Currency Markets Showing Signs of Technical Rebound

Morning Briefs

Currency Markets Showing Signs of Technical Rebound

Markets soften. FOMC meets today while other central banks make their moves. Swedish's Riksbank and Bank of England lowered rates while Norway kept rates steady.

On this page

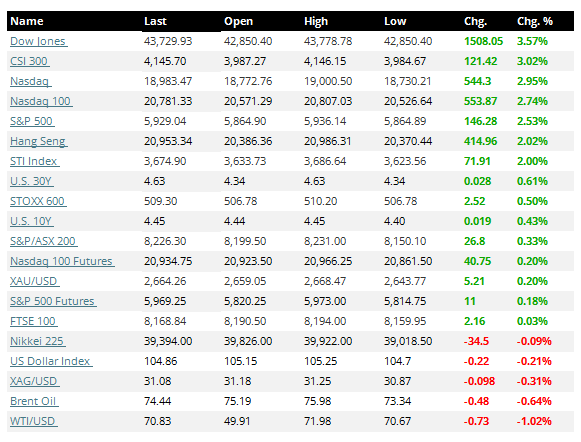

- Markets have largely subsided after yesterday's exciting session due to the results of US elections. All major currencies are showing signs of a technical rebound. NZD, AUD, and EUR surged against the USD by 1.2%, 1.0%, and 0.30%. Against the JPY, dollar has fell by 0.25%. Currently, US futures continue to point towards the upside. Dow increase by 0.19% while the S&P 500 climbs by 0.16%.

- In US previous session, small caps outperformed the broader market, netting a 5.84% gain! All other major indices showed record gains with the Dow up by 3.57%. S&P 500 and Nasdaq closed 2.53% and 2.95% higher.

- In Asia, today, we also saw strong gains. Shanghai Composite surged by 2.57% while the Hang Seng rallied by 2.02%. Interestingly, Japan's Nikkei finished in the negative territory, down by 0.09%.

- In Europe, FTSE remained flat while France's CAC and Germany's Dax netted a return of 0.53% and 1.22% respectively.

- Finally, the commodities market continues to soften. Gold fell by 0.06%. Brent and US Crude fell by 0.05% and 0.04%. Silver plunged by 0.19%.

Nissan Announces Major Global Job Cuts Amid Declining Sales

- Nissan projects an operating income of ¥975 million for FY2025, a sharp decline from the previous ¥500 billion.

- Facing reduced sales, Nissan plans to cut approximately 9,000 jobs worldwide, decrease production capacity by 20%, and sell 10% of its shares to Mitsubishi Motors.

- Like many established automakers, Nissan faces challenges in China, the world’s largest car market.

- Nissan’s updated forecast follows Toyota’s recent report of a 20% drop in operating profit for Q2 2024.

FOMC Meeting Scheduled for Today as Bank of England Lowers Rates

- Amid post-election excitement, don’t overlook interest rate decisions!

- The Powell-led FOMC is set to meet today, with investors anticipating a 0.25% rate cut by the U.S. Fed.

- In other news, the Bank of England has reduced its borrowing rate to 4.75%, and Sweden’s Riksbank lowered its rate by 0.50%.

- Meanwhile, Norway has kept its rate steady at 4.5%, with Governor Ida Wolden Bache stating it will remain unchanged through 2024.

Other Notable News

- The U.S. will release initial jobless claims later today, with markets expecting a total of up to 223,000. Previously, claims surprised by coming in at 216,000, below the forecast of 229,000.

- Moderna reports unexpected profits as its COVID-19 vaccine continues to perform strongly.

- China urges the U.S. to cooperate amid the backdrop of trade threats from President Trump.

- In October, China’s exports saw the highest surge in 19 months, while imports fell more than expected.

- China has extended its visa-free policy to nine more countries, including Slovakia, Norway, Finland, Denmark, Iceland, Andorra, Monaco, Liechtenstein, and South Korea.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.