China's AI Surge, Trump’s Tariff Threats to German Auto Giants, and Alibaba's Strategic Transformation

China's AI prowess surges ahead of the U.S. with innovative open-source models, while German automakers brace for Trump's looming tariffs threatening exports; in this shifting landscape, Alibaba’s major sale reveals critical strategic changes amidst economic challenges.

Hello, it’s Ryosuke! Today, we’re diving into some significant global developments making waves in various sectors. Here’s what you can expect in the report:

- China's AI Ascendancy: Chinese AI models are outperforming U.S. alternatives, thanks to open-source innovations and strategic global ambitions.

- Automotive Tariff Tensions: President Trump's potential tariffs threaten the stability of Germany’s automotive industry, leading to investor concerns and highlighting opportunities for greener technologies.

- China’s Economic Goals: Amidst economic challenges, China targets a 5% growth rate while increasing its budget deficit, signaling aggressive approaches to stimulate the economy.

- M&A Market Resurgence: Global mergers and acquisitions are rebounding, with dealmakers adapting to a volatile political landscape as they anticipate impacts from a possible second Trump presidency.

- Alibaba’s Strategic Shift: Alibaba faces a $1.3 billion loss after selling its Intime business, marking a strategic pivot as it narrows its focus on core operations amid challenging retail conditions.

Details and broader implications are covered below—let’s dive in!

China's Rise in AI: Surpassing U.S. Rivals with Open Source Innovations

Photo by Jonathan Kemper / Unsplash

Emerging Competitors: Chinese AI models are rapidly gaining traction and even surpassing their U.S. counterparts in functionality and performance, as noted by industry analysts. This shift marks a significant landscape change in the global AI race, highlighting the effectiveness of China’s approach.

Open Source Advantage: Many Chinese tech firms are embracing open-source models to drive innovation and accessibility. These models, such as Alibaba's Qwen, allow developers to utilize and enhance AI applications without heavy licensing constraints, fostering a community of creators that propels the technology forward.

Global Aspirations: By promoting open-source technologies, Chinese companies aim to position their models on the international stage, creating pathways for global adoption. This ambition not only enhances their competitiveness but also suggests a broader strategy to expand their influence and user base in the AI sector.

Challenges Ahead: Despite the progress, China faces hurdles, particularly regarding access to advanced AI chips from U.S. manufacturers like Nvidia, which could hinder long-term development. However, ongoing investments in domestic alternatives may mitigate these gaps, revealing that the race in AI is just as much about infrastructure as it is about innovation.

Trump's Tariff Threats: A Looming Crisis for German Automakers

Photo by Domenik Kowalewski / Unsplash

Potential for Major Impact: President-elect Donald Trump’s intention to implement a blanket tariff on all imports poses a significant threat to European auto manufacturers, particularly Germany's leading companies. With Germany exporting around €23 billion worth of cars to the U.S. last year, any tariffs could exacerbate their existing challenges amid economic struggles and reduced demand globally.

Manufacturing at Risk: Rico Luman from ING highlighted that the automotive industry is central to Germany’s manufacturing sector, linking it to various suppliers from steel to chemicals. Trump’s rhetoric suggesting he wants German companies to shift manufacturing stateside intensifies concerns about job losses and the overall supply chain in this critical sector.

Investor Sentiment Shaken: Shares of major German automakers like Volkswagen and BMW have already seen declines of approximately 23% this year, largely due to profit warnings tied to market conditions. As the industry braces for potential tariff impositions, there’s rising anxiety about the long-term viability of Germany’s automotive effort in a changing trade climate.

A Chance for Europe?: Amid these threats, some analysts, such as Julia Poliscanova from Transport & Environment, see an opportunity for Europe to strengthen its green technology and electric vehicle initiatives. While the immediate outlook for German car manufacturers appears grim, focusing on innovation and sustainability could be a crucial strategy to counteract the predicted impacts of Trump's policies.

China Sets Growth Goal Amidst Economic Challenges

Targeted Growth Rate: China is aiming for an annual growth rate of about 5% in 2025, matching this year's expectations, as reported by Reuters. This goal was discussed during a key economic conference led by President Xi Jinping, with final announcements expected in March during the parliamentary meetings.

