Gladstone Land (LAND): Positive Long-Term Trends, Short-Term Regulatory Risks From Deportation

Gladstone Land Corporation (LAND) shows strong long-term potential driven by rising farmland values and urbanization trends. However, short-term challenges like declining revenue, high interest rates, and labor cost risks lead us to rate LAND as HOLD.

Executive Summary

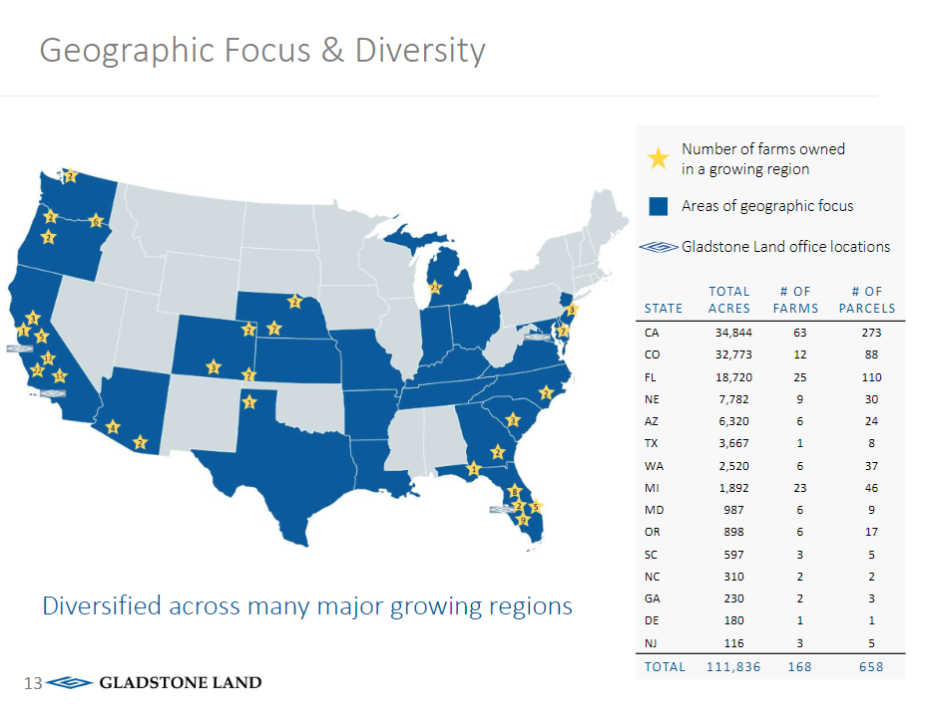

Gladstone Land Corporation (LAND), a U.S.-based agricultural REIT, specializes in acquiring and leasing farmland used for growing fresh produce and permanent crops. As of 3Q24, the company owns 168 farms spanning over 11,000 acres across 15 states, generating revenue primarily through long-term triple-net leases with farmers. Despite strong long-term industry drivers, we rate LAND as HOLD, given the absence of near-term catalysts and potential headwinds from elevated costs and geopolitical risks.

We base this rating on the following factors:

