Bessent's Nomination, China's Yuan Moves, UniCredit's Deal, and Russia's Inflation Struggles

Today’s key developments include Bessent’s Treasury nomination, China’s yuan stabilization moves, UniCredit’s $10.5B merger plans, and Russia’s inflation struggles.

Good morning! It’s Ryosuke. Today’s key developments revolves around Scott Bessent’s Treasury nomination shaking up global markets, China’s yuan stabilization efforts, UniCredit’s ambitious $10.5 billion merger plans, and Russia’s soaring inflation amidst war and sanctions.

Bessent's Treasury Nomination Sparks Global Currency Relief

Relief Rally: Scott Bessent’s nomination as Treasury Secretary has sparked a global market rebound, with the US dollar falling 0.6%—its largest two-week drop. Known for his measured approach, Bessent’s selection has eased concerns about economic upheaval under Trump’s presidency.

Market Reaction: Currencies in Asia and Europe regained ground, with the Korean won leading gains. US Treasury yields also dipped, with the 10-year note down six basis points to 4.34%. This provided a pause to the dollar’s eight-week rally, its longest in over a year.

Strategic Priorities: Bessent emphasized his commitment to implementing Trump’s tax cuts and tariff plans, including proposed 60% tariffs on Chinese imports. He also aims to control federal spending and maintain the dollar’s status as the world’s reserve currency. These policies will shape the administration’s economic direction and are expected to drive near-term market movements.

Outlook Ahead: Despite this optimism, the dollar’s strength may persist, driven by robust US growth and inflation concerns. Bessent’s role in balancing Trump’s ambitious agenda with market stability will be pivotal in determining the global economic landscape.

China Holds Lending Rates Steady Amid Yuan Pressure

Steady Rates: The People’s Bank of China (PBOC) kept its medium-term lending facility (MLF) rate unchanged at 2.0% on Monday, issuing 900 billion yuan ($124.26 billion) in one-year loans to financial institutions. The decision aims to stabilize the yuan, which has weakened over 2% since Trump’s election victory on Nov. 5.

Economic Context: Analysts expect the PBOC to delay further rate cuts until the new U.S. administration takes office in January, given looming tariff increases on Chinese exports. Commercial banks in China continue to face tight net-interest margins, with overall profitability falling below the regulatory threshold of 1.8%.

Market Implications: The yuan’s recent 3.3% depreciation against the dollar has raised concerns, but economists suggest gradual adjustments rather than abrupt shocks to support exports. Meanwhile, a reduction in reserve requirement ratios is anticipated to balance economic growth and currency stability.

Outlook Ahead: While the PBOC signaled its commitment to supportive monetary policies, further adjustments to the seven-day reverse repo rate or the reserve requirement ratio may come before year-end. However, maintaining a steady yuan remains a priority amid global economic pressures.

UniCredit Moves to Acquire Banco BPM in $10.5 Billion Deal

Proposed Merger: UniCredit has offered to acquire Banco BPM for approximately €10 billion ($10.5 billion), proposing an all-stock deal at €6.657 per share—a slight premium to the prior closing price. If completed, the merger would unite two of Italy's largest banks.

Strategic Implications: This acquisition would strengthen UniCredit’s position as a leading pan-European banking group. The offer follows a series of strategic moves, including UniCredit’s increasing stake in Germany’s Commerzbank to nearly 21% earlier this year.

Market Reactions: Banco BPM shares surged 5% following the announcement, while UniCredit’s stock dropped 1.7%. Analysts highlight significant regulatory and execution risks, particularly as UniCredit simultaneously pursues expansion in Germany.

Challenges Ahead: Regulatory scrutiny and integration complexities could complicate UniCredit CEO Andrea Orcel’s plans. Experts suggest the timeline for managing both the Banco BPM and Commerzbank deals is overly ambitious, raising questions about execution feasibility.

Russian Food Prices Soar Amid Inflation and War

Soaring Costs: Food inflation in Russia continues to climb, with butter prices rising 30% since December 2023, alongside sharp increases in sunflower oil and vegetables. Despite a recent interest rate hike to 21%, inflation remains stubbornly high at 8.5% in October, more than double the central bank's target.

Economic Strain: High food costs are disproportionately affecting lower-income Russians, with many downgrading their consumption to lower-quality goods. Rural areas and small towns bear the brunt of the crisis, while Moscow remains relatively insulated.

War Impact: Russia’s economy has pivoted toward defense spending amidst the Ukraine war, exacerbating inflation and food shortages. President Putin has denied prioritizing "guns over butter," but the government faces criticism for failing to alleviate the rising cost of basic goods.

Deflected Blame: The Kremlin attributes inflation to sanctions and "unfriendly" nations, leveraging propaganda to shield Putin and the government from widespread discontent. While discontent over economic conditions is growing, open criticism remains risky in Russia’s restrictive environment.

Latest On Global Markets

US Futures: Futures are pointing higher, signaling a positive market sentiment. Dow Jones futures are up 0.66%, while S&P 500 futures have gained 0.45%.

