Carter's Legacy, Musk's Satellite Expansion, Tragic Aviation Incident, Adani's Strategic Shift, and Resilient US Economy

As we honor the enduring legacy of Jimmy Carter, a former U.S. president known for his humanitarian work, the U.S. economy defies odds with steady growth, while Elon Musk's Starlink expands globally amid regulatory challenges and the tragic Jeju Air crash casts a shadow over aviation safety.

Hello, it’s Ryosuke! Today we’ve gathered some significant stories that capture pivotal moments and trends shaping our world. Here’s a quick overview of the key topics covered in the report:

-

Remembering Jimmy Carter: Reflecting on the legacy of the longest-living U.S. president, whose humanitarian efforts post-presidency earned him global respect and the Nobel Peace Prize.

-

Elon Musk's Starlink Expansion: Exploring how strategic partnerships are easing regulatory barriers as Starlink rapidly expands its global footprint, even amidst competition and regional hesitations.

-

Tragic Jeju Air Crash: Delving into the recent aviation disaster raising safety concerns, with investigations focusing on potential bird strikes and overall aircraft safety protocols.

-

Adani Group's Strategic Divestment: Highlighting Gautam Adani's $2 billion exit from Wilmar, signaling a shift back to core infrastructure investments in light of rapid business restructuring.

-

US Economy Resilience: Analyzing the surprising strength of the U.S. economy in 2024, driven by consumer spending, while also acknowledging emerging financial strains and challenges ahead.

Details and broader implications are covered below—let’s dive in!

Remembering Jimmy Carter: The Longest-Living U.S. President

Photo by Tim Mossholder / Unsplash

A Life of Service: Jimmy Carter, who passed away at the age of 100, was not only the longest-living U.S. president but also a significant figure in American history. His presidency, marked by challenges such as high inflation and the Iran hostage crisis, ultimately led to notable achievements, including the Camp David Accords, which established peace between Israel and Egypt.

Post-Presidential Impact: Following his time in office, Carter had a profound influence on global humanitarian efforts through the Carter Center, which tackled issues from disease eradication to promoting democracy. His relentless commitment to humanitarian causes culminated in receiving the Nobel Peace Prize in 2002, recognizing his decades of efforts devoted to peace and human rights.

A Legacy of Challenges and Triumphs: Although Carter faced significant setbacks during his presidency, including a struggling economy and the infamous “malaise speech,” his dedication to human rights and social justice has been reassessed positively over time. His complexities as a leader illustrated the tension between his moral convictions and the political realities of the day.

Bipartisan Respect: Leaders across the political spectrum, including President Joe Biden and former President Donald Trump, have paid tribute to Carter’s extraordinary contributions. Biden will be honoring his legacy with a state funeral and a national day of mourning on January 9, showing that regardless of political differences, Carter’s humanitarian spirit and leadership resonate with many.

Elon Musk's Global Reach: Starlink's Expanding Influence

Photo by Mariia Shalabaieva / Unsplash

Strategic Partnerships in South Africa: Elon Musk, utilizing his close ties with President-elect Donald Trump, is negotiating with South African President Cyril Ramaphosa to ease regulations on local ownership for Starlink. In exchange, Musk's companies are looking to invest in local initiatives like Tesla's battery production, showcasing how economic incentives are reshaping regulatory landscapes.

Diminishing Barriers Worldwide: As global resistance to Starlink weakens, many countries that previously imposed strict bans are reconsidering their policies. Musk's formidable network of satellites has already expanded to over 100 countries, highlighting a growing acceptance of his services as governments recognize the benefits of fast internet access.

The Pressure of Competition: With more than 7,000 satellites in orbit, Starlink now has a significant edge over competitors like Eutelsat OneWeb and Hughes Communications. This competitive advantage, combined with rising demand, is giving Musk leverage in negotiations with both support-seeking governments and eager consumers worldwide.

Challenges Ahead in Regions like Taiwan: Despite Starlink's success, some territories remain cautious, particularly Taiwan, which has opted for alternatives like OneWeb due to concerns about Musk's political connections. Nevertheless, the demand for reliable satellite internet remains high, suggesting that the pressure on local regulators to embrace Starlink will continue to mount as the need for connectivity grows.