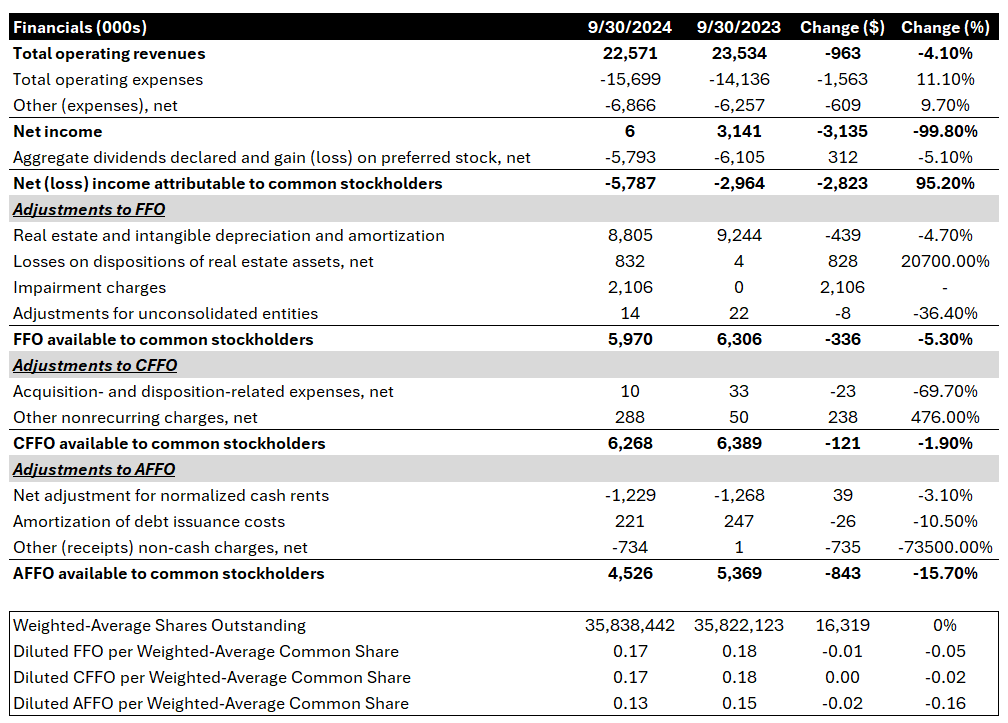

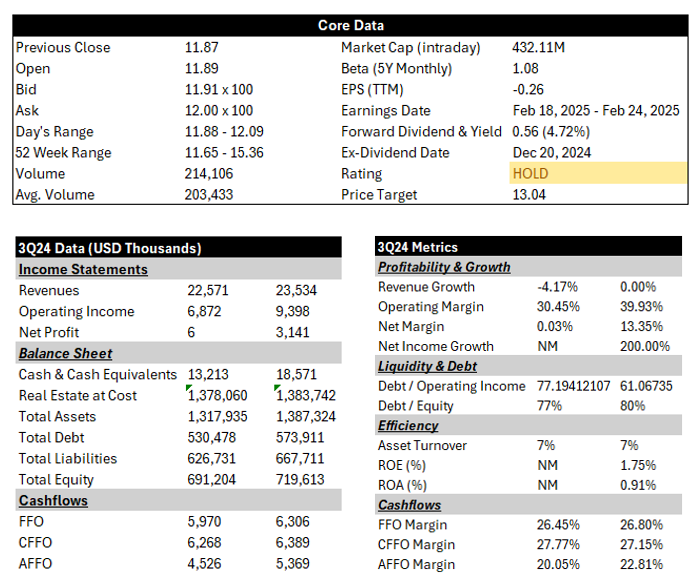

- Declining Short-Term Performance: In 3Q24, LAND reported revenues of $22.57 million, a YoY decline of 4.1%, with net income falling sharply due to impairment charges on Michigan blueberry farms. Adjusted funds from operations (AFFO) dropped by 15.7%, primarily driven by farm disposals and rising operating expenses for vacant or directly managed properties.

