Boeing's Delivery Dilemma, TikTok's User Exodus, Trump's Tariff Agency Plan, and India's Rupee Flexibility

In a tumultuous week for industries worldwide, Boeing grapples with a significant delivery drop amid production woes, TikTok users flock to competing apps ahead of a possible ban, and Trump's call for an 'External Revenue Service' faces scrutiny over its economic impact.

Hello, it’s Ryosuke! Today brings us a wealth of insightful developments across various sectors, from aviation to social media and economic policies. Here are the key highlights you won’t want to miss:

- Boeing's Delivery Dilemma: Boeing faced a staggering one-third drop in deliveries this year, widening its gap with Airbus amid production challenges and operational setbacks.

- Shifting Social Media Landscape: Users are rapidly turning to Chinese apps like Xiaohongshu and Lemon8 as TikTok faces a potential ban, generating significant interest in these emerging platforms.

- Trump's Tariff Agency Proposal: Donald Trump outlined plans for an "External Revenue Service" to manage tariffs, though the proposal has drawn skepticism and warnings from economists regarding its potential impact.

- Rupee Flexibility: RBI Governor Sanjay Malhotra signals a shift towards a more flexible approach to the Indian rupee, balancing intervention strategies with market adaptability to address ongoing economic challenges.

Details and broader implications are covered below—let’s dive in!

Boeing Faces Delivery Challenges as Gap with Airbus Widens

Significant Decline in Deliveries: Boeing completed only 348 airplane deliveries in 2024, marking a staggering one-third drop from the previous year. This decline has intensified its delivery gap with Airbus, which successfully delivered 766 aircraft, a notable achievement for the European manufacturer.

Production Struggles: The reduction in Boeing's deliveries stems from serious issues, including a midair door panel blowout incident and a machinist strike that halted production in the fall. These setbacks disrupted Boeing's operations at critical moments, highlighting vulnerabilities in their supply chain.

Recent Performance Improvement: Despite the challenges, Boeing managed to deliver 30 airplanes in December after resuming production of its popular 737 Max models. This resumption is crucial, as deliveries are integral for cash flow, involving significant payments from customers upon delivery.

Future Outlook: Boeing recorded 142 gross orders in December, including a major purchase from Turkey’s Pegasus Airlines. As the company prepares to report its fourth-quarter results on January 28, all eyes will be on its recovery plan to improve production efficiency and regain its competitive edge against Airbus.

Users Flock to Alternatives as TikTok Faces Possible US Ban

Rising Alternatives: With TikTok's future in limbo, users are eagerly downloading Xiaohongshu and Lemon8, two Chinese social apps recently climbing to the top of Apple’s iPhone download charts. Xiaohongshu, known as China's Instagram, has gained traction among new users identifying as "TikTok refugees," highlighting a notable shift as they seek new platforms for sharing and discovering content.

Imminent Deadline: TikTok must find a US buyer by January 19 to avoid a ban, with potential options for acquisition including a deal involving Elon Musk. As the pressure mounts, TikTok's significant user base appears increasingly open to alternatives, perhaps further fueling the popularity of these emerging platforms.

Industry Impacts: The surge in popularity for Xiaohongshu has lifted the stocks of associated Chinese companies, including digital marketing firms and consumer brands linked to the app. This surge signals a strategic shift in the social media landscape, where established players must adapt quickly to retain users amidst regulatory uncertainty.

Cultural Expansion: Although originally focused on the Chinese-speaking market, Xiaohongshu's increased visibility in the US is supported by a wave of new English-language content and a sense of community among newcomers. The hashtag #tiktokrefugee has gone viral, encouraging TikTok users to explore the platform, which has successfully adapted its e-commerce features to attract a broader audience.

Trump Proposes 'External Revenue Service' for Tariff Collection

New Agency Concept: President-elect Donald Trump has announced plans to create an “External Revenue Service” aimed at collecting tariffs from foreign imports, stepping up his commitment to implement trade levies as a means to fund his policy initiatives. This move reflects his intent to ensure that foreign entities contributing to U.S. revenue do so fairly, as per his recent statements.

Democratic Pushback: The idea has faced skepticism, particularly from Democrats who mock it as a vague rebranding of existing functions. Representative Richard Neal highlighted that tariffs are already managed by Customs and Border Protection (CBP), questioning the necessity of a new agency and suggesting it lacks a concrete plan.

Economic Implications: Although Trump frames tariffs as a way to raise revenue and support American manufacturing, economists warn that this approach may lead to higher consumer prices and complicate inflation issues. Analysts indicate that any new agency wouldn't fundamentally change the current system, as tariffs are ultimately a cost passed on to American consumers, not an external revenue source.

