Coffee Wars, Adani's Woes, and Musk's Federal Work

From Starbucks' bold move in China to Adani's $250 million bribery scandal and Elon Musk's push to end federal work-from-home, today’s stories span business, politics, and global markets. Dive in for key updates shaping the world right now.

Good morning! It’s Ryosuke. Today’s highlights include Musk and Ramaswamy’s plan to end federal remote work, Adani’s legal troubles, Starbucks’ big decision in China, and Nvidia’s AI challenges. Plus, market trends and economic updates to kickstart your day. Let’s dive in!

Coffee Wars, Starbucks to Give Up China Business

-

Brewing a Deal in China: Starbucks is flirting with the idea of selling a stake in its Chinese operations to spice up growth, possibly teaming up with private equity or local heavyweights. It's a strategic move in a market that’s both a goldmine and a minefield.

-

Luckin’s Got the Mojo: With local rival Luckin Coffee turning heads and macroeconomic headwinds swirling, Starbucks faces the classic “adapt or lose steam” conundrum. Selling a stake could inject local know-how—but also means sharing the latte profits.

-

Niccol’s Moment to Shine: New CEO Brian Niccol, fresh from Chipotle’s burrito battles, is tackling Starbucks' China challenge head-on. His vow to fix sluggish service and rethink partnerships sounds great, but action needs to match ambition in this “extreme” environment.

-

A Bold Brew Needed: China isn’t just a market; it’s the market for Starbucks' future. A local partner could help navigate the complexities, but Starbucks must tread carefully to avoid diluting its brand and profits. Luckin's playbook is worth studying, but the real test? Making the Starbucks vibe resonate with China's next-gen coffee drinkers.

Adani's $250 Million Bribery Case

Photo by Bermix Studio / Unsplash

-

Adani in Hot Water: US prosecutors accused Gautam Adani of orchestrating a $250 million bribery scheme to secure solar contracts in India, marking a seismic blow to his business empire and ties with PM Modi. The fallout wiped $30 billion off Adani Group's market value, while the company denied allegations and scrapped a $600 million bond sale.

-

Ripple Effects on Politics and Business: With Adani as a cornerstone of Modi’s infrastructure plans, the charges reverberate across Indian politics and global markets. Opposition leaders are calling for probes, while Moody’s flagged governance concerns as a "credit negative" for the group’s companies.

-

Luck Runs Out?: Adani, once India’s poster child for green energy and growth, now faces existential threats to his global ambitions. The indictment, more severe than the Hindenburg report, casts a shadow over Adani’s international expansion and credibility.

-

A Tough Road Ahead: For India’s markets and Modi’s administration, this is a litmus test for transparency and accountability. Adani's cozying up to US investments won’t shield him from the legal storm brewing, and his ability to bounce back may hinge on stronger governance reforms—or a long legal slog.

Nvidia's Growth Meets Growing Pains

-

Blackwell Buzz: Nvidia’s much-anticipated Blackwell chips are finally shipping amid “very strong” demand, but high production costs are biting into profit margins. The company’s Q4 sales forecast of $37.5 billion fell short of the most optimistic Wall Street expectations, leading to a 4% dip in shares.

-

AI Still Driving the Train: Nvidia’s data center revenue doubled to $30.8 billion, with major cloud players like Microsoft and Amazon accounting for half. However, the concentration of revenue among a few customers raises concerns about broader AI adoption.

-

Margins Under Pressure: Gross margins are slipping due to Blackwell’s rollout costs, dropping to 73% from 75% last quarter. CFO Colette Kress anticipates recovery by mid-2025, but supply constraints and high expectations leave little room for error.

-

A Delicate Balancing Act: Nvidia remains the king of AI chips, with unparalleled growth and dominance. However, the market’s towering expectations mean the company must navigate production challenges, diversify its customer base, and prove it can sustain this level of performance without stumbling.

Russia's ICBMs Have Arrived

Photo by Michael Parulava / Unsplash

-

First ICBM Use in Conflict: Russia reportedly launched an intercontinental ballistic missile at Dnipro, marking the first such use since the invasion began. Designed for long-range nuclear delivery, this escalation raises alarm bells for Kyiv’s allies.