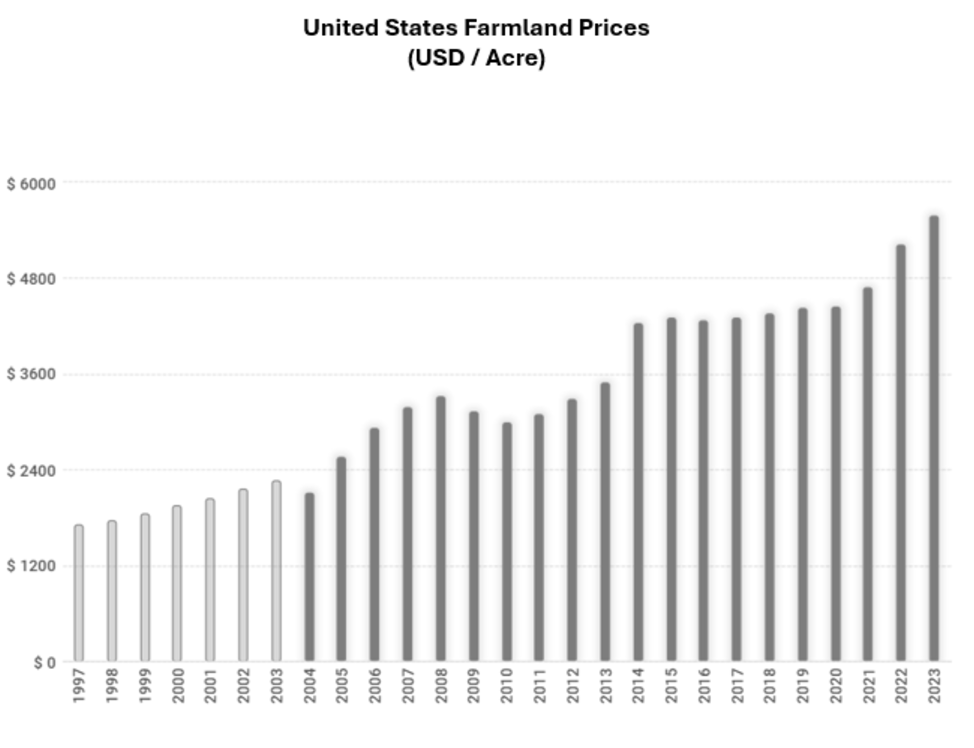

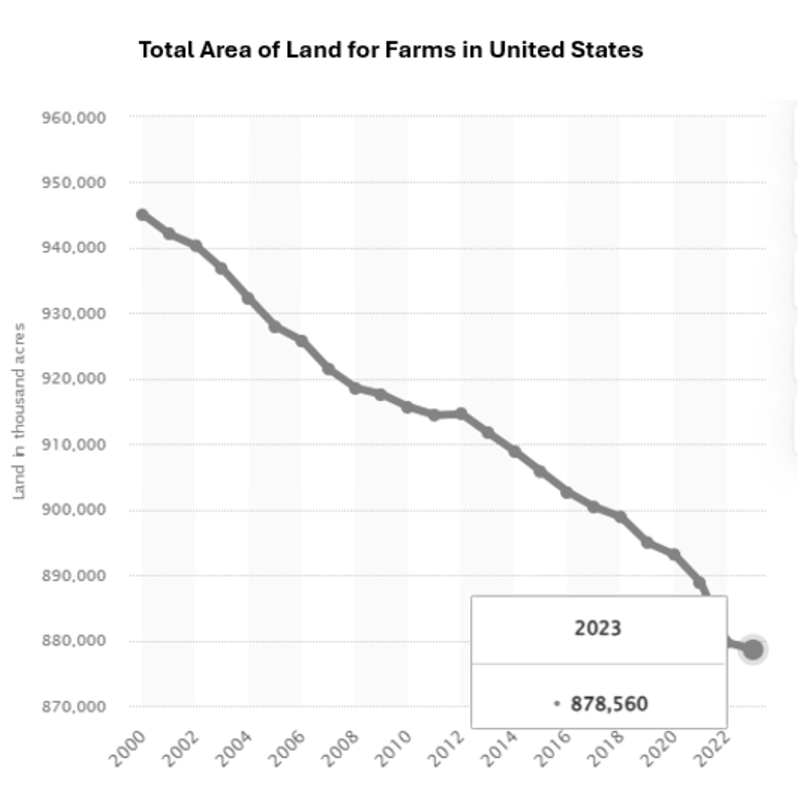

- Long-Term Industry Tailwinds: Urbanization trends continue to reduce farmland availability, driving up per-acre valuations. Between 2000 and 2023, U.S. farmland acreage declined by 7.04 million acres, while cropland values rose 4.7% YoY to $5,500 per acre. Further urbanization could eliminate 18 million additional acres by 2040, bolstering LAND's asset value.

