Fed's Inflation Focus, Yen's Low Dive, and European Business Woes Amid Political Turbulence

The Federal Reserve shifts its focus to inflation amidst rate cuts, the yen hits a new low as the BOJ weighs rate decisions, and French business confidence dips due to political turmoil, all painting a complex picture of today's global economy.

- Fed Reinforces Commitment to Tackling Inflation Amid Rate Cuts

- Yen Hits New Low Amid BOJ's Rate Decisions

- French Business Confidence Wanes Amid Political Turmoil

- European Car Sales Decline Amid Consumer Slowdown

- Trump and Musk Unite Against GOP Funding Bill: Implications for Government Shutdown

- China's Satellite Ambitions: A Counter to Starlink

- Latest On Global Markets

- Economic Data & Central Bank Developments (Eastern Time)

- Other Notable News

Hello, it’s Ryosuke! Today’s report dives into pivotal developments shaping global markets and economies. Here are the key topics covered:

- Federal Reserve's Inflation Commitment: Fed Chair Jerome Powell emphasizes a renewed focus on controlling inflation amidst ongoing rate cuts, projecting inflation at 2.5% by 2024 due to political dynamics.

- Yen Weakness Amid BOJ Uncertainty: The Japanese yen hits a new low against the dollar as speculation around future rate hikes by the Bank of Japan grows, raising concerns about currency stability.

- French Business Confidence Decline: A drop in French business confidence highlights the impact of political instability on investment and growth projections as companies navigate uncertain financial conditions.

- Automotive Market Challenges: European car sales experienced a notable decline, influenced by rising living costs, with major manufacturers enacting cost-cutting strategies in response to market pressures.

- China’s Expanding Satellite Network: In an effort to rival SpaceX's Starlink, China plans to deploy a vast number of satellites for global internet connectivity, reflecting both commercial ambitions and national security considerations.

Details and broader implications are covered below—let’s dive in!

Fed Reinforces Commitment to Tackling Inflation Amid Rate Cuts

Photo by engin akyurt / Unsplash

Shift in Focus: Federal Reserve Chair Jerome Powell has highlighted a renewed emphasis on controlling inflation, revealing that their year-end inflation forecast has "kind of fallen apart." This marks a notable strategy change as officials previously prioritized labor market conditions, emphasizing the importance of progress toward the inflation target of 2%, which has eluded them for nearly four years.

Rate Cuts and Economic Reaction: Following the Fed's recent decision to implement a third consecutive interest rate cut, the market reacted sharply. This adjustment brought the federal funds rate down to a range of 4.25%-4.5%, yet signaled only modest expectations for future cuts—down to a forecasted half-percentage point for 2024, half of what was anticipated in previous discussions.

Inflation Projections and Political Influence: In light of new economic conditions and anticipated political policies from President-elect Donald Trump, officials now predict an inflation rate of 2.5% by the end of 2024, up from earlier estimates of 2.1%. The presence of proposed tax cuts and trade measures is driving concerns about inflation persisting above the Fed's target, contributing to a greater level of uncertainty among policymakers.

Commitment to the Mandate: Despite some signs of inflation easing, Powell emphasized that many Americans are still grappling with high prices. He reiterated the Fed's mission to stabilize inflation and ensure it aligns with their target, reflecting the broader commitment to mitigating economic challenges for the public as they navigate uncertain times ahead.

Yen Hits New Low Amid BOJ's Rate Decisions

Photo by Cullen Cedric / Unsplash

Yen Decline: The Japanese yen has slipped over 1%, reaching its weakest point against the dollar since July, following Bank of Japan (BOJ) Governor Kazuo Ueda's comments about considering economic momentum before making rate decisions. This sentiment creates uncertainty around a potential rate hike in January, shifting market expectations.

Bond Market Response: In response to the yen's decline, Japanese government bond futures showed a modest increase after fluctuating throughout the day. This suggests that while equities seem steady, bonds are reacting to the BOJ's cautious stance, with futures rising to 142.42 as traders adjust their expectations.

Market Speculation: Currently, the swaps market indicates only a 49% chance for a rate hike at the BOJ’s next meeting, down from previous confidence levels. This reflects growing skepticism about the timing of potential rate adjustments, especially in consideration of upcoming wage negotiations, which are key to Japan's economic recovery.

Future Implications: Analysts warn that sustained yen depreciation may prompt intervention from Japanese authorities and increase pressure on the BOJ to act. As the situation develops, currency strategists are closely monitoring the BOJ’s policy moves, as continued inaction could lead to further yen weakness, impacting Japan's competitiveness in global markets.

