Fed's Jerome Powell Asserts Independence Against US President

The US dollar weakened as the Fed cut interest rates by 0.25%. Asian and European markets mostly declined. US futures mixed. China launched a $1.4 trillion debt swap for local government relief.

Latest On Global Markets

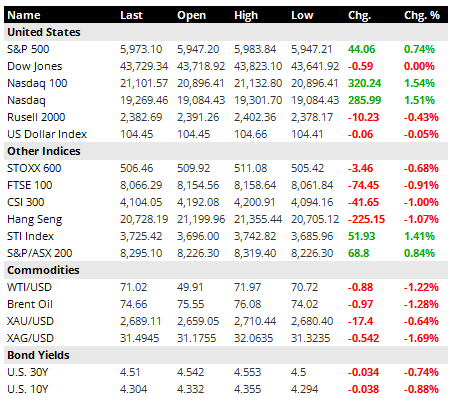

- US dollar is weakening slightly after the Fed's decision to reduce interest rates by 25 bps. US futures currently mixed with the Dow up by 0.12% and the S&P 500 down by 0.02%.

- Yesterday, during the US session, we saw S&P closing higher by 0.74% and the Nasdaq surged by 1.5%. Russell 2000 underperformed. Considering the huge rally in prices post-election, markets are still holding up well without any huge reversion.

- In the Asian market, we saw the Hang Seng fell by 1.07% whereas the CSI 300 fell by 1%. Chinese markets shrugged off the announcement of China's trillion debt plan to support local governments. Singapore's STI outperformed with a 1.41% gain.

- In Europe, the broader EU market fell by 0.68% while the FTSE fell by 0.91%.

- Finally, in the commodities market, all major commodities weakened against the dollar. WTI fell by 1.22% while silver and gold fell by 0.64% and 1.69%.

China Launches $1.4 Trillion Debt Swap To Help Local Governments

- China introduced a $1.4 trillion initiative aimed at alleviating its local government debt crisis.

- The Standing Committee of the National People's Congress announced the funding will be available through 2028.

- The Finance Minister hinted at a more assertive fiscal policy next year, suggesting potentially bolder economic measures.

- Despite the announcement, the USD rose 0.32% against the Chinese Yuan as markets reacted cautiously; the Hang Seng Index and CSI finished in the negative territory.

US's Jerome Powell Stood Up Against Trump To Protect Fed's Independence

![]()

- The U.S. Federal Reserve cut interest rates by 0.25%, aligning with expectations.

- In a press conference, Chair Jerome Powell emphasized repeatedly that Trump lacks the legal power to demote or remove Federal Reserve officials.

- Powell’s statements reinforced the Fed's commitment to remaining independent from presidential influence.

- During Trump’s previous term, he reportedly investigated options for dismissing the Fed Chair.

What Would Trump Do?

- As Trump prepares to assume office, he has reiterated his commitment to fulfilling promises made to the American public.

- What actions might he take? Based on analysis, several key moves are likely:

- Deportation & Border Security: Trump may intensify efforts to deport undocumented migrants and complete the construction of a wall along the Mexico border, aiming to address record-high crossings observed during the Biden-Harris administration.

- Taxes & Tariffs: Expected proposals include a minimum 10% tariff on foreign imports to reduce trade deficits, with especially high tariffs—up to 60%—on Chinese imports. Additional plans may involve making tips tax-free, removing taxes on Social Security payments, and further reducing corporate taxes.

- Reduced Global Involvement: Trump has criticized U.S. spending in the Ukraine-Russia conflict and pledged to withdraw financial support to end it. For the Middle East, he is expected to limit U.S. engagement, aiming to protect American taxpayers from funding foreign conflicts disconnected from national interests.

Other Notable News

- Sony increased its financial forecast due to strong gaming performance; operating profit exceeded expectations.

- Leading oil trader Vitol is exploring opportunities in the metals market, anticipating a peak in global oil demand within the next decade.

- Australian airports experienced disruptions due to an outage affecting immigration counters.

- Trump stated that no expense would be too high to support deportation efforts.

- Russian President Putin congratulated Trump, expressing willingness for discussions while maintaining firm demands regarding Ukraine.

- Reports indicate possible engagement between Ukrainian forces and North Korean units in the Russia-Ukraine conflict.

- Severe weather events are occurring, including a hurricane in Cuba and flooding in Spain.

- Google launched a new AI-powered video creation tool, now available to Workspace users.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.