Bitcoin’s $100K Milestone, TikTok Ban Uncertainty, and South Korea's Political Crisis

Bitcoin hits a record $100,000 as pro-crypto policies fuel optimism, TikTok faces a potential ban with implications for Meta and Oracle, and South Korea’s political scene heats up with impeachment debates.

- Impeachment Hurdles for South Korea's President Yoon

- Bitcoin Crosses $100,000 in Historic Crypto Milestone

- Hong Kong Leader Reshuffles Cabinet to Revive Tourism

- Singapore’s Bank Stock Rally Nears Market Record

- TikTok Ruling Sparks Speculation for Meta, Alphabet, and Oracle

- Shell and Equinor Form UK's Largest Independent Oil and Gas Company

- Vodafone-Three Merger Gets UK Approval

- Latest On Global Markets

- Economic Data Calendar and Central Bank Developments (ET)

- Other Notable Developments

Good morning! It's Ryosuke. Today’s highlights: Bitcoin hits a record $100,000 as pro-crypto policies fuel optimism, TikTok faces a potential ban with implications for Meta and Oracle, and South Korea’s political scene heats up with impeachment debates. Meanwhile, Singapore’s stock market nears a historic high, and Shell teams up with Equinor to create the UK’s largest independent oil producer. Let’s break it down.

Impeachment Hurdles for South Korea's President Yoon

Photo by Hill Country Camera / Unsplash

Opposition Leader Faces Challenges: Democratic Party leader Lee Jae-myung admitted that gaining sufficient ruling party support to impeach President Yoon Suk Yeol over his martial law declaration may prove difficult. Despite controlling the majority, Lee's party needs eight People Power Party (PPP) votes to pass the motion.

Ruling Party Pushback: PPP leader Han Dong-hoon has vowed to oppose impeachment, even asking Yoon to leave the party to distance the PPP from the embattled president. While some PPP lawmakers voted against Yoon's martial law order earlier, Han's rallying efforts may keep the party line intact during the upcoming vote.

Political Turmoil Deepens: The DP accused Yoon of treason for his failed martial law attempt, which sparked protests and international criticism. Lee pledged to continue impeachment efforts even if the motion fails, insisting that Yoon's ouster is inevitable, though the timeline remains uncertain.

Leadership Stakes Rise: Both Lee and Han are contenders to replace Yoon if he steps down. However, Lee’s political future is also precarious following a conviction for election law violations. Meanwhile, Yoon is shuffling his cabinet, replacing the defense minister amid escalating political tensions.

Broader Implications: The turmoil has shaken South Korea’s reputation and raised questions about its political stability. With public opinion playing a critical role, the opposition hopes pressure will sway ruling party lawmakers in future votes, potentially altering the outcome.

Bitcoin Crosses $100,000 in Historic Crypto Milestone

Milestone Achieved: Bitcoin has reached $100,000 for the first time, marking a significant achievement in its 15-year history. This breakthrough follows a 135% year-to-date rally, fueled by optimism surrounding pro-crypto policies under US President-elect Donald Trump.

Policy Shifts Boost Momentum: Trump’s nomination of Paul Atkins, a known crypto advocate, to lead the SEC has reinforced market confidence. Analysts believe Atkins will reduce regulatory pressures, fostering growth in the digital-asset industry. ETFs investing directly in Bitcoin, led by BlackRock and Fidelity, have also driven demand, now holding $100 billion in assets.

From Crisis to Comeback: Bitcoin’s recovery from its 2021–2022 bear market, which included the collapse of FTX and Binance scandals, underscores its resilience. Despite its tumultuous history, Bitcoin has become increasingly integrated into mainstream finance, with a market cap now nearing $2 trillion.

Future Outlook: Analysts like Fadi Aboualfa foresee a “new phase of the bull run” as demand outpaces supply. Speculation also grows around Trump’s potential plans to establish a government Bitcoin reserve, further elevating its status as a global financial asset.

Hong Kong Leader Reshuffles Cabinet to Revive Tourism

Photo by Fidel Fernando / Unsplash

Tourism and Transport Ministers Replaced: Chief Executive John Lee has dismissed Kevin Yeung and Lam Sai-hung, appointing Rosanna Law as Secretary for Culture, Sports, and Tourism, and Mable Chan as Secretary for Transport and Logistics. Lee emphasized the need for leaders who align with his vision for Hong Kong’s recovery.

