Markets In the Green, Dollar Soften, Last Day To Cast Your Votes

Morning Briefs

Markets In the Green, Dollar Soften, Last Day To Cast Your Votes

On this page

Latest On Global Markets

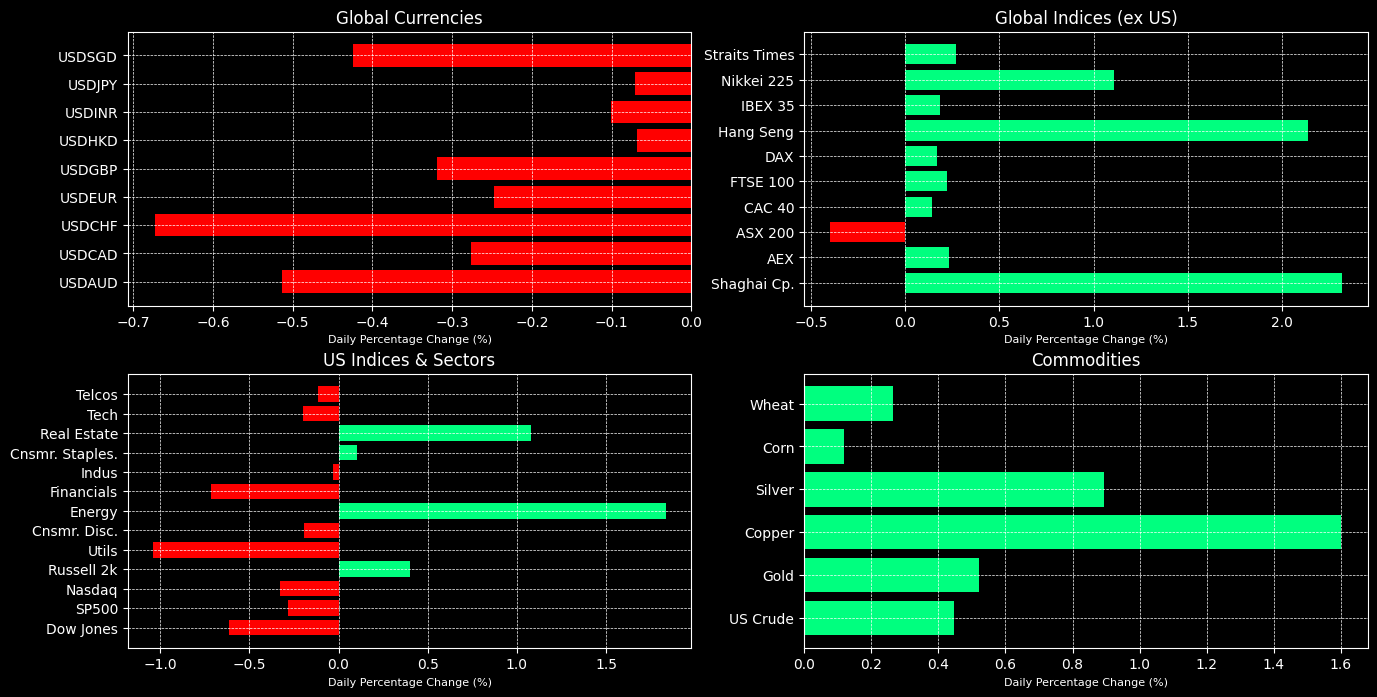

- It is election day today! US dollar have weakened against all major currencies. USDCHF was the biggest underperformer, declining by close to -0.66%. Currently, US futures point towards the upside with the Dow and S&P 500 climbing by 0.21% and 0.28% respectively.

- In US's previous session, all major indices finished in the negative territory. The Dow, S&P500, and Nasdaq fell by 0.61%, 0.28% and 0.32% respectively. Interestingly, the Russell 2000 showed strength, finishing the day up by 0.40%.

- In Asia, we see mostly greens with Shanghai Composite and Hang Seng outperforming again, surging by 2.31% and 2.13% respectively. Nikkei trekked upwards by 1.10%.

- In Europe, gains were not as strong. FTSE up by 0.26% while the CAC and DAX are near flat in the positive territory.

- All major commodities continue their upside momentum with copper outperforming. Copper surged close to 1.6% while Gold and Silver climbed 0.51% and 0.84%.

Today Is the Last Day to Place Your Votes

- All 435 seats in the House of Representatives are up for election.

- One-third of the Senate seats are also on the ballot.

- Today is the last day to vote! Polls close at varying times across states, generally between 7:00 p.m. and 8:30 p.m. Eastern Standard Time, so be sure to check local polling hours.

