Donald Trump Secures House and Senate

Republicans secure House control, giving Trump full power in Congress. India’s RBI warns of global inflation risks, while a UK court ruling disrupts car finance. The yen weakens due to low growth and high foreign investment. Oil prices may drop with weak Chinese demand, and U.S. CPI hits 2.6% YoY.

Triple Threat. Donald Trump Secures Control of Congress

Photo by Kenny Eliason / Unsplash

- The republicans have clinched 218 seats, winning the house majority.

- Having won the senate earlier, this will give Donald Trump a full control of the congress, allowing him to enact his right-wing policies as compared to before.

- Now that Donald Trump has full control, the threat of a potential congressional investigation now cease to exist. Previously, the House impeached him twice.

- As of this report, GOP holds 218 seats while the democrates holds 208 seats.

India's Central Bank Chief Warns Of Potential Global Inflation

Photo by Vishal Bhutani / Unsplash

- RBI Governor Shaktikanta Das praised central banks' efforts in engineering a soft landing despite macro-related challenges and obstacles over the past couple of years.

- Das suggests that risks such as potential inflation and economic slowdown is still lingering due to geopolitical conflicts and geoeconomic fragmentation.

- Despite a more dovish US Fed, he noted multiple dislocations in the global markets such as rising dollar and government bond yields and the breakdown of relationship between Gold and Oil.

- In October, the RBI held key interest rates at 6.5% and did not comment on possible future rate cuts.

- Das also noted that the equity markets remain strong despite escalating risks, suggesting that the risk/reward is deteriorated and the markets will be sensitive for a huge correction (if it happens).

UK's Car Finance Industry Is Facing A Crisis

Photo by Joey Banks / Unsplash

- The crisis stems back to the judgement from UK's court of Appeal in October 2024. Previously, the court ruled that it is not lawful for car dealers to receive bonuses from banks providing motor finance without getting the customer's informed consent (i.e., kickbacks)

- The decision caught many players off-guard and may lead to a multi billion compensation scheme for affected consumers.

- Financial Conduct Authority of UK requested that the Supreme Court to expedite a decision on whether banks can appeal, as the ruling has caused uncertainty for lenders. The FCA also urged motor finance groups to set aside provisions to resolve high volume of complaints.

- If you have UK banks in your portfolio, make sure that their exposure to motor financing business is not substantially. Currently, Llyods is expected to have the highest risk.

- Other lenders involved in motor financing include: Barclays, Investec, and Santander.

Japanese Yen Continues Capitulating

Photo by Cullen Cedric / Unsplash

- At the time of writing, the USD/JPY had already hit 156 as traders continue to unwind the JPY.

- Despite a more dovish fed, market participants are pricing in the more inflationary policies from President-elect Donald Trump.

- Moreover, the huge interest rate differential, continues to push investors to either hedge their JPY exposure or take up carry trades against the JPY (i.e. Long USD Short JPY).

- Limited domestic investment opportunities also prompt Japan to reinvest income abroad, surpressing JPY gains.

- Capital flows are limited due to high market entry barriers and slow economic gorwth in the Japan economy.

- Overall, it seems that the outlook for JPY remains bleak. Then again, perhaps it is a good time to take a vacation there.

IEA Suggests A Potential Oil Glut Is Coming

Photo by Zbynek Burival / Unsplash

- According to the IEA, due to weakening demand from the Chinese economy, the oil market is likely to face a surplus of more than a million barrels per day!

- Recent data indicated that oil consumption in China had fell for six months consecutively.

- If OPEC+ decides to restart its previously halted production, we will expect to see the global glut worsening, potentially crashing oil prices.

- Currently, Brent Crude Oil trades at $68.44 and has retreated 5.42% over the past five days.

US Consumer Price Index Rose In-Line With Market Expectations

Photo by Peter Bond / Unsplash

- Yesterday, the US CPI numbers were released. Overall, Headline CPI surged 0.2% month-on-month while core CPI rose by 0.3% month-on-month.

