Coffee Crisis, Disease X Dangers, Syrian Governance Shifts, and China's Economic Reboot

Coffee prices hit a record high amid severe drought in Brazil, 'Disease X' raises alarms in Congo as health officials scramble for answers, and China prepares for unprecedented economic stimulus as UK business confidence takes a sharp downturn.

Good morning, everyone! Today, we delve into a range of pressing issues shaping our global landscape. From surging coffee prices due to climate-related supply concerns to an alarming outbreak of a mysterious illness in the Democratic Republic of Congo, the outlook remains complex. Stay tuned for all the insights and implications behind these stories!

Coffee Prices Surge: Arabica Reaches Record High Amid Supply Concerns

Photo by Mikesh Kaos / Unsplash

Record High Prices: Arabica coffee futures hit a staggering $3.434 per pound in New York, reaching the highest level since records began in 1972. This rise of approximately 80% this year is primarily driven by significant supply constraints, particularly in Brazil and Vietnam, setting the stage for potential increases in consumer prices.

Drought and Production Issues: Severe droughts have devastated coffee crops in Brazil, the world’s largest arabica producer, leading to a significant reduction in output projections. Major trader Volcafe has slashed Brazil's arabica production forecast to just 34.4 million bags, down 11 million from earlier estimates, emphasizing the dire supply situation.

Global Impact on Coffee Supply: As concerns grow, global coffee supplies are on track to fall behind demand by 8.5 million bags in the upcoming 2025-26 season. This marks the fifth consecutive year of deficits in coffee production, severely impacting prices and raising fears among roasters and cafes about the sustainability of their operations.

Broader Implications for Consumers: With rising costs, cafes and roasters are increasing prices and cutting discounts to maintain profit margins. As coffee finds itself amidst one of the hottest commodity markets this year, consumers might soon feel the pinch as these cost increases trickle down, contrasting sharply with overall lower wholesale food prices.

Emerging Concerns Over 'Disease X' in Congo

Photo by Markus Spiske / Unsplash

Mysterious Outbreak: A new flu-like illness, referred to as 'Disease X,' has emerged in the Democratic Republic of Congo, resulting in dozens of deaths and hundreds of sicknesses since late October 2024. The symptoms resemble a severe flu, including fever, coughs, and body aches, raising alarms among international health agencies due to the potential for widespread impact.

Challenges in Detection: Congo's limited healthcare infrastructure has hindered rapid detection and response efforts. With the outbreak primarily affecting a remote area—and reported to the government just on December 1—investigation teams face difficulties reaching the Panzi health zone, where access is cut off during the rainy season.

Investigating Possible Causes: Currently, health experts are exploring multiple factors that may be contributing to the outbreak, including pneumonia and influenza. The region is home to a vast array of wildlife viruses, increasing the risk of new infectious diseases emerging, especially affecting vulnerable populations like young, malnourished children.

Preparedness for Future Threats: The unofficial designation of 'Disease X' underscores the importance of preparing for unknown pathogens. Originally introduced by the WHO in 2017, the term encapsulates the need for research in developing vaccines and treatments that can quickly adapt to emerging health crises like this recent outbreak. This situation serves as a crucial reminder of the ongoing risks posed by infectious diseases in our interconnected world.

Syria's Rebel Leadership Takes Steps Toward Transitional Government

Photo by Mahmoud Sulaiman / Unsplash

New Leadership Role: Mohammed Al Bashir has been appointed by Hayat Tahrir Al-Sham (HTS) to lead the formation of a transitional government, as announced by Syrian television. This appointment aims to provide stability during a critical period of change and to prevent potential chaos in the region.

Past Experience: Al Bashir is no stranger to governance; he previously led a quasi-governmental authority established by HTS in 2017. This body operated in northwestern Syria, specifically Idlib, where Al Bashir managed local affairs funded through taxes collected from the Bab Al-Hawa border with Turkey.

Strategic Meetings: His appointment follows strategic discussions with HTS leadership, including Ahmed Al-Sharaa, who oversees both military operations and political strategy. This collaboration is crucial as the transitional government navigates the complexities of managing various factions and international relations in the wake of Assad's ousting.

