LATAM Airlines (NYSE: LTM): Restructured, Recovered, and Ready to Fly Higher

We analyzed LATAM Airlines (LTM) post-NYSE relisting in July 2024 and found strong growth, fleet expansion, solid financials, and potential upside as key reasons to buy. We rate LTM as OUTPERFORM.

Executive Summary

LATAM Airlines (LTM) has demonstrated remarkable resilience and growth since emerging from Chapter 11 in 2022. Formed through the 2012 merger of Chile's LAN Airlines and Brazil's TAM Airlines, the company operates one of the most extensive networks across South America, North America, Europe, Oceania, and Africa, positioning itself as the largest airline conglomerate in Latin America. LTM relisted its ADSs on the New York Stock Exchange (NYSE) on 25th July 2025 2024 after the company delisted in June 2020 due to Chapter 11 restructuring.

We rate LATAM Airlines as OUTPERFORM based on the following factors:

-

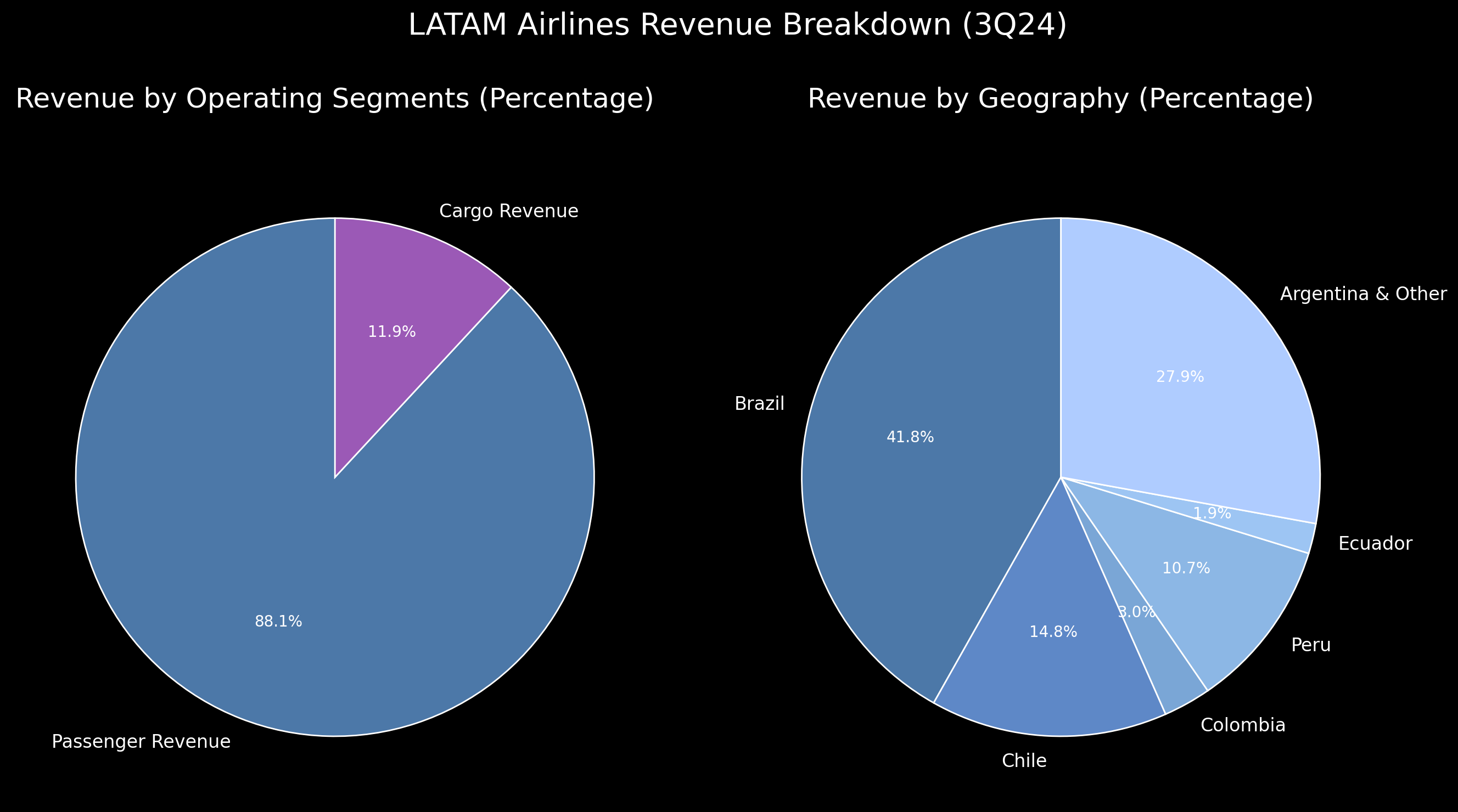

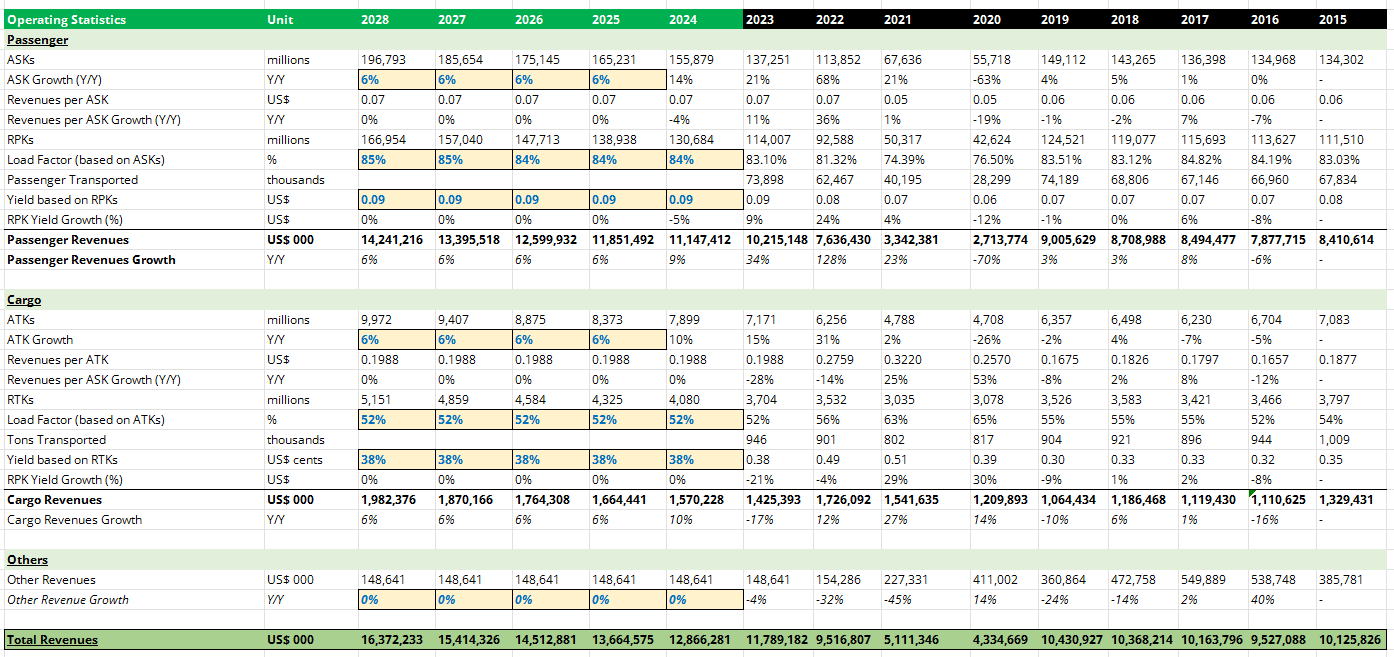

Strong Demand Indicators: LATAM’s passenger and cargo operations continue to expand, with over 74 million passengers transported across 148 destinations in 26 countries in 2023. Passenger revenues, which account for 88% of total income, grew by 6.27% YoY in 3Q24, while cargo revenues rose by 15.67% YoY.

-

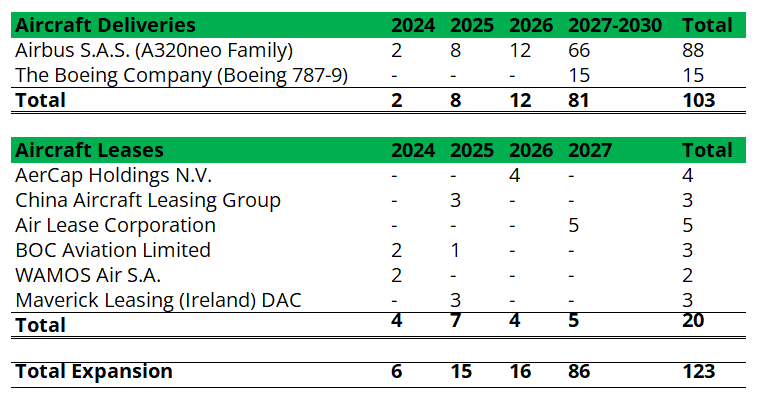

Fleet Expansion Driving Revenue Growth: With a fleet expected to grow from 334 aircraft to 418 by 2030, LATAM is on track for a 42% increase in revenue capacity (CAGR of 5.14%). Modern aircraft investments ensure operational efficiency and enhanced fuel savings, supporting long-term growth.

