Intel Says Goodbye to Pat Gelsinger, Spacex's 350 Bn Valuation

Intel’s CEO steps down, Musk challenges OpenAI. U.S. manufacturing surprises, and central banks signal rate cuts. Markets react to oil output and rising uncertainty.

Hello, it's Ryosuke. Today’s key updates: Intel’s CEO steps down, Musk challenges OpenAI. U.S. manufacturing surprises, and central banks signal rate cuts. Markets react to oil output and rising uncertainty.

Intel’s CEO Departure Opens Door for New Deal Opportunities

Leadership Change Sparks Fresh Deal Speculation: Intel’s CEO Pat Gelsinger’s departure has reopened discussions about potential strategic options for the company, including the possibility of breaking up its operations—a scenario Gelsinger had previously rejected. The board, with the help of financial advisors like Morgan Stanley and Goldman Sachs, is now exploring new avenues, potentially leading to divestitures or acquisitions.

Potential Deals and Divestitures:

-

Splitting Intel’s Operations: One possibility under consideration is separating Intel’s manufacturing and product-design divisions. While the foundry business has struggled to become profitable, Intel could find buyers for its product division, though this would complicate efforts to secure federal funding under the U.S. Chips and Science Act.

-

Acquisition by Qualcomm or Broadcom: Qualcomm, which had previously explored acquiring Intel, could now consider purchasing Intel’s product business. Broadcom, despite past discussions, is currently not pursuing an Intel deal due to ongoing integration efforts. Any large merger would face significant regulatory hurdles.

-

Selling Altera: Intel could look to sell its Altera unit, a key acquisition from 2015, which has attracted interest from private equity firms like Francisco Partners and Bain Capital. Lattice Semiconductor is also considering a bid, adding further momentum to the sale discussions.

-

Investment from Apollo: Apollo Global Management, which had previously expressed interest in investing in Intel, may re-enter discussions, particularly after its $11 billion deal with Intel’s chip plant in Ireland earlier this year.

-

Mobileye Stake Sale: Intel could consider selling its majority stake in Mobileye, a self-driving tech company it acquired in 2017. Though Intel has not made a decision yet, the potential sale of its 88% stake could recoup some of the $15 billion Intel paid for the business, which now has a market value of $14.1 billion.

Outlook for Intel’s Future: With Gelsinger’s departure, Intel is reassessing its strategic direction, and these potential deals could reshape the company’s future in the semiconductor industry. However, any major restructuring or sale will require careful consideration of regulatory, financial, and operational risks.

Vietnam Tycoon’s Death Penalty Appeal Rejected Amid Fraud Scandal

Appeal Rejected: Truong My Lan, the former chairwoman of Van Thinh Phat Group, has lost her appeal against the death sentence for orchestrating Vietnam's largest-ever fraud scandal, resulting in the embezzlement of $12.3 billion. The court upheld the ruling, citing the significant and far-reaching consequences of the crime.

Potential for Sentence Reduction: While the death sentence stands, Lan could still have it commuted if she repays at least three-quarters of the embezzled amount and cooperates with authorities. She may also petition for a pardon from President Luong Cuong. Legal options remain as her team negotiates investments and loans to settle her massive debts.

Crackdown on Corruption: Lan’s case has become a symbol of Vietnam’s broader anti-corruption efforts. The Communist Party’s “blazing furnace” campaign, aiming to target high-profile corruption, has led to the detention of numerous officials and business leaders, highlighting the government’s commitment to tackling systemic issues.

Economic and Social Implications: The case’s severity underscores risks in Vietnam’s booming real estate sector and may influence future foreign investments. Lan’s sentencing draws global attention to the intersection of political power, corruption, and economic growth in the country.

SpaceX Considers Tender Offer at $350 Billion Valuation

Photo by Sven Piper / Unsplash

Valuation Surge: SpaceX is in talks to sell insider shares that could raise the company’s valuation to approximately $350 billion. This would mark a significant increase from the previously considered $255 billion valuation, further solidifying SpaceX as the world’s most valuable private startup.