Looking Ahead: With Al Bashir at the helm, the newly formed government will face the significant task of establishing legitimacy and stability in a region long marked by conflict. As the landscape evolves, regional dynamics will heavily influence the success of this transitional phase, with both domestic and international stakeholders watching closely.

China Poised for Significant Economic Stimulus and Rate Cuts

Anticipated Fiscal Changes: Chinese economists predict a fiscal deficit could rise to 4% of GDP in 2025, marking the highest level seen in three decades. This potential increase comes on the heels of a major policy shift by Beijing, which has historically aimed to maintain a deficit below 3%, demonstrating a newfound commitment to stimulating economic growth.

Rate Cuts on the Horizon: A number of brokerages are forecasting substantial interest rate cuts between 40 to 60 basis points next year, a shift towards a more aggressive monetary policy. This change signals a departure from a cautious approach held for nearly 14 years, encouraging optimism about future economic improvements.

Support for Domestic Demand: The increase in the fiscal deficit means the government is likely to borrow more to increase public spending, aiming to boost domestic demand amidst weak economic conditions. This also includes the possibility of expanding funding mechanisms like local government special bonds for infrastructure and other strategic projects.

Extraordinary Measures Ahead: The Politburo's commitment extends to unconventional tools for economic stimulation, including a potential stabilization fund for the stock market and subsidies for low-income groups. As the global economic landscape becomes more unpredictable, these strategies may play a crucial role in assuring growth and market confidence in the months to come.

UK Business Confidence Plummets Amid Economic Concerns

Confidence Decline: Business confidence in the UK has dropped to its lowest level since January 2023, with BDO's Optimism Index falling 5.81 points in November. This significant decline is a direct reaction to the recent “pro-growth” budget presented by the Labour government, which raised taxes and increased the National Living Wage. Businesses fear these changes will exacerbate inflation rather than stimulate growth.

Rising Costs and Job Vacancies: The UK's job market is similarly feeling the strain, as vacancies fell at their fastest rate since the onset of the pandemic. Data from KPMG highlights that demand for staff has diminished sharply, particularly for permanent positions, signaling a hesitance by businesses to hire amid rising employee costs due to the recent budget measures. As hiring slows, the overall economic landscape appears increasingly uncertain.

Impact of Fiscal Measures: The Labour government’s budget has raised alarms across various sectors, particularly regarding the increase in National Insurance Contributions that businesses face. Experts warn that these financial pressures could stifle hiring and lead to potential layoffs, supported by comments from Bank of England Governor Andrew Bailey regarding employers’ concerns about job cuts.

Looking Ahead: Despite optimism surrounding possible interest rate cuts in the near future, experts suggest that rising employee costs might neutralize any beneficial effects. As the economic climate continues to cool due to these fiscal changes, the outlook for UK businesses remains mixed, creating a challenging environment for navigation in 2024.

ByteDance and TikTok Seek Immediate Relief from U.S. Ban

Photo by Solen Feyissa / Unsplash

Emergency Motion Filed: ByteDance, the parent company of TikTok, has urgently petitioned the U.S. Court of Appeals to pause a law that mandates them to divest TikTok by January 19. They argue that failing to secure this temporary block could lead to the app's closure, affecting over 170 million monthly users just before a significant presidential inauguration.

Potential Impact on Value: If the ban proceeds, it could drastically reduce TikTok's market value and disrupt countless businesses that rely on its platform for sales. With only six weeks until the deadline, this uncertainty underscores the stakes for ByteDance and its investors.

Supreme Court Involvement: ByteDance’s legal team believes there’s a significant chance the Supreme Court may intervene, meriting a pause for further discussions. This request also aims to provide the incoming administration time to consider its stance, possibly mitigating both the immediate harms and the necessity for Supreme Court review.

Political Context: As TikTok navigates this legal landscape, the situation is further complicated by political dynamics. President-elect Trump, who previously attempted to ban the app, has expressed intentions to protect it, creating ambiguity about the future of TikTok under his administration. Meanwhile, the decision also highlights the broader implications for foreign-owned apps and data privacy concerns in the U.S.