-

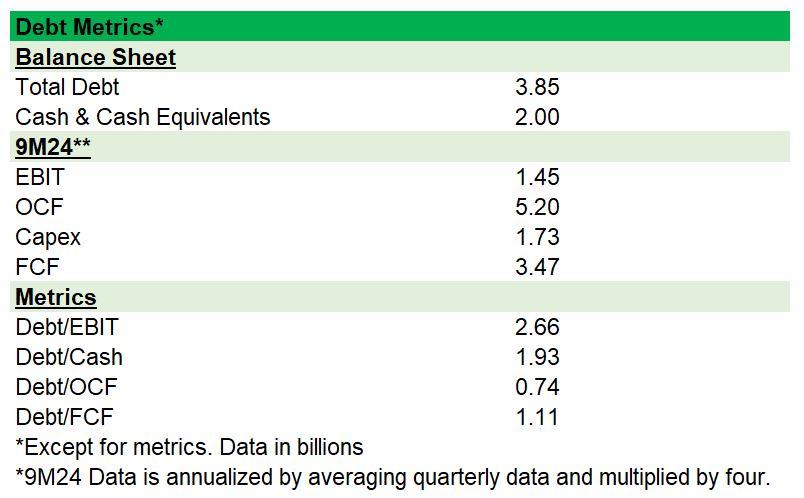

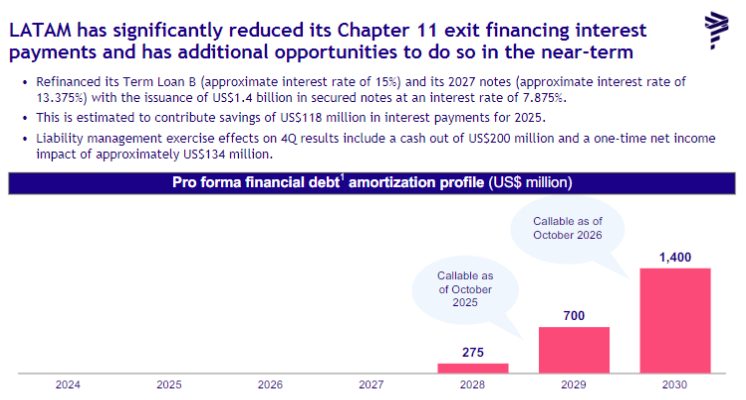

Solid Liquidity and Cash Flow Generation: LATAM maintains a manageable debt profile with interest-bearing liabilities at $3.85 billion and a strong cash position of $2 billion (Debt/Cash ratio of 1.93x). Strategic refinancing has further reduced interest costs, providing flexibility for debt servicing and shareholder returns through dividends and buybacks.

-

Underappreciated Long-Term Potential: Despite achieving net income and revenues above pre-COVID levels, market participants have yet to fully price in LATAM’s recovery and future potential. Valuation analysis suggests a potential upside of 34%, with an implied share price of $36.33 by FY2028.

Download the financial models and other materials used in this research here.

Company Overview: LATAM Airlines

LTM is the largest airline conglomerate in Latin America. The company was formed in 2012 through the merger between Chile's LAN Airlines and Brazil's TAM Airlines. LTM currently operates an extensive network across South America, North America, Europe, Asia, and Oceania.

LTM generates revenue from two different operations: (1) Passenger operations and (2) Cargo operations. In 2023, LTM's passenger operations have transported more than 74 million passengers and operates in 26 countries with 148 destinations across four continents in America, Europe, Oceania, and Africa. Passenger operations is the company's primary activity, representing more than 88% of the company's total revenues. For LTM's cargo operations, the company flies to 33 countries with close to 166 destinations. Cargo operations takes up about 12% of the company's total revenues.

