Government Shutdown Tensions, Tencent's WeChat Boost, and Biden's Ukraine Strategy Scrutinized

As a government shutdown looms after Trump's funding plan collapses, Tencent's WeChat gifting feature sparks a stock rally, while Biden faces allies' concerns over military support for Ukraine, compounded by Trump's trade ultimatum to the EU on energy purchases.

Hello, it’s Ryosuke! Today’s report dives into some significant developments from the political and business landscapes. Here’s a quick summary of what we're covering:

- Government Shutdown Crisis: The House rejected a temporary funding plan supported by President-elect Trump, raising concerns over a looming government shutdown.

- Tencent's Market Momentum: Tencent's new WeChat gifting feature has invigorated the stock market, resulting in notable gains for both Tencent and related companies.

- Biden's Ukraine Strategy in Question: Allies express worry over President Biden’s cautious military support for Ukraine, fearing missed opportunities in the ongoing conflict with Russia.

- Trump’s Trade Ultimatum: Trump is pressuring the EU to boost American oil and gas purchases or face tariffs, complicating future U.S.-EU trade relations.

Details and broader implications are covered below—let’s dive in!

Trump's Funding Plan Fails as Government Shutdown Looms

Photo by Darren Halstead / Unsplash

Unprecedented Rejection: In a surprising turn of events, the House voted down a temporary funding plan backed by President-elect Donald Trump, just over 24 hours before a potential government shutdown. Despite pressure from Trump and high-profile adviser Elon Musk, the bill fell short with a significant number of Republicans defying the call, leading to a vote outcome of 235 to 174.

Bipartisan Fractures: The bill aimed to extend government funding and raise the federal debt limit but faced backlash from both sides. House Democrats argued against it, with their leader deeming the proposal “laughable,” while some Republicans criticized the debt increase attached to the plan, arguing it contradicted their fiscal goals.

Impending Shutdown: Without a new spending bill, government funding will lapse on Friday night, leaving many services in jeopardy. Speaker Mike Johnson expressed determination to find alternative solutions, while some House members, like Tom Cole, were baffled by their peers’ resistance to extending protections for Americans, emphasizing the urgency of the situation.

Contentions and Future Perspectives: As lawmakers scramble for a new plan, Trump suggested possibly eliminating the debt ceiling entirely, emphasizing drastic changes in fiscal policy. The negotiation tensions hint at broader implications for Republican unity moving forward, as internal divisions threaten to disrupt the party's control in Washington.

Tencent's WeChat Gifting Feature Sparks Market Rally

Investor Excitement: Tencent Holdings Ltd. saw its shares surge up to 3.5% in Hong Kong, driven by enthusiasm for a new gifting tool on its WeChat platform. This positive shift marks a significant milestone, with Tencent potentially poised for its first weekly gain in months.

Broader Impact on Stocks: The ripple effect was felt across related companies, with Weimob Inc. rising as much as 23%, and snack and cosmetics producers like Yankershop Food Co. and Guangzhou Ruoyuchen Tech Co. hitting their daily limits of 10%. This movement is indicative of a booming sentiment around the holiday shopping season, with WeChat's gifting function in the spotlight.

E-commerce Integration: The new gifting feature allows users to send presents worth up to 10,000 yuan ($1,370), excluding specific categories like jewelry. Analysts project that this functionality will enhance user traffic to WeChat mini-stores, particularly benefiting sectors like snacks and cosmetics, as demand for holiday gifts surges.

Strategic Advantage for Tencent: Experts believe Tencent’s vast user base positions it well to take advantage of this new opportunity, especially given its past underutilization of its platform for e-commerce. As WeChat integrates gifting into its diverse offerings, this could signal a transformative phase for Tencent in the competitive landscape, especially as rival shares like Alibaba and JD.com experience declines.

