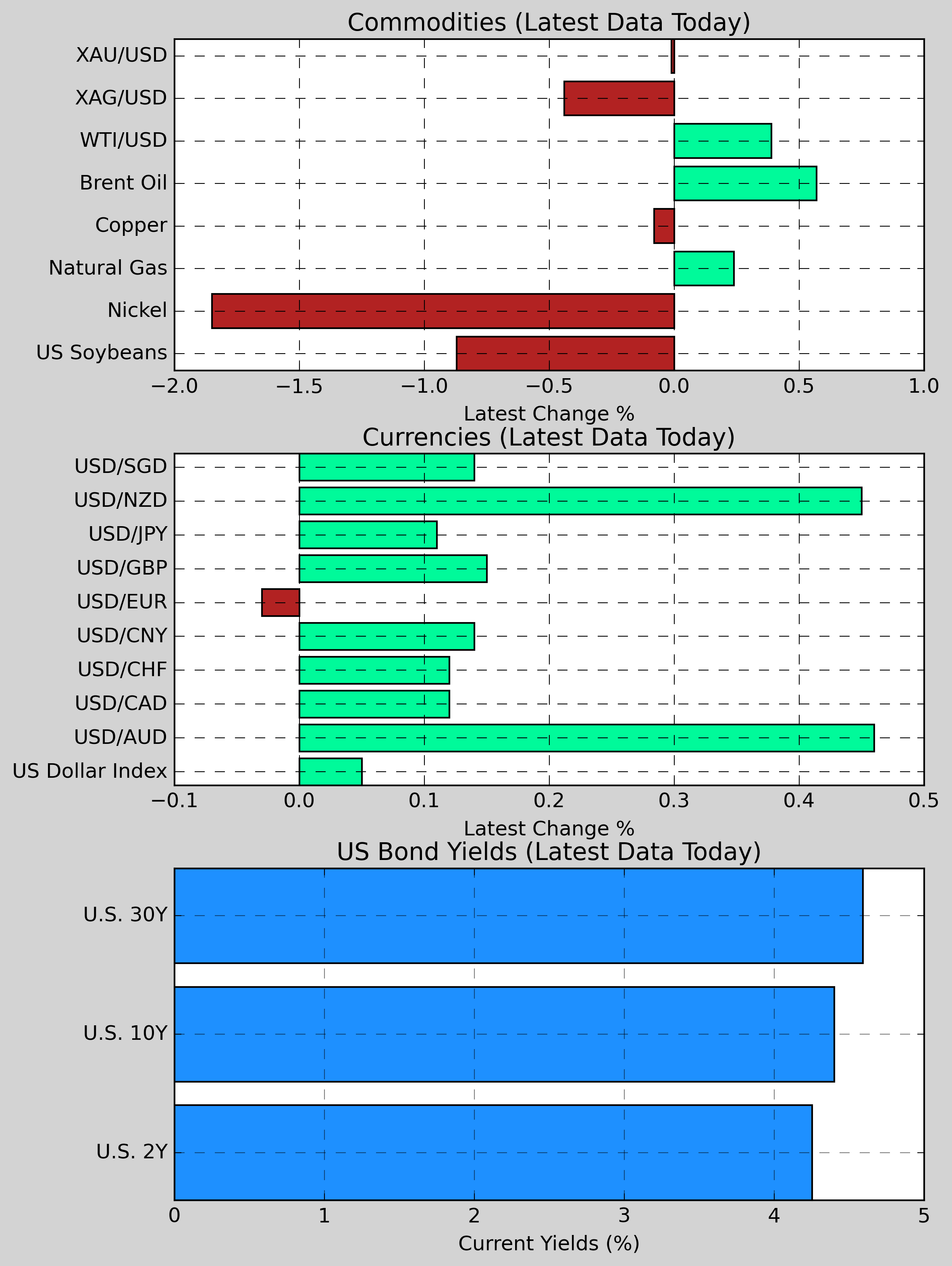

Commodities: Gold declined 0.01% to $2,646.48, while Copper fell 0.08% to $4.1430. Nickel dropped 1.85% to $15,876. Natural Gas saw a slight rise, gaining 0.24% to $3.3160. US Wheat edged up 0.11% to $544.60, and US Soybeans decreased 0.87% to $967.50. Brent Oil rose 0.57% to $73.61.