-

Economic Ripples: Oil and gold prices surged while stocks dipped following the news. Eastern European currencies weakened, though Ukraine’s dollar bonds rose on hopes of a potential truce under a Trump-led administration.

-

Targeted Strikes and Fallout: The missile barrage damaged infrastructure, including an industrial facility and a rehabilitation center. Ukraine’s air defense intercepted six of seven Kh-101 missiles, minimizing further destruction.

-

High Stakes, High Risks: Deploying an ICBM sends a chilling message of Moscow's willingness to escalate, yet it’s a costly and arguably inefficient tactic. For Ukraine’s allies, this underscores the urgent need to strengthen support while balancing efforts to de-escalate nuclear threats.

Trump's Cabinet Controversy: Skipping FBI Checks Sparks GOP Pushback

Photo by Marija Zaric / Unsplash

-

Breaking Tradition: President-elect Trump plans to bypass FBI vetting for controversial cabinet nominees like Matt Gaetz, Pete Hegseth, and Tulsi Gabbard, challenging over 60 years of precedent. This move is fueling GOP resistance, with key senators demanding traditional checks.

-

Gaetz Under Fire: Gaetz’s nomination as Attorney General faces scrutiny over past allegations, including a House Ethics investigation and claims of sexual misconduct. Senate Democrats have called for the FBI to release all investigatory files, emphasizing his unfitness for the role.

-

Private Vetting Concerns: Trump’s consideration of privately run vetting raises alarms about transparency and reliability. Experts warn of potential conflicts of interest and a lack of safeguards compared to the FBI’s rigorous and standardized process.

-

A Risky Gamble: Trump’s approach risks alienating GOP allies and complicating his broader legislative agenda. Forcing controversial picks without bipartisan support or credible vetting could set a combative tone for his administration and weaken confidence in key appointments.

DOGE's Musk and Ramaswamy Shaking Up The Federal Work Culture

Photo by Larissa Avononmadegbe / Unsplash

-

No More WFH for Federal Workers: Elon Musk and Vivek Ramaswamy, part of Trump’s newly formed Department of Government Efficiency, are pushing to end work-from-home policies for federal employees. They argue this would trim the workforce by encouraging voluntary resignations, framing it as a win for taxpayers.

-

Economic Ripple Effect: A full return to office could boost Washington, D.C.’s struggling downtown economy, where office vacancy rates remain high post-pandemic. However, the move risks clashes with unions and long-standing telework arrangements.

-

Musk's Hardline Stance: Musk, a vocal critic of remote work, sees it as a relic of the pandemic era. His stance aligns with Trump’s efficiency-focused agenda but could spark widespread resistance within the federal workforce.

-

Bold or Backward?: Musk and Ramaswamy’s vision to restore office attendance reflects a private-sector mindset that could disrupt government operations. While it might trim budgets and boost urban economies, it risks alienating workers and fueling union unrest—a risky gamble for an already divided workforce.