Biden’s Approach to Ukraine: Allies Concerned Over Missed Opportunities

Photo by Alex Fedorenko / Unsplash

Alarming Missed Chances: As President Biden’s term winds down, allies express serious concerns that his administration's hesitance to provide Ukraine with critical military support has hampered Kyiv’s chances of victory against Russia. Ukrainian officials fear that the conflict may lead to unfavorable settlements, forcing President Zelenskiy to concede areas in exchange for security that falls short of NATO membership promises.

Cautious Strategy: While the U.S. has committed over $90 billion in aid, frustration mounts over Biden's slow response to military requests. Following initial Ukrainian successes in 2022, Biden’s reluctance to escalate support was heavily influenced by fears of provoking a nuclear response from Russia, which some allies now view as overly cautious.

Caught Between Two Paths: Critics point out that Biden's strategy didn’t decisively advocate for either increased military support or negotiations with Russia. This indecision left Ukraine caught in a protracted war, with many lives lost and little clarity about the way forward, as some former officials believed prompt negotiations might have capitalized on Russia's vulnerable state at the time.

Evolving Battlefield Realities: Despite increasing supplies, Ukraine faces broader challenges, including manpower shortages rather than just a lack of weaponry. As Biden weighed long-range missiles and advanced defenses, time allowed Russia to fortify its positions, leading to calls from allies for a more urgent response to change the conflict's trajectory decisively.

Trump Issues Trade Ultimatum to EU Over Oil and Gas Purchases

Photo by Christian Lue / Unsplash

Trade Deficit Pressure: President-elect Donald Trump has announced that the European Union must address its significant trade deficit with the U.S. by increasing purchases of American oil and gas, or else face the imposition of tariffs. His insistence on this point reflects a continuation of the tough trade stance he adopted during his campaign.

EU’s Retaliation Plans: In response, former Italian Prime Minister Enrico Letta emphasized the need for the EU to prepare for potential retaliation against Trump’s tariff threats. He critiqued Trump's approach as overly simplistic, suggesting that energy and tariffs should not be conflated as they relate to different aspects of trade.

Recent Diplomatic Discussions: Following a recent EU summit focused on transatlantic relations, discussions between Trump and German Chancellor Olaf Scholz have heightened awareness of the emerging trade landscape. EU officials have indicated they see energy as a viable means to reduce the trade gap, aligning with Trump’s demands.

Future of EU-U.S. Trade: Looking ahead, the EU is reportedly looking to increase its energy purchases from the U.S. to replace Russian imports. European Commission President Ursula von der Leyen has noted that U.S. liquefied natural gas might be a more affordable option, indicating a willingness to engage in negotiations with the incoming administration while preparing for possible outcomes of Trump's tariff strategy.