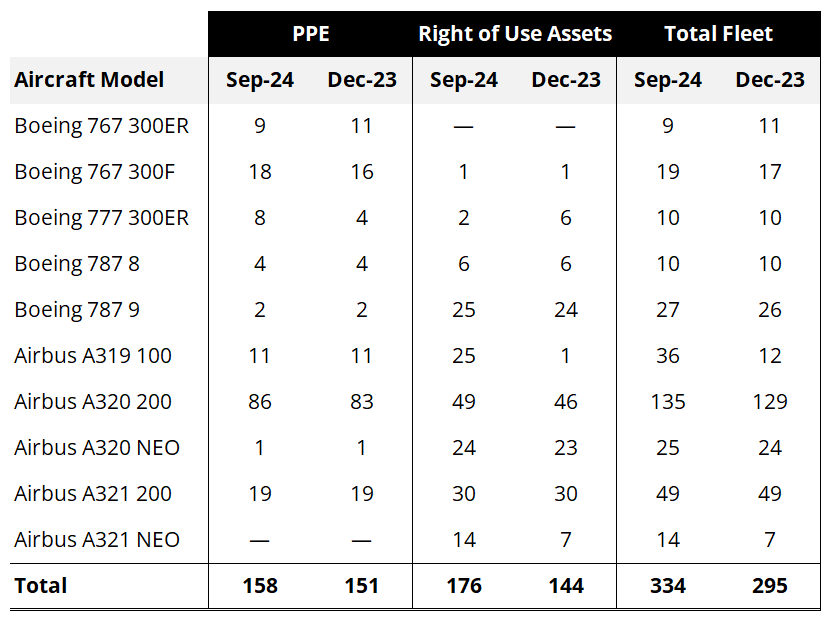

As of 3Q24, the company operates 334 aircrafts, comprising a mix of Boeing and Airbus models. The Boeing lineup includes 767s for both passenger and freighter services, 777-300ERs, and fuel-efficient 787 Dreamliners. Airbus aircraft dominate the short and medium-haul fleet, with a strong presence of A320-family aircraft, including the modern A320neo and A321neo for enhanced fuel efficiency and reduced emissions.

Latest Developments (3Q24)