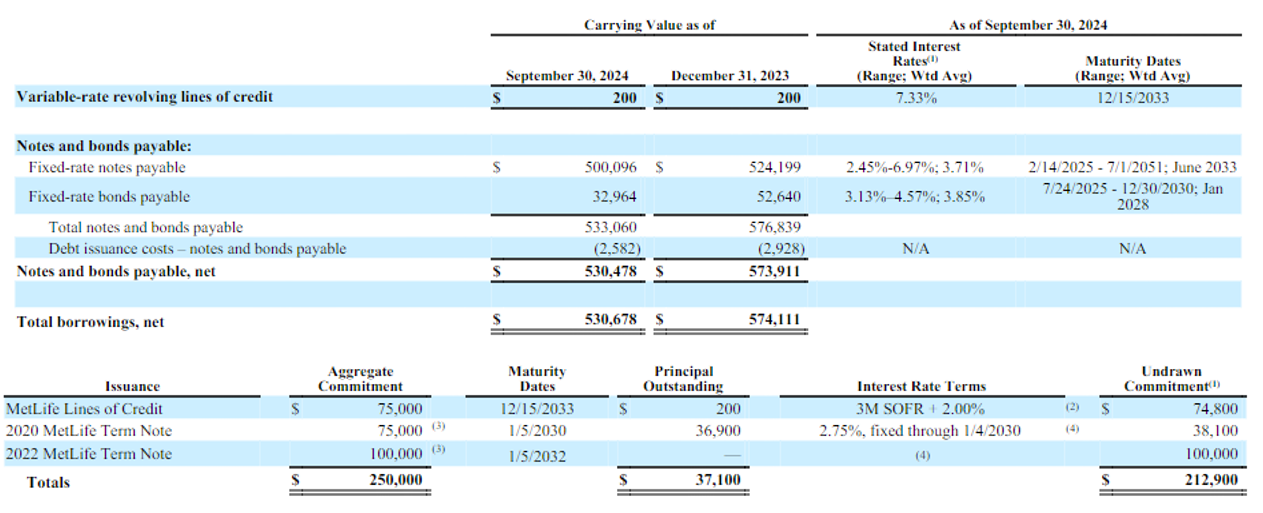

- Cautious Growth Strategy Amid High Interest Rates: LAND has slowed acquisitions, citing elevated financing costs, with credit line rates as high as 7.33%. The company sold 11 blueberry farms and expects further asset sales, limiting its revenue growth potential. Elevated interest rates, projected to remain between 3.75%-4% into 2025, further restrict growth opportunities.

