China Tightens Tungsten Exports, Ferrari Races Amid Tariff Threats, and Le Pen Fuels French Budget Crisis

China tightens tungsten export controls, impacting global supply chains; Ferrari remains resilient amid U.S. tariff threats affecting the auto industry; Marine Le Pen escalates France's budget standoff, threatening government stability; Chinese stocks rally on stimulus expectations.

Good morning! It’s Ryosuke. Today’s developments revolve around China’s tighter tungsten export controls and the global supply chain shifts they’re causing, Ferrari’s resilience as tariff threats shake the auto industry, Marine Le Pen’s escalating budget standoff in France, and a strong rally in Chinese stocks driven by stimulus hopes. Let’s get started!

China Limits Tungsten Exports as Alternatives Emerge

China Tightens Grip on Tungsten: Starting December 1, China will restrict tungsten exports, requiring licenses for businesses exporting the critical metal. This marks a shift from decades of flooding global markets with cheap tungsten to dominate 80% of the supply chain. Tungsten is vital for weapons and semiconductors, making it a key asset in China’s strategic trade arsenal.

US-China Trade Tensions Escalate: The U.S. banned its contractors from purchasing China-mined tungsten starting in 2027, while tariffs on Chinese tungsten rose by 25% this September. These measures aim to reduce dependency on China, though experts say domestic mining projects may take years to become commercially viable.

Global Shift Toward “Friendshoring”: Alternatives to Chinese tungsten are emerging. South Korea’s Sangdong mine, owned by Canada-based Almonty Industries, is set to resume operations by 2025, with nearly half its output contracted to the U.S. Other projects in Kazakhstan, Australia, and Spain also aim to stabilize supply and prices.

Reviving U.S. Production: While dormant for years, U.S. tungsten mines are regaining attention. A Canadian company plans to reopen Idaho’s IMA tungsten mine by spring, citing significant reserves of tungsten and related metals. Meanwhile, the U.S. Geological Survey has identified around 100 tungsten-rich sites across 12 states, signaling potential for a more self-reliant future.

Ferrari Stays Resilient Amid Trump’s Tariff Threats

Photo by Joey Banks / Unsplash

Trump’s Tariff Push Targets Auto Giants: President-elect Donald Trump has vowed to impose steep tariffs on imports from China, Canada, and Mexico, sparking concerns across the global auto industry. European automakers avoided the initial crosshairs, but fears linger that the region could face similar measures soon.

Ferrari’s Unique Advantage: Unlike its European peers, Ferrari seems largely immune to tariff-induced disruption. Analysts note the Italian luxury carmaker’s wealthy clientele can absorb higher costs, allowing Ferrari to pass tariffs onto customers without major impacts on demand. Manufacturing exclusively in Maranello, Italy, Ferrari avoids supply chain relocations that other automakers might face.

Luxury Rivals Face Bigger Challenges: While Porsche shares some of Ferrari’s exclusivity, analysts argue that higher tariffs, such as 30%, could be harder for Porsche to offset. The Volkswagen-owned brand may need to invest heavily to set up U.S.-based production, adding financial strain. Porsche’s shares have dropped 26% this year, reflecting broader industry concerns.

Ferrari Outperforms the Pack: Ferrari has surged 34% year-to-date, outperforming rivals like Renault and Mercedes-Benz. Analysts credit its strong brand identity, high margins, and customer base’s low price sensitivity. While the broader auto sector braces for potential tariff fallout, Ferrari continues to race ahead, unscathed.

Le Pen Raises Stakes as France Faces Budget Standoff

Photo by Brina Blum / Unsplash

Le Pen Sets Monday Deadline: Far-right leader Marine Le Pen has demanded Prime Minister Michel Barnier revise his 2025 budget plans by Monday, threatening to support a no-confidence vote if her party’s demands aren’t met. Key demands include indexing pensions to inflation, halting tax increases, and tougher migration policies.

Government on Shaky Ground: While Barnier has already conceded on electricity tax hikes, opposition lawmakers on the left are readying a no-confidence motion. If Le Pen’s National Rally backs the motion, the government could fall as early as Wednesday.

Investor Jitters: The political standoff has rattled markets, pushing France’s 10-year bond spread over Germany to 82 basis points, its highest since Macron’s snap election in June. Though the spread eased slightly this week, it reflects growing investor concern over France’s fiscal and political stability.

Broader Implications: Barnier’s concessions on electricity taxes will bring power price cuts from February, but the budget battle underscores broader tensions in France’s fractured parliament. With economic uncertainty looming, the risk of political gridlock threatens to derail both fiscal reforms and investor confidence.

Chinese Stocks Rally Again Amid Stimulus Hopes

Photo by Timon Studler / Unsplash

Market Surge on Policy Optimism: Chinese stocks rallied sharply for the second time this week, with the CSI 300 Index climbing 2.3% at one point—its biggest gain in three weeks. Technology, healthcare, and consumer staples led the charge, while a Bloomberg Intelligence index of Chinese developer shares rose over 3%.

Stimulus Speculation Builds: Traders anticipate major economic support measures at December’s Central Economic Work Conference (CEWC), where top leaders will outline priorities for 2025. Rumors suggest possible actions, including a stabilization fund, reserve ratio cuts, and changes to local government housing metrics.

Investor Sentiment Strengthens: Unverified reports about an earlier-than-expected CEWC and a higher fiscal deficit target for 2025 added to market momentum. This follows Wednesday’s rebound, which saw the CSI 300 Index rise 1.7%, fueled by speculation about proactive government measures.