Latest On Global Markets

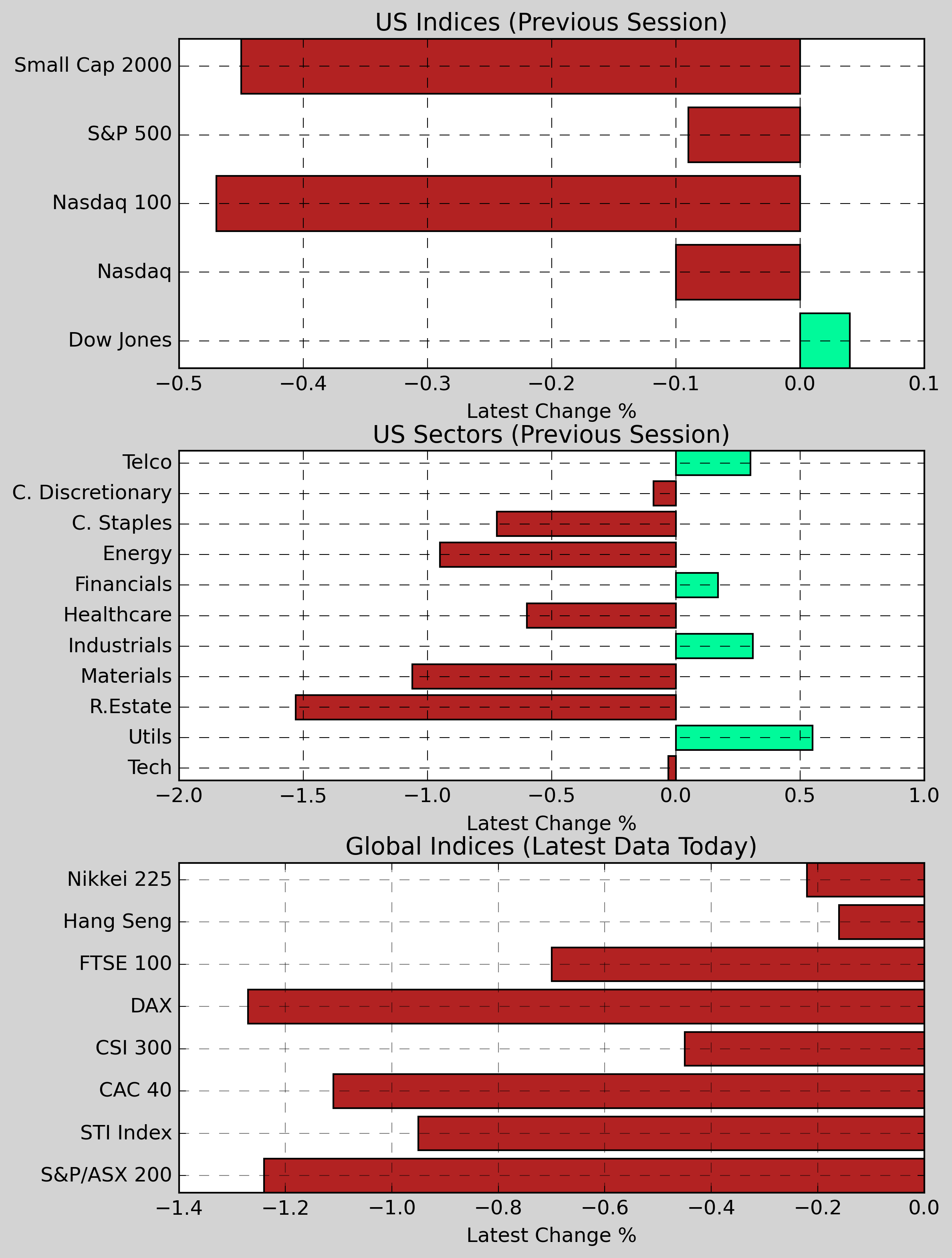

US Futures: Futures are showing a downward trend, with Dow Jones futures decreasing 0.43%, S&P 500 futures falling 0.54%, and Nasdaq 100 futures declining 0.88%.

US Indices (Previous Session): The S&P 500 fell 0.09% to 5,867.08, while the Dow Jones edged down 0.04% to 42,342.24. The Nasdaq decreased 0.10%, closing at 19,372.77, and the Nasdaq 100 lost 0.47%. The Small Cap 2000 also retreated, down 0.45%.

US Sectors (Previous Session): Utilities were the only sector to show gains, rising 0.55%. On the downside, Consumer Goods fell 0.72%, Healthcare declined 0.60%, and Financials slipped 0.17%.

Global Indices: In Asia, the Nikkei 225 dropped 0.22%, while the Hang Seng declined 0.16%. In Europe, the DAX fell 1.27%, and the CAC 40 decreased 1.11%. Meanwhile, the FTSE 100 also experienced a drop of 0.70%.

