Israel-Hezbollah Truce, Fed Rate Cut Signals, and China's Military Turmoil

Trump’s new economic team and their aggressive trade policies, a US-brokered cease-fire between Israel and Hezbollah, the Fed’s cautious approach to rate cuts, and corruption scandals disrupting China’s military leadership.

Good morning! It’s Ryosuke. Today’s developments revolves around Trump’s latest economic team appointments and their aggressive trade strategies, a US-brokered Israel-Hezbollah cease-fire amid rising tensions, the Federal Reserve’s cautious stance on rate cuts, and corruption scandals shaking China’s military leadership. Let’s dive in!

Hassett Joins Trump's Economic Team, Greer Appointed Trade Chief

Photo by Natilyn Photography / Unsplash

Strategic Decoupling from China: Jamieson Greer, nominated as US Trade Representative, is a staunch advocate for reducing economic dependence on China. He proposes revoking China’s permanent normal trade relations (PNTR) status and imposing higher tariffs, aiming to categorize Beijing alongside nations like North Korea and Russia. Greer has emphasized that “strategic decoupling” may cause short-term pain but is necessary to counter China’s long-term economic and strategic threats.

Aggressive Trade Policies: Greer’s roadmap includes stricter customs rules to prevent Chinese companies from bypassing tariffs, expanded export controls targeting critical industries, and laws to shield US firms from Chinese retaliation. His approach reflects Trump’s tariff-heavy agenda, including plans for sweeping levies—25% on Canadian and Mexican imports and 10% on Chinese goods.

Economic Team Bolstered: Kevin Hassett, a veteran of Trump’s first term, will lead the National Economic Council, focusing on reviving 2017 tax cuts and expanding incentives for critical sectors like semiconductors and pharmaceuticals. Hassett has vowed to counteract inflation and renew Trump’s tax reforms to support American families.

Policy Priorities Take Shape: With nearly two months before inauguration, Trump has outlined a dual strategy of boosting domestic manufacturing through tariffs and subsidies while reducing the federal deficit by cutting $2 trillion in spending. This hardline economic plan signals a return to Trump’s combative trade policies and tax-focused governance.

Israel and Hezbollah Agree to Cease-Fire Amid Rising Tensions

Photo by Chris Liverani / Unsplash

60-Day Truce Begins: Israel and Hezbollah have agreed to a US-brokered cease-fire, ending weeks of escalating violence that left thousands dead and over a million displaced. The truce, effective immediately, includes provisions for Hezbollah to withdraw fighters from the border region and for UN peacekeepers to patrol southern Lebanon.

US Push for Regional Stability: President Biden hailed the agreement as a step toward calming tensions across the Middle East. The truce is part of broader US efforts to secure a cease-fire in Gaza and restart peace initiatives, including normalizing ties between Israel and Saudi Arabia.

Hezbollah’s Setback: The Iran-backed militant group suffered significant losses, with much of its arsenal depleted by Israeli strikes. Despite initial demands for Gaza’s conflict to end before agreeing to a truce, Hezbollah conceded as its military capabilities eroded.

Skepticism Remains: Hardline critics in Israel and Lebanon question the cease-fire’s durability. Israeli Prime Minister Netanyahu emphasized that any violations by Hezbollah would prompt immediate retaliation, while concerns linger over the long-term stability of the border region.

Fed Signals Caution on Rate Cuts Amid Cooling Inflation

Photo by Alexander Grey / Unsplash

Gradual Cuts Preferred: Federal Reserve officials emphasized a cautious approach to interest-rate reductions, citing persistent inflation risks and uncertainty over the neutral rate. Minutes from the November meeting highlighted that gradual policy easing is appropriate as inflation moves closer to the 2% target.

Labor Market Stability: Officials noted that employment risks have “decreased somewhat,” with no signs of rapid deterioration in the labor market. Despite disruptions from strikes and hurricanes, the job market remains solid, though gradually cooling.

Inflation Still Elevated: While inflation has eased from its peak, core price measures remain above target levels. Policymakers warned that achieving sustained progress could take longer than anticipated.

Unclear Neutral Rate: The Fed flagged ambiguity around the neutral interest rate as a factor complicating decisions. Officials are considering technical adjustments to monetary tools, including the overnight reverse repurchase facility, to refine their approach.

Policy Outlook: The November rate cut, reducing the benchmark to 4.5%-4.75%, may be followed by a pause if inflation remains sticky. However, accelerated cuts are possible if the economy or labor market weakens significantly.

China Defense Minister Under Corruption Investigation, Reports Say

Photo by Kayla Kozlowski / Unsplash

Fresh Scandal in the PLA: Admiral Dong Jun, China’s defense minister, is reportedly under investigation for corruption, marking the latest upheaval in the People’s Liberation Army. The probe follows the ousting of Dong’s two predecessors for graft amid a sweeping anti-corruption campaign targeting military procurement since 2017.