Gradual Tariff Increases Planned: Trump's team is reportedly considering a gradual implementation of tariffs to lessen their immediate economic impact. By incrementally increasing tariffs, they aim to gain leverage in international negotiations without causing significant price spikes for consumers or disturbing the market, leaving the final approach still under development.

RBI Governor Signals Shift Towards a More Flexible Rupee

New Approach from RBI Leadership: Sanjay Malhotra, the recently appointed Governor of the Reserve Bank of India, appears to be favoring a more flexible approach to the Indian rupee. During discussions regarding recent rupee fluctuations, he expressed no opposition to allowing the currency to depreciate, hinting at a possible shift from the stricter policies of his predecessor.

Maintaining Stability Amid Flexibility: Despite embracing flexibility, Malhotra reassured stakeholders that the RBI would continue to intervene in the foreign exchange market to manage excessive volatility. The central bank aims to prevent speculative attacks while avoiding a targeted exchange rate for the rupee, ensuring a balanced approach as market dynamics change.

Market Reaction and Current Trends: Following reports of these possible policy shifts, the rupee experienced significant fluctuations, dipping to a record low before partially recovering. The currency's decline has been fueled by a strong dollar and rising oil prices, prompting discussions on how these factors influence both investor sentiment and the broader economic landscape in India.

Implications for Exports and Imports: As the RBI grapples with a weakened currency and a rising import bill—especially for oil—there’s growing recognition of the need for a more adaptable exchange rate. This shift may not only benefit exporters who have felt the pinch from currency stability but could also stabilize market expectations going forward, especially as global political shifts loom.

Latest On Global Markets

US Futures: Futures are showing mixed results, with Dow Jones futures increasing 0.30% and S&P 500 futures gaining 0.15%, while Nasdaq 100 futures remain relatively stable with a change of 0.00%.