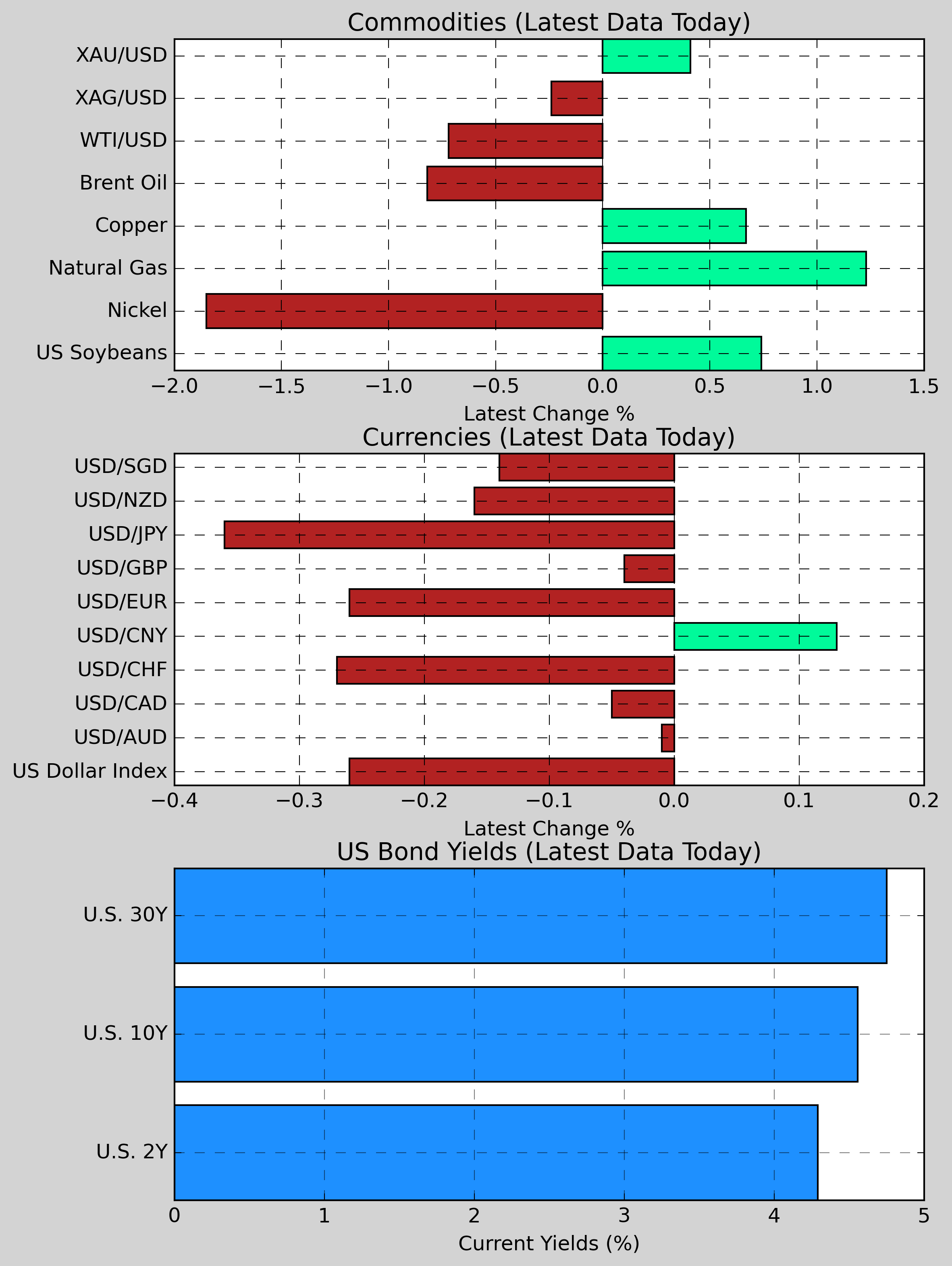

Commodities: Gold rose 0.41% to $2,605.16, while Copper increased 0.67% to $4.1045. US Wheat gained 0.73% to $536.88, and Natural Gas moved up 1.23% to $3.628. Conversely, Nickel fell 1.85% to $15,876.00, and Brent Crude declined 0.82% to $72.28. Silver experienced a slight decrease, down 0.24%.

Currencies: The US Dollar weakened against a few currencies, with USD/CNY rising 0.13%. However, USD/JPY and USD/NZD fell 0.36% and 0.16%, respectively. The US Dollar Index decreased 0.26% to 108.13.

