Futures Slide, Dollar Rallies, And Trump Assembles His Team.

Morning Briefs

Futures Slide, Dollar Rallies, And Trump Assembles His Team.

Trump assembles a hardline team. Toyota criticizes California’s EV targets. China cuts homebuying taxes. Markets dip as the dollar rises. China shows military tech; Amazon and Apple adjust strategies.

On this page

Donald Trump's New Team Assembles!

- As the incoming of POTUS readies to takeover in 2025, Donald Trump starts to choose his team to carry out his "America First" policies. Not surprisingly, many of them are very tough of China; do not be surprise when we see Trade War 2.0 to be all the rage for the next four years.

- That being said, who are some people that are being picked?

- Currently, Susie Wiles, who headed Donald Trump's campaign will become the first female chief of staff. Tom Homan, who previously served Trump in his first term, will play a role on border security and immigration.

- US Secretary of State. Marco Rubio is likely going to be the new secretary, advising the POTUS on foreign affairs. Rubio has been known to be anti-China and is technically banned from entering China.

- National Security Advisor. Mike Waltz is a combat veteran and former Green Beret. Previously, he had criticized the pentagon for teaching Critical Race Theory in military institutions and unnecessary spending in the Air Force. Like many others, Waltz believes that China represents United States' biggest threat.

- Homeland Security Secretary. Kristi Noem is likely to help trump implement his policies on immigration. More importantly, help enact Trump's promises of mass deportation of illegal migrants. Interestingly, Kristi Noem's past history of shooting her own dog had been put her in the spotlight (for the wrong reasons).

- Border Czar. Tom Homan will be Trump's new Border Czar. In July, Homan said, "" got a message to the millions of illegal immigrants that Joe Biden's released in our country: You better start packing now."

Toyota Claims California's EV Mandates Are Not Achievable

Photo by Joseph Greve / Unsplash

- Recently, Toyota had stated that California's EV mandates that are slated to start next year are impossible to meet. If these mandates are not changed, consumers will face less choices.

- As per California's regulations, 35% of 2026 model-year vehicles must be zero-emission vehicles (e.g. electric vehicles, plug-in hybrid or, fuel cell). According to the EV mandates, by 2035, all new vehicle sales in California must be zero-emission models.

- Unfortunately, as compared to ICE vehicles, zero-emission models still lag significantly behind. Currently, the estimated EV adoption rate is only 9%.