Rising Valuation Reflects Musk’s Success: The potential valuation jump highlights the massive growth of SpaceX, alongside the broader success of Elon Musk’s ventures. SpaceX was valued at $210 billion in a tender offer earlier this year. The move is seen as a reflection of Musk’s empire’s growth, especially following Tesla’s 42% stock surge since November.

Secondary Offering Provides Liquidity: The tender offer allows SpaceX employees and early investors to sell shares, providing liquidity within the privately held company. This comes amid growing ties between Musk and President-elect Trump, which may impact market sentiment.

SpaceX's Market Position: At a $350 billion valuation, SpaceX would be among the largest companies globally, rivalling major publicly traded corporations in market capitalization, reflecting its prominence in the space industry.

Speculation Surrounds RBI Governor Amid Economic Slowdown

Photo by Martin Jernberg / Unsplash

Pressure on Governor Das: The recent GDP growth miss, with India’s economy expanding only 5.4% in Q3, has intensified speculation over the future of Reserve Bank of India (RBI) Governor Shaktikanta Das. Despite expectations for his reappointment, his term is set to expire next week, and the government has yet to clarify his position.

Rate Cut Expectations Rise: The underwhelming economic growth, coupled with rising inflation, has sparked calls for a rate cut. Economists are split on whether the RBI will act now or wait until February. A rate cut is seen as critical to stimulate growth, with many fearing that delays could require deeper cuts later.

Monetary Policy Challenges: The uncertainty surrounding Das’s tenure, combined with the evolving composition of the RBI’s monetary policy committee, is heightening concerns over the central bank’s ability to navigate the economic slowdown. With inflation pressures still high, there are growing concerns that the RBI is not doing enough to support the economy.

Future of India’s Growth Prospects: The GDP miss has led to downward revisions of growth estimates, with some analysts now forecasting a 6% growth rate for FY 2025, below the RBI’s previous 7% projection. This slowdown is casting a shadow over India’s appeal as a high-growth economy for global investors, further complicating the central bank’s decision-making ahead of a potential leadership change.

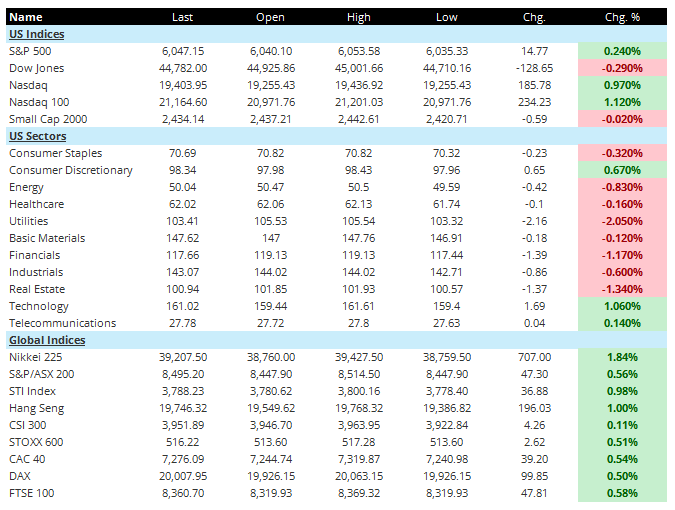

Latest On Global Markets

US Futures: Futures are mixed, with Dow Jones futures down 0.03%, while S&P 500 futures are up 0.03%.

US Indices (Previous): The Nasdaq 100 outperformed, rising 1.12%, followed by the Nasdaq with a 0.97% gain. The S&P 500 advanced 0.24%, while the Dow Jones slipped 0.29%. The Small Cap 2000 remained mostly flat, down 0.02%.

US Sectors (Previous): Technology led the gains, up 1.06%, followed by Consumer Discretionary with a 0.67% increase. Telecommunications edged up 0.14%. Utilities posted the steepest loss, down 2.05%, with Real Estate and Financials declining 1.34% and 1.17%, respectively.

Global Indices: The Nikkei 225 gained 1.84%, and the Hang Seng rose 1.00%. The STI Index advanced 0.98%, while the S&P/ASX 200 climbed 0.56%. In Europe, the CAC 40 was up 0.54%, the STOXX 600 added 0.51%, and the FTSE 100 increased 0.58%. The DAX posted a smaller rise of 0.50%.

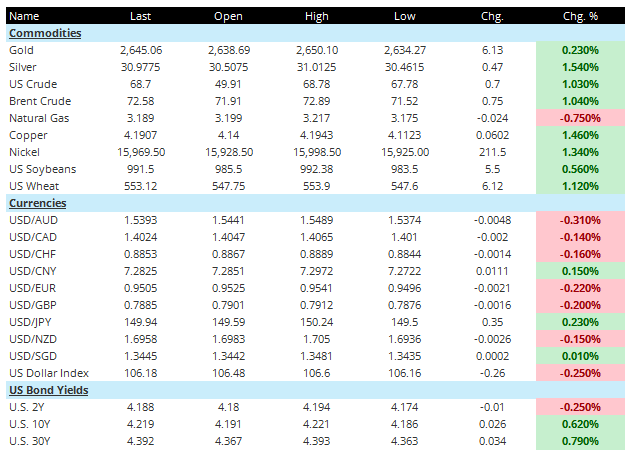

Commodities: Gold edged up 0.23%, while Silver gained 1.54%. US Crude rose 1.03%, and Brent Crude climbed 1.04%. Copper saw a notable increase of 1.46%, and Nickel advanced 1.34%. Natural Gas, however, declined 0.75%.

Currencies: The USD weakened against most major currencies, falling 0.31% against the AUD, 0.22% against the EUR, and 0.20% against the GBP. However, the USD strengthened 0.15% against the CNY and 0.23% against the JPY. The US Dollar Index slipped 0.25%.

US Bond Yields: The 2-year yield dropped 1 basis point to 4.18%. The 10-year yield rose 2.6 basis points to 4.22%, and the 30-year yield climbed 3.4 basis points to 4.39%.

Economic Data & Central Bank Related Speeches

10:00 AM ET: U.S. job openings data for October will be released. Estimates are at 7.519 million, up from the prior 7.443 million.

10:30 AM ET: ECB Executive Board member Fabio Panetta is scheduled to speak.

12:35 PM ET (Dec 4): Federal Reserve Board member Adriana Kugler will deliver remarks.

01:30 PM ET (Dec 4): Chicago Federal Reserve President Austan Goolsbee is set to speak.

Other Notable News

-

French Political Drama: The French Prime Minister plans to push through controversial parts of the budget bill. Meanwhile, the far-right National Rally is joining forces with the left to topple the government, with a no-confidence motion expected soon. The political turmoil has led to a sell-off in French assets, with 10-year French and German bond yields nearing their widest spread since 2012, and the euro briefly dropping over 1% against the dollar.

-

US Manufacturing Recovery: Data from the Institute for Supply Management shows that the manufacturing sector contracted less than expected in November, with the new orders index finally showing a significant improvement.

-

Fed and ECB Signal Rate Changes: Three Federal Reserve officials, including the New York Fed President, expressed openness to further rate cuts next year. Governor Waller hinted at supporting another cut in December. Meanwhile, ECB board member Martins Kazaks suggested a deeper rate cut will be discussed next week, though uncertainties remain high.

-

Ukraine Tensions Rise: Allies of Russian President Vladimir Putin suggest Moscow may reject a Trump-brokered truce with Ukraine, aiming for greater concessions from Kyiv.

-

OPEC Oil Production Rises: OPEC's crude oil output increased for the second consecutive month in November, buoyed by a rebound in Libyan supply.

-

Musk Challenges OpenAI: Elon Musk has urged a U.S. federal court to block OpenAI's alleged "illegal" transition to a for-profit model.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.