Assad's Flight from Syria, Yoon's Impeachment Narrow Escape, and Global Tech Tensions

As Syria's Assad flees to Russia amidst a rebellion reshaping the region, South Korea's Yoon narrowly escapes impeachment, while Japan eyes potential rate hikes amid positive GDP growth, and global tensions mount over tech regulations, trade, and unrest.

Good morning, everyone! It’s time to dive into today’s world developments that are shaking up the global markets. In Syria, President Assad’s unexpected departure raises questions about the future of the region as rebel forces gain ground, while South Korea’s President Yoon narrowly dodges impeachment attempts in a politically charged climate. Plus, in a troubling incident, an arson attack on a synagogue in Melbourne is now being investigated as a potential act of terrorism. Let’s unpack these stories together!

Assad Flees Syria Amidst Rebellion; Yoon Survives Impeachment Efforts**

Photo by Omar Ramadan / Unsplash

Assad's Regime Crumbles: In a startling turn of events, President Bashar Al-Assad has reportedly fled to Russia as rebel forces advance into Damascus, marking the end of his family's 50-year dominance in Syria. This moment could signal a pivotal shift in the region's ongoing conflict, potentially opening the door to new governance and stability.

Russia Offers Asylum: According to Russian state news sources, Assad and his family have been granted asylum in Russia following their flight from Syria. This move not only protects Assad but also raises questions about Russia's role in shaping Syrian politics moving forward, highlighting its influence in the Middle East.

Yoon’s Impeachment Vote: Meanwhile, in South Korea, President Yoon Seok Yeol has narrowly escaped an impeachment vote, which was supported by all 192 opposition lawmakers but ultimately fell short of the required 200 votes. The ruling People’s Power Party's strategic boycott played a crucial role in shielding the president from removal during this politically charged time.

Political Underpinnings: Yoon's survival of this vote may strengthen his administration as it navigates domestic and international pressures, while the turmoil in Syria and the fate of its leadership could have broader implications across the region. Both situations underscore the fragility of political power in the face of rebellion and public dissent, reflecting a time of significant change.

Japan's Economy Grows Stronger Amid Speculation of BOJ Rate Hike

Photo by Redd Francisco / Unsplash

Stronger Growth Indicators: Japan's economy has outperformed expectations, with GDP growing at an annualized rate of 1.2% for the last quarter, exceeding forecasts and previous estimates. This growth was significantly bolstered by improved net exports, increased capital expenditures, and better inventory performance, signaling recovery momentum.

Bank of Japan's Decision on the Horizon: With these encouraging numbers, speculation is rising around the Bank of Japan (BOJ) potentially increasing interest rates at their upcoming December 19 meeting. Governor Kazuo Ueda emphasized that the timing for a rate hike is "nearing," especially as he prepares to analyze important survey data next week.

Caution Despite Optimism: Notably, while the economy is showing signs of life, some economists express caution regarding the sustainability of this growth. Factors such as one-off tax cuts and consumer hesitance due to ongoing inflation could impact long-term economic stability, calling into question the robustness of current spending patterns.

Broader Economic Challenges: Japan remains susceptible to global economic shifts, particularly with uncertainties stemming from the US and China. The government's cautious approach, including a newly expanded economic stimulus plan, reflects an awareness of these external pressures as it aims to stabilize the economy while navigating complex trade dynamics.

Europe's Rising Tension Over Big Tech Regulations

Big Tech Under Fire: The EU's intensified scrutiny of major US tech firms like Apple, Google, and Meta could clash with President-elect Donald Trump's interests. With potential fines in the billions and probes targeting market dominance, Trump's longstanding grievances against Europe may flare up as he navigates his relationships with powerful tech leaders.

Musk's Complicated Position: Elon Musk’s X platform faces significant fines for non-compliance with EU regulations, despite his support for Trump. The EU's Digital Services Act could impose hefty penalties, especially given Musk's close ties to Trump and potential political retaliation that could complicate the EU's efforts.

Apple Stands at a Crossroads: Apple is also in the EU's crosshairs, with investigations into its App Store practices potentially leading to severe penalties. Trump's favorable history with Apple’s CEO can complicate the narrative; he previously intervened in EU tax matters and expressed his intent to shield American companies from excessive regulation.

The Google Challenge and Zuckerberg's Shift: The EU's ongoing antitrust case against Google could culminate in a breakup of its advertising technology business, reflecting its serious stance on competition. Meanwhile, Mark Zuckerberg has appeared to soften his approach towards Trump, highlighting the shifting dynamics as the tech giants prepare to adapt to strict European regulations under a potentially hostile US administration.