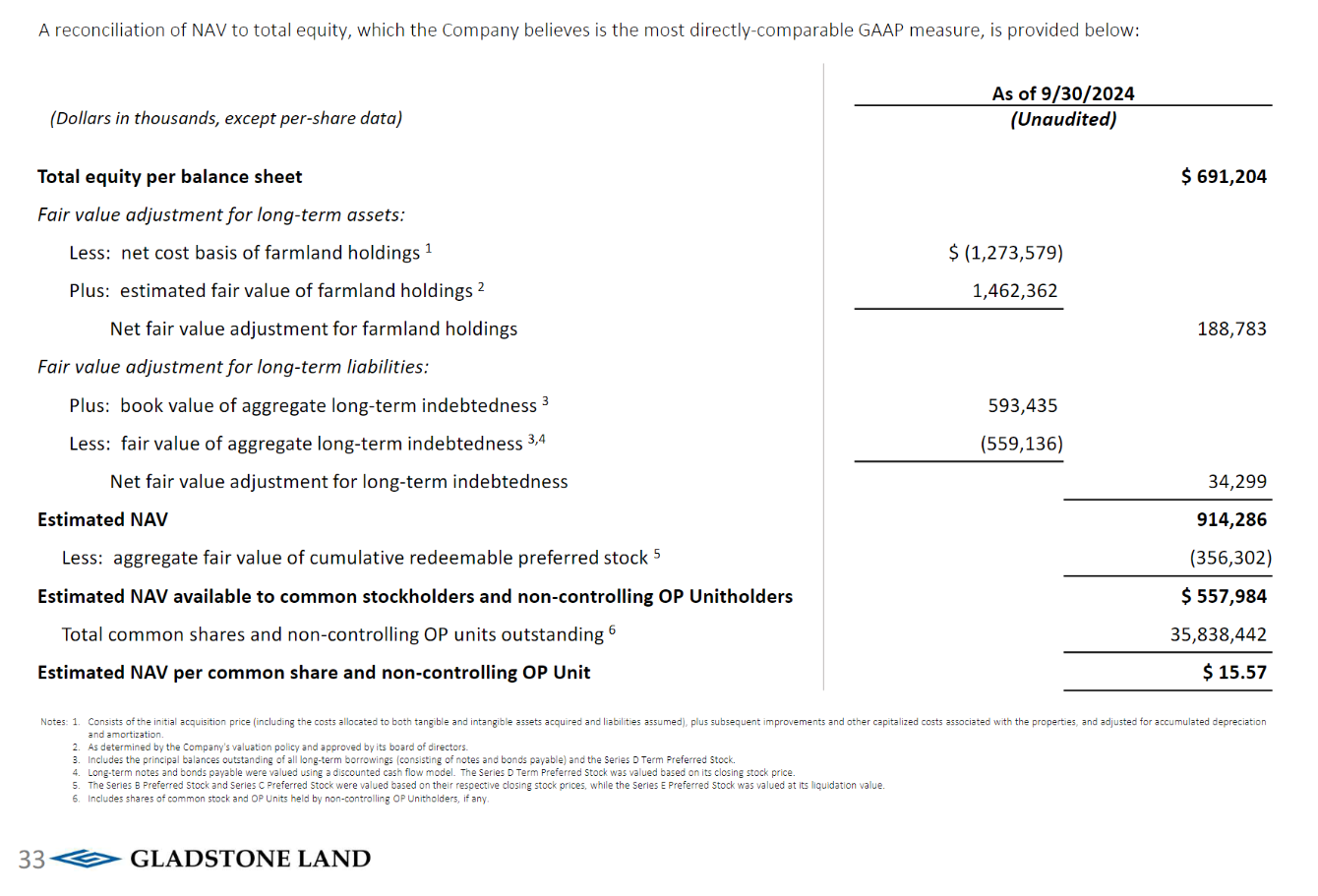

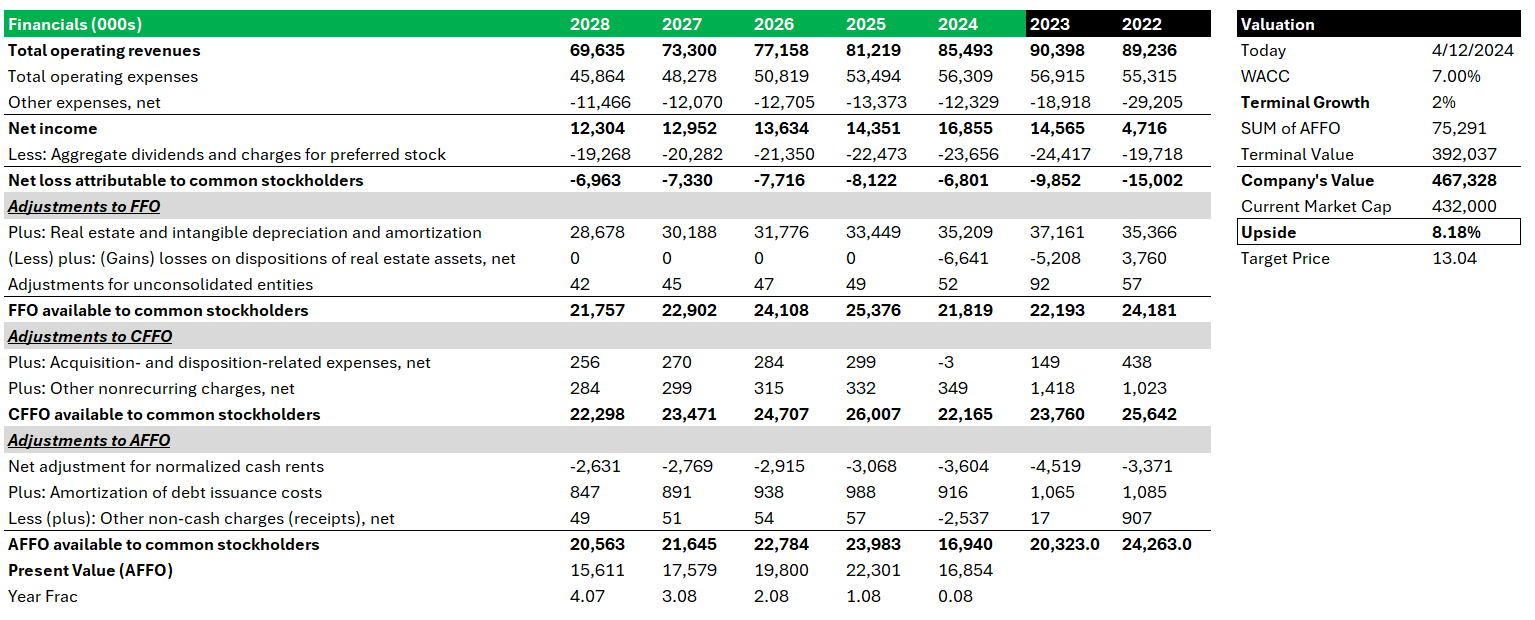

- Attractive Valuation vs. Net Asset Value: LAND trades at a 30% discount to its $15.57 net asset value (NAV), based on third-party appraisals. A perpetual AFFO valuation model estimates an implied market capitalization of $467 million, indicating an 8.18% upside from the current market valuation of $432 million.

- Risks from Labor Cost Pressures: The incoming Trump administration’s deportation policies could increase labor costs for U.S. farms, where illegal immigrants account for about 50% of the workforce. LAND's recent lease amendments aimed to helped tenants to offset rising input costs, further labor disruptions may strain their ability to contribute to LAND's topline.

Introduction

Gladstone Land (LAND) is an agriculture REIT based in the United States. The company buys farmland used for growing fresh produce and permanent crops such as berries, vegetables, apples, and more. LAND generates revenue by entering into long-term triple-net lease agreements, leasing properties to both independent and corporate farmers.

As of 3Q24, LAND owns 54k acre-feet of water assets and more than 168 farms comprising of more than 11k acres across 15 different states. It is important to note that LAND may also acquire other facilities and assets that are related to farming. Currently, LAND is headquarter in Virginia with more than 69 full-time employees.

Overall, we rate LAND a hold. Based on my analysis, LAND presents a compelling investment opportunity. Long-term drivers will continue to serve as tailwinds for LAND. Moreover, LAND is also trading at an attractive discount to its net asset value. However, it is important to note that there are currently no catalysts that may potentially correct LAND's price towards the upside. Moreover, the incoming Trump administration's stance on deportation may cause higher labor costs, affecting LAND's overall topline. In this report, we will explore these issues in detail.