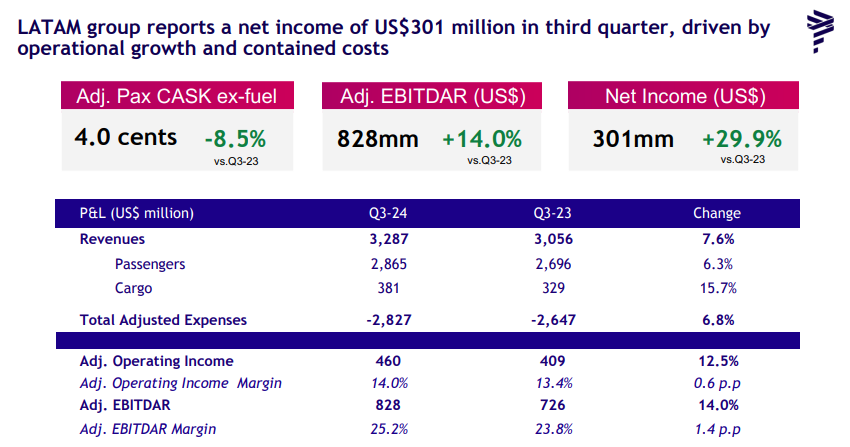

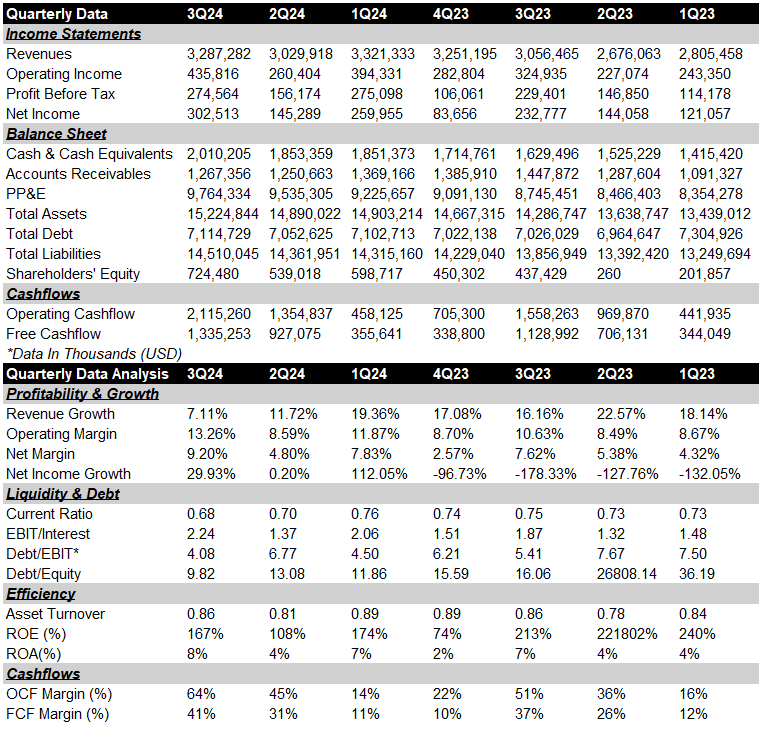

In 3Q24, LTM posted yet another strong set of results. The company generated $3.28 billion in revenues, representing a year-on-year growth of 7.55%. Across the company's segments, passenger revenues grew by 6.27% year-on-year while cargo and other revenues grew by 15.67% year-on-year and 31.67% year-on-year. Overall, demand indicators remain strong. In the latest quarter, LTM transported 21.1 million passengers as compared to 19.7 million passengers in the same period last year.

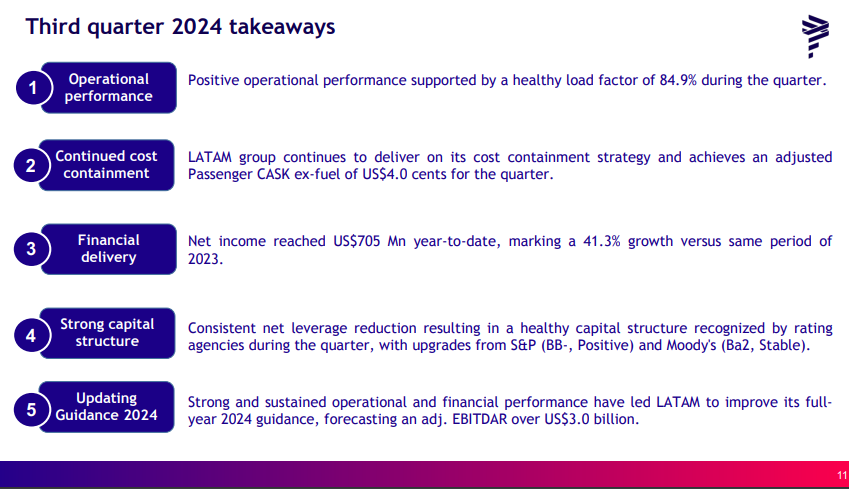

Total capacity has increased during this period with Available Seats Kilometers (ASK) surging by 15.1% as compared to the same period last year; Despite having higher capacity, LTM has managed to maintained its capacity utilization rates (i.e., Load Factor) at 84.9% as compared to 85.3% in the same period last year.

The airline continue to make progress in its cost optimization, total operating expenses (as % of revenues) improved to 86.7% as compared to 91.4% last quarter and 89.4% the same period last year. Cost per Available Seat Kilometer (CASK) fell by 9% year-on-year to 7 cent as compared to 7.7 cents in the same period last year. Reduction in costs can be attributable to relatively lower fuel expenses and rental and landing fees.

During this period, the company posted a net income of $301 million, representing a net income growth of 30% year-on-year and 107% quarter-on-quarter. For the second time in 2024, the company has updated its guidance. Currently, the company expects to generate an adjusted EBITDA of $3 billion for the year of FY2024.