Trump Connects with Xi Jinping Following Election Win

Photo by Darren Halstead / Unsplash

First Communication Since Reelection: Donald Trump disclosed that he recently communicated with Chinese leader Xi Jinping, marking their first interaction since Trump's reelection last month. Although he kept specifics vague, this development underscores the resumption of high-level contacts between the two leaders, crucial for navigating U.S.-China relations.

Trade Tensions Loom: As the exchange occurred, both nations prepare for potential trade confrontations; Trump previously promised hefty tariffs on Chinese imports, posing a significant threat to bilateral trade. This follows outreach from other global leaders, indicating a push for dialogue amidst concerns over economic policies and illegal immigration.

New Administration, Tough Stance: Trump is reinforcing his tough stance on China by appointing known critics to key roles in his administration, including nominating David Perdue as ambassador to China. Such appointments may signal a return to aggressive trade strategies that characterized Trump's earlier term, further complicating U.S.-China dynamics.

Xi's Response and Broader Implications: While Trump engages with Xi, China's leadership remains careful; a spokesperson reiterated their commitment to maintaining stable relations but emphasized their principles. The evolving dialogue reflects a complicated relationship, as both sides assert their positions on trade and governance, with long-term implications for global markets.

China Adopts Easing Monetary Policy and Enhanced Fiscal Support

Photo by Yiran Ding / Unsplash

Monetary Shift Announced: China's Politburo, under President Xi Jinping, has revealed a "moderately loose" monetary policy for 2025, marking its first significant change in over a decade. This strategic pivot aims to bolster the economy ahead of anticipated trade tensions, notably with the incoming U.S. administration.

Stronger Fiscal Commitments: In conjunction with the monetary stance, leaders pledged to adopt a "more proactive" fiscal approach, signaling a readiness to ramp up government spending. This shift reflects an urgency to stabilize key markets and counter the economic challenges posed by potential U.S. tariffs.

Market Reactions: Following the announcement, the offshore yuan saw a slight recovery, signaling optimism about China's economic resilience. Moreover, bond yields dipped, indicating that investors view the new policies as a potential stimulus for growth amid ongoing global uncertainties.

Broader Economic Context: With signs of stabilization after recent stimulus efforts, the Politburo's decisions set the stage for the upcoming Central Economic Work Conference, where detailed growth targets will be discussed. Experts suggest that these proactive measures could bolster China's GDP growth target to around 5%, a hopeful outlook in light of international pressures.

Rising Optimism: Institutional Investors Shift Focus to the Dollar

Photo by Alexander Grey / Unsplash

Changing Perspectives on the Dollar: Recent geopolitical tensions and a resilient U.S. economy are shifting the views of institutional investors on the dollar's future. As of December 3, 2024, data shows that asset managers have decreased their net dollar short positions significantly, marking the lowest levels since 2017, signaling a renewed confidence in the greenback.

Hedge Funds Join the Bullish Trend: Hedge funds have also ramped up their bullish bets on the dollar by 9.3% since October, moving in sync with broader market trends. This growing appreciation comes as various Fed officials express hesitance about cutting interest rates, with expectations now set for a pause aimed at controlling persistent inflation, which further supports dollar strength.

Safe Haven Demand Surges: Concerns over political instability globally—particularly unrest in France and South Korea—are driving demand for the dollar as a safe haven. According to analysts, the combination of geopolitical strife and the potential for higher U.S. yields makes the dollar particularly attractive for investors seeking security in uncertain times.

Mixed Signals for Other Currencies: While confidence grows in the dollar, sentiment about other currencies like the euro remains mixed, particularly as asset managers remain heavily invested in euro positions. With leveraged funds showing a bearish tilt towards the euro and other currencies, analysts emphasize the dollar's pivotal role in a fluctuating global market landscape, underscoring its unique status as a seemingly reliable asset amid worldwide uncertainty.

Arson Attack on Melbourne Synagogue Investigated as Terrorism

Photo by Artur Rekstad / Unsplash

Incident Overview: An early morning arson attack on the Adass Israel Synagogue in Melbourne on December 6 has been escalated by Australian authorities to a likely terrorist incident. The Australian Federal Police are now investigating the attack, viewing it as politically motivated, which reflects heightened concerns over community safety in the wake of such acts.

Government Response: Prime Minister Anthony Albanese condemned the attack, labeling it an “outrage” and a direct assault on the values of safety and tolerance that Australia upholds. He emphasized the need to protect places of worship from violence and intimidation, highlighting the broader impact of such incidents on community cohesion.