Latest Developments

In 3Q24, LAND generated $22.57 million in revenues, representing a decline of 4.1% year-on-year. Net income came in at $6 thousand as compared to $3.1 million in the same period last year. The huge deterioration in net income is due to impairment charges from the write down of LAND's Michigan blueberry farms to reflect the latest sales price. During this period, operating expenses surged by 11.1% as the company incurred additional costs on properties that are either vacant or managed directly by LAND.

During this period, LAND posted an adjusted fund from operations ("AFFO") of about $4.5 million, representing a decline of 15.70% year-on-year. AFFO declined as the companies have sold farms earlier, resulting in lower revenues. In 3Q24, LAND had also renewed and amended 21 leases. 8 of these new leases for annual row crops are expected to increase operating income by $309 thousand. However, for the remaining permanent crop leases, LAND expect the amended leases will decrease net operating income by $441 thousand.

Long-term Urbanization Will Continue To Support The Value Proposition of LAND

Since the 1996 Farm Bill, where farmers are allowed to choose what crops to plant based on market demand instead of government quotas, we saw a huge decline in the land for US farms. From 2000 to 2023, the total area of land used for farming purposes in the United States declined substantially by 7.04% million acres to 878.6 million acres.

Naturally, because of ever declining supply of farms, the value per acre for farmland has been continuously inching towards the upside. According to USDA, the value of cropland and farm real estate values have averaged 5.5k per acre and 4.17k per acre, up 4.7% and 5.03% year-on-year.