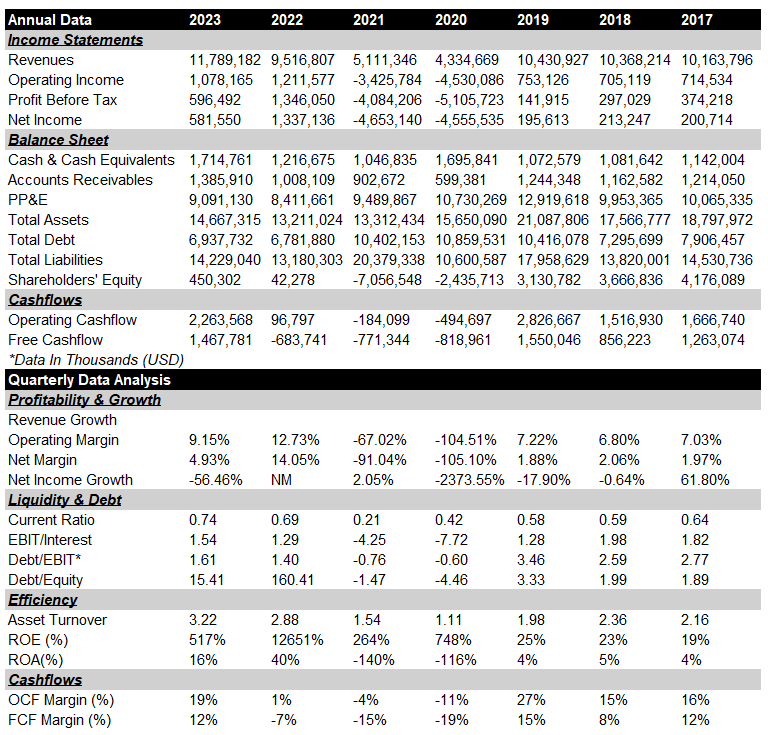

LTM Has Achieved A Remarkable Turnaround And Is Well Positioned For Continued Success

In 2020, LTM's passenger revenues plunged from $9 billion in the prior year to $2.7 billion while net income fell to -$4.56 billion. On 26th May 2020, LTM filed for Chapter 11 bankruptcy protection as the Covid-19 pandemic decimated the company's financials. However, after 29 months, LTM completed its restructuring under chapter 11 and managed to reduced its debt by about 35% with a liquidity of more than $2.2 billion.

Since then, LTM's performance has surpassed its pre-Covid performance. As of 2023, operating revenues and net income have surpass 2019 levels while retained earnings have re-entered the positive territory. Although ASKs (i.e., the company's operating capacity) are still below pre-Covid levels, it has largely recovered and is on track to surpass 2019 levels by the end of FY2024.

For first three quarters of 2024, LTM's passenger quarterly passenger revenues surged by 16.27% on average while cargo revenues increased by 18.59% year-on-year. Margins continue to improve as the company continue to reduce overall costs. Operating expenses as percentage of revenues for the first three quarters came in at 88.76% on average as compared to 90.74% as compared to the same period last year. Net income margin remains healthy at an average rate of 7.3% as compared to 5.8% in the same period last year.

Based on current demand indicators, LTM is likely to sustain its strong performance. Domestic capacity in Latin America has increased by 3.3% to 27 million seats while international capacity expanded by 6% to 14.2 million seats. Total passengers for the year is likely to increase 5.5% year-on-year to 773 million and 12.4% as compared to 2019 levels.

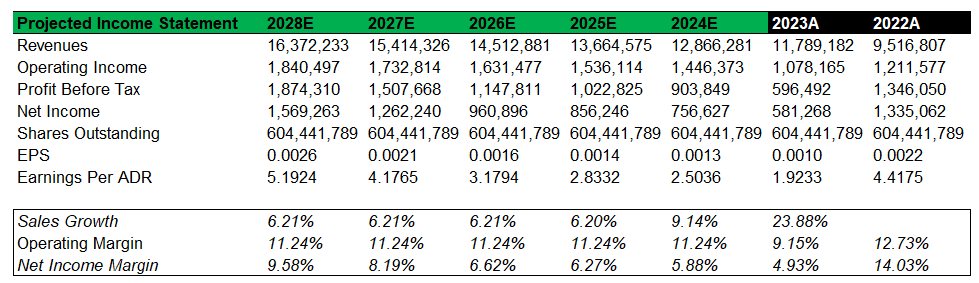

Looking ahead, we expect LTM's ASKs to increase 14% to 155 billion as compared to 137 billion in 2023. For FY2024, we expect LTM to post revenues of $12.8 billion, representing a 9.14% year-on-year growth. Revenue is primarily driven by higher capacity (i.e., ASKs and ATKs). Based on LTM's performance in the first three quarters, the company is ontrack to achieve an ASK and ATK growth rate of 14% and 10% respectively. After factoring declining and stagnating growth for revenues per ASKs and revenues per ATKs respectively, we still expect to see growth in the high single digits.

Fleet Expansion Plan is Projected to Boost Revenue Capacity by 42% by 2030.

Although LTM has only recently emerged from Chapter 11, it is important to note that the company is not merely scraping by. In fact, LTM is already gearing up for future growth. As of 3Q24, the company has 103 aircraft commitments with Boeing and Airbus through FY2030. Additionally, the company has signed leases with AerCap, Air Lease, and China Aircraft Leasing Group to have access to more aircrafts. For FY2024 and FY2025, LTM's fleet should expand by 6 and 15 aircrafts respectively. Through FY2030, the company's fleet is likely to grow by another 123 aircrafts.