- Polling data indicates a tight race between Trump and Harris. However, election betting markets show Trump with a slight edge, leading at 59% compared to Kamala Harris’s 49%. It’s shaping up to be an exciting day!

- Investors are closely watching the results, as both candidates are expected to bring significant policy shifts. If Trump wins, more tariffs on China could be anticipated.

Boeing Factory Strike Finally Ends

- Boeing factory workers have accepted a contract offer, ending their strike after more than seven weeks and allowing the company to resume production.

- The agreement includes a 38% wage increase over the next four years, along with ratification and productivity bonuses. Approximately 59% of voting members approved Boeing's fourth official offer.

- Despite the deal, Boeing did not reinstate the company pension plan that workers had demanded; this plan was frozen nearly a decade ago. Bank of America estimated that Boeing was losing about $50 million per day during the strike.

- CEO Kelly Ortberg expressed satisfaction with the agreement reached.

China Is Getting Vocal Today

- Chinese Premier Li Qiang expressed confidence in the government’s ability to revive the economy, highlighting room for fiscal and monetary measures to support the country’s 5% growth target.

- Recent data aligns with Li’s optimism, as industrial and retail sales have significantly outperformed estimates.

- In addition to Li’s comments, Chinese media criticized the U.S. presidential election, describing it as a showcase of financial waste and disorder.

- State and social media outlets have voiced concerns over the U.S. democratic system, alleging that big money influences politics and that practices like billionaire donors' involvement undermine the interests of ordinary people.

Latest Economic Data

- US factory orders have declined by 0.5% month-on-month, failing to meet consensus estimates of 0.40%.

- However, we are seeing strong vehicle sales data in the US. Total vehicle sales for the month of October was 16.2M, beating estimates of 15.60M. Total car sales and truck sales came in at 3.05M and 12.99M respectively, beating previous data of 2.98M and 12.78M.

- S&P Global Hong Kong Manufacturing PMI indicates an expansion with data coming in at 52.2 as compared to 50 previously. China's Caixin Services PMI also beat estimates; data came in at 52.0, beating estimates of 50.50.

- In Australia, the RBA decided to keep interest rate stagnant. No change in interest rate. Currently, rates are 4.35%.

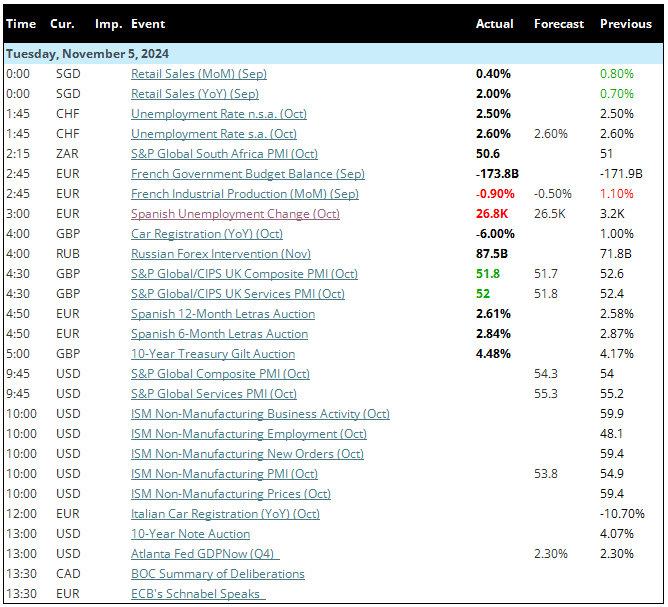

- In Europe, France's industrial production fell 0.9%, underperforming estimates of 0.50%. In addition, Spain posted an increase in unemployment by 26.8k as compared to estimates of 26.5k. That being said, UK's composite and services PMI outperformed and beat estimates, posting 51.8 and 52 respectively as compared to estimates of 51.7 and 51.8

- Later today, ECB's Lagarde is scheduled to speak at 9.30AM. United States will release key economic data such as Composite PMI and Services PMI at 9.45AM. Other manufacturing and non-manufacturing data from ISM will come at 10AM. All timings are Eastern Time, GMT-5.

Other Notable News

- Nintendo’s profit dropped by 69% due to weak Switch sales.

- Saudi Aramco reported a 15% decline in third-quarter profits but will continue its dividend payments.

- Trump Media shares rose on election day, fueled by hopes that a Trump victory would benefit the business.

- Restaurant Brands International, the parent of Burger King, fell short of revenue expectations.

- Meanwhile, Israel killed another 17 people in Gaza and continued its offensive in Lebanon.

- Myanmar’s military leader made his first visit to China since the coup.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.