Xi’s Leadership Questioned: Dong’s potential downfall less than a year into his role raises concerns over President Xi Jinping’s vetting process. Xi’s aggressive anti-corruption drive aims to modernize the military, but the scandals expose deep-seated challenges within the PLA.

Impact on Military and Diplomacy: Dong, the first defense minister from China’s navy, had eased tensions with the US by resuming talks with Defense Secretary Lloyd Austin. His investigation adds strain to an already fragile US-China relationship and could complicate Beijing’s strategic focus on Taiwan and the South China Sea.

Broader Implications: The corruption purge, including senior Rocket Force figures, highlights instability in key military departments critical to China’s Taiwan ambitions. As Xi pushes for a modernized force by 2027, these disruptions threaten to undermine his military and geopolitical goals.

Latest On Global Markets

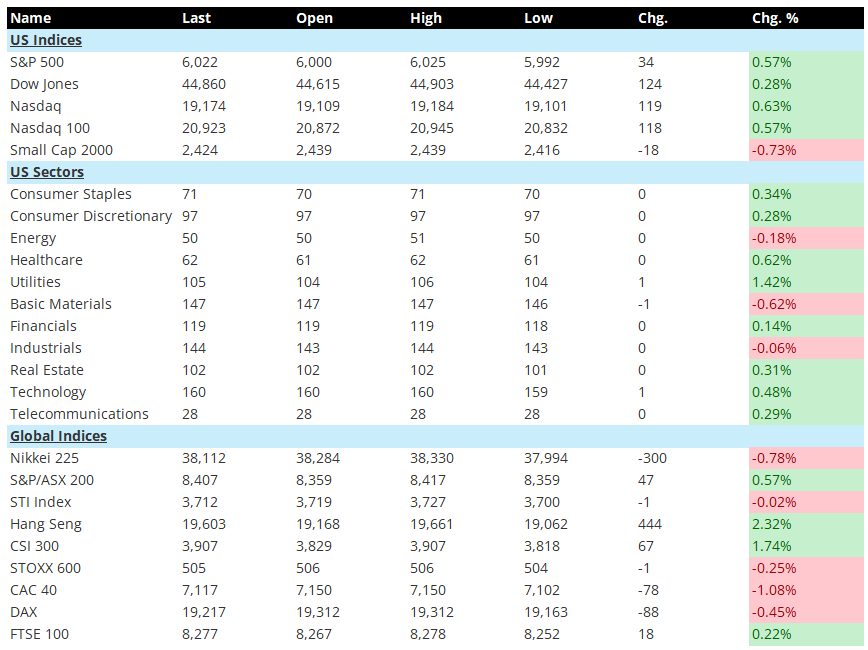

US Futures: Indices are currently down. Dow Jones futures are down 0.11%, and S&P 500 futures are down 0.21%.

US Indices (Previous Session): The US markets saw mixed performance. The S&P 500 rose by 0.57%, the Dow Jones added 0.28%, and the Nasdaq gained 0.63%. The Nasdaq 100 climbed 0.57%, while the Small Cap 2000 lagged, falling 0.73%.

US Sectors (Previous Session): Sector performance was mixed. Utilities led gains, rising 1.42%, followed by Healthcare at 0.62%. Technology added 0.48%. However, Basic Materials dropped 0.62%, and Energy edged lower by 0.18%.

Asia: Asian markets displayed mixed results. The Nikkei 225 fell 0.78%, while the S&P/ASX 200 gained 0.57%. The STI Index was flat, losing 0.02%. Meanwhile, the Hang Seng surged 2.32%, and the CSI 300 climbed 1.74%.

Europe: European markets posted losses. The STOXX 600 slipped 0.25%, the CAC 40 fell 1.08%, and the DAX declined 0.45%. The FTSE 100 bucked the trend, gaining 0.22%.

