Markets Cheer As Donald Trump Wins Presidential Election

Trump wins election. US dollar strengthened. China affirms monetary policy stance.

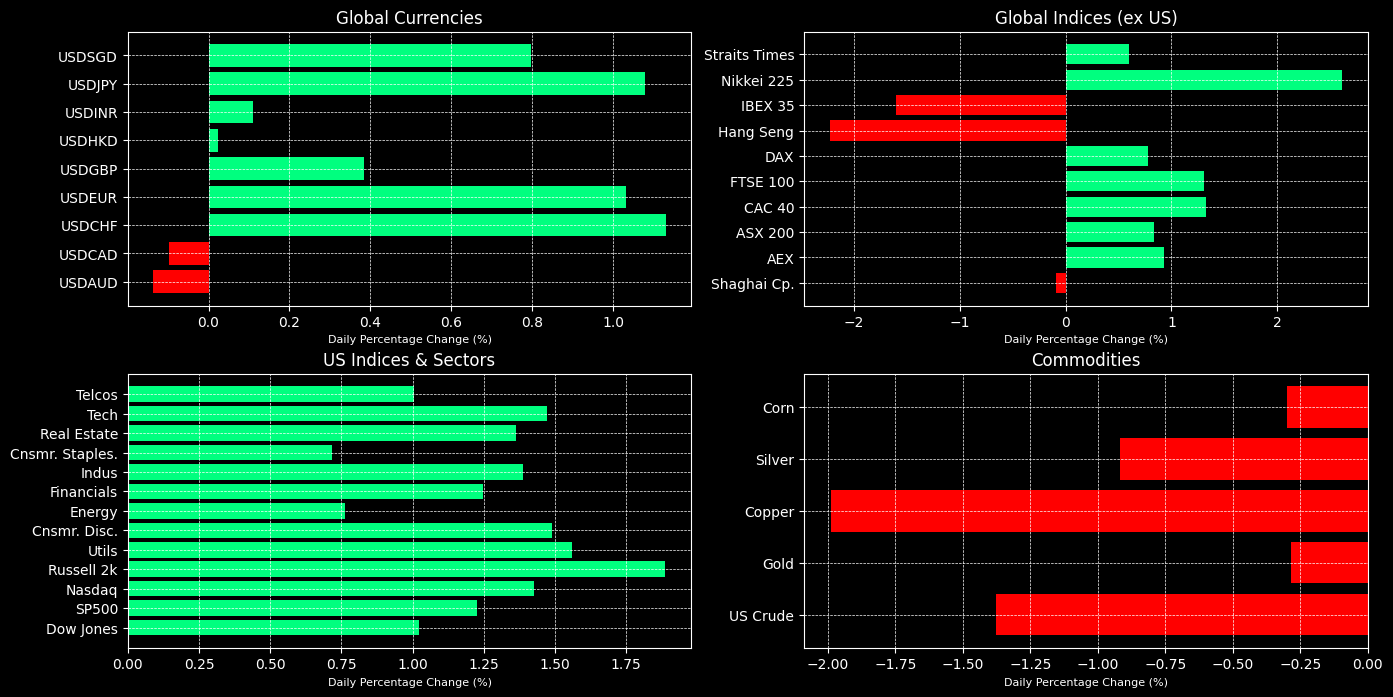

- What an exciting day! US dollar have strengthened against all major currencies. USD against the JPY, EUR, and CHF made the most notable gains, surging more than 1%. Currently, US Futures point towards the upside with the Dow rallying by more than 2.89% while the S&P 500 increasing by 2.29%.

- In US's previous session, we saw all sectors and major indices ended in the positive territory. The small-caps Russell 2k outperformed, ending the day 1.88% higher.

- In Asia, we saw mixed performance. Japan's Nikkei 225 outperformed, netting a gain more than 2%. However, China's Shanghai Composite and Hang Seng lost its legs. Hang Seng fell by 2.23% while Shanghai Comp fell by -0.09%.

- In Europe, we are seeing strong gains across the board. CAC, FTSE, and DAX are all in the positive territory.

- Over in the commodities market, all major commodities fell against the dollar. More notably, Copper fell by approximately 2% while US crude fell by -1.38%.

World Leaders Start to Congratulate Trump As Elections Come to An End

-

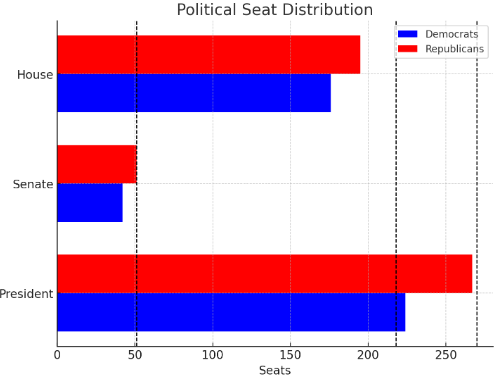

Although the elections have yet to come to an end, world leaders are already congratulating Donald Trump. Currently, Trump has won 267 electoral votes and requires only another 3 more to secure the presidency.

-

While yesterday's polls suggests that it is going to be a tight content, Kamala Harris only had attained 224 votes. I honestly doubt that there will be a turn of events here.

-

Markets are celebrating as we are seeing greens for anything Trump related! Elon Musk's Tesla surge 15% pre-market. Seems like it pays to support Trump.

Update: As of 6.13AM, Donald Trump secures 277 votes.

China Affirms Monetary Policy Stance

- In China, the head of the People’s Bank of China (PBOC) stated that the bank plans to maintain a supportive monetary policy.

- According to China's state media, the PBOC governor added that the bank will intensify its monetary policy measures.

- Separately, China's Finance Minister announced a plan to boost local government financing to replace hidden off-balance-sheet debts.

Latest Economic Data

- Yesterday, the US saw PMI data releases from both ISM and S&P. The ISM Non-Manufacturing PMI came in at 56, surpassing estimates of 43.8, while the S&P Global Composite PMI was 54.1, slightly below expectations of 54.3. Overall, the results were mixed, though investors remain more focused on the US election.

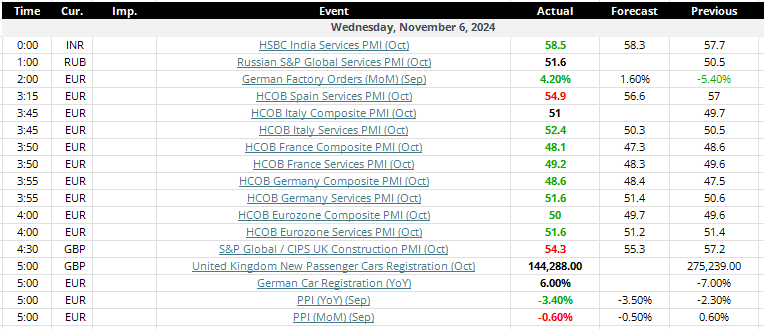

- European countries released a range of PMI data today, with Italy, France, and Germany all surpassing forecasts. The Eurozone Composite PMI came in at 50, above the estimated 49.7, while the Services PMI reached 51.6, exceeding the 51.2 forecast.

- Later today, the US will release data related to crude oil.

Other Notable News

- Nintendo shares rose 6% after announcing that current-generation Switch games will be compatible with its upcoming console.

- British fintech company Wise reported a 55% profit increase, reflecting its expanded market share.

- Toyota reported a nearly 20% decline in second-quarter operating profit, falling short of expectations.

- Tesla shares climbed over 15% in pre-market trading as Trump positioned himself as a leader on the global stage.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.