Tourism Struggles Amid Declining Spending: The shake-up comes as Hong Kong faces declining tourism and retail sales, exacerbated by weak spending from Chinese visitors. Lee criticized the outgoing Culture Bureau for failing to deliver a development blueprint, as promised in his October policy address.

High-Stakes Projects Ahead: Hong Kong’s HK$30 billion ($3.9 billion) Kai Tak Sports Park, featuring a 50,000-seat stadium, is set to open next year. Events like the Hong Kong Sevens and Coldplay concerts will test the city’s ability to restore its international appeal post-pandemic.

Broader Implications: Lee’s proactive reshuffle reflects urgency to recover from lost time due to the 2019 protests and Covid-19. His leadership, marked by a commitment to reviving Hong Kong’s economy, underscores the city's challenges in regaining its global standing.

Singapore’s Bank Stock Rally Nears Market Record

Photo by Aditya Chinchure / Unsplash

STI Approaches 2007 Peak: The Straits Times Index (STI) gained 0.6% on Thursday, bringing it within reach of its all-time high from October 2007. The benchmark has surged 18% year-to-date, making it Southeast Asia's best-performing stock market.

Banking Stocks Drive Gains: Robust bank performance underpins the rally, with lenders maintaining profitability despite narrowing net interest margins. Steady loan growth, controlled deposit costs, and rising wealth management inflows continue to attract investors, alongside stable dividend payouts.

Policy and Market Optimism: While the Monetary Authority of Singapore has held rates steady, expectations for eventual easing align with global trends, bolstering market sentiment. Government initiatives to enhance stock market liquidity and attract private sector participation further support confidence.

2025 Outlook Brightens: Analysts from Morgan Stanley and Goldman Sachs are optimistic about Singapore’s market potential in 2025, citing expected earnings growth and ongoing reform efforts. The push for a more vibrant stock market is anticipated to sustain momentum.

TikTok Ruling Sparks Speculation for Meta, Alphabet, and Oracle

Court Decision Looms: The US Court of Appeals is set to rule on a law requiring TikTok's Chinese owner, ByteDance, to divest or face a US ban by January 19. Analysts expect appeals and further delays, but traders are closely watching TikTok's 170 million US users and its billions in ad revenue.

Winners Among Social Media: A TikTok ban could boost Meta (up 70% YTD), Alphabet, Pinterest, and Snap by reducing competition for user attention and ad dollars. Meta’s Reels, a TikTok competitor, and Pinterest's push into shoppable content could gain traction in TikTok's absence.

Oracle Faces Risks: As TikTok’s cloud provider, Oracle stands to lose as much as $800 million in annual sales if a ban proceeds. Oracle shares have surged 80% this year, but the company has acknowledged significant financial exposure tied to TikTok.

Uncertain Outcomes: Analysts propose multiple scenarios, including upholding the ban, tweaking the statute, or striking it down as unconstitutional. Even if TikTok is allowed to operate under tighter US oversight (like "Project Texas"), appeals and political shifts — including Donald Trump’s changing stance — ensure the saga is far from over.

Shell and Equinor Form UK's Largest Independent Oil and Gas Company

Photo by Marc Rentschler / Unsplash

Joint Venture Announcement: Shell and Norway’s Equinor will merge their UK offshore oil and gas assets to create a new energy company headquartered in Aberdeen, Scotland. The deal, subject to regulatory approvals, is expected to close by the end of 2025 and will position the venture as the largest independent producer in the UK North Sea.

Production and Strategic Goals: The joint entity is projected to produce over 140,000 barrels of oil equivalent per day in 2025. The venture aims to support the UK’s energy security while balancing fossil fuel production with energy transition goals.

Asset and Workforce Integration: The partnership combines Shell’s holdings, including Shearwater and Jackdaw, with Equinor’s assets like Mariner and Rosebank. The combined workforce will leverage both companies’ expertise, with Equinor employing 300 people and Shell 1,000 in the UK.