Latest On Global Markets

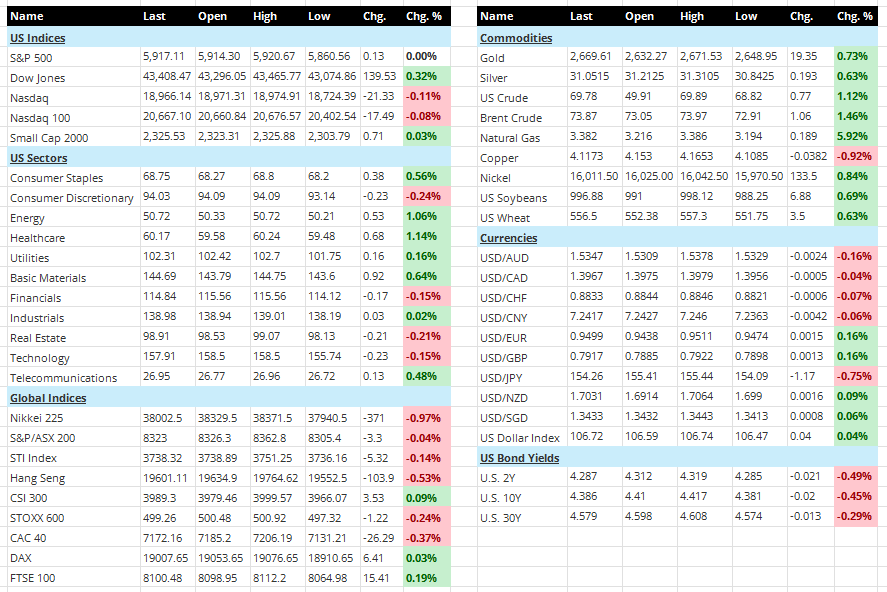

Market Update

-

US Futures: Futures are under pressure. Dow Jones futures are down 0.11%, and S&P 500 futures have slipped 0.27%, reflecting cautious sentiment.

-

US Indices: Mixed results in the previous session. The S&P 500 was flat (0.00%), while the Dow Jones added 0.32%. The Nasdaq fell 0.11%, and the Nasdaq 100 dipped 0.08%. Small Caps rose slightly by 0.03%.

-

US Sectors: Gains were led by Healthcare (1.14%) and Energy (1.06%). Basic Materials and Consumer Staples rose 0.64% and 0.56%, respectively. Technology and Financials saw modest declines (0.15% each).

-

Asia: Negative momentum dominated. The Nikkei 225 dropped 0.97%, while the S&P/ASX 200 fell 0.04%. The Hang Seng declined 0.53%, though the CSI 300 gained 0.09%.

-

Europe: European indices struggled. The STOXX 600 fell 0.24%, and the CAC 40 dropped 0.37%. The DAX held steady, rising slightly by 0.03%, and the FTSE 100 edged up 0.19%.

-

Commodities: Strong gains in energy and metals. US Crude rose 1.12%, and Brent Crude climbed 1.46%. Gold and Silver advanced 0.73% and 0.63%, respectively, while Natural Gas surged 5.92%. Copper lagged, falling 0.92%.

-

Currencies: The US Dollar Index gained 0.04%. The dollar strengthened against the euro (0.16%) and the pound (0.16%) but weakened against the yen (0.75%).

-

US Bond Yields: Yields fell across the board. The 2-year yield dropped 2.1 basis points to 4.287%, the 10-year yield decreased 2.0 basis points to 4.386%, and the 30-year yield declined 1.3 basis points to 4.579%.

Key Economic Data & Central Bank Speeches (ET)

- 8:30 AM: U.S. Philadelphia Fed Manufacturing Index for November

- 8:45 AM: Speech by Cleveland Fed President Hammack

- 10:00 AM: Eurozone November consumer confidence index (prelim)

- 10:30 AM: ECB Chief Economist Lane speaks

- 10:00 AM: U.S. October second-hand home sales (annual rate)

- 12:25 PM: Chicago Fed President Goolsbee speaks

- 4:40 PM: Fed Vice Chair Barr speaks

Other Notable News

- Fed Caution on Rate Cuts: Fed Governor Bowman urged caution in cutting rates, emphasizing the need for prudence, while Governor Cook suggested any reductions should be gradual and data-driven.

- Trump’s Crypto Focus: Reports indicate the Trump administration is exploring the creation of a new White House role dedicated to cryptocurrency policy, signaling a potential shift in regulatory priorities.

- Eurozone Wage Growth Challenges ECB: Accelerating wage growth in the eurozone complicates the ECB’s plans for rate cuts. Board member Stournaras predicts inflation will hit 2% by early 2025, while the ECB flagged rising trade frictions as additional risks to the region’s economy.

- BOE Considers Faster Rate Cuts: Bank of England Deputy Governor Ramsden suggested rate cuts could accelerate if economic uncertainty diminishes in the coming months.

- Iran Nuclear Update: The IAEA announced that Iran has agreed to halt production of 60% enriched uranium, a significant move in nuclear negotiations. - Ford’s European Job Cuts: Ford plans to eliminate 4,000 jobs in Europe by 2027, with most cuts affecting operations in Germany and the UK, as part of cost-saving measures.

- Pessimism Among Japanese Firms in China: A Japan Chamber of Commerce survey revealed growing pessimism among Japanese companies in China, with nearly half reducing or suspending investments amid economic concerns.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.