US Bond Yields: The U.S. 2-Year Treasury yield decreased 6.50bps to 4.291%, while the U.S. 10-Year Treasury yield dipped 0.24bps to 4.559%. The U.S. 30-Year Treasury yield remained relatively unchanged, up 1.80bps to 4.750%.

Economic Data & Central Bank Developments (Eastern Time)

- 07:30 AM ET: Speech by Daly, President of the Federal Reserve Bank of San Francisco

- 08:30 AM ET: Speech by Williams, President of the New York Fed

- 08:30 AM ET: US personal income in November (estimated to be 0.4%, previous value is 0.6%)

- 08:30 AM ET: US personal spending in November (estimated to be 0.5%, previous value is 0.4%)

- 08:30 AM ET: US November personal consumption expenditure core price index month-on-month (estimated to be 0.2%, previous value is 0.3%)

- 08:30 AM ET: Canada's October retail sales month-on-month (estimated to be 0.7%, previous value is 0.4%)

- 10:00 AM ET: Eurozone December consumer confidence index preliminary value (estimated to be -14, previous value -13.7)

- 10:00 AM ET: Final value of the University of Michigan Consumer Confidence Index in December (estimated to be 74.2, initial value to be 74)

Other Notable News

-

French Government Reshuffle Ahead: French Prime Minister Francois Bayrou is expected to unveil a new cabinet this weekend and deliver a budget proposal to parliament by mid-February.

-

Bank of Japan’s Currency Policy Stays Steady: Following the Bank of Japan's decision to maintain its existing policy, traders are feeling less optimistic about the yen, which has dropped to a five-month low. Analysts at Nomura suggest this decline may prompt Japanese officials to intervene verbally to stabilize the currency.

-

U.S. Economic Growth Revision: The U.S. has adjusted its third-quarter GDP growth rate up to 3.1%, spurred by improved consumption and exports, while the core PCE price index saw a slight increase to 2.2%.

-

Korean Won Weakness Triggers Concerns: The depreciating value of the Korean won against the dollar has raised fears that the National Pension Service may need to liquidate foreign assets to mitigate financial losses.

-

Swedish Central Bank Lowers Rates: In a move to support its economy, the central bank of Sweden has reduced interest rates by 25 basis points, with a possibility of further cuts in the first half of next year if economic conditions do not improve.

-

U.S. Congress Faces Budget Challenge: The latest stopgap spending bill proposed by House Republicans has received Trump's backing, yet Democratic leaders have criticized it as "ridiculous." A vote is scheduled for Thursday night, and the bill is expected to struggle without Democratic support.

-

FedEx Focuses on Core Operations: FedEx has announced plans to allocate its resources more effectively by spinning off its $30 billion freight unit to concentrate on its core business functions.

-

Political Stalemate Over Debt Ceiling: Trump has asserted that the Biden administration should be shutdown if the debt ceiling isn't addressed, while House Minority Leader Jeffries has indicated that Democrats will not support an increase in the debt limit.

-

Interest Rates Held Steady by Bank of England: The Bank of England has maintained its interest rates, despite Deputy Governor Ramsden and two others advocating for a reduction. Governor Bailey acknowledged the increased uncertainty surrounding the economy.

-

U.S. Unemployment Claims Decline: Jobless claims in the U.S. have decreased last week, continuing the trend influenced by holiday fluctuations.

-

Fed Treasury Curve at Steepest Point: The U.S. Treasury yield curve has achieved its steepest slope in approximately 30 months, prompting speculations among some traders about potential interest rate hikes by the Federal Reserve in the coming year.

-

Powell and Trump’s Relationship: Russian President Vladimir Putin recently stated he hasn't communicated with Trump in over four years and expressed his openness to meeting him whenever the opportunity arises.

-

UK’s Trade Position Under Starmer: British Prime Minister Starmer signaled that the UK would resist any attempts by the Trump administration to impose trade restrictions.

-

Intel's Bidding Efforts for Altera: Intel is reportedly in the process of selecting potential bidders for its chip subsidiary, Altera, with formal proposals expected to be submitted by the end of January.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.