Tragic Jeju Air Plane Crash: Key Facts and Investigations

Photo by Richard R. Schünemann / Unsplash

What Happened? The Boeing 737-800 operated by Jeju Air crashed at Muan International Airport, resulting in 179 fatalities and only two survivors. The plane skidded across the runway on its belly before colliding with a wall and exploding, with emergency calls indicating a potential bird strike during landing, further complicating the situation as investigators piece together the events.

Understanding Bird Strikes: Bird strikes are a serious safety concern in aviation, often leading to engine failures and catastrophic accidents. Past incidents, such as the famous "Miracle on the Hudson," highlight their dangerous impact, with the FAA reporting 61% of bird strikes occurring during landing—an alarming statistic as this recent crash unfolds amidst a public awareness of increasing wildlife strikes.

Investigation Focus: Authorities in South Korea are thoroughly examining all 101 Boeing 737-800 aircrafts in the country. Their investigation is not only looking into the bird strike possibility but also expanding to assess safety protocols at the airline and airport, the airplane's power systems, and the functionality of landing guidance systems as they analyze the critical data from the recovered black boxes.

Implications for Boeing: Despite its reputation for reliability, the crash of the Boeing 737-800 raises concerns about this aircraft model, especially as it follows recent aviation tragedies worldwide. While overall fatalities in commercial aviation dropped significantly in 2023, the focus on safety continues to intensify in light of incidents, prompting both industry leaders and regulators to reevaluate operational standards moving forward.

Adani Group Divests $2 Billion From Wilmar Joint Venture

Photo by Naveed Ahmed / Unsplash

Major Exit Strategy: Billionaire Gautam Adani is set to exit from Adani Wilmar Ltd. through a $2 billion multi-phased divestment, shifting focus back to core infrastructure. This decision reflects the Adani Group's strategy to streamline operations, enhancing its emphasis on sectors like air transport and renewable energy.

Share Sale Agreement: As part of this deal, Adani Enterprises will sell 13% of its shares to joint venture partner Wilmar International, which is necessary to meet minimum public shareholding requirements. Following this, Adani will completely divest its 44% stake in the company, signaling a significant restructuring within the business framework.

Board Changes and Future Implications: The exit will also lead to the resignation of Adani’s nominee directors from the Adani Wilmar board, suggesting a complete withdrawal from operational involvement. It's expected that Adani Wilmar may undergo a name change, marking a fresh start as the company navigates this transition.

Focus on New Ventures: The funds generated from this exit will be redirected to bolster Adani's extensive infrastructure projects, illustrating a calculated pivot in business strategy. This shift not only strengthens its financial foundation but also positions the group to capitalize on the burgeoning sectors of air transport and green energy.

US Economy Thrives Amid Challenges in 2024

Steady Growth Despite Risks: Surprisingly, the US economy continued to outshine its G-7 counterparts in 2024, fueled mainly by robust consumer spending and wage growth. Despite ongoing election uncertainties and high interest rates, the International Monetary Fund (IMF) forecasts the US will lead economic performance among wealthy nations.

Consumer Spending: American consumers have played a crucial role in this economic resilience. Although hiring slowed, increasing household wealth has led to a projected 2.8% growth in consumer spending, reflecting strong outlays in both goods and services, a remarkable rebound from the previous year.

Emerging Financial Strains: However, signs of strain are becoming evident, especially among lower-income households. Many have depleted their pandemic savings and rely on credit for spending, contributing to rising delinquency rates that suggest financial pressure is mounting among certain segments of the population.

Challenges Ahead: Despite the positive consumer spending outlook, higher borrowing costs have negatively impacted the housing and manufacturing sectors. With mortgage rates climbing and manufacturing jobs dwindling, there’s concern about how these trends will influence the economy moving into 2025, especially with potential policy changes on the horizon from the incoming administration.