Latest On Global Markets

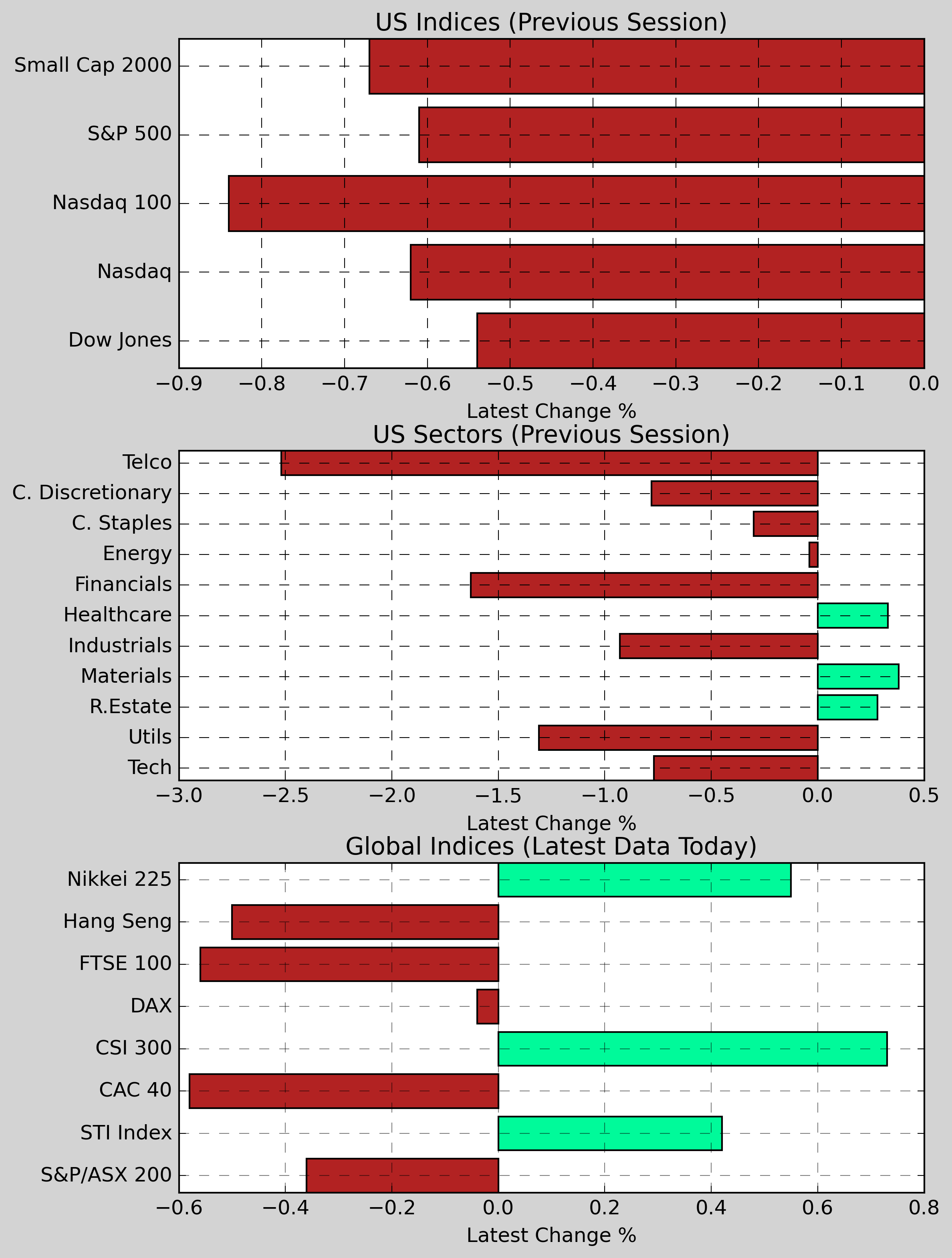

US Futures: Futures are currently showing a mixed picture, with Dow Jones futures declining 0.10%, S&P 500 futures down 0.12%, and Nasdaq 100 futures falling 0.13%.