- From an annualized perspective, inflation rate hit 2.6% in October, in-line with market expectations, supporting Fed's case of another rate cut

- Of the many components, the shelter index (i.e. housing) was the biggest driver, surging by 0.4% in October, translating to 4.9% on an annualized basis; surge in the shelter index is estimated to be resposibile for about half of all the gains in CPI.

- Vehicle prices and airlines fares also surged, up 2.7% and 3.2% on the month respectively.

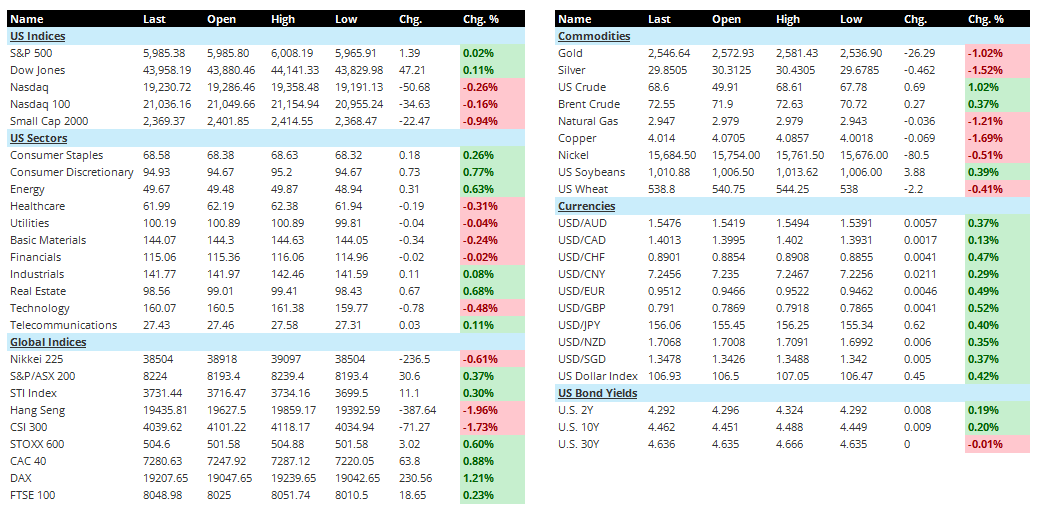

Latest On Global Markets

- Markets are pretty mixed today after the release of US CPI data. However, the US dollar continues its trek upwards, rallying against all major currencies. Currently, the dollar index surged by 0.42%. 2Y yield remained at 4.29% while the 10Y maintains at 4.46% US futures point towards the upside with the Dow and S&P 500 increasing by 0.11% and 0.10% respectively.

- In the previous US session, we saw technology and small caps underperforming the broader market. Small caps fell by 0.94% while Nasdaq 100 fell by 0.16%. The S&P 500 remained flat but the Dow closed higher by 0.11%. In terms of sectors, Consumer Discretionary outperformed the broader market, closing 0.77% higher.

- In Asia, Japan's Nikkei plunged by 0.61%. The CSI 300 and Hang Seng plunged by 1.73% and 1.96%, indicating that market participants are exhausted and do not buy the "stimulus" story. However, Singapore's STI and Australia's ASX closed higher by 0.30% and 0.37% respectively.

- In Europe, we are seeing strong gains. DAX surged by 1.21% while the CAC 40 and FTSE 100 posted 0.88% and 0.23% of gains.

- Commodities are painting a mixed picture with US crude surging by 1.02%. However, other major commodities such as Gold, Natural Gas, and Copper fell by 1.02%, 1.21%, and 1.69%.

- Looking ahead tonight, US will post jobless claims data and PPI data at 8.30AM eastern time.

- Quite a lot of speakers tonight. At 9:00 am, FOMC's Barkin is scheduled to speak. BOE's Bailey and ECB's Lagarde will also speak at 13:30 and 14:00 eastern time respectively. Finally, Fed's Powell will speak at 15:00 eastern time.

Other Notable News

- In an effort to revive its country, Bhutan is making it easier to visit

- EU to seek support from Biden to support Ukraine before Trump takes over

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.