Without account for any inflation, a quick revenue analysis will yield that LTM's fleet expansion will expand its revenue significantly. As of FY2030, LTM generates about $11.78 billion with 295 aircrafts, implying 39.96 million in revenues per aircraft. If LTM is able to receive all of these aircrafts by 2030, expanding its fleet size to 418 aircrafts, the company will be able to generate $16.7 billion which represents a revenue expansion of approximately 42% (CAGR of 5.14%).

Adequate Liquidity and Cashflow To Meet Debts And Return Value Through Dividends And Buybacks

Overall, our analysis suggests that LTM has a strong liquidity profile and is able to generate sustainable cashflows to provide value back to shareholders. In fact, LTM's debt is highly manageable. As of 3Q24, LTM's total interest bearing debt amounts to $3.85 billion. Total cash and cash equivalents is about 2 billion, representing Debt/Cash of 1.93x. Other metrics such as OCF, EBIT, and FCF also suggests that shareholders need not worry about the company's debt obligations.

We also do not expect to see any issues arising from the company's debt amortization. LTM has effectively managed its debt through strategic refinancing and eliminated refinancing risks until 2028 while reducing interest costs by securing favorable rates, saving approximately $118 million starting in 2025. Callable debt in 2025-2026 offers opportunities to optimize costs, reinforcing LATAM’s robust financial structure and reducing concerns over debt amortization.

From the latest earnings call, LTM expressed confidence in maintaining balance sheet strength and sustaining robust cash flows. While management has yet to decide on the exact mechanism for returning value to shareholders, their confidence in cash flow generation suggests that shareholder returns are likely on the horizon. This could materialize through higher dividend yields or a repurchase plan.

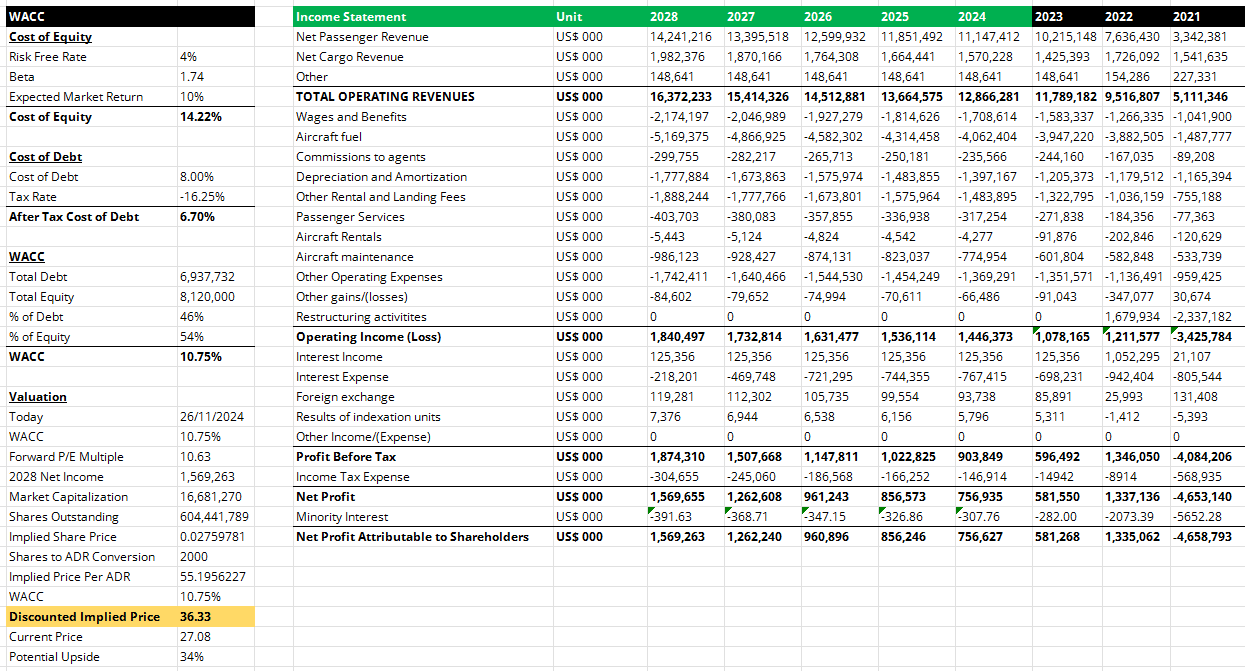

Valuation Analysis Suggests That Market Participants Have Yet to Factor in LTM's Long-Term Potential

To account for the long-term growth of LTM, we value the company based on its FY2028 net income. Based on the following assumptions: (1) LTM's overall margins from now through FY2028 remain stagnant and in-line with its TTM margins, (2) ASKs and ATKs grow at an average rate of approximately 7% a year, allowing LTM to generate a revenue of $16.37 billion, in-line with the company's fleet expansion plans, our analysis suggests that LTM is able to generate a net income of $1.57 billion in FY2028.