Currencies: The US Dollar appreciated against several currencies, with USD/AUD up 0.46% and USD/NZD rising 0.45%. USD/CNY increased 0.14%, while USD/CAD climbed 0.12%. USD/GBP saw a modest gain of 0.15%, and the US Dollar Index was up slightly, rising 0.05% to 107.01.

US Bond Yields: The U.S. 2-Year Treasury yield increased 2bps to 4.253%, whereas the U.S. 10-Year Treasury yield rose 1bps to 4.403%. The U.S. 30-Year Treasury yield also saw an uptick, adding 1bps to 4.593%.

Economic Data & Central Bank Developments (Eastern Time)

- 08:30 AM ET: U.S. November new home starts seasonally adjusted annual rate (estimated to be 1.345 million, previous value is 1.311 million)

- 08:30 AM ET: U.S. November building permits seasonally adjusted annualized rate preliminary value (estimated to be 1.43 million, previous value is 1.416 million)

- 08:30 AM ET: U.S. current account balance in the third quarter (estimated to be a deficit of US$287.1 billion, previous value was a deficit of US$266.8 billion)

- 03:00 PM ET: U.S. Federal Open Market Committee interest rate decision

Other Notable News

-

UK Wage Growth Surges: For the first time in a year, wage growth in the UK has picked up, leading traders to reevaluate their expectations for rate cuts in the upcoming year. This shift has resulted in the UK-Germany 10-year bond yield spread reaching its widest point since 1990.

-

Canada’s Economic Struggles: The Canadian dollar has dropped below 1.43 CAD per USD, marking its lowest point since the onset of the COVID-19 pandemic. This decline comes amid a challenging economic and political landscape, while inflation rates in Canada have fallen below the central bank's 2% target for the second consecutive time, reinforcing a dovish outlook.

-

Brazil's Bold Currency Intervention: In a drastic effort to stabilize the real, Brazil's central bank has enacted extraordinary measures to sell over $3 billion in a single day, which has temporarily halted the currency's decline.

-

Retail and Industrial Shifts in the U.S.: In the U.S., retail sales experienced an unexpected increase in November, driven largely by a boom in online shopping and auto sales. Conversely, industrial output has seen a surprising drop for the third straight month due to weaknesses in utilities and mining sectors.

-

Hopes for Gaza Ceasefire: Reports indicate that a ceasefire agreement in Gaza may be imminent, as Israel expresses optimism for a breakthrough in negotiations.

-

Political Turmoil in Ukraine: Ukrainian intelligence has reportedly conducted a bombing in Moscow aiming to eliminate Igor Kirillov, who leads Russia's chemical and biological defense forces. This event follows news that Trump's special envoy for Russia and Ukraine plans to visit Kiev next month and is open to an invitation to Moscow.

-

Fed's Upcoming Decision: The Federal Reserve is expected to announce its interest rate decision soon, with predictions pointing to a 25 basis point cut. RBC forecasts the dot plot will show only two interest rate reductions in the coming year, amid concerns that tariffs are driving inflation forecasts higher for 2025.

-

Economic Optimism Shifts Funds to U.S. Stocks: As cash levels among fund managers hit record lows, there is a notable shift of investments towards U.S. stocks, with Bank of America signaling a possible sell-off in global equities.

-

Bitcoin Peaks Again: In a remarkable turn, Bitcoin has reached a new record high for the second consecutive day, with traders setting their sights on a target of $110,000.

-

Germany’s Business Outlook Deteriorates: Economic uncertainties have led to an unexpected and steep drop in Germany's business outlook index for December, signaling concerns over the economic climate.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.