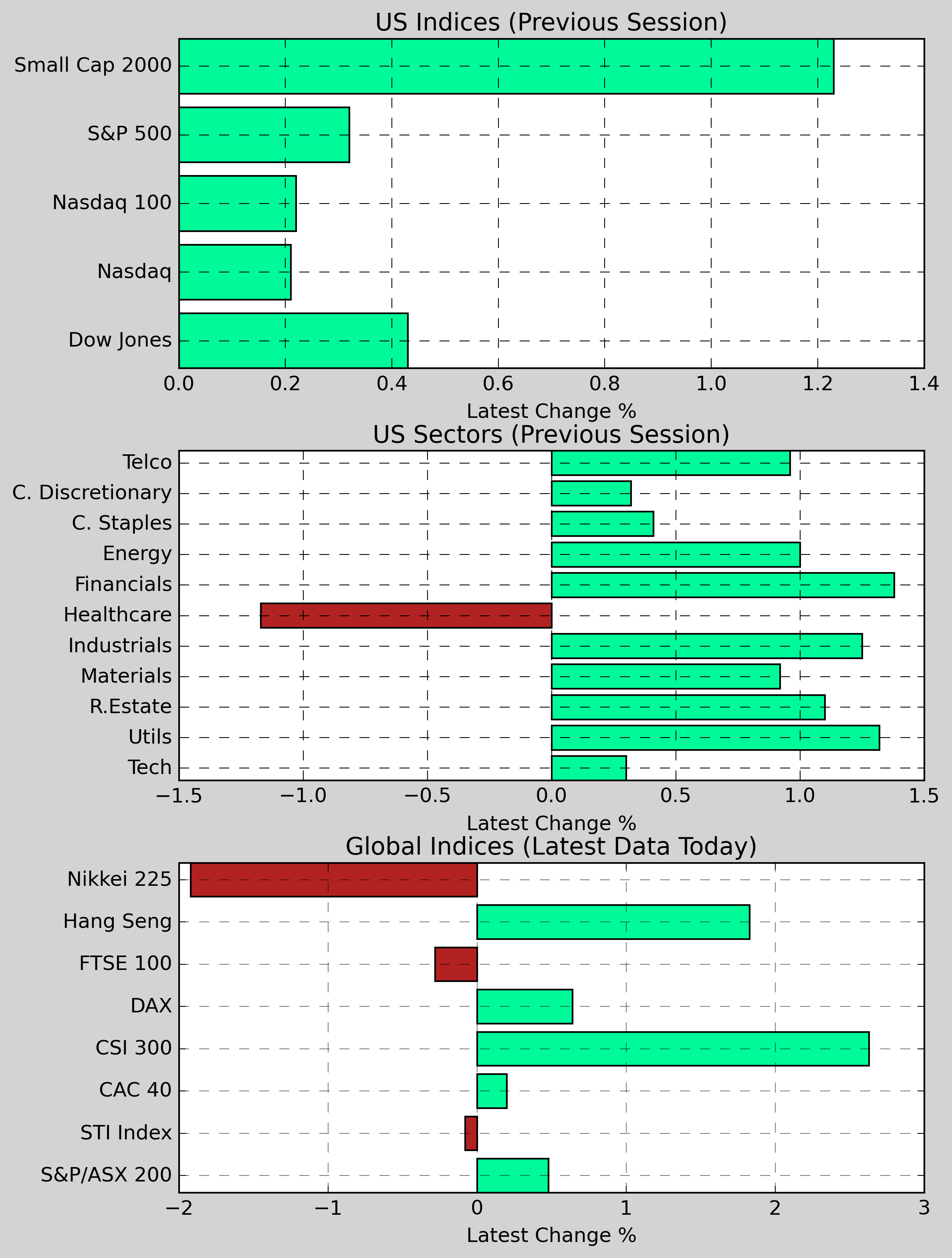

US Indices (Previous Session): In the last trading session, the S&P 500 rose 0.32% to 5,854.81, while the Dow Jones gained 0.43% to 42,480.44. The Nasdaq experienced a modest uptick of 0.21%, closing at 19,127.80. The Small Cap 2000 climbed 1.23%.

US Sectors (Previous Session): Among US sectors, iShares US Financials led with an increase of 1.38%, followed by iShares US Utilities, up 1.32%, and iShares US Real Estate which rose 1.10%. Conversely, iShares U.S. Healthcare declined 1.17%, while iShares U.S. Energy fell 1.00%.

Global Indices: The Hang Seng gained 1.83%, while the CSI 300 climbed 2.63%. In Europe, the CAC 40 advanced 0.20%, whereas the DAX saw modest growth of 0.64%. On the downside, the Nikkei 225 dropped 1.92%, and the FTSE 100 fell 0.28%.