International Reactions: In a pointed response, Israeli Prime Minister Benjamin Netanyahu has connected the attack to Australian political stances, criticizing what he perceives as “extreme anti-Israeli” sentiments from Albanese's government. His comments underscore a growing tension between international diplomatic relations and domestic acts of violence.

Ongoing Investigation: Australian authorities are actively pursuing three suspects believed to be involved in this arson attack, stressing their commitment to countering crimes that threaten national security. As the investigation continues, the situation serves as a reminder of the urgent need to address hate and protect diverse community environments in Australia.

Latest On Global Markets

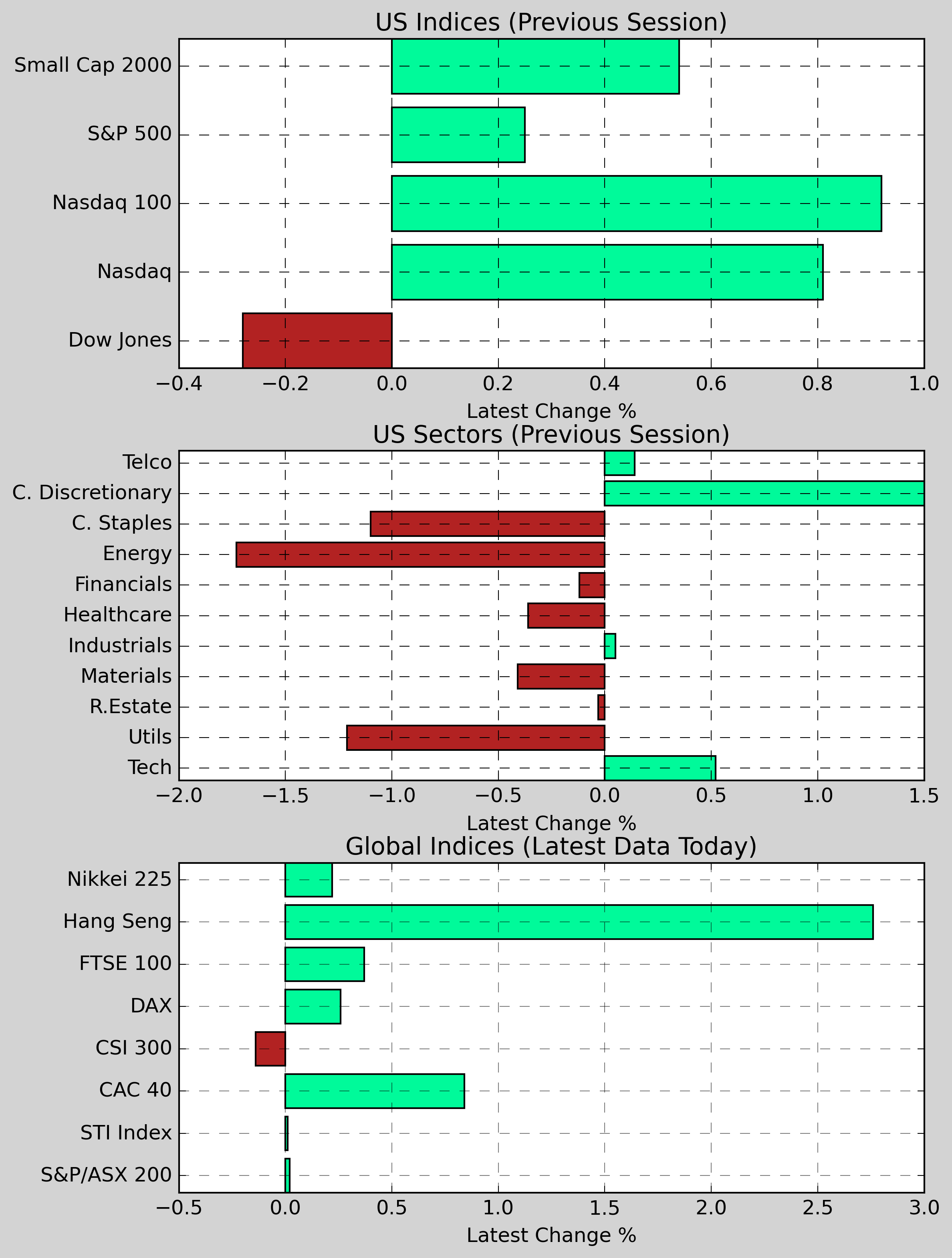

US Futures: Futures are mixed, with Nasdaq 100 futures climbing 0.15% and S&P 500 futures increasing 0.05%. However, Dow Jones futures are down 0.00%.