Increased Budget Deficit: Alongside the growth target, China plans to raise its budget deficit to 4% of GDP, marking the highest level in decades. This shift suggests a move towards more aggressive fiscal stimulus while the economy faces pressure from potential trade tensions with the U.S., particularly with a new administration coming into power.

Stimulus Approach: Recent actions include promises of more government spending and easier monetary policies, which aim to support domestic consumption amid ongoing economic uncertainty. This proactive strategy comes as officials seek to improve growth in light of a weakening labor market and sluggish consumer confidence, largely impacted by a downturn in the property sector.

Public Response and Outlook: Discussions on social media reflect broader societal concerns, especially about falling wages and job market struggles. The government’s increased borrowing and special bond issuance signal their commitment to boosting the economy, but analysts warn that these measures may not be sufficient to tackle deep-rooted economic issues in the near term.

Dealmakers on Edge: Anticipating Trump's Impact on M&A Landscape

Photo by Darren Halstead / Unsplash

Resurgence in M&A Activity: Following a challenging two-year period, global mergers and acquisitions are experiencing a significant rebound, with transaction values reaching $3.1 trillion in 2024—up 16% from last year. This uptick is largely attributed to easing inflation and reduced interest rates, prompting companies to explore new deals and divest non-core businesses as they adapt to the post-pandemic market.

Trump's Presidency: A Double-Edged Sword: As bankers await the ramifications of a potential second Trump presidency, there's a mix of optimism and caution. While Trump's tax cuts and less regulatory environment are seen as boosts for M&A activity, concerns linger over possible inflation spikes due to proposed tariffs, which could complicate the financial landscape for dealmakers.

Sector-Specific Deal-Making Trends: In 2024, we've seen major deals in sectors like advertising and banking, with billions at stake, such as the $36 billion acquisition of Kellanova by Mars Inc. This trend signals a shift where companies are now more willing to explore large-scale mergers and spinoffs, fueled by a realistic assessment of the evolving market dynamics as we move into 2025.

Activist Investors and Future Prospects: With hundreds of billions in spinoffs and asset sales occurring this year, companies that haven't streamlined their operations may soon face pressure from activist investors. As we look forward, sectors across the board are expected to leverage M&A strategies to fortify their positions, with key players like Intel and Hershey drawing attention as potential takeover targets. The evolving political and economic climate will shape the intentions and strategies of these companies in the year ahead.

Alibaba's Strategic Shift Leads to $1.3 Billion Loss on Intime Sale

Significant Loss on Sale: Alibaba has agreed to sell its Intime department store business to Youngor Fashion for approximately $1 billion, marking a significant turnaround from its initial investment, resulting in a $1.3 billion loss. This move signifies a strategic transition away from non-core assets that had been part of Alibaba's ambitious attempt to merge online and offline retailing since 2017.

Market Reaction: Following the announcement, Alibaba's share value reflected concerns, dropping by as much as 2.1% before recovering slightly to a 0.8% decline by midday. Investors are keeping a close eye on these developments, especially given the competitive landscape with rivals like PDD Holdings and ByteDance making significant inroads.

Focus on Core Operations: Under the leadership of CEO Eddie Wu, Alibaba is pivoting towards consolidating its main business areas and investing in promising growth segments, including technology and global e-commerce. This approach is critical as the company integrates both domestic and international operations, reflecting a broader shift in its business strategy.

Broader Economic Context: The decision comes amidst disappointing retail performance in China, where recent data showed the slowest growth in retail sales in three months. The Chinese government has prioritized the need to boost domestic consumption, creating a challenging environment that amplifies the importance of Alibaba's strategic realignment for future success.

Latest On Global Markets

US Futures: Futures are trending downwards, with Dow Jones futures decreasing 0.39%, S&P 500 futures falling 0.33%, and Nasdaq 100 futures down 0.22%.