Broader Implications: With Donald Trump’s election raising concerns about escalated US-China trade tensions, investors are betting on Beijing to counteract potential growth risks. While specific CEWC outcomes won’t be confirmed until March’s legislative session, hopes for robust stimulus are driving optimism.

Latest On Global Markets

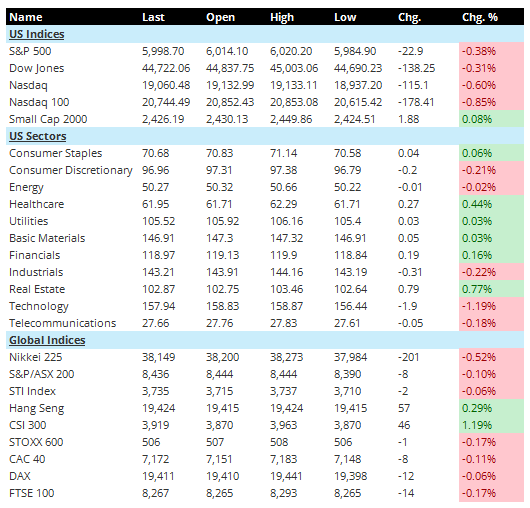

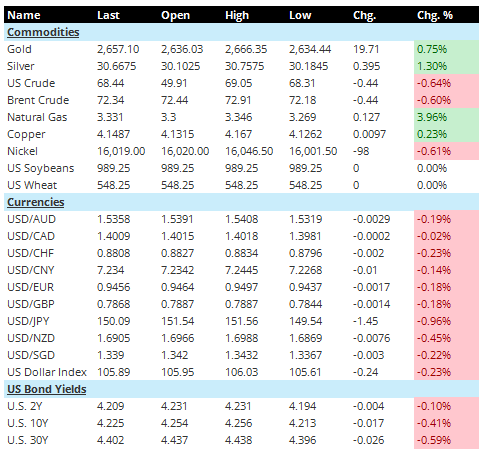

US Futures: Futures indicate a mixed opening for the US market. S&P 500 futures rose 0.31%, showing some upward momentum, while Dow Jones futures remained flat at 0.02%.

US Indices: Closed for Thanksgiving day.

Asia: Asian markets showed a mixed performance. Japan’s Nikkei 225 fell -0.52%, while Australia’s S&P/ASX 200 declined -0.10%. In contrast, Chinese indices advanced, with the CSI 300 gaining 1.19% and the Hang Seng up 0.29%.

Europe: European markets edged lower, reflecting a subdued sentiment. The STOXX 600 slipped -0.17%, while France’s CAC 40 declined -0.11%. Germany’s DAX and the UK’s FTSE 100 both fell slightly, down -0.06% and -0.17%, respectively.

Commodities: Commodities showed a mixed performance. Gold rose 0.75% to $2,657.10, while Silver gained 1.30%. Energy markets dipped, with US Crude down -0.64% and Brent Crude falling -0.60%. Natural Gas surged 3.96%, while Copper posted a modest increase of 0.23%. Nickel fell -0.61%, and agricultural commodities like US Soybeans and US Wheat remained unchanged.

Currencies: The US dollar weakened against most major currencies. The USD/AUD dropped -0.19%, and the USD/EUR declined -0.18%. The USD/JPY fell -0.96% to 150.09, reflecting notable movement. The US Dollar Index decreased -0.23% to 105.89, signaling broader dollar weakness.

US Bond Yields: Treasury yields declined across the board. The 2-year yield dipped by 1 basis point to 4.209%, while the 10-year yield fell 4 basis points to 4.225%. The 30-year yield saw the largest decline, down 6 basis points to 4.402%, reflecting investor demand for longer-term bonds.

Economic Data & Activities

- 05:00 AM: Eurozone November consumer price index month-on-month preliminary value (estimated to be -0.2%, previous value is 0.3%)

- 05:30 AM: Bank of England releases financial stability assessment report

- 06:30 AM: ECB Vice President de Guindos speaks

- 08:30 AM: Canada's third-quarter GDP seasonally adjusted quarter-on-quarter annualized rate (estimated to be 1.1%, previous value was 2.1%)

Other Notable News

ECB board member François Villeroy de Galhau suggested the central bank is nearing a point where interest rates may need to be adjusted to foster economic growth. In Germany, inflation remained unexpectedly stable in November, adding further justification for potential rate cuts by the ECB.

Australian central bank governor Michele Bullock ruled out short-term rate cuts, citing persistently high core inflation, which is projected to remain above target until 2026. Meanwhile, Australia’s Senate approved a central bank reform bill, splitting the board into two entities while retaining the treasurer’s authority to overturn decisions. Separately, the Senate passed a law banning children under 16 from using social media, set to take effect in about a year.

Germany plans to inject €2 billion in subsidies into its chip industry to bolster technological competitiveness.

Russian President Vladimir Putin assured the public that the ruble’s exchange rate remains under control, dismissing fears of instability. Putin also praised Donald Trump as a skilled and experienced politician. On the military front, Russian forces targeted Ukraine’s power infrastructure in a second major strike this month, with Putin hinting at potential ballistic missile use against decision-making centers in Kyiv.

Brazil’s real hit a record low after the government’s proposed $12 billion in spending cuts failed to meet investor expectations.

OPEC+ has postponed its online production meeting to December, adding uncertainty to oil markets.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.