French Business Confidence Wanes Amid Political Turmoil

Photo by Chris Karidis / Unsplash

Decline in Sentiment: French business confidence has fallen for the third straight month, with the latest Insee gauge dipping to 94—its lowest since July. This decline reflects deepening concerns as businesses grapple with a landscape marked by political uncertainty and an ineffective budget process.

Political Impasse's Impact: The uncertainty stems from President Macron's political maneuvers, including the dismissal of Prime Minister Michel Barnier, which have left businesses wary about future investments and hiring. As cabinet negotiations continue, companies are feeling the strain of a potentially extended period without a functional budget.

Broad Sector Struggles: With the exception of industrial sectors, every other area reported falling confidence levels, signaling widespread unease. The overall employment climate also hit a slump, falling to 96, suggesting that job security may become another area of concern amidst the ongoing political instability.

Growth Projections Revised: Analysts note that without swift resolution to the political deadlock, France may see only modest growth in 2025, with the Bank of France now estimating a mere 0.9% increase. As businesses brace for the new year under emergency budget measures, the hope for recovery will depend on overcoming the current legislative gridlock.

European Car Sales Decline Amid Consumer Slowdown

Photo by Hayes Potter / Unsplash

Sales Dip: November saw a 2% drop in new car registrations across Europe, totaling 1.06 million units. France and Italy were the hardest hit, reflecting a pressing challenge as consumers wrestle with rising living costs, while Spain bucked the trend with a slight increase in sales.

Electric Vehicles Struggle: Despite a slight 0.9% uptick in fully electric car sales, the overall demand remains subdued, particularly due to the withdrawal of subsidies in various countries. The trend highlights the ongoing struggle of buyers to fully embrace electric vehicles, contrasted by a 16% increase in hybrid car sales without plugs.

Industry Reactions: Major players like Volkswagen and Stellantis are reacting to the downturn with aggressive cost-cutting measures and proposed layoffs. This industry strain is also impacting parts suppliers, leading to significant job cuts as companies like Robert Bosch and ZF Friedrichshafen adapt to the shrinking market.

Wider Implications: The automotive crisis has broader consequences, influencing workforce dynamics as defense industries seek to hire displaced auto workers. With stricter emission regulations looming, manufacturers are under immense pressure not just from market conditions, but potential fines, indicating a turbulent road ahead for the European auto sector.

Trump and Musk Unite Against GOP Funding Bill: Implications for Government Shutdown

Photo by Darren Halstead / Unsplash

Joint Opposition: President-elect Donald Trump has publicly opposed a Republican government funding bill backed by House Speaker Mike Johnson, aligning himself with Elon Musk’s criticism of the proposal, which both claim is fraught with unnecessary spending. This stance raises the likelihood of a government shutdown if a resolution isn’t reached soon.

Call for Change: Together with Vice President-elect JD Vance, Trump issued a statement advocating for a streamlined funding bill that excludes "Democrat giveaways" while combining it with a debt ceiling increase. Their emphasis on a more fiscally responsible approach is indicative of a growing frustration among some Republicans regarding the current funding process.

Musk's Influence: Musk has been actively campaigning against the extensive 1,547-page bill, arguing that it is laden with waste. He implies that a government shutdown might actually be preferable to passing this bill, emphasizing that the government’s essential functions would still continue, which shows his commitment to significant governmental reform.

Political Ramifications: As dissent grows within the Republican ranks, Speaker Johnson faces a challenge in garnering the necessary support to pass the funding bill and maintain his position when the new Congress convenes. With members like Rep. Thomas Massie openly signaling intentions to vote against him, Johnson's leadership may be jeopardized as he navigates these internal conflicts alongside the looming threat of a government shutdown.

China's Satellite Ambitions: A Counter to Starlink

Rivaling Satellite Networks: SpaceX's Starlink has established a significant lead with nearly 7,000 satellites in orbit and a customer base of around 5 million in over 100 countries. In response, China plans to launch approximately 38,000 satellites through its Qianfan, Guo Wang, and Honghu-3 projects, aiming to compete in the realm of global internet connectivity.

Geopolitical Implications: Experts note that China's motivation for this satellite push is multifaceted. By providing an alternative to Starlink, they aim to control internet access for citizens and allies, maintaining their censorship standards while countering the risk of uncensored information reaching their populace or friendly nations.