China To Slash Homebuying Taxes To Encourage Home Purchases

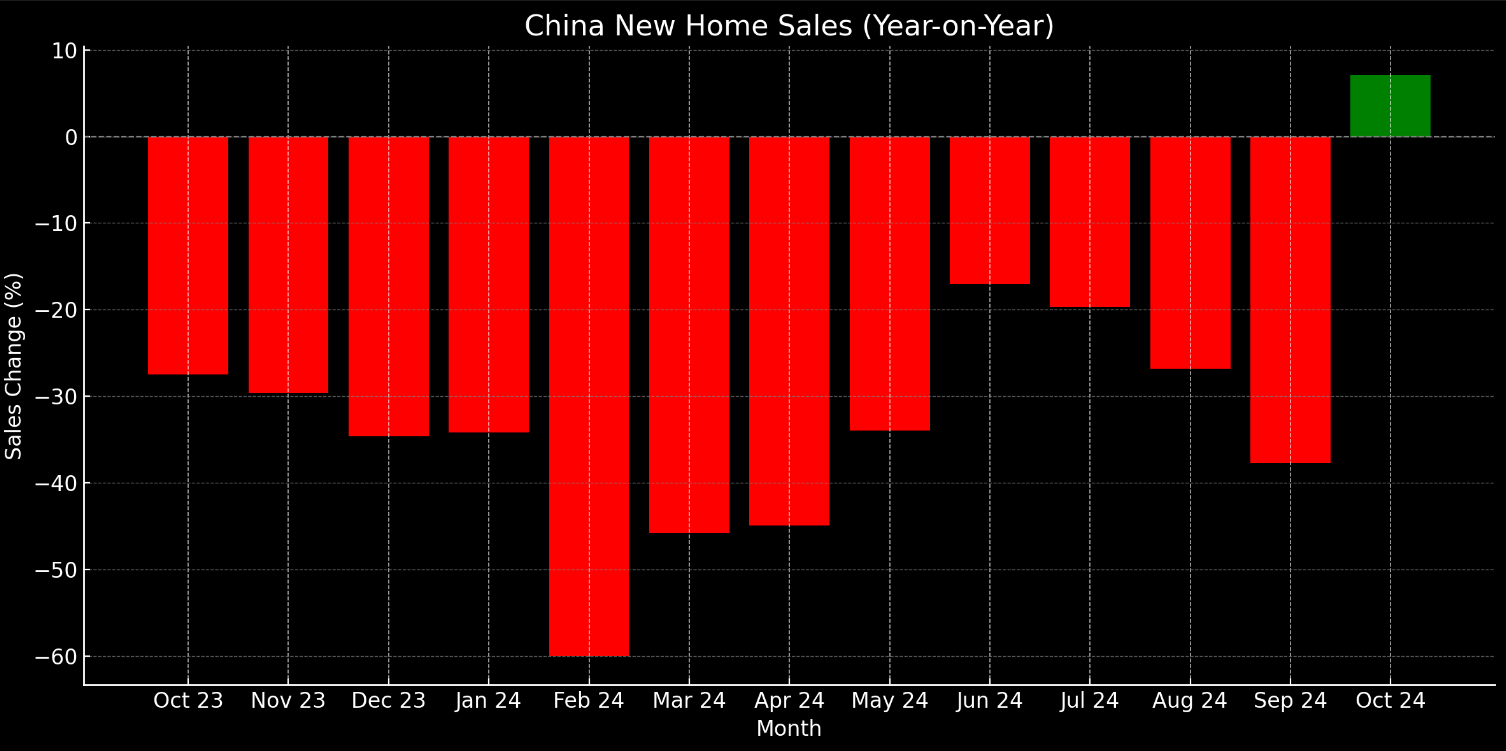

- China plans to reduce taxes on home purchases as part of increased fiscal support.

- Currently, regulators are considering a proposal to lower the deed tax in major cities like Shanghai and Beijing from 3% to 1%, highlighting Beijing's commitment to support economic recovery using fiscal measures alongside monetary easing.

- This initiative came after a slew of policies enacted over the last two months where China had reduced borrowing costs, easing purchasing restrictions, and reducing downpayment requirements.

- Overall, it seems that these policies are finally working. In October 2024, residential property sales rose for the first time this year. That being said, investors should continue to exercise prudence in the Chinese markets. We are still in the early stages; it remains to be seen whether President Xi can turnaround the massive economy successfully.

Dollar Continue Its Trek Towards The Upside While Equity Markets Show Signs Of Exhaustion

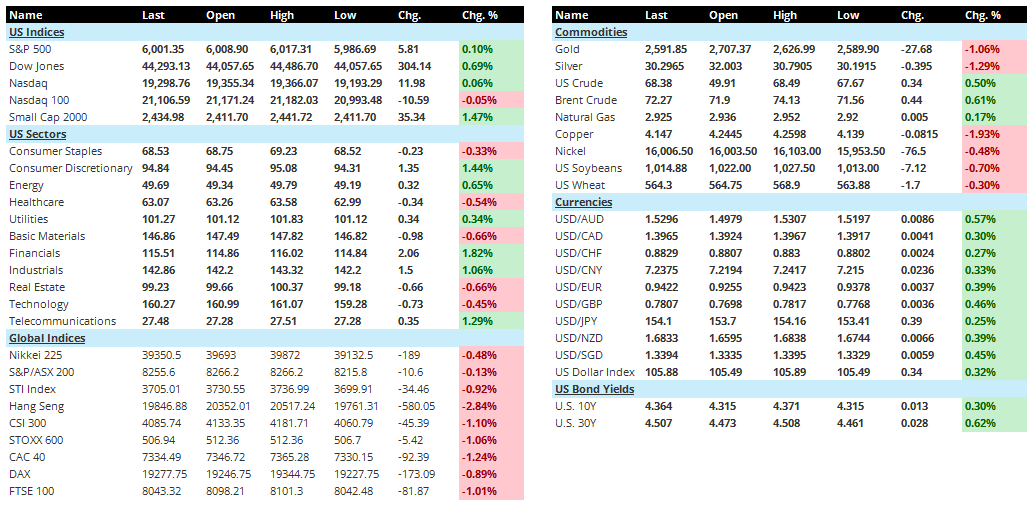

- We are seeing red for most of the board today. Clearly a risk-off day for investors. Futures currently point towards the downside with the Dow and S&P 500 declining by 0.15% and 0.23% respectively.

- Previously, in the US session, we saw small caps outperforming all other major indices. S&P trekked slightly upwards by 0.10% while the Dow rallied by 0.69%%. However, the Russell 2000 (small caps) outperformed, ending the day 1.47% stronger. In terms of sectors, Consumer Discretionary and Financials outperformed, gaining 1.44%% and 1.82%% respectively.

- Earlier today, in the Asian and European market, we saw RED for all major indices. Nikkei fell by 0.48%. China's CSI 300 and Hang Seng plunged by 1.10% and 2.84% respectively. All EU indices including UK's FTSE fell with France's CAC 40 underperforming the most by 1.24%.

- For commodities, we are seeing mixed performance. Gold and Silver underperformed, plunging by 1.06% and 1.29% respectively. Crude oil outperformed, rallying by 0.61%.

- In terms of currencies and rates. Dollar continue its strong trek towards the upside. Dollar Index surged by 0.32%. Both 10Y and 30Y yields rallied as well. Currently, the 2Y surged to 4.3% while 10Y rallied to 4.36%.

Other Notable News

- China is displaying upgraded military equipment at the Zhuhai Airshow, unveiling the Z-20 and J-35 stealth jet.

- Amazon is developing driver eyeglasses to shave a few more seconds off deliveries

- Apple is tactically retreating and scaling back production of its 3.5k Vision Pro headset.

- Alibaba releases AI search tool for small business in Europe.

- Elon Musk is $70 billion richer after Trump's Victory

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.