Israel-Hezbollah Truce, Hong Kong Financial Scrutiny, Xiaomi's Chip Ambitions, and Market Reactions

Trump’s tariff threats, Tesla’s exclusion from California EV credits, progress on an Israel-Hezbollah ceasefire, Hong Kong’s financial scrutiny, and Xiaomi’s bold chip ambitions.

Good morning! It’s Ryosuke. Today’s edition dives into Trump’s tariff threats, Tesla’s exclusion from California EV credits, progress on an Israel-Hezbollah ceasefire, Hong Kong’s financial scrutiny, Xiaomi’s bold chip ambitions, and the latest market movements. Let’s jump in!

Trump Roils Markets With Tariff Threat

- Early Test for Xi: Trump’s 10% tariff threat on Chinese goods is seen as an opening move to gauge President Xi Jinping’s willingness to cooperate with the new administration. Analysts warn this could escalate into a broader standoff between the world’s two largest economies.

- Diplomatic Pushback: China defended its counter-narcotics progress and dismissed Trump’s accusations, with officials emphasizing that "no one wins a trade war." Beijing hinted at a cautious initial response while strategizing its long-term approach to US-China relations.

- Rising Trade Tensions: Trump’s threats extend beyond China, with 25% tariffs proposed for Mexico and Canada, citing border security and fentanyl trafficking. Markets reacted sharply, with currencies in Canada, Mexico, and China weakening.

- Strategic Constraints: Facing economic fragility, China is likely to adopt a restrained strategy, focusing on global partnerships and avoiding tit-for-tat measures that could exacerbate tensions. Experts suggest Beijing will aim to counterbalance Trump’s aggressive moves with offers of “win-win” cooperation.

Tesla Excluded From California EV Credits

Photo by Prometheus 🔥 / Unsplash

- No Rebates for Tesla: California Governor Gavin Newsom proposed reintroducing state EV rebates if Trump repeals the federal $7,500 tax credit. However, Tesla’s popular models would be excluded under market-share limits, sparking backlash from Elon Musk, who called the plan “insane.”

- Political Tensions: The proposal pits Newsom, a Democratic presidential hopeful, against Musk, a Republican ally and key figure in Trump’s transition team. This marks a continuation of their strained relationship, worsened after Tesla moved its headquarters to Texas in 2021.

- Market Impact: Tesla, which still accounts for over half of California’s EV sales, faces growing competition as its market share in the state dropped from 63% to 54.5% year-over-year. Overall EV sales in California rose 1% during the same period.

- Broader Implications: Newsom’s proposal reflects California’s push to promote EV adoption through diverse automakers while safeguarding its climate policies against Trump’s incoming administration, which plans to roll back fuel-efficiency standards and EV subsidies.

Israel and Hezbollah Near Ceasefire Deal

Photo by Robert Bye / Unsplash

- Ceasefire Talks Progress: Israel and Hezbollah are close to a 60-day truce mediated by the US and France, with Israel's security cabinet likely to approve the deal. The ceasefire would see Hezbollah moving north of the Litani River and halting Iranian weapon shipments.

- Ongoing Violence: Despite negotiations, hostilities continue, with Hezbollah launching 250 rockets on Sunday and Israel responding with airstrikes in southern Lebanon. Both sides remain cautious about finalizing terms.

- Political Tensions: The proposed truce faces opposition within Israel’s far-right coalition, while Lebanon and Hezbollah push back on Israel's demand for resumed strikes in case of infractions.

- Humanitarian Toll: Two months of conflict have killed 2,500 people in Lebanon, displaced over 1.2 million, and left northern Israeli communities unable to return home, underscoring the urgency of an agreement.

Hong Kong Branded a ‘Global Leader’ in Financial Crime

Photo by Florian Wehde / Unsplash

- US Concerns Escalate: US lawmakers accused Hong Kong of facilitating financial crimes tied to China, Russia, Iran, and North Korea, citing its role in sanctions evasion and illicit trade. This comes amid strained ties following Beijing’s 2020 national security law.