Targeting Underserved Markets: While China's service may not appeal to Western countries, experts highlight regions like Russia, Afghanistan, Syria, and parts of Africa as potential markets. With substantial existing investments in telecommunications, especially by Chinese companies like Huawei, a satellite internet service could solidify China's presence and influence in these areas.

A National Security Strategy: Beyond commercial aspirations, developing a satellite internet network is becoming crucial for national security. In times of conflict, such systems can ensure robust communication capabilities, as seen in Ukraine's use of satellite technology for military operations, showcasing why China views this project as vital for its strategic goals.

Latest On Global Markets

US Futures: Futures are pointing towards a positive start, with Dow Jones futures rising 0.29%, S&P 500 futures increasing 0.36%, and Nasdaq 100 futures gaining 0.32%.

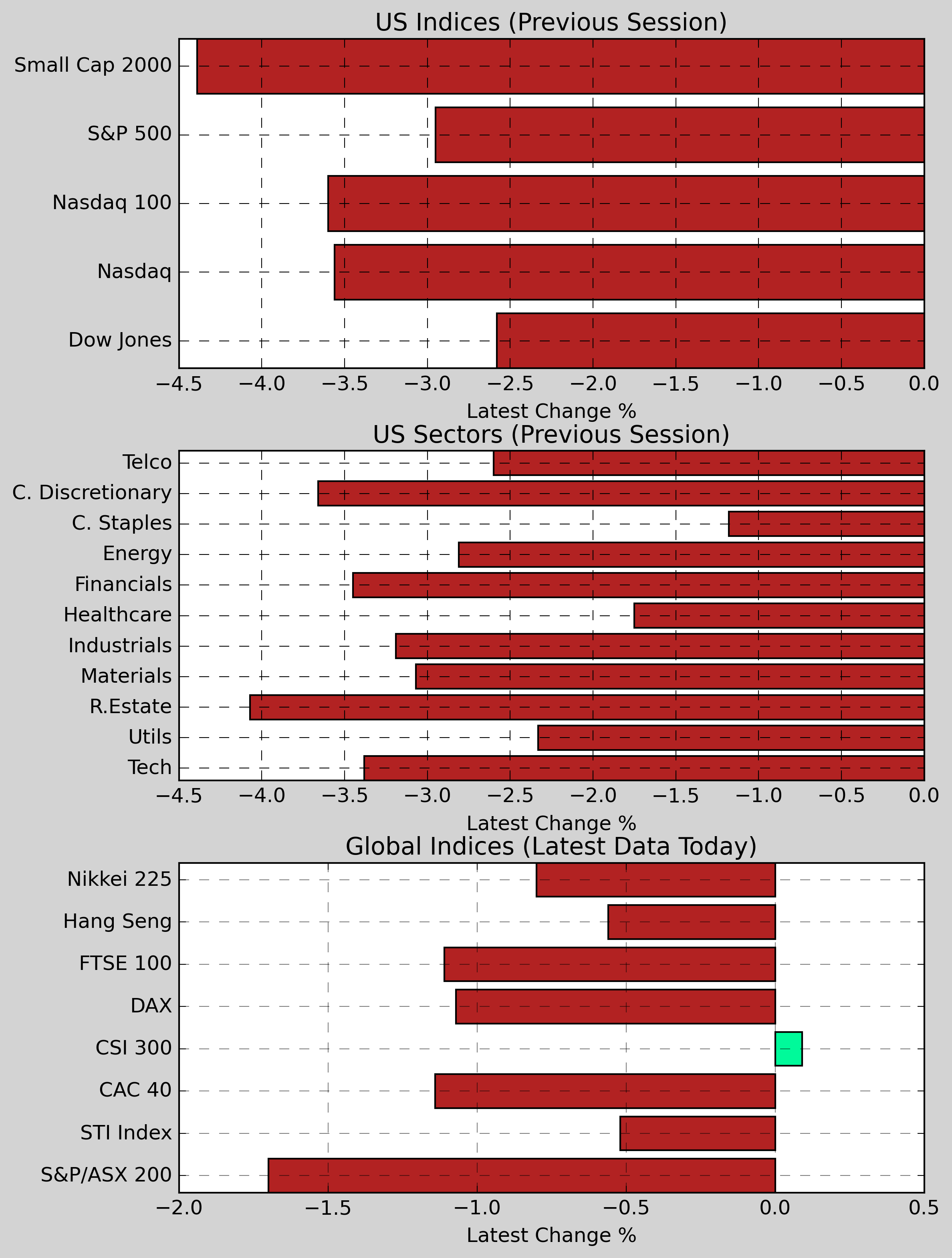

US Indices (Previous Session): The S&P 500 fell 2.95% to 5,872.16, while the Dow Jones dropped 2.58% to 42,326.87. The Nasdaq declined 3.56% closing at 19,392.69, and the Small Cap 2000 dropped 4.39%.