Strategic Rationale: Analysts at RBC Capital Markets highlight potential tax synergies and strategic alignment, as both companies look to pool resources amid increased windfall taxes and fiscal policy challenges in the North Sea. The move follows similar industry consolidations aimed at optimizing resources while reducing capital exposure.

Vodafone-Three Merger Gets UK Approval

Photo by Matthew Buchanan / Unsplash

Regulatory Green Light: The UK’s Competition and Markets Authority (CMA) has approved the $19 billion merger between Vodafone and Three, subject to conditions. Vodafone will hold a 51% stake in the combined entity, while Three’s owner, CK Hutchison, retains the minority interest.

Conditions for Approval: Vodafone and Three must commit to investing £11 billion to roll out a 5G network across the UK within eight years. Additional conditions include capping mobile tariffs for three years and providing pre-set prices and terms for mobile virtual network operators (MVNOs).

Market Impact: The merger consolidates the UK’s telecom market from four major players to three, creating a new market leader with 29 million customers. Analysts view the CMA’s decision as favorable for Vodafone and Three, with less stringent conditions than anticipated.

Looking Ahead: Completion is expected by mid-2025. While Vodafone CEO Margherita Della Valle hailed the merger as transformative for UK telecom infrastructure, experts caution that the benefits may take years to materialize amid significant operational changes.

Latest On Global Markets

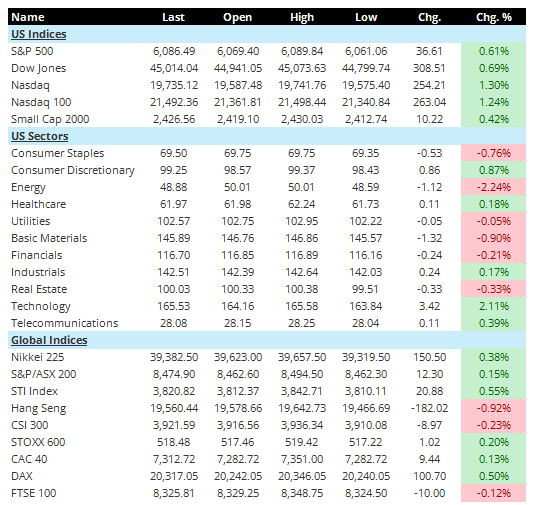

US Futures: Futures are slightly down, with S&P 500 futures decreasing 0.08% and Dow Jones futures slipping 0.07%.

US Indices (Previous Session): The Nasdaq led the gains, up 1.30%, followed by the Nasdaq 100 with a 1.24% rise. The Dow Jones climbed 0.69%, the S&P 500 increased 0.61%, and the Small Cap 2000 rose 0.42%.

US Sectors (Previous Session): Technology surged 2.11%, leading gains, followed by Consumer Discretionary, up 0.87%. Healthcare and Industrials edged up 0.18% and 0.17%, respectively. Energy posted the steepest decline, down 2.24%, with Basic Materials and Consumer Staples falling 0.90% and 0.76%.

Global Indices: The DAX rose 0.50%, the STOXX 600 gained 0.20%, and the CAC 40 added 0.13%. The Nikkei 225 climbed 0.38%, while the S&P/ASX 200 increased 0.15%. In contrast, the FTSE 100 dropped 0.12%, and the Hang Seng and CSI 300 fell 0.92% and 0.23%, respectively.

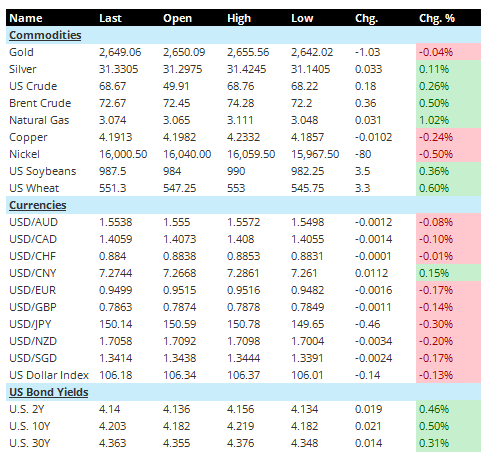

Commodities: Gold edged down 0.04% to $2,649.06, while Silver rose 0.11% to $31.33. US Crude increased 0.26% to $68.67, and Brent Crude gained 0.50% to $72.67. Natural Gas surged 1.02%, while Copper and Nickel declined 0.24% and 0.50%, respectively. US Soybeans and US Wheat rose 0.36% and 0.60% each.