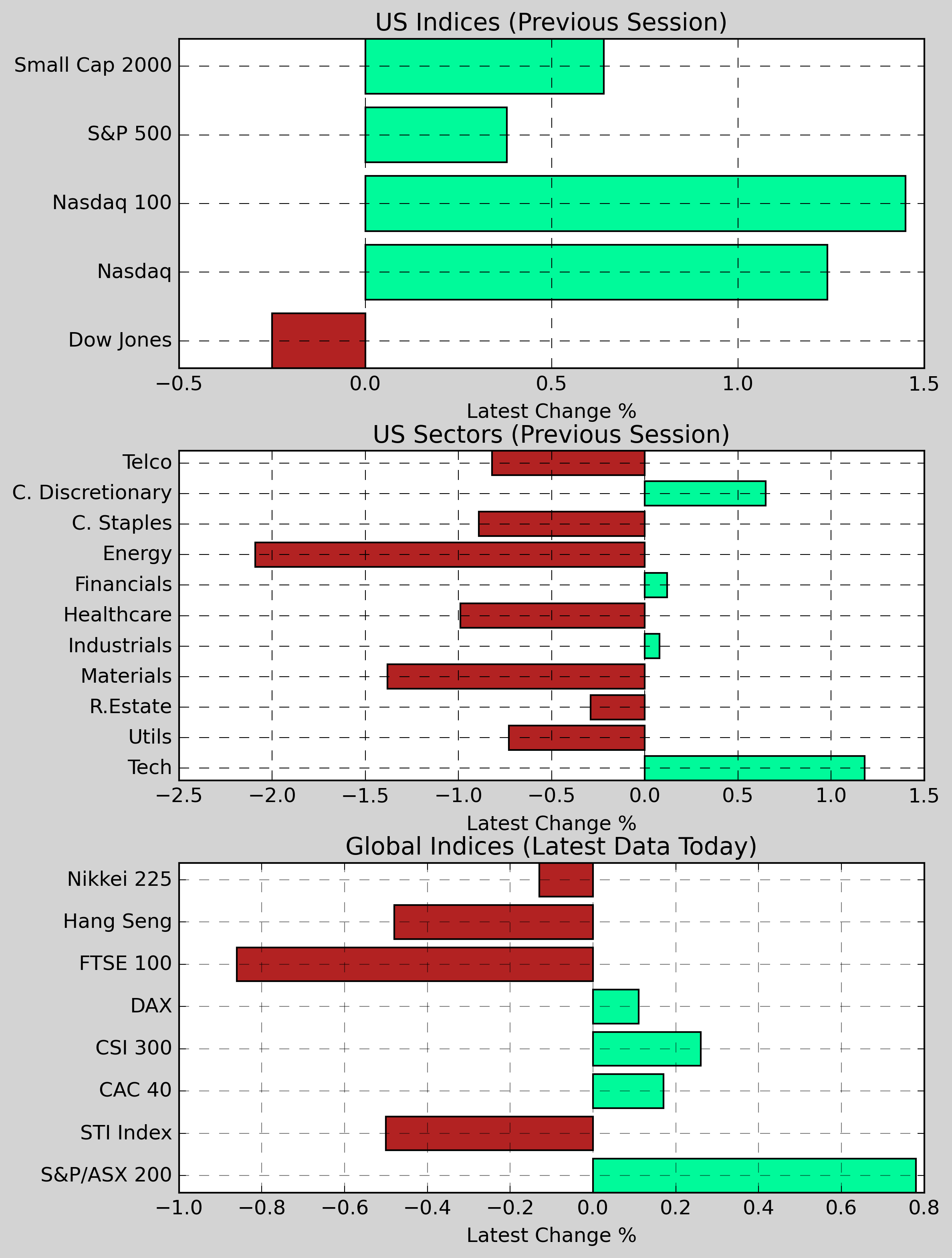

US Indices (Previous Session): The S&P 500 dropped 0.30% to 6,074.08, while the Dow Jones declined 0.25% to 43,717.48. The Nasdaq rose 0.12%, closing at 20,173.89, and the Nasdaq 100 gained 0.15%. The Small Cap 2000 posted a gain of 0.64%.

US Sectors (Previous Session): Consumer Services led the gains, rising 0.65%, followed by Industrials, up 0.08%. Conversely, Basic Materials dropped 1.38%, Utilities fell 0.73%, and Healthcare decreased 0.99%.