Latest On Global Markets

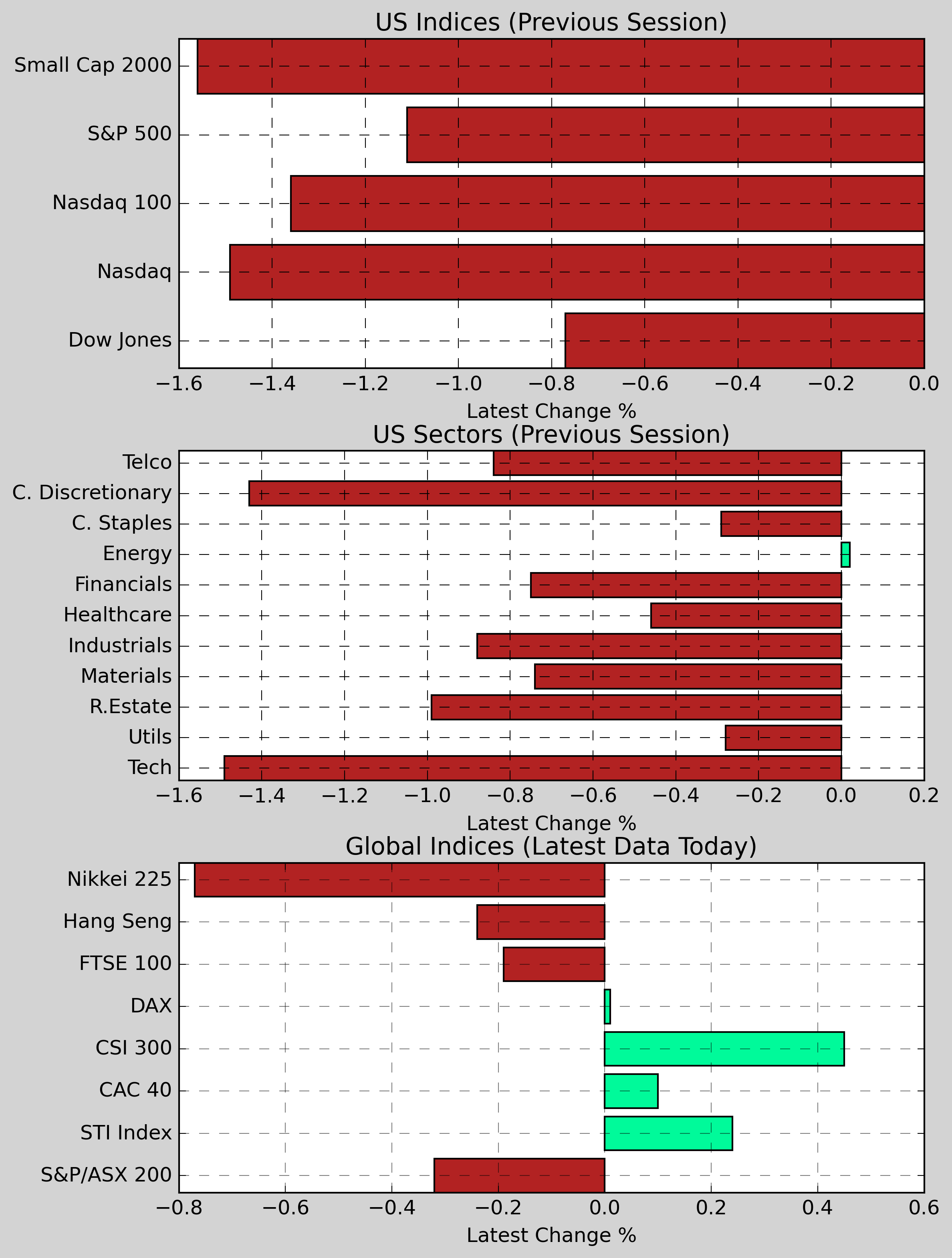

US Futures: Futures are showing a downward trend, with Dow Jones futures falling 0.20%, S&P 500 futures decreasing 0.21%, and Nasdaq 100 futures dropping 0.18%.

US Indices (Previous Session): The S&P 500 declined 0.11% to 5,970.84, while the Dow Jones dropped 0.77% to 42,992.21. The Nasdaq fell 1.49% to 19,722.03, and the Nasdaq 100 decreased 1.36%. The Small Cap 2000 saw a decline of 1.56%.