- Allegations of Illicit Activity: A letter to Treasury Secretary Janet Yellen highlighted Hong Kong's involvement in providing Russia access to Western technology, aiding Iranian oil sales, and enabling North Korea’s illegal trade. Approximately 40% of shipments to Russia from Hong Kong reportedly included sanctioned goods.

- Policy Reevaluation: Lawmakers questioned the appropriateness of US financial ties to Hong Kong, with potential penalties under discussion, including the closure of Hong Kong’s economic offices in the US.

- Defensive Stance: Hong Kong officials dismissed the allegations, asserting compliance with UN sanctions, while warning of repercussions for American businesses if punitive measures proceed.

Xiaomi Readies In-House Mobile Chip

Photo by Alejandro Morgado / Unsplash

- Challenging the Giants: Xiaomi plans to launch its self-designed mobile processor in 2025, reducing reliance on Qualcomm and MediaTek while aiming to gain a competitive edge in the crowded Android market.

- Strategic Move: The chip initiative aligns with Beijing's push for technological self-sufficiency and strengthens Xiaomi’s position amid growing US-China tech tensions.

- Broad Applications: Beyond smartphones, Xiaomi’s in-house chips could enhance its connected EVs, marking another step in its diversification strategy following significant investments in electric vehicles.

- R&D Surge: Xiaomi will increase R&D spending to 30 billion yuan ($4.1 billion) in 2025, focusing on chips, AI, and operating systems, as the company sharpens its competitive edge across tech verticals.

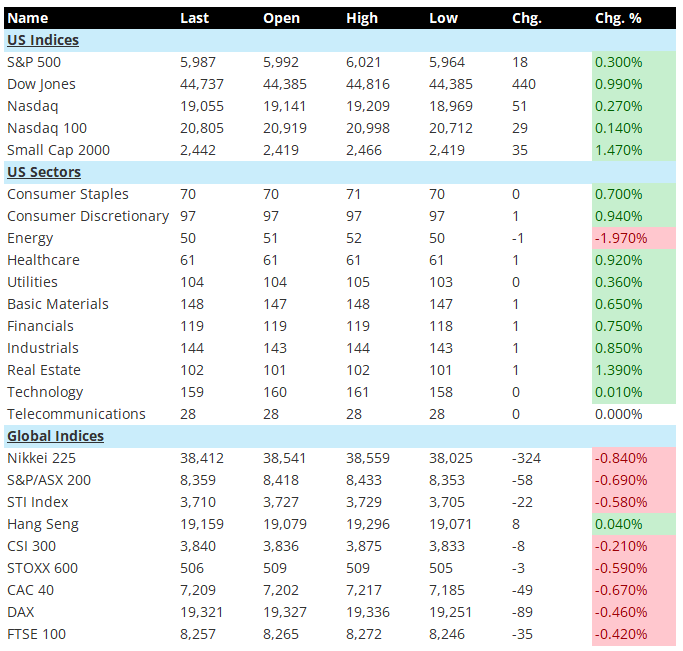

Latest On Global Markets

-

US Futures: Indices are currently flat. S&P 500 futures are flat at 0.02%, while Dow futures remain unchanged at 0.00%.

-

US Indices (Previous Session): We saw strength during the previous US session. The S&P 500 rose by 0.30%, the Dow Jones surged by 0.99%, and the Nasdaq gained 0.27%. Small Caps led the charge, climbing 1.47%.

-

US Sectors (Previous Session): All sectors rallied except for Energy. Consumer Discretionary rose 0.94%, and Healthcare added 0.92%, while Energy lagged, falling 1.97%. Real Estate showed notable strength with a gain of 1.39%.

-

Asia: Asian markets closed mostly in the red. The Nikkei 225 dropped by 0.84%, the S&P/ASX 200 fell 0.69%, and the STI Index lost 0.58%. The Hang Seng managed a slight gain of 0.04%, while the CSI 300 slipped 0.21%.

-

Europe: European markets posted losses. The STOXX 600 fell 0.59%, the DAX dropped 0.46%, the CAC 40 slid 0.67%, and the FTSE 100 declined by 0.42%.