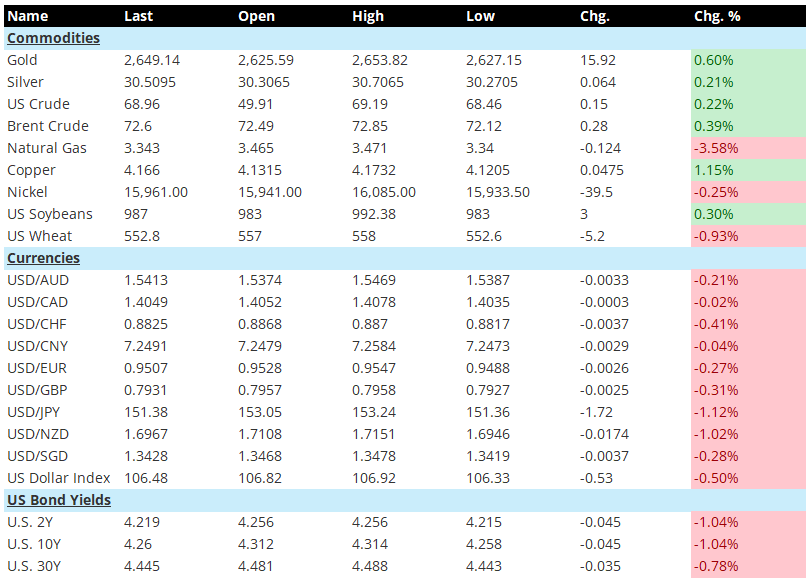

Commodities: Precious metals showed strength, with Gold rising 0.60% to $2,649.14 and Silver gaining 0.21% to $30.5095. US Crude edged higher by 0.22% to $68.96, and Brent Crude climbed 0.39% to $72.60. In contrast, Natural Gas dropped sharply by 3.58%, closing at $3.343. Copper showed notable strength, up 1.15%, while Nickel fell 0.25%.

Currencies: The US Dollar weakened against major currencies. USD/JPY saw the largest decline, down 1.12% to 151.38. USD/NZD dropped 1.02%, and USD/GBP fell 0.31%. The US Dollar Index slipped 0.50% to 106.48, reflecting a broad decline.

US Bond Yields: Yields decreased across the board. The 2-year yield dropped by 4.5 basis points to 4.219 (-1.04%), the 10-year yield fell to 4.26 (-1.04%), and the 30-year yield declined by 3.5 basis points to 4.445 (-0.78%).

Economic Data Today

8:30 AM ET: The revised annualized quarter-on-quarter GDP growth rate for Q3 in the US is expected to hold steady at 2.8%, matching the initial estimate.

8:30 AM ET: Revised Q3 GDP personal consumption growth in the US is projected to remain at 3.7%, unchanged from the initial estimate.

8:30 AM ET: The revised annualized GDP price index for Q3 in the US is anticipated to align with the initial estimate of 1.8%.

8:30 AM ET: The core GDP price index for Q3 in the US, on a revised annualized basis, is expected to remain at 2.2%, consistent with the initial figure.

8:30 AM ET: October’s advance goods trade balance for the US is estimated to show a reduced deficit of $102.4 billion, down from the prior deficit of $108.7 billion.

8:30 AM ET: Preliminary data for US durable goods orders in October is expected to increase by 0.5%, following a decline of -0.7% previously.

8:30 AM ET: Initial jobless claims in the US for last week are forecast at 215,000, slightly higher than the prior week’s 213,000.

10:00 AM ET: US personal income for October is projected to rise by 0.3%, in line with the previous month’s increase.

10:00 AM ET: US personal spending in October is expected to grow by 0.4%, slightly below September’s 0.5% increase.

10:00 AM ET: The core personal consumption expenditures (PCE) price index for October in the US is estimated to rise by 0.3%, unchanged from September’s rate.

10:00 AM ET: October’s pending home sales in the US are expected to decline by 2% month-on-month, following a 7.4% surge in September.

1:00 PM ET (on Nov 28): ECB Chief Economist Lane is scheduled to deliver a speech.

Other Notable News

The minutes revealed that Fed officials are weighing a "technical adjustment" to the overnight reverse repurchase rate to align it with the lower bound of the benchmark interest rate range.

Mexico's president suggested possible retaliatory measures in response to Trump’s tariff threats, warning of severe economic repercussions.

The Conference Board reported that U.S. consumer confidence in November reached its highest level in over a year, driven by economic and job market optimism following Trump's election victory.

U.S. housing market activity cooled, with house price growth slowing in September and October's new home sales hitting a near two-year low.

Political turmoil in France pushed a key debt risk gauge to its highest level, as disputes over the country’s budget add to mounting challenges.

Japanese Prime Minister Shigeru Ishiba called on businesses to continue raising wages to support stable inflation and economic growth while addressing rising living costs.

Reports indicate that major OPEC+ countries are discussing delaying the planned crude oil production increase scheduled for January, potentially pushing it back by several months.

The UK is considering further easing restrictions on banker bonuses as part of efforts to enhance its global financial competitiveness.

Russia's Defense Ministry announced preparations for a response to Ukraine’s recent attacks using U.S.-supplied missiles against air defense systems.

The U.S. government plans to allocate $7.9 billion in federal grants to Intel to strengthen domestic semiconductor manufacturing.

French Cognac workers’ strike led to a significant win, with Hennessy halting plans to test Cognac bottling in China to bypass tariffs.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.