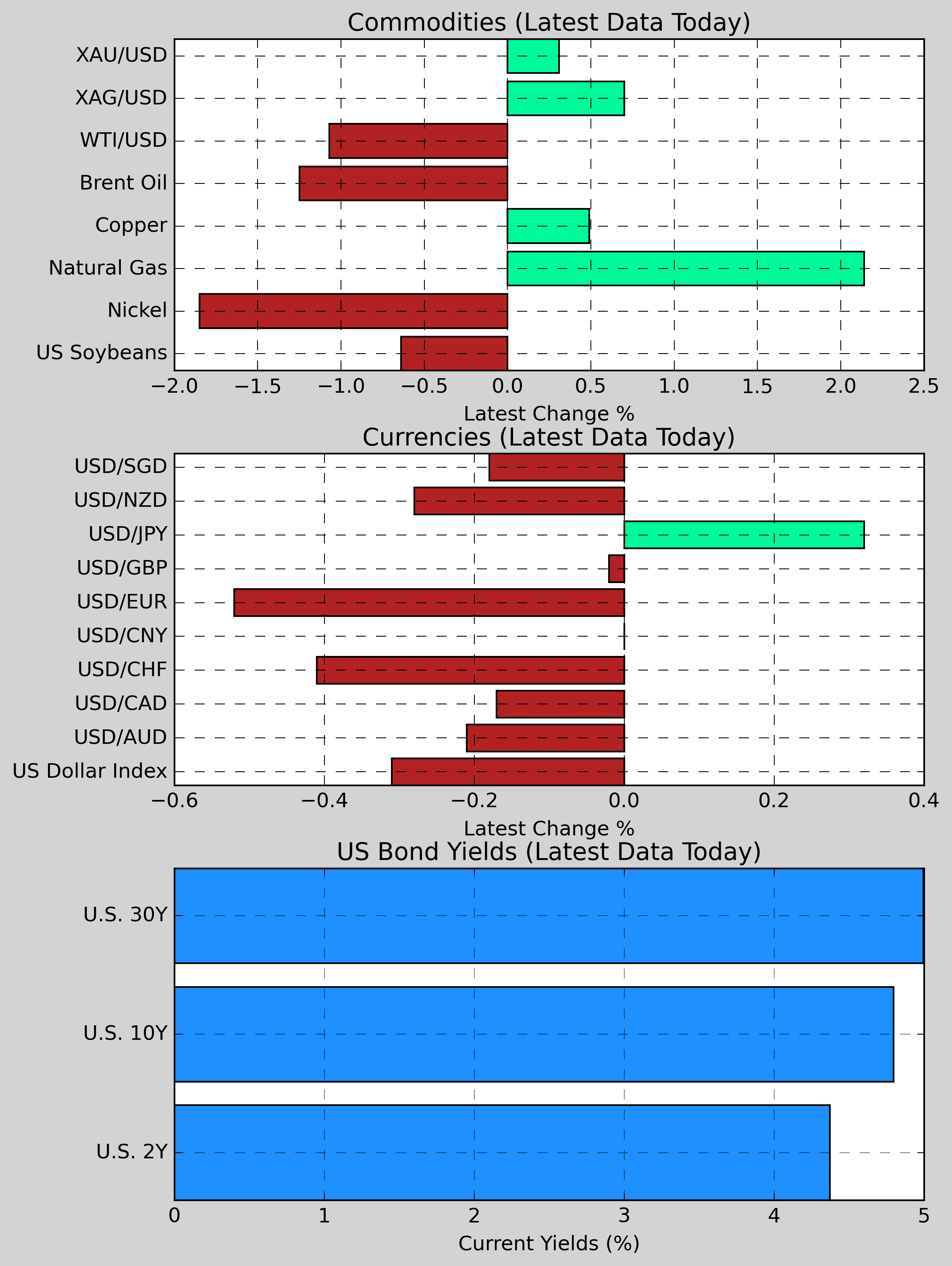

Commodities: Gold increased 0.31% to $2,671.50. Silver saw modest growth, up 0.70% to $29.84. Nickel fell -1.85% to $15,876.00, while Copper rose slightly, gaining 0.49% to $4.3468. US Wheat edged up 0.39% to $546.10. Soybeans declined -0.64% to $1,046.25. Brent Crude decreased -1.25% to $80.00, and Natural Gas rose 2.14% to $4.0180.

Currencies: The US Dollar saw a mixed performance, with USD/JPY rising 0.32% to 157.99, while USD/AUD fell -0.21% to 1.6155. Other pairs included USD/CAD down -0.17% and USD/EUR declining -0.52%. The US Dollar Index dipped -0.31% to 109.27.

US Bond Yields: The U.S. 2-Year Treasury yield fell -0.66bps to 4.373%, while the U.S. 10-Year Treasury yield decreased slightly by -0.19bps to 4.796%. The U.S. 30-Year Treasury yield rose a negligible 0.18bps to 4.996%.

Other Notable News

-

U.S. Consumers' Inflation Expectations Rise: A recent survey from the New York Federal Reserve indicated an uptick in American consumers' inflation expectations for the upcoming years, with the outlook for inflation over the next three years now standing at 3%.

-

Biden Administration Unveils AI Chip Export Restrictions: The Biden administration has set forth new extensive regulations limiting the export of AI chips from Nvidia and similar companies, capping the allowable computing power sent to numerous countries. National Security Advisor Sullivan noted that Trump is expected to maintain these restrictions upon assuming office.

-

Impeachment Trial Looms for South Korean President: South Korean President Yoon Seok-yeol is scheduled to undergo an impeachment trial this Tuesday, with a decisive ruling from the court anticipated around June 11.

-

Cleveland-Cliffs Inc. Explores U.S. Steel Bid: Reports suggest that Cleveland-Cliffs Inc. is considering a collaboration with Nucor Corp. to pursue an acquisition of U.S. Steel.

-

California Wildfire Casualties Rise: The death toll from the escalating wildfire in Los Angeles has surged to 24, fueled by strong winds that have exacerbated the situation. Meteorologists are forecasting extreme fire conditions for Monday and Tuesday.

-

Investors Brace for Fed Rate Cuts Adjustments: JPMorgan Chase has revised its projections for Federal Reserve rate cuts this year, reducing its estimate from three anticipated cuts to just two, expected in June and September.

-

Biden Spotlights Potential Ceasefire Between Israel and Hamas: President Biden announced that Israel and Hamas are on the verge of reaching a ceasefire agreement, with National Security Advisor Sullivan claiming that an agreement is "very likely" to materialize this week.

-

AI Chip Delivery Delays for Major Clients: Reports have surfaced that Nvidia’s latest AI chip models are encountering performance issues, leading to significant delivery delays for major customers, including Microsoft.

-

Bill Ackman Proposes Corporate Merger: Investor Bill Ackman's Pershing Square Capital Management has suggested merging a newly established subsidiary with real estate firm Howard Hughes to develop a "modern" iteration of Berkshire Hathaway.

-

O'Leary Discusses TikTok Acquisition with Trump: Notable Canadian businessman Kevin O'Leary has reportedly met with Trump to discuss strategies for acquiring TikTok’s U.S. operations, amid ongoing scrutiny over the platform.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.