US Indices (Previous Session): The S&P 500 rose 0.25% to 6,090.27, while the Dow Jones fell 0.28% to 44,642.52. The Nasdaq gained 0.81%, ending at 19,859.77, and the Nasdaq 100 increased 0.92%. The Small Cap 2000 also saw growth, rising 0.54% to 2,408.99.

US Sectors (Previous Session): Consumer Services led the gains with an increase of 1.50%. Healthcare declined 0.36%, while Financials and Energy posted minor declines of 0.12% and 1.73%, respectively. Basic Materials edged down 0.41%, and Utilities fell 1.21%.

Global Indices: The Hang Seng soared 2.76%, while the CAC 40 rose 0.84%. The DAX increased 0.26%, but the CSI 300 fell 0.14%. In Asia, the Nikkei 225 had a slight increase, gaining 0.22%.

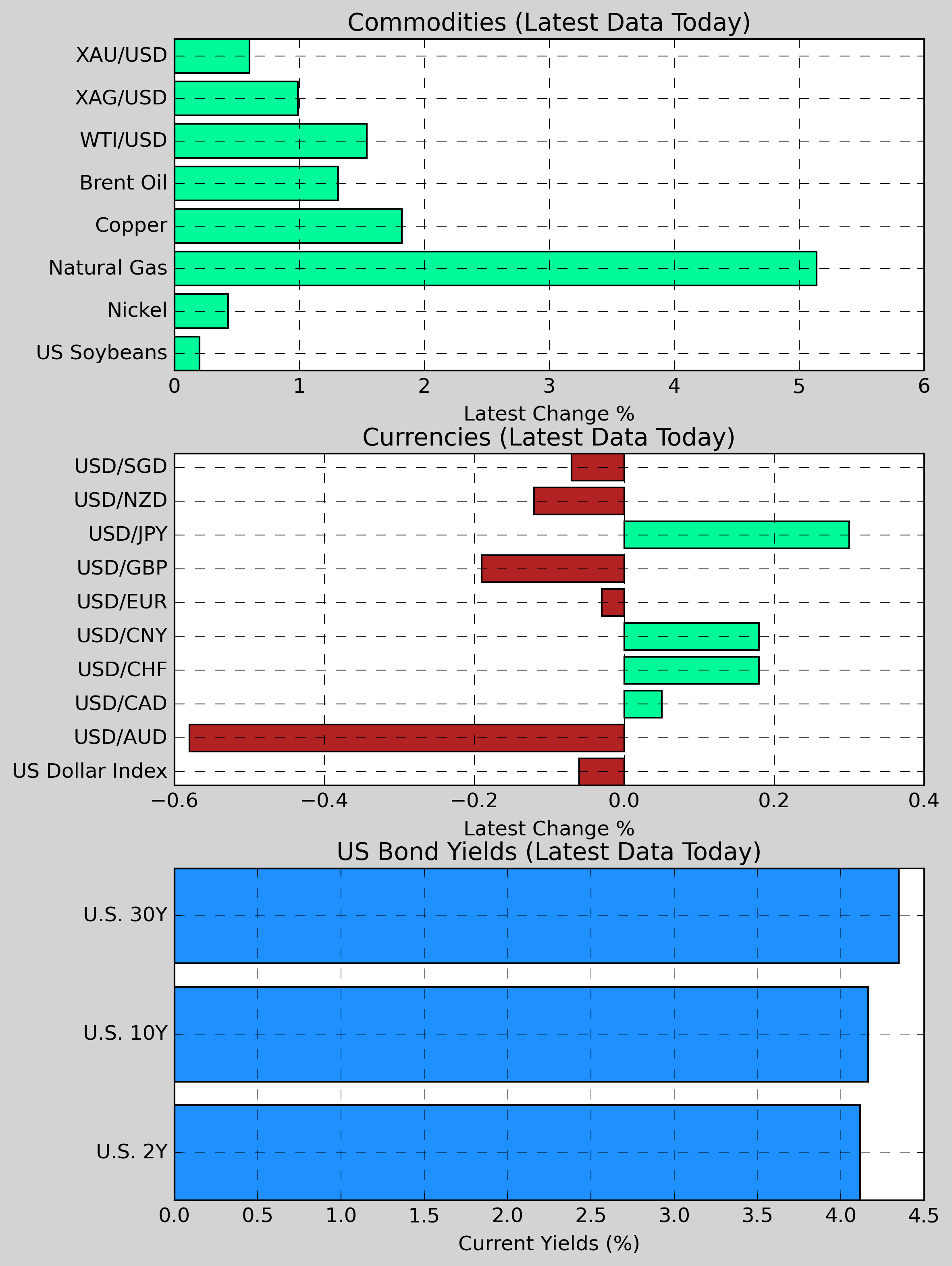

Commodities: Gold rose 0.59% to $2,648.59, while Copper increased 1.82% to $4.273. Nickel gained 0.43% to $16,081.50. US Wheat saw a boost of 1.15% to $563.38, and Natural Gas climbed 5.14% to $3.234. On the other hand, Silver appreciated 0.99% to $31.29, while US Soybeans nudged up 0.20% to $995.00. Brent Crude rose 1.31% to $72.05.