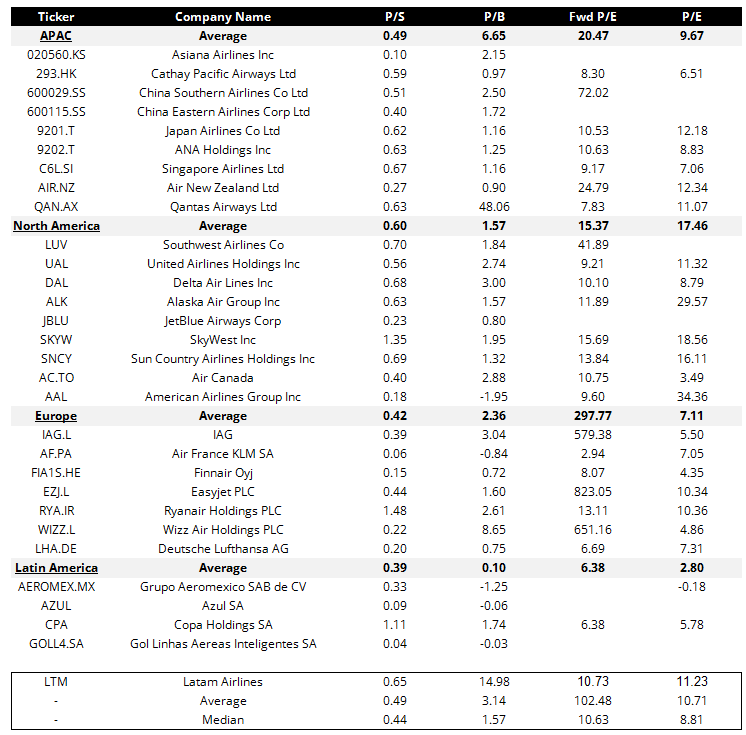

Currently, the airline industry trades at a forward price/earnings of 10.63x; applying 10.63x to LTM's net income of $1.57 billion will result in a market capitalization of $16.7 billion. After accounting for the company's shares outstanding and shares-to-ADR conversion, our valuation analysis suggests that the implied price per ADR is $55.19. We further discount the share price using a WACC of 10.63%, resulting in a implied ADR price of $36.33. Currently, LTM trades at $27.08, implying a potential upside of 34% exists for long-term investors.

Closing Remarks

LATAM Airlines has emerged stronger from its restructuring, with solid financial performance and a clear growth trajectory. However, investors should remain mindful of the risks associated with its operations. LATAM’s heavy reliance on debt financing for fleet expansion makes it vulnerable to rising interest rates and potential delays or cost overruns in aircraft procurement.

The company also faces economic and political volatility in key Latin American markets, where currency devaluations and shifting government policies could impact demand and profitability. Additionally, rising competition from low-cost carriers in the region, exposure to fuel price volatility, and evolving environmental regulations pose challenges to maintaining margins and market share.

Considering its recovery trajectory, expanding capacity, robust cash flow generation, and promising growth outlook, we rate LATAM Airlines as OUTPERFORM, underscoring our confidence in its potential to drive long-term shareholder value and seize growth opportunities in the dynamic Latin American aviation market.

Financial Summary & Analysis (Projected)

Financial Summary & Analysis (Quarterly)

Financial Summary & Analysis (Annual Data)

Comparable Companies Analysis

Disclaimer

We have no stock, option, or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. This article is written solely by us and reflects our own opinions. We are not receiving compensation from any third party for this article and have no business relationship with any company mentioned.

Past performance is no guarantee of future results. No recommendation or advice is being provided regarding the suitability of any investment for a particular investor. Any views or opinions expressed are solely those of Seven Insights and do not reflect the views of any external organization. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.

All information provided by Seven Insights is intended solely for general informational purposes. We do not take into account individual financial goals or situations and do not provide personalized investment advice.