Currencies: The US Dollar weakened against most major currencies, with USD/AUD down 0.08%, USD/CAD down 0.10%, and USD/EUR falling 0.17%. USD/GBP slipped 0.14%, and USD/JPY dropped 0.30%. The US Dollar Index declined 0.13% to 106.18. The only notable exception was USD/CNY, which rose 0.15%.

US Bond Yields: The U.S. 10-Year Treasury yield climbed 0.50% to 4.203%, while the U.S. 30-Year Treasury yield increased 0.31% to 4.363%.

Economic Data Calendar and Central Bank Developments (ET)

- 05:00 AM ET: Taiwan's November consumer price index year-on-year (estimated to be 1.9%, previous value was 1.69%)

- 05:20 AM ET: Taiwan's foreign exchange reserves in November (previous value: US$576.85 billion)

- 07:00 AM ET: Eurozone October retail sales month-on-month (estimated to be -0.3%, previous value of 0.5%)

- 07:00 AM ET: ECB board member Vujcic speaks

- 10:30 AM ET: U.S. trade balance in October (estimated to be a deficit of $75 billion, the previous value was a deficit of $84.4 billion)

- 10:30 AM ET: Number of first-time unemployment claims in the United States last week (estimated at 215,000, previous value at 213,000)

- 02:15 PM ET: Speech by Barkin, President of the US Federal Reserve Bank of Richmond

Other Notable Developments

-

French Political Turmoil Deepens: The Barnier government in France narrowly survived a no-confidence vote, driven by the unusual coalition of far-right and left-wing parties. However, the political landscape is set for long-term instability.

-

Fed Beige Book Insights: The Federal Reserve's Beige Book indicated slight economic growth in November, with businesses showing increased optimism about future demand despite lingering uncertainties.

-

Powell on Trump Administration: Federal Reserve Chairman Jerome Powell expressed confidence in working effectively with the Trump administration, emphasizing that the U.S. economy remains robust and rate cuts will be approached cautiously.

-

ECB President’s Outlook: Christine Lagarde, President of the European Central Bank, stated that while the fight against inflation is nearing its conclusion, it is not yet fully resolved.

-

South Korea’s Economic and Political Challenges: Bank of Korea Governor Lee Chang-yong dismissed the possibility of a rate cut amidst a political crisis, as the nation’s defense minister issued an apology and stepped down.

-

U.S. Service Sector Slows: ISM data revealed that the U.S. service sector grew at its slowest pace in three months in November, with employment and new orders both showing signs of weakening.

-

Trump’s Trade Focus Intensifies: President Trump has nominated Peter Navarro, a staunch advocate of tariffs and a critic of China, as a senior adviser for trade and manufacturing policy.

-

ADP Employment Data: The ADP report showed robust job growth in November, with small businesses posting their fastest wage increases in two years, highlighting the resilience of the labor market.

-

German Central Bank’s Stance: Bundesbank President Joachim Nagel stressed that interest rates should remain above the neutral level to avoid premature cuts that could undermine economic stability.

-

Bank of England Signals Rate Cuts: BoE Governor Andrew Bailey hinted at four potential 25-basis-point rate cuts next year, citing a faster-than-expected decline in inflation.

-

Trump’s Defense Shake-Up: Reports suggest that President Trump is considering Florida Governor Ron DeSantis for the role of Secretary of Defense, replacing embattled incumbent Pete Hegseth.

-

U.S. Health Insurance Executive Murdered: Brian Thompson, a UnitedHealth executive, was tragically shot in Midtown Manhattan early Wednesday. The police have launched a citywide manhunt for the suspect.

-

Paul Atkins to Lead SEC: Trump has nominated conservative financial regulator Paul Atkins to chair the SEC, a move expected to prioritize deregulation and reduce penalties for financial violations.

-

Fed Rate Pause Possible: St. Louis Federal Reserve President suggested that rate cuts might be paused as early as this month, reflecting a cautious approach to monetary easing.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.