US Indices (Previous Session): The S&P 500 fell 0.61% to 6,052.85, while the Dow Jones declined 0.54% to 44,401.93. The Nasdaq slipped 0.62%, closing at 19,736.69, and the Nasdaq 100 dropped 0.84%. The Small Cap 2000 also experienced a loss of 0.67%.

US Sectors (Previous Session): There were limited gains, with Basic Materials rising 0.38% and Real Estate increasing 0.28%. Conversely, Financials dropped 1.63%, Industrials fell 0.93%, and Utilities declined 1.31%.

Global Indices: The Hang Seng decreased 0.50%, while the CSI 300 gained 0.73%. In Europe, the CAC 40 fell 0.58%, and the DAX edged down 0.04%. Meanwhile, the Nikkei 225 increased 0.55%, while the S&P/ASX 200 slipped 0.36% and the FTSE 100 dropped 0.56%.

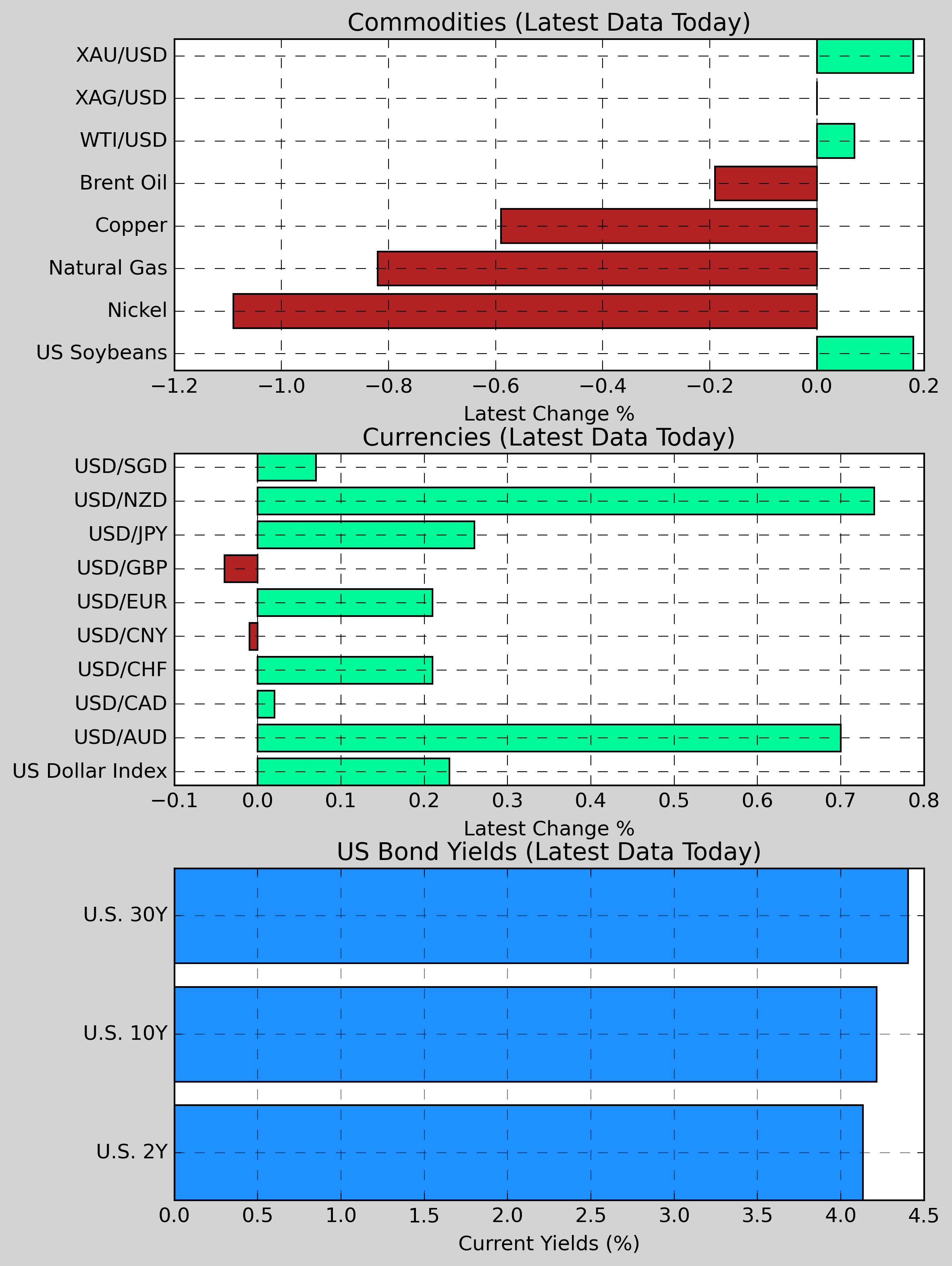

Commodities: Gold rose 0.18% to $2,665.24. Silver was nearly flat, slipping 0.00%. US Wheat declined 0.54% to $555.00, and US Soybeans saw a slight gain of 0.18% to $991.75. Natural Gas fell 0.82% to $3.156, while Copper dropped 0.59% to $4.2503. Brent Crude edged down 0.19% to $72.00. Nickel experienced a decline of 1.09% to $15,824.50.

Currencies: The US Dollar showed strength against various currencies, with USD/AUD rising 0.70% to 1.5639 and USD/NZD increasing 0.74% to 1.7179. The US Dollar Index gained 0.23%, reaching 106.39. However, USD/GBP dipped 0.04%, settling at 0.7841, while USD/CNY slightly declined 0.01% to 7.2600.

US Bond Yields: The U.S. 2-Year Treasury yield increased 1.30bps to 4.133%, while the U.S. 10-Year Treasury yield rose 3.80bps to 4.216%. The U.S. 30-Year Treasury yield advanced 1.40bps to 4.404%.

Economic Data & Central Bank Developments (Eastern Time)

- 05:00 AM ET: OPEC Meeting

- 05:00 AM ET: ECOFIN Meetings

- 05:00 AM ET: Eurogroup Meetings

- 06:00 AM ET: NFIB Small Business Optimism (Nov) (actual: 101.7, forecast: 94.6, previous: 93.7)

- 08:30 AM ET: Nonfarm Productivity (QoQ) (Q3) (forecast: 2.20%, previous: 2.50%)