Global Indices: The CAC 40 rose 0.17%, while the DAX increased 0.11%. The CSI 300 climbed 0.26%, and the S&P/ASX 200 made gains of 0.78%. However, the Nikkei 225 experienced a decline of 0.13%, the Hang Seng edged down 0.48%, and the FTSE 100 fell 0.86%.

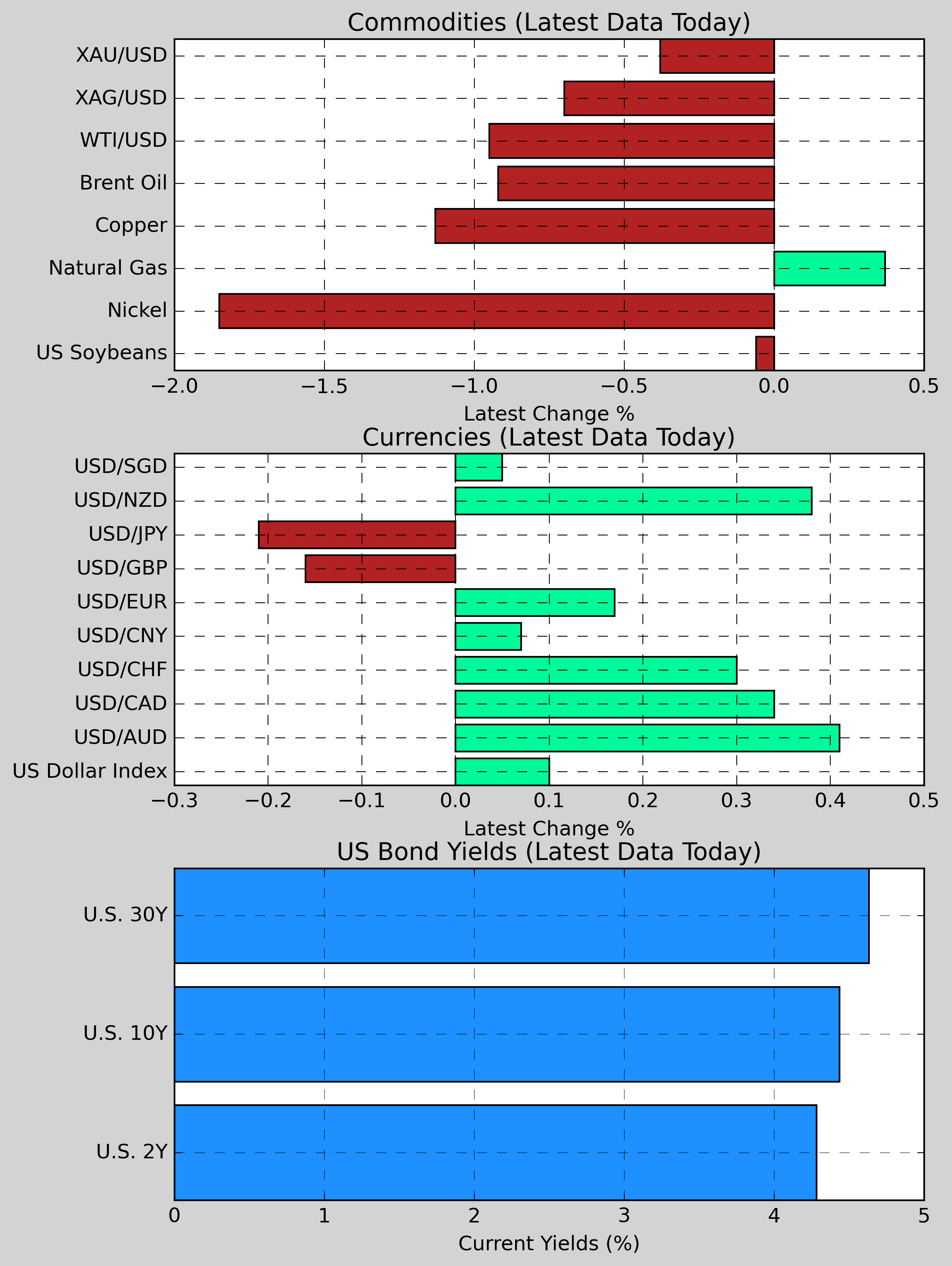

Commodities: Gold declined 0.38% to $2,642.74, and Silver fell 0.70% to $30.31. Copper saw a slight dip, decreasing 1.13% to $4.1437. US Wheat gained 0.34% to $551.88, while Natural Gas inched up 0.37% to $3.2260. Nickel dropped significantly, down 1.85% to $15,876. Brent Crude fell 0.92% to $73.23.