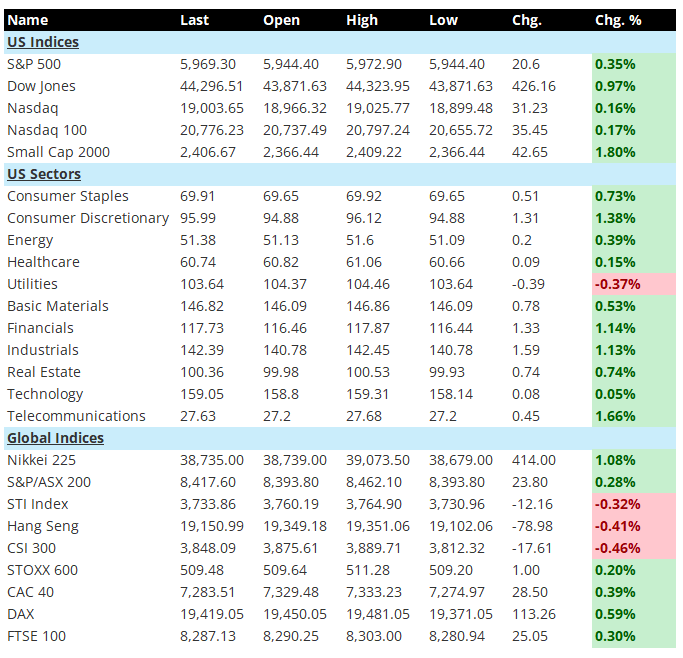

US Indices: The Dow Jones rose 0.97%, and the S&P 500 climbed 0.35%. The Nasdaq 100 edged higher by 0.17%, while Small Cap 2000 surged 1.80%, leading the day's performance.

US Sectors: Gains were broad, led by Telecommunications (1.66%) and Consumer Discretionary (1.38%). Financials and Industrials also performed well, rising 1.14% and 1.13%, respectively. Utilities was the only laggard, slipping 0.37%.

Global Indices: Global markets were mostly positive. The Nikkei 225 gained 1.08%, and the DAX rose 0.59%. The FTSE 100 climbed 0.30%, while the Hang Seng dipped 0.41%, and the CSI 300 declined 0.46%.

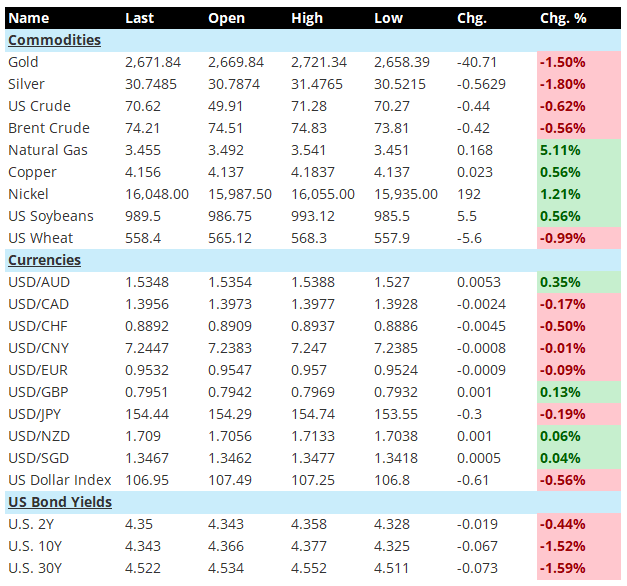

Commodities: Natural Gas jumped 5.11%, and Copper advanced 0.56%. However, Gold fell 1.50%, and Silver dropped 1.80%. Both US Crude and Brent Crude declined by 0.62% and 0.56%, respectively.

Currencies: The US Dollar Index weakened, falling 0.56%. The dollar declined 0.50% against the Swiss franc and 0.19% against the yen, while gaining 0.35% versus the Australian dollar.

US Bond Yields: Bond yields saw significant declines. The 2-year yield fell 1.9 basis points to 4.35%, the 10-year yield dropped 6.7 basis points to 4.343%, and the 30-year yield declined 7.3 basis points to 4.522%.

Economic Data & Central Bank Speeches Today

- 8:30 AM: The U.S. Chicago Fed National Economic Activity Index for October is set to be released, with expectations at -0.2, compared to the previous reading of -0.28.

- 10:30 AM: The U.S. Dallas Fed Manufacturing Index for November will be announced, with forecasts at -2.4, up from the prior value of -3.

- 11:30 AM: ECB Chief Economist Lane is scheduled to deliver a speech.

- 12:30 PM: German Central Bank President Nagel will address the public in a speech.

Other Notable News

- The Federal Reserve's semi-annual Financial Stability Report identified the U.S. government's growing debt burden as the biggest risk to financial stability, according to survey findings.

- November's initial S&P Global PMI revealed growth in U.S. business activity. Meanwhile, the University of Michigan Consumer Confidence Index rose less than initially estimated, and one-year inflation expectations dropped to 2.6%, the lowest since 2020.

- The euro hit a two-year low as bets on a European Central Bank rate cut surged, following an unexpected contraction in eurozone business activity reported in the November S&P Global PMI.

- ECB board member Centeno indicated that a larger rate cut might be discussed if certain economic risks materialize. The central bank's deputy governor emphasized that the trajectory of rate reductions is more critical than the magnitude of individual cuts.

- In the UK, S&P Global's November PMI highlighted stagnant private-sector growth, with businesses expressing opposition to the government’s budget plans.

- Japan’s cabinet approved a $140 billion stimulus package, expected to boost GDP growth by 1.2 percentage points.

- At the United Nations Climate Change Conference, wealthy nations committed to providing a minimum funding amount (unspecified in the text) to support climate initiatives.

- Observers anticipate OPEC+ will delay plans to restore oil production again. JPMorgan Chase warned that even with extended production cuts, the oil market may face a significant supply surplus.

- Kyodo News, citing Iranian diplomatic sources, reported that Iran plans to hold nuclear discussions with Britain, France, and Germany this week.

- Russian President Vladimir Putin signaled the possible use of new missiles in Ukraine. South Korean officials claimed that Russia traded air defense systems with North Korea in exchange for Kim Jong-un sending troops to assist Russia.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.