US Sectors (Previous Session): Consumer Staples led the sectors with minor losses, down 1.18%. Financials followed closely, declining 3.45%, while Utilities dropped 2.33%. The worst-performing sectors included Basic Materials, which fell 3.07%, and Real Estate decreasing 4.07%.

Global Indices: In Asia, the Hang Seng slipped 0.56%, while the CSI 300 posted a modest gain of 0.09%. European markets were mixed; the CAC 40 decreased 1.14%, and the DAX fell 1.07%. Conversely, the Nikkei 225 edged down 0.80% while the S&P/ASX 200 fell 1.70%.

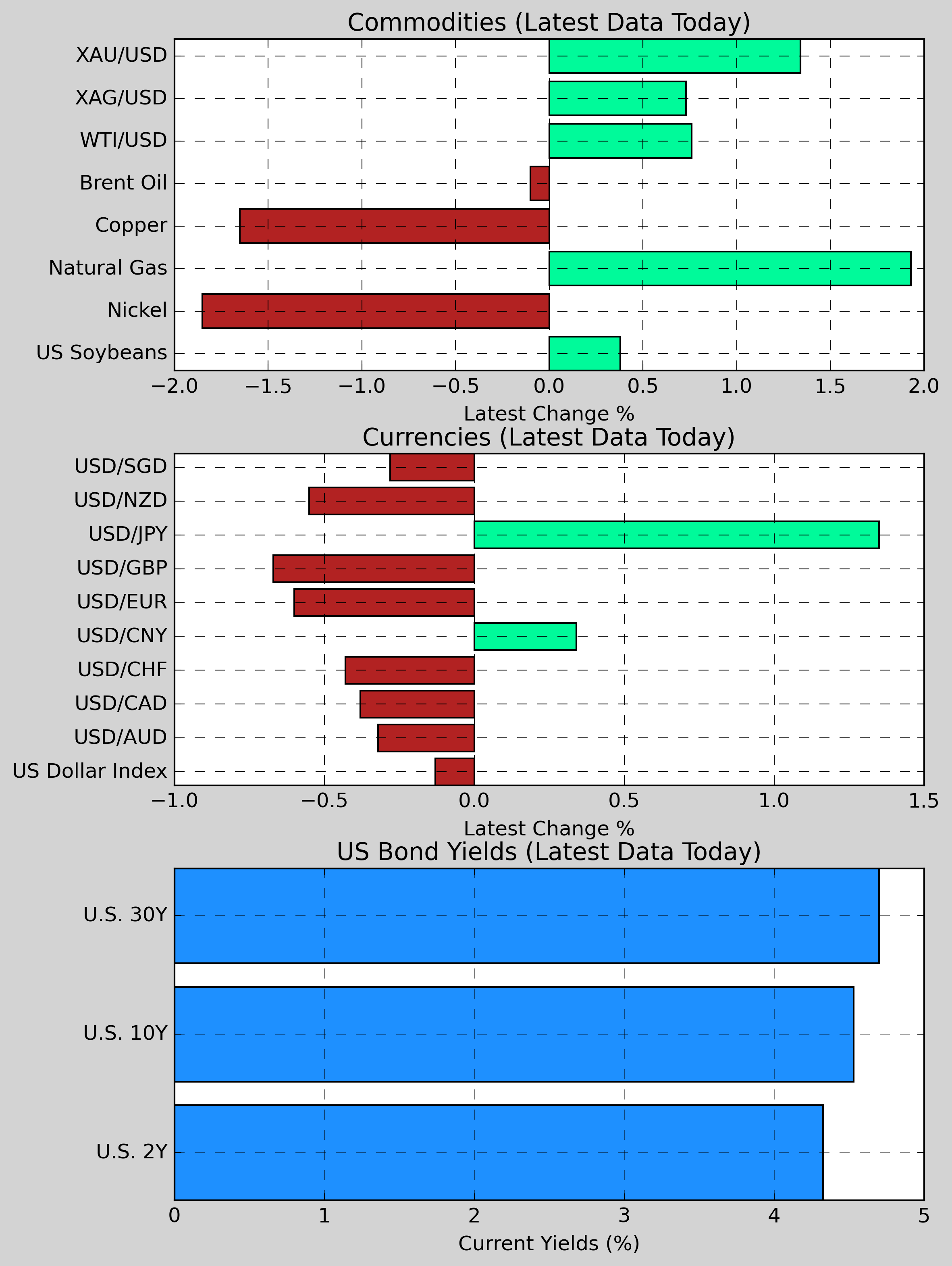

Commodities: Gold increased 1.33% to $2,620.52, while Silver gained 0.73% to $29.57. Copper fell 0.17% to $4.0883. Natural Gas rose 1.89% to $3.439, while Nickel declined 1.88% to $15,876. US Wheat dipped 0.94% to $535.90. On a broader scale, US Soybeans rose 0.38% to $954.62. Brent Crude remained steady at $73.32.

Currencies: The US Dollar saw mixed performance, with USD/CNY climbing 0.34% and USD/JPY rising 1.35%. Conversely, USD/GBP fell 0.67% and USD/AUD slipped 0.32%. The US Dollar Index decreased slightly by 0.13% to 107.89.

US Bond Yields: U.S. Treasury yields experienced slight changes; the 2-Year yield decreased 2.80bps to 4.327%, while the 10-Year yield ticked up 3.00bps to 4.531%. The 30-Year yield increased marginally, rising 4.00bps to 4.700%.

Economic Data & Central Bank Developments (Eastern Time)

- 08:30 AM ET: Final value of the seasonally adjusted quarter-on-quarter annualized rate of GDP in the third quarter of the United States (estimated to be 2.8%, revised value to be 2.8%)

- 08:30 AM ET: Final value of the seasonally adjusted quarter-on-quarter annualized rate of personal consumption GDP in the third quarter of the United States (estimated to be 3.6%, revised to be 3.5%)

- 08:30 AM ET: Final value of the seasonally adjusted quarter-on-quarter annualized rate of the US GDP price index in the third quarter (estimated to be 1.9%, revised to be 1.9%)

- 08:30 AM ET: Final value of the seasonally adjusted quarter-on-quarter annualized rate of the US GDP core price index in the third quarter (estimated to be 2.1%, revised to be 2.1%)

- 08:30 AM ET: US December Philadelphia Fed Manufacturing Index (estimated to be 2.8, previous value -5.5)

- 08:30 AM ET: Number of first-time unemployment claims in the United States last week (estimated at 230,000, previous value at 242,000)