Currencies: The US Dollar Index slightly declined 0.06% to 106.00. The USD/CAD pair inched up 0.05%, while USD/CNY gained 0.18%. On the other hand, the USD/GBP fell 0.19%, and USD/NZD dipped 0.12%. USD/AUD decreased 0.58%, while USD/JPY rose 0.30%.

US Bond Yields: The U.S. 2-Year Treasury yield increased 4bps to 4.116%, while the U.S. 10-Year Treasury yield edged up 3bps to 4.164%. The U.S. 30-Year Treasury yield experienced a slight rise of 17bps to 4.348%.

Economic Data & Central Bank Developments (Eastern Time)

- 05:00 AM ET: Eurogroup Meetings

- 08:00 AM ET: MPC Member Ramsden Speaks

- 9:00 AM ET: NY Fed 1-Year Consumer Inflation Expectations (November) (previous value: 2.90%)

- 9:00 AM ET: French 12-Month BTF Auction (previous value: 2.34%)

- 9:00 AM ET: French 3-Month BTF Auction (previous value: 2.87%)

- 9:00 AM ET: French 6-Month BTF Auction (previous value: 2.66%)

- 10:00 AM ET: CB Employment Trends Index (November) (previous value: 107.66)

- 10:00 AM ET: Wholesale Inventories (MoM) (October) (estimated to be 0.20%, previous value was -0.20%)

- 10:00 AM ET: Wholesale Trade Sales (MoM) (October) (previous value: 0.30%)

- 9th: Chinese Premier Li Qiang holds a dialogue with heads of the World Bank, International Monetary Fund and other organizations.

Other Notable News

-

Challenges in South Korea's Political Landscape: President Yoon Seok-yeol managed to dodge impeachment with backing from his party, yet the political turmoil could escalate. The ruling party aims for a structured transition that would allow Prime Minister Han Deok-soo to handle state duties temporarily, while the opposition accuses Yoon of undermining constitutional norms and insists on his immediate resignation or acceptance of impeachment.

-

Economic Data and Labor Market Trends: In November, non-farm payrolls in the United States surged by 227,000, rebounding from previous setbacks caused by hurricanes and strikes. However, the unemployment rate climbed to 4.2%, signaling a potential slowdown in labor demand. The University of Michigan reported a peak in consumer confidence for December, alongside rising inflation expectations and an unexpected boost in consumer credit.

-

Trump's Engagement on Global Issues: Former President Trump reemerged on the international front in Paris, where he conversed with French President Emmanuel Macron and Ukrainian leader Volodymyr Zelensky regarding strategies to conclude the conflict in Ukraine. In an NBC interview, he declared no intention of replacing Federal Reserve Chairman Powell upon his return to office and vowed to utilize presidential power effectively from day one to pardon Capitol rioters.

-

Insights from Central Banks: Fed Governor Bowman reiterated a cautious approach to interest rate cuts due to core inflation remaining significantly above the 2% target, with the Cleveland Fed president suggesting that the pace of reducing rates is nearing its limit. Meanwhile, Bank of England member Dhingra advocated for a reduction, cautioning that elevated interest rates are stifling both consumer and business spending, projecting a gradual decline from the current 4.75% to a neutral range of 2.5% to 3.5%.

-

U.S. Military Actions in Syria: The U.S. military carried out airstrikes against various Islamic State targets in central Syria. President Biden highlighted potential risks of rising Islamic extremism in the wake of Assad's government collapse.

-

Economic Outlook in Canada: Canada saw its largest payroll increase since April in November, though the unemployment rate reached 6.8%, the highest in three years, potentially influencing the central bank's decision to continue easing rates.

-

Concerns Over Economic Bubbles: Bank of America strategist Hartnett raised alarms about a bubble forming in both the U.S. stock market and cryptocurrency, noting that the S&P 500's price-to-book ratio is approaching levels last seen during the tech bubble peak of March 2000.

Disclaimer: All information provided is intended solely for general informational purposes. Seven Insights does not take into account individual financial goals or situations and does not provide personalized investment advice. Seven Insights is not a licensed securities dealer, broker, U.S. investment adviser, or investment bank.