Currencies: The US Dollar experienced a slight uptick, with USD/AUD rising 0.41% to 1.5761 and USD/NZD gaining 0.38% to 1.7360. Conversely, USD/GBP dropped 0.16% to 0.7871, while USD/CNY rose 0.07% to 7.2885. The US Dollar Index moved up 0.10% to 106.97.

US Bond Yields: The U.S. 2-Year Treasury yield increased 7bps to 4.283%, while the U.S. 10-Year Treasury yield rose 8bps to 4.436%. The U.S. 30-Year Treasury yield also saw a gain, up 2bps to 4.632%.

Indices: Nasdaq 100 Futures fell 0.22% to 22,359.25, while Dow Jones Futures dropped 0.39% to 44,089.00. S&P 500 Futures also slipped 0.33% to 6,133.75. Overall, major stock indices faced downward pressure, with the Nikkei 225 declining 0.13% to 39,410.00 and the FTSE 100 dipping 0.86% to 8,190.92.

Economic Data & Central Bank Developments (Eastern Time)

- 08:30 AM ET: U.S. November retail sales month-on-month (estimated to be 0.6%, previous value is 0.4%)

- 08:30 AM ET: Canada's November consumer price index year-on-year (estimated at 2%, previous value at 2%)

- 09:15 AM ET: U.S. industrial production month-on-month in November (estimated to be 0.3%, previous value -0.3%)

Other Notable News

-

Resignation in Canadian Cabinet: Finance Minister Chrystia Freeland stepped down from her position on Monday due to disagreements regarding the approach to the Trump administration. Prime Minister Trudeau has since appointed Dominic LeBlanc as her successor.

-

Political Unrest in Germany: German Chancellor Olaf Scholz faced defeat in a parliamentary confidence vote, paving the way for potential early elections in February.

-

Economic Growth in U.S. Services: The services sector in the United States showed remarkable expansion in December, marking its fastest growth rate in over three years. This development comes amidst a worsening slump in manufacturing.

-

Inflation Outlook from ECB: ECB President Christine Lagarde indicated that the war against inflation might be nearing an end, with the central bank potentially easing interest rates further, though Executive Board member Schnabel cautioned against a rapid pace of cuts.

-

Record Highs in Cocoa Prices: Cocoa futures surged to an unprecedented level on Monday, putting additional pressure on chocolate producers already struggling with high operational costs.

-

Economic Measures in Brazil: The Brazilian real has plummeted to an all-time low, following the latest attempt by the central bank to stabilize the currency, which has not alleviated market concerns.

-

SoftBank’s Commitment to U.S. Jobs: Masayoshi Son, the CEO of SoftBank, announced his intention to invest $100 billion in the U.S. and generate 100,000 jobs over the next four years, addressing future economic growth.

-

Trump’s Stance on Ukraine: Former President Trump suggested that Ukraine should prepare for a peace deal to end the war and minimized the significance of the territories currently occupied. He noted that Ukrainian President Zelensky would not be welcomed at his inauguration.

-

November Home Sales Surge in Singapore: Home sales in Singapore reached a decade-high level in November, leading to rising speculation regarding new government restrictions.

-

Mixed Economic Signals from Eurozone: The private sector in the Eurozone contracted more than anticipated in December, although this downturn was somewhat mitigated by an increase in the services sector.

-

Argentina's Currency Strategy: Argentina is contemplating the implementation of a managed floating exchange rate system to help stabilize its economy amidst ongoing challenges.

-

Fed's Rate Cut Expectations: Economists from Goldman Sachs speculated that the forthcoming Federal Reserve meeting might indicate a more gradual approach to easing monetary policy, with expectations that a rate cut could be deferred in January.

-

French Political Challenges: In France, the National Assembly approved a temporary budget to ensure governmental operations continue, as the central bank revised its growth outlook downward, citing the negative impact of ongoing political instability on both household and business confidence.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.