- 10:00 AM ET: U.S. Conference Board Leading Index for November (estimated to be -0.1%, previous value -0.4%)

- 10:00 AM ET: U.S. November second-hand home sales seasonally adjusted annual rate (estimated to be 4.09 million, previous value of 3.96 million)

Other Notable News

-

UK Inflation Peaks: The inflation rate in the United Kingdom surged to its highest level in eight months during November. Anticipation mounts that the Bank of England will maintain current interest rates, as traders show diminishing confidence in predicted rate cuts for the upcoming year.

-

Political Controversy Over U.S. Budget: A potential government shutdown looms in the United States as funding issues remain unaddressed. Former President Trump vehemently rejected a recently proposed stopgap spending bill and urged Congress to initiate discussions regarding the debt ceiling crisis.

-

Eurozone Inflation Declines: Recent figures demonstrate that inflation within the Eurozone for November was lower than expected, leading to increased speculation about the central bank’s movement towards lowering interest rates. The ECB's chief economist emphasized the need for a flexible approach to these cuts amidst uncertain economic conditions.

-

New Zealand in Recession: New Zealand has entered a recession, with its gross domestic product (GDP) experiencing a quarter-on-quarter downturn of 1.0% in the third quarter, a decline that was sharper than anticipated.

-

Micron Technology's Disappointing Outlook: Micron Technology projected second-quarter revenues that fell significantly below analyst forecasts, causing a considerable drop in its stock price following market close.

-

Trump’s Auto Industry Overhaul Proposal: Advisers to former President Trump have put forth a transformative plan aimed at revamping the U.S. automotive sector, focusing on building a domestic supply chain while abolishing federal incentives for electric vehicles.

-

Apple Halts iPhone Subscription Plans: Reports indicate that Apple has halted the development of its iPhone hardware subscription service, leading to the disbandment of the team working on the initiative.

-

India's Gold Imports Miscalculations: Record levels of gold imports reported by India in November were attributed to a miscalculation, as officials mistakenly counted gold stored in warehouses more than once.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.