- 08:30 AM ET: Unit Labor Costs (QoQ) (Q3) (forecast: 1.90%, previous: 0.40%)

- 08:55 AM ET: Redbook (YoY) (previous: 7.40%)

Other Notable News

-

Rising Tensions in South Korea: The main opposition party in South Korea has accused Prime Minister Han Deok-soo of treason, leading to the prosecution's request for an arrest warrant for the former Defense Minister over a controversial martial law incident.

-

Japan's Monetary Policy Scrutiny: The Bank of Japan has organized a scheduled address and press session with its deputy governor on January 14, fueling expectations among economists for an interest rate hike during the upcoming policy meeting.

-

China's Export Restrictions Impacting Ukraine: Reports indicate that China has started to limit the supply of essential components for UAVs supplied by the U.S. and Europe to Ukraine, with broader export restrictions anticipated in the coming year.

-

Concerns Over Syria Under Assad's Regime: The collapse of President Assad's government in Syria could pose significant challenges for Putin, raising uncertainty regarding the future of critical Russian military positions in the region.

-

Bank of England's Liquidity Measures: The Bank of England is preparing to enhance liquidity through its key repo facility to manage a potential cash shortfall as it continues to decrease its balance sheet.

-

Bitcoin ETFs Post-Trump: Since the election of Trump, U.S. Bitcoin exchange-traded funds (ETFs) have seen inflows nearing $10 billion, bringing total assets to approximately $113 billion.

-

Oracle's Quarterly Performance: Oracle reported a 9% increase in revenue for its second quarter, which fell short of investor expectations hopeful for stronger growth from its cloud services.

-

Mondelēz Explores Hershey Takeover: Mondelēz International is considering acquiring U.S. chocolatier Hershey, a move that would form a new food behemoth boasting near $50 billion in annual sales.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.