US Sectors (Previous Session): Energy was the lone gainer, slightly increasing 0.02%, while Utilities and Basic Materials fell 0.28% and 0.74%, respectively. Financials and Industrials also suffered losses, declining 0.75% and 0.88%.

Global Indices: In the global markets, the CAC 40 rose slightly by 0.10%, and the DAX showed minimal gains of 0.01%. Conversely, the CSI 300 surged 0.45%, while the Hang Seng slipped 0.24%. In Asia, Nikkei 225 decreased by 0.77%, and the S&P/ASX 200 fell 0.32%.

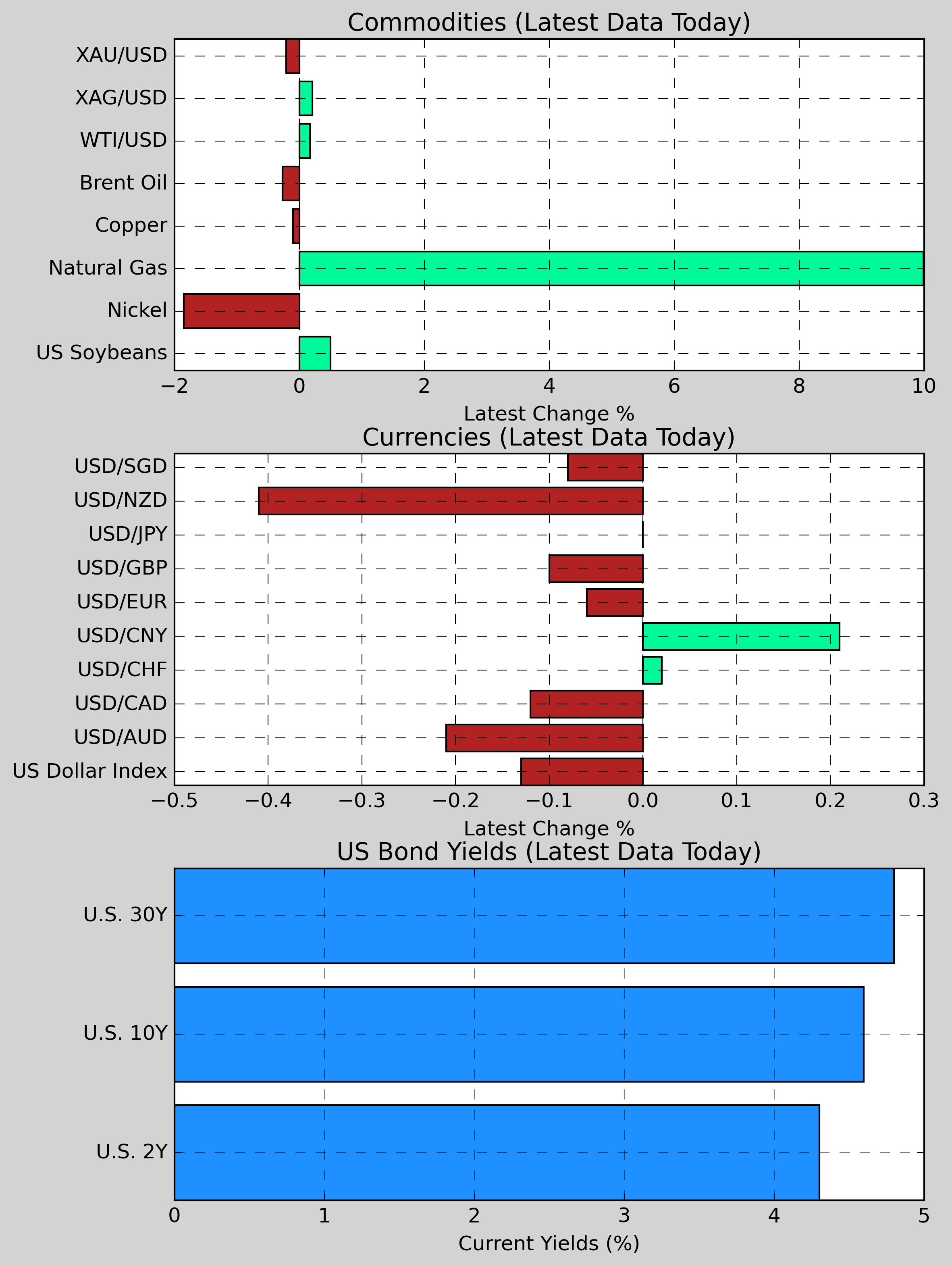

Commodities: Gold decreased 0.21% to $2,614.60, while Copper fell 0.10% to $4.1178. Nickel declined 1.85% to $15,876. Natural Gas rose 0.10% to $3.7210. US Wheat edged higher 0.26% to $548.40, and US Soybeans gained 0.50% to $984.88. Brent Crude slipped 0.27% to $73.59.

Currencies: The US Dollar weakened against some currencies, with USD/AUD down 0.21% and USD/CAD declining 0.12%. Conversely, USD/CNY rose 0.21%, and USD/JPY remained nearly unchanged. The US Dollar Index dropped 0.13% to 107.86.

US Bond Yields: The U.S. 2-Year Treasury yield decreased 5.5bps to 4.302%, while the U.S. 10-Year Treasury yield fell 4.8bps to 4.597%. Meanwhile, the U.S. 30-Year Treasury yield dropped 2.1bps to 4.800%.

Economic Data & Central Bank Developments (Eastern Time)

- 10:00 AM ET: U.S. second-hand housing sales contract volume in November increased month-on-month (estimated to be 0.8%, previous value was 2%)

- 10:30 AM ET: U.S. Dallas Fed Manufacturing Index for December (estimated to be -3.0, previous value -2.7)

Other Notable News

-

Tragic Aviation Incident in South Korea: A Jeju Air Boeing 737-800 tragically crashed into a wall and ignited during an emergency landing at a southern South Korea airport on Sunday. Out of the 181 individuals on board, only two flight attendants were rescued, marking one of the darkest days in South Korean aviation history.

-

Political Turmoil in South Korea: Following the impeachment of Acting President Han Deok-soo, South Korea is now facing a growing political crisis, with two leaders having been impeached in the span of just two weeks. Reports also emerged of prosecutors indicting former Defense Minister Kim Yong-hyun.