-

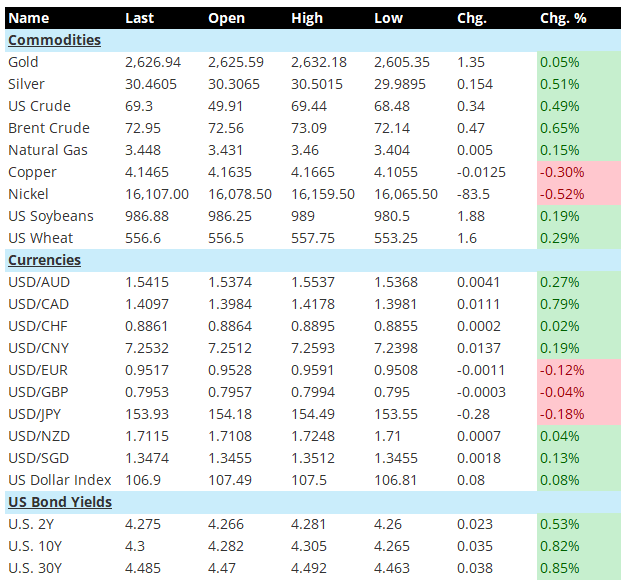

Commodities: Mixed movements in commodities. Gold edged up by 0.05%, and Silver rose 0.51%. US Crude gained 0.49%, while Brent Crude climbed 0.64%. Copper fell by 0.30%, and Nickel dropped 0.52%.

-

Currencies: The US Dollar Index strengthened slightly by 0.08%. The dollar gained 0.29% against the yuan and 0.02% against the Australian dollar, while losing 0.03% against the yen and 0.12% against the euro.

-

US Bond Yields: Treasury yields increased. The 10-year yield rose by 3.5 basis points to 4.3%, while the 30-year yield climbed by 3.8 basis points to 4.485%.

Economic Data Today

- 9:00 AM ET: US FHFA house price index month-on-month in September (estimated to be 0.3%, previous value is 0.3%).

- 9:00 AM ET: U.S. S&P CoreLogic Case-Shiller 20-city house prices in September year-on-year (estimated to be 4.7%, previous value was 5.2%).

- 10:00 AM ET: U.S. October new home sales seasonally adjusted annual rate (estimated to be 725,000, previous value is 738,000).

- 10:00 AM ET: U.S. November Conference Board Consumer Confidence Index (estimated at 111.8, previous value at 108.7).

- 10:00 AM ET: US November Richmond Fed Manufacturing Index (estimated to be -11, previous value -14).

- 3:00 AM ET: Speech by Villeroy, Governor of the Bank of France and ECB Governing Council.

- 2:00 PM ET (on Nov 27): The Federal Reserve releases the minutes of the November monetary policy meeting.

Other Notable News

-

Trump Case Dismissal: The U.S. Department of Justice, adhering to the policy of not prosecuting sitting presidents, halted its criminal case against Trump. A judge approved the withdrawal.

-

Rate Cuts Advocacy: Chicago Fed President Austan Goolsbee urged further rate cuts unless economic overheating occurs.

-

ECB’s Gradual Rate Cuts: The ECB’s chief economist emphasized a cautious approach to rate cuts, echoed by Germany's central bank president, who warned against rapid reductions.

-

Bank of England Caution: Deputy Governor Lombardelli called for careful rate cuts due to concerns that wage growth and inflation may persist longer than expected.

-

Barclays Optimism: Barclays strategists project the S&P 500 will climb to 6,600 points by late next year, supported by favorable macroeconomic conditions and investor positioning.

-

Dollar Forecast: Morgan Stanley predicts the dollar will peak by year-end, entering a bear market in 2025. The yen and Australian dollar are expected to perform strongly, influenced by contrasting interest rate policies in Japan and Australia.

-

UniCredit’s Acquisition Plans: UniCredit proposed a €10 billion all-stock acquisition of Banco BPM, expanding its acquisition strategy alongside its pursuit of Commerzbank.

-

Anglo American Asset Sale: Anglo American announced the sale of its steelmaking coal business to Peabody Energy for up to $3.78 billion, accelerating its restructuring efforts.

-

HSBC Leadership Shakeup: HSBC’s new CEO Achille Arbridge unveiled a series of executive management changes as part of ongoing restructuring.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.