Looking forward, it is unlikely that prices of these lands will decline anytime soon. It is likely that we will continue seeing price surging upwards as we are seeing more farmlands being converted for other uses such as schools, parks, office buildings, and other suburban related uses. In fact, based on a recent study, if the current rate of urbanization simply persists, the United States will lose another 18 million acres of agricultural land to urbanization by 2040.

All of these industry-related drivers will continue to provide tailwind support for LAND and serve as fundamental reasons why investors should consider exposure in the agriculture real-estate industry.

Do Not Expect LAND To Expand Revenue Capacity Any Time Soon

Despite structural factors supporting the valuation of LAND's assets, it is likely that operating income will continue deteriorating. In the latest quarter, LAND has entered a deal to sell 11 blueberry farms in Michigan. Although these farms had affected LAND's operating expenses, selling off these farms will reduce LAND's overall revenue capacity. Based on the latest earnings call, LAND expects to list and sell more farms if the price is right as there is currently a strong demand for farms and LAND is seeing an uptick of potential buyers. Of course, these proceeds will likely trickle back to investors; however, these are non-recurring and sustainable returns.

More importantly, currently, we are in a elevated interest rate environment. Even LAND has highlighted and acknowledged that their cost of capital is relatively high. For reference, the company is paying about 6% for preferred shares and as high as 7.33% for its credit lines. Unless it is an extremely good opportunity, it is likely that LAND will stay extremely cautious in terms of acquisitions, translating to deteriorated income.

Currently, majority of the market expects that the Fed Fund Rate by the End of 2025 will be between 375 bps and 400 bps. In other words, interests rates are unlikely to come down so soon and will stay relatively elevated as compared to the previous decade. Hence, this further supports the likelihood that LAND will remain cautious on the acquisition front. Separately, based on LAND's latest lease activities, operating income has already been affected.

LAND Trades At a Huge Discount To Net Asset Value

Perhaps, the biggest reason to own land is its discount to net asset value. Based on the latest third-party appraisals, the net asset value per share is approximately $15.57 after accounting for long-term liabilities and preference shares. Currently, LAND is trading at $12; in other words, there is a mispricing of close to 30% for investors to capitalize on.

To further validate LAND's valuation, we have conducted a perpetual AFFO model to ascertain LAND's share price based on the following assumptions: (1) operating revenues decline by 5% a year, (2) other expenses increase to 25% while operating expenses maintain at 65.9%, (3) no other gains and losses on disposition of assets, and (4) a terminal value of 2% and WACC of 7%, LAND's implied market capitalization is $467 million. Currently, LAND is trading at $432 million; in other words, there is a potential upside of 8.18%. Overall, this is in-line with LAND's net asset value.

Closing Remarks

Overall, LAND presents a compelling investment opportunity for investors who are interested in gaining exposure in the agriculture sector. Long-term structural drivers for the industry will continue to be favorable for for LAND. Even though there is a potential upside of at least 8%, we currently do not see any upcoming catalysts that will push and correct LAND's share price. Investors who are interested in LAND should consider its preference shares such as LANDO or LANDP instead as they are giving at least 6% yield.

More importantly, we are currently seeing risks from the incoming Trump's administration. President Trump seems adamant on deporting illegal immigrants; unfortunately, about half of the country's farm workers are illegal immigrants. In 3Q24, LAND amended a few leases to help farms to minimize their costs due to higher input costs. If the worker situation further cause an industry wide surge in labor costs, it is very likely that we will see LAND's topline getting affected.

Financial Snapshot

Disclaimer

We have no stock, option, or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. This article is written solely by us and reflects our own opinions. We are not receiving compensation from any third party for this article and have no business relationship with any company mentioned.

Past performance is no guarantee of future results. No recommendation or advice is being provided regarding the suitability of any investment for a particular investor. Any views or opinions expressed are solely those of Seven Insights and do not reflect the views of any external organization. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.

All information provided by Seven Insights is intended solely for general informational purposes. We do not take into account individual financial goals or situations and do not provide personalized investment advice.