-

Japan’s Massive Budget Plan: The Japanese government has sanctioned an unprecedented budget of 115.5 trillion yen (approximately $732 billion) for the upcoming fiscal year, putting Prime Minister Shigeru Ishiba's minority administration to the test as it seeks parliamentary approval for the funding.

-

U.S. Debt Ceiling Alert: Treasury Secretary Janet Yellen announced that the U.S. Treasury is expected to hit the new debt ceiling by mid-January, outlining plans for special accounting measures to temporarily manage the limit without going over.

-

Concerns Over Ukraine’s Military Position: U.S. officials fear that Ukraine may have already sustained 50% losses of its military capabilities, raising alarms that further losses could occur in the coming months, which would significantly weaken Kiev's bargaining power in ongoing ceasefire discussions.

-

ECB Rate Cut Strategy: ECB board member Holzmann suggested that the central bank might delay its next interest rate reduction if inflation risks arise from a potential drop in energy prices or further euro depreciation.

-

U.S. Supreme Court and TikTok's Future: President-elect Trump is advocating for the Supreme Court to freeze any impending legislation that would force the sale or ban of TikTok, possibly signaling a more favorable future for the Chinese-owned app in the United States.

-

Trump's Stance on Skilled Worker Visas: President-elect Trump revealed to the New York Post that he is inclined to back a visa initiative for high-skilled workers, though his supporters are divided regarding the H-1B visa, a program championed by some prominent figures like Elon Musk.

-

Azerbaijan Airline Crash Incident: Azerbaijan's president accused Russia of mistakenly downing an Azerbaijan Airlines passenger flight on December 25, which led to the crash, demanding accountability from Moscow after Putin had previously offered his apologies.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.