Inflation Gains, Trade Battles Heat Up, and Gold Stays in the Spotlight

Key updates on UK inflation figures, Japan’s export performance, China’s trade ambitions under Xi, and the recent climb in gold prices.

Good morning! It's Ryosuke. Today’s edition covers UK inflation, Japan’s export rebound, Xi’s free trade push, and gold’s rally, along with key market updates and economic data. Let’s get started!

UK's Inflation Surged By 2.3% Beating Estimates

Photo by Scott Warman / Unsplash

- Inflation Hits a Curveball: U.K. inflation jumped to 2.3% in October, overshooting expectations and casting doubt on a December rate cut. Core inflation nudged up too, thanks to soaring energy costs and winter’s early bite.

- Sterling Struts (Sort Of): The pound edged higher—up 0.1% against the dollar and 0.4% against the euro—while gilt yields followed suit, as markets mulled the inflation surprise and its impact on rate decisions.

- Rate Drama Brewing: With only a 14% chance of another rate cut, analysts reckon the Bank of England may play it safe as inflation risks pile up, from energy bills to global trade spats.

- Budgets and Black Holes: Tax hikes and spending plans from the Autumn budget aim to patch the U.K.’s finances, but they’re also stoking inflationary flames—just as global tensions loom large for 2025.

Euro Reaching Parity Against The Dollar

Photo by micheile henderson / Unsplash

- Dollar Dominates: Trump's proposed tariffs and fiscal plans are driving predictions of euro-dollar parity by 2025, with the U.S. dollar surging to a yearly high and the euro falling below $1.05 for the first time in a year.

- Tariff Turmoil: A potential 10% universal tariff and higher rates on China could stoke U.S. inflation, slow Fed rate cuts, and strengthen the dollar, while Europe faces pressure from slowing exports and potential ECB policy easing.

- Parity Predictions: Deutsche Bank, Barclays, and Goldman Sachs agree euro-dollar parity is likely, with some models suggesting a dip below parity if Trump's policies are fully implemented and European retaliation ensues.

- Geopolitical Gloom: Mounting tensions between Russia and Ukraine are hitting European assets, reviving recession fears, and driving demand for safe havens like the dollar, yen, and Swiss franc.

Weakening Yen, Rising Exports

Photo by CHUTTERSNAP / Unsplash

- Export Surprise: Japan’s exports rose 3.1% year-on-year in October, bouncing back from a 43-month low in September and beating expectations of a 2.2% rise. The biggest boost came from the Middle East, with exports soaring 35.4%.

- Imports Edge Up: Imports climbed 0.4%, defying predictions of a 0.3% decline, contributing to a wider-than-expected trade deficit of ¥461.2 billion ($2.98 billion).

- Tariff Worries: Analysts warn that U.S. tariff policies under President-elect Trump could pose risks to Japan’s open economy, especially amid global trade tensions.

- Global Ripple Effects: Any escalation in U.S.-China trade disputes may weigh on global trade and growth, with Japan likely feeling the pinch due to its cyclical and export-dependent economy.

Seven & i Soars Amid Privatization Rumors

Photo by Md Samir Sayek / Unsplash

- Shares Surge: Seven & i stock jumped nearly 11% after reports that its founding family is raising over $50 billion to take the company private by March 2025, in what would be Japan’s largest-ever buyout.

- ACT's Bid Rejected: Canadian firm Alimentation Couche-Tard had its $47 billion offer declined, with Seven & i claiming it "grossly undervalued" the company. Talks are reportedly ongoing.

- National Security Spotlight: Seven & i, designated "core" to Japan's national security, faces strict foreign investment scrutiny, adding complexity to potential buyouts or takeovers.

- Big Backers: The privatization plan involves funding from Japanese megabanks and major U.S. financial institutions, underscoring the high stakes in this landmark deal.

UBS & Goldman Sachs Expect Gold To Continue Rallying

Photo by Scottsdale Mint / Unsplash

- Bullish Forecasts: UBS and Goldman Sachs predict gold will hit $2,900–$3,000 by the end of 2025, with UBS expecting further gains to $2,950 by 2026, fueled by central bank buying and geopolitical tensions.

- Key Drivers: Strategic gold allocations, heightened global uncertainty, and official-sector purchases are set to underpin prices despite near-term consolidation due to the strong dollar and fiscal policy concerns.

- Record Year: Gold has surged 28% in 2024, buoyed by central-bank accumulation, the Fed’s monetary easing, and geopolitical tensions across Europe and the Middle East.

- Central Banks in Focus: UBS highlights ongoing gold buying by central banks as a diversification strategy amid sanctions risks, noting many hold minimal gold reserves relative to total assets.

Xi Jinping Urge For Free Trade

- Focus on Free Trade: At the G-20 and APEC summits, Xi urged world leaders to uphold free trade and resist protectionism, aiming to counter Trump’s proposed 60% tariffs on Chinese goods and safeguard China’s export-driven recovery.

- Calming Global Tensions: Xi navigated tricky diplomacy, urging resolution on the EU-China EV tariff dispute and advocating for de-escalation in Ukraine, presenting China as a stabilizing force amid U.S. and Russian disruptions.

- China as a Role Model: Xi framed China’s economic rise as an example for other developing nations, while emphasizing the dangers of unilateralism and its potential ripple effects on global trade.

- Economic Stakes: With Trump’s tariffs threatening GDP growth and rising global skepticism of China’s manufacturing dominance, Xi positioned himself as a defender of globalization to avoid further economic fallout.

Jimmy Lai Faces High-Stakes Trial in Hong Kong

- Denouncing Independence: Former media mogul Jimmy Lai dismissed Hong Kong independence as a "crazy idea" in his first testimony under national security charges, aiming to counter allegations of sedition and foreign collusion.

- Diplomatic Ripples: Lai’s trial has drawn global attention, with the US, UK, and EU monitoring closely. President-elect Trump and UK leader Starmer have voiced concerns, while Beijing labels Lai a traitor aligned with foreign powers.

- Freedom Advocate: Known for founding pro-democracy tabloid Apple Daily, Lai recounted his commitment to defending Hong Kong’s freedoms, citing his newspaper's role before its 2021 closure under Beijing's crackdown.

- Life in Limbo: Held in solitary confinement since 2020, Lai faces a potential life sentence if convicted, as international calls for his release clash with Beijing’s unwavering stance on dissent.

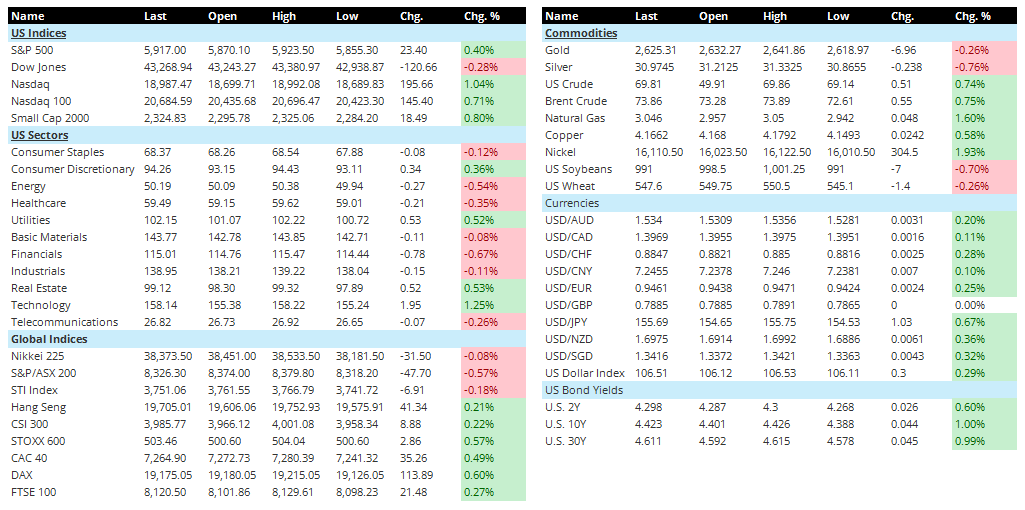

Latest On Global Markets

-

US Futures: Mixed signals in futures trading. S&P 500 futures are up by 0.25%, and Dow futures have gained 0.30%, reflecting cautious optimism.

-

US Indices: The previous session saw varied performance. The S&P 500 rose 0.40%, and the Nasdaq surged by 1.04%, while the Dow Jones slipped 0.28%. Small Caps posted a solid gain of 0.80%.

-

US Sectors: Sector movements were mixed. Technology led with a 1.25% gain, while Utilities rose 0.52%. Energy and Healthcare lagged, falling 0.54% and 0.35%, respectively.

-

Asia: Mixed results in Asian markets. The Nikkei 225 dropped by 0.08%, and the S&P/ASX 200 fell 0.57%. Meanwhile, the Hang Seng rose 0.21%, and the CSI 300 added 0.22%.

-

Europe: European markets showed positive momentum. The STOXX 600 rose 0.57%, the DAX climbed 0.60%, and the CAC 40 added 0.49%. The FTSE 100 saw a modest gain of 0.27%.

-

Commodities: Mixed trends in commodities. Gold fell 0.26%, and Silver dropped 0.76%, while US Crude and Brent Crude gained 0.74% and 0.75%, respectively. Natural Gas surged 1.60%, and Nickel rose 1.93%.

-

Currencies: The US Dollar Index strengthened by 0.29%. The dollar gained 0.25% against the euro and 0.67% against the yen, while holding steady against the pound.

-

US Bond Yields: Treasury yields rose modestly. The 2-year yield increased by 2.6 basis points to 4.298%, the 10-year yield rose by 4.4 basis points to 4.423%, and the 30-year yield climbed by 4.5 basis points to 4.611%.

Economic Data Today

- 5:00 AM ET: Final value of Eurozone consumer price index year-on-year in October (estimated at 2%, initial value at 2%).

- 5:00 AM ET: Final value of Eurozone consumer price index month-on-month in October (estimated at 0.3%, initial value at 0.3%).

- 8:30 AM ET: U.S. October new home starts seasonally adjusted annual rate (estimated at 1.334 million, previous value is 1.354 million).

- 8:30 AM ET: U.S. October building permits seasonally adjusted annual rate (estimated at 1.435 million, previous value at 1.425 million).

- 8:30 AM ET: Canada’s October consumer price index year-on-year (estimated at 